Via Canva Pro

Fannie Mae issued Selling Guide Announcement SEL-2025-10 on December 10, 2025, introducing updates to renovation lending programs and property eligibility guidelines.

These changes support greater flexibility for home improvements and accessory units in conventional financing.

Renovation Lending Updates

HomeStyle Renovation loans now permit upfront disbursements of up to 50% of total renovation costs at closing for materials, permits, architectural or design fees, and borrower deposits.

For manufactured homes, the previous $50,000 renovation cost cap has been removed; costs may now reach 50% of the as-completed appraised value, aligning with site-built properties.

Limited cash-out refinances under this program can include buying out a co-owner’s interest—such as in inheritance or divorce scenarios—alongside renovations, with no cash back to the borrower.

HomeStyle Refresh, rebranded from HomeStyle Energy and effective for applications received on or after March 31, 2026, finances up to 15% of the as-completed appraised value for cosmetic or functional upgrades, disaster resiliency improvements (e.g., storm barriers or wildfire-resistant roofing), and environmental remediation (lead, asbestos, or mold).

Energy reports are often not required under this streamlined option.

Via Canva Pro

ADU and Manufactured Housing Expansions

Effective March 31, 2026, and requiring compliance with UAD 3.6, Fannie Mae broadens accessory dwelling unit (ADU) eligibility.

Single-unit properties may now include up to three ADUs if permitted by local zoning.

Two- to three-unit properties qualify for ADUs provided the total unit count does not exceed four.

Standard manufactured homes, including single-wide models, are eligible for one ADU classified as real property.

MH Advantage properties support multiple ADUs, with the overall unit total capped at four.

These expansions also extend eligibility to two- to four-unit and multi-story manufactured homes.

While a small subset of the overall market, the Portland Region sees about 300 sales a year of manufactured homes on owned land. These provisions will materially expand options for manufactured home owners.

In the Portland metro area, where local policies already encourage middle housing and ADUs to address supply constraints, these guidelines complement recent incentives such as the temporary SDC exemption for new housing units.

Appraisal Implications

The updates increase reliance on as-completed appraised value for determining loan-to-value ratios, renovation limits, and eligibility.

Appraisers serving the region may see growing demand for projected-value analyses on properties with multiple ADUs, manufactured home additions, or significant renovations.

Highest-and-best-use conclusions will need to carefully reflect local zoning allowances and market acceptance of these configurations.

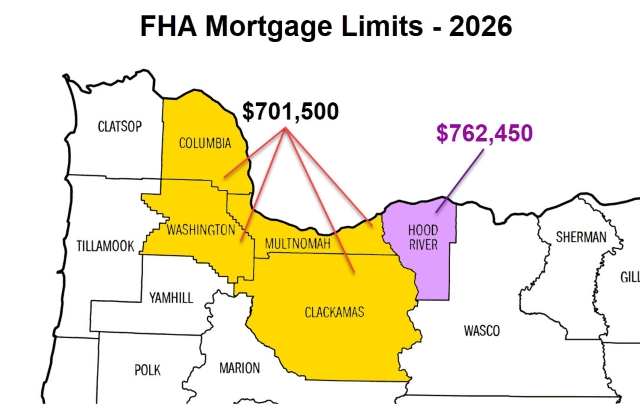

Lenders and homeowners exploring alternatives to jumbo financing may find added flexibility here, especially alongside the recently announced higher FHA 2026 loan limits in the Portland metro.

Sources & Further Reading

- Fannie Mae Selling Guide Announcement SEL-2025-10: Official Document

- FHA 2026 Loan Limits Rise to $701,500 in Portland Metro: PortlandAppraisalBlog

- Portland’s Temporary SDC Exemption for New Housing Units (2025–2028): PortlandAppraisalBlog

- The 2024 Portland Region Manufactured Housing Market in Review: PortlandAppraisalBlog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.