Photo: Abdur Abdul-Malik, Portland Appraisal Blog

The manufactured‑home market in 2025 moved through a year defined by steadier demand, uneven inventory, and a noticeable shift in how long homes took to find the right buyer in some counties. Manufactured homes remain the second most affordable ownership segment in the Portland Region, right after condominiums. Yet the contrast between the two couldn’t be more stark: a condominium typically offers an apartment in an urban core with monthly dues and shared maintenance, while a manufactured home often delivers acreage in rural or pastoral settings—sometimes in remote locales.

Across the Portland Region, roughly 21,400 homes sold in 2025 across the four major residential segments. Manufactured homes accounted for less than 1.5% of that activity, but they continued to play a meaningful role in the market—often representing one of the few affordable paths to owning acreage.

Table of Contents

- Data Housekeeping

- Portland Region 2025 Overview

- Multnomah County 2025 Stats

- Washington County 2025 Stats

- Clackamas County 2025 Stats

- Yamhill County 2025 Stats

- Columbia County 2025 Stats

- Hood River 2025 Stats

- Closing Thoughts

- Sources & Further Reading

- Coda

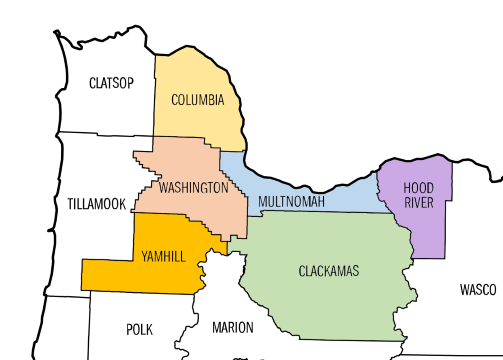

Data Housekeeping

The Portland Region in this update comprises the six Oregon counties of Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill. These counties form a contiguous housing ecosystem centered on Portland—Multnomah as the core home county, with the others tightly integrated through commuting patterns, economic ties, and shared market dynamics (e.g., Yamhill’s strong connection via Highway 99W and wine-country adjacency). Beyond Yamhill, the MLS system changes, further distinguishing this six-county area from broader geographic aggregations. For a detailed overview—including county profiles, population data, key value influencers, and why this definition differs from the official seven-county Portland–Vancouver–Hillsboro MSA—see our dedicated page: The Portland Region – Six-County Market Area Overview.

Via SunCatcherStudio

All data is sourced from RMLS and reflects open-market manufactured residential sales (excluding condominiums, attached homes, and site-built detached homes). SNL (“Sold Not Listed”) entries—off-market transactions entered retroactively—have been excluded to preserve consistency with true market activity.

All figures have undergone our standard cleaning process to address common RMLS accuracy challenges, including misclassifications (e.g. manufactured homes hiding in other categories, such as the detached category), square footage/price typos, incomplete fields, status/date mismatches, and non-representative entries. For a detailed overview of these issues, their impact on market analysis, and how we mitigate them through automated flagging, cross-verification, and manual review, see the dedicated page: RMLS Data Accuracy Challenges.

It is important to note that this review focuses on manufactured homes permanently affixed to land that is also owned by the same party. This means we are excluding classic mobile home parks where the owner of the mobile home must pay a lease/lot rental fee.

Portland Region 2025 Overview

Overall Regional Trends

The table below summarizes key metrics for attached single-family manufactured residential sales in the Portland Region (Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill counties) for 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $127.6 Million | $148.4 Million | +16.25% |

| Average Price | $462,411 | $471,014 | +1.86% |

| Median Price | $419,000 | $435,000 | +3.82% |

| Avg SP/OLP | 96.69% | 96.14% | -0.57% |

| Avg PPSF (TSF) | $295.71 | $299.03 | +1.12% |

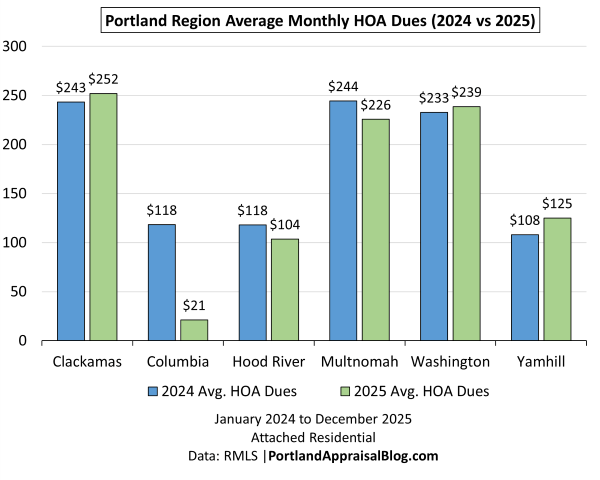

| Avg HOA Dues | $74.61 | $72.60 | -2.69% |

| Avg Lot Size (ac) | 3.48 | 3.44 | -1.15% |

| Avg Age (Yrs) | 28.20 | 30.50 | +8.14% |

| Avg CDOM | 60.55 | 61.03 | +0.79% |

| Avg Total SF | 1,609 | 1,629 | +1.24% |

| Total # of Sales | 276 | 315 | +14.13% |

| # of New Constr. | 3 | 4 | +33.33% |

| Avg Supply (Mos.) | 4.34 | 4.09 | -5.75% |

| # of REOs | 7 | 4 | -42.86% |

| # of Short Sales | 0 | 0 | — |

Single-Family Manufactured Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

Key Observations From the Aggregate Data

- Manufactured homes posted the strongest price gains of the four major housing segments, with both the average and median rising more than any other category in 2025. What makes this notable is that the segment didn’t rely on a shift toward larger homes or larger parcels; the underlying composition stayed remarkably stable, which means the appreciation reflects genuine demand strength rather than mix effects.

- Sales activity expanded sharply, marking one of the largest year‑over‑year increases in the region. The rise in closed sales outpaced the modest changes in size, acreage, and days on market, signaling that more buyers were willing to engage with the segment even as inventory remained thin and the stock continued to age. This represented a return to form as 2023 had 310 sales and 2025 closed 5 additional sales.

- County‑level performance was uneven but ultimately supportive of regional growth. Washington, Multnomah, and Hood River delivered clear price strength, each contributing meaningful upward pressure to the regional averages. Clackamas—by far the largest county by sales count—did not appreciate, but it held close to parity with 2024, providing the stability needed for the stronger counties to carry the region forward.

- The segment’s physical profile barely changed, with total square footage and acreage holding near 2024 levels and the average home age increasing. In most years, an older stock profile would exert downward pressure on pricing; the fact that prices rose anyway reinforces that the appreciation was demand‑driven rather than structural.

- Negotiation patterns and market pace remained steady, with only slight softening in sale‑to‑list ratios and days on market. Buyers were selective, but not disengaged; well‑prepared homes in desirable settings continued to attract firm pricing, while more remote or older properties required patience without signaling a broader slowdown.

- Distressed activity stayed low, continuing a multi‑year trend of stability in the manufactured‑home segment. Even with an aging stock and a wide range of property conditions, bank‑owned and short‑sale activity remained minimal, underscoring the segment’s resilience.

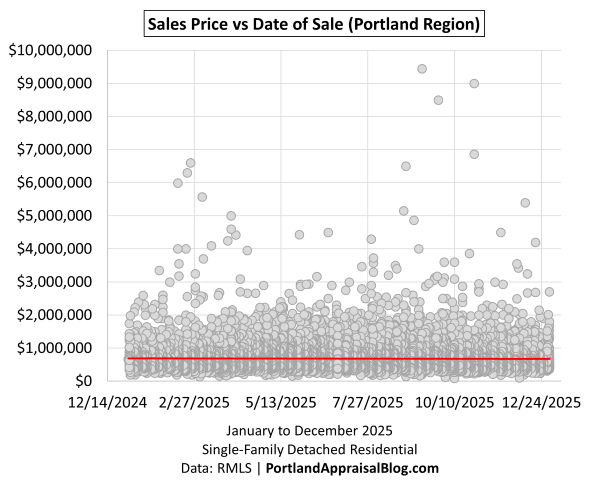

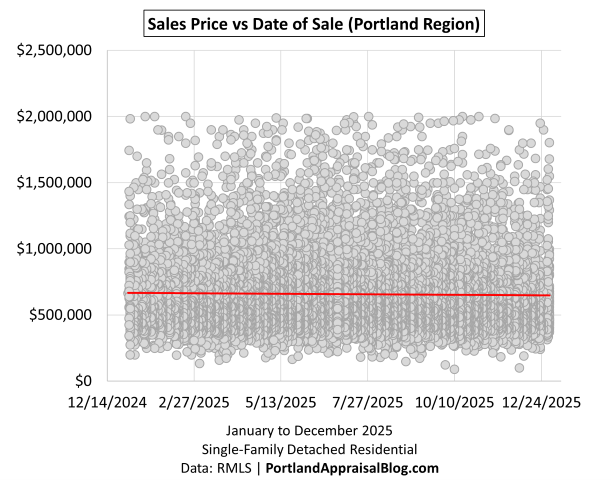

Portland Region Scatter Plots

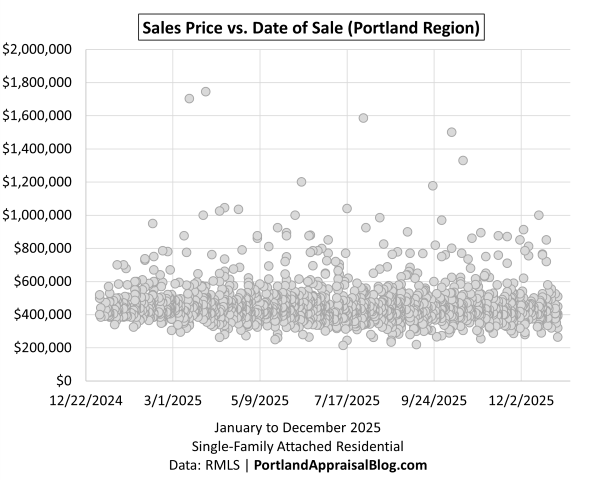

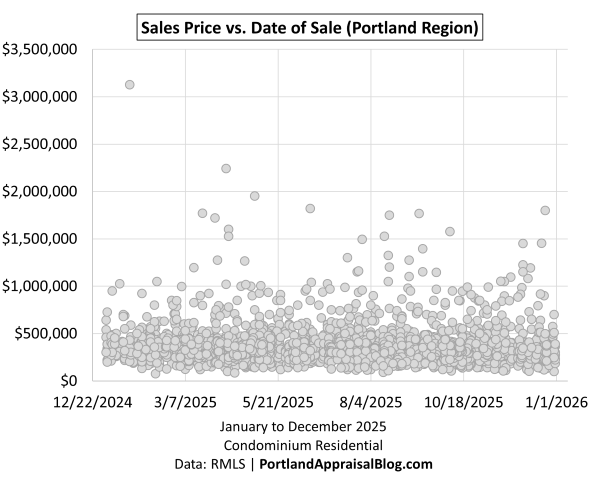

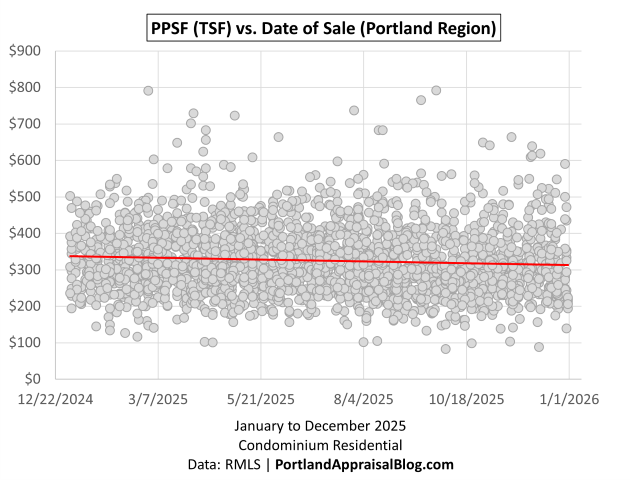

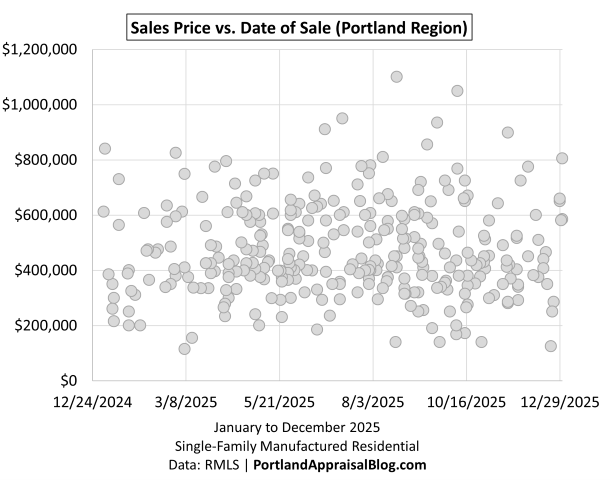

To visualize the distribution of individual manufactured homes sales prices across 2025, the following scatter plots show sales price against date of sale:

The 2025 sales‑price‑versus‑date scatter shows a remarkably steady rhythm for a segment as small and diverse as manufactured homes. Instead of the sharp seasonal swings that often appear in niche markets, the year unfolds as a consistent band of activity, with sales distributed evenly across all twelve months and no visible collapse in the early winter or late fall. The mid‑range of the market remains especially stable, forming a dense horizontal band that anchors the chart and reflects a year in which buyers and sellers were able to find agreement without dramatic shifts in pricing.

A subtle compression appears from late summer through the end of the year, with fewer low‑end outliers and a tighter clustering around the middle of the price distribution. This narrowing is not a sign of weakening; rather, it reflects a firmer pricing floor and a more consistent mix of properties entering the market in the second half of the year. The upper end of the market continues to register throughout this period, with several higher‑priced sales in the fall and early winter preventing the trendline from flattening and reinforcing the sense of a market that remained confident even as the year wound down.

Taken together, the scatter presents a picture of a segment that moved with calm, steady momentum. The absence of volatility, the persistence of a stable mid‑band, the tightening of the lower range, and the presence of late‑year upper‑band sales all point to a market supported by genuine demand rather than mix‑driven noise. The regional pattern is coherent and balanced, and the underlying county‑level dynamics that shaped this composite view become even clearer when examined individually in the latter sections.

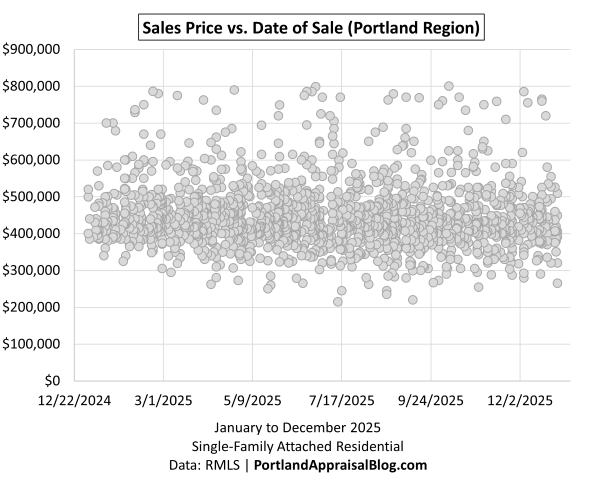

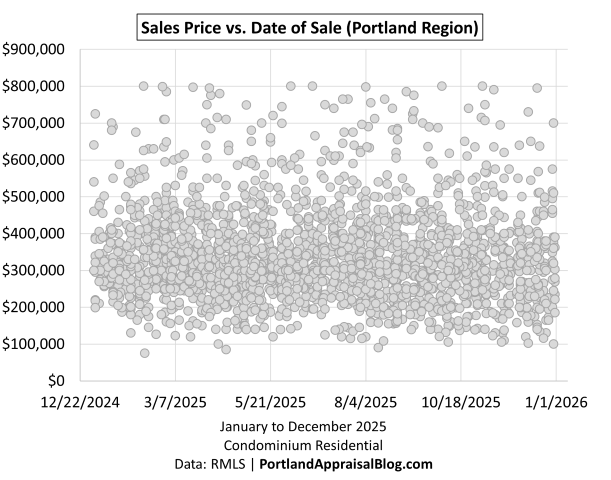

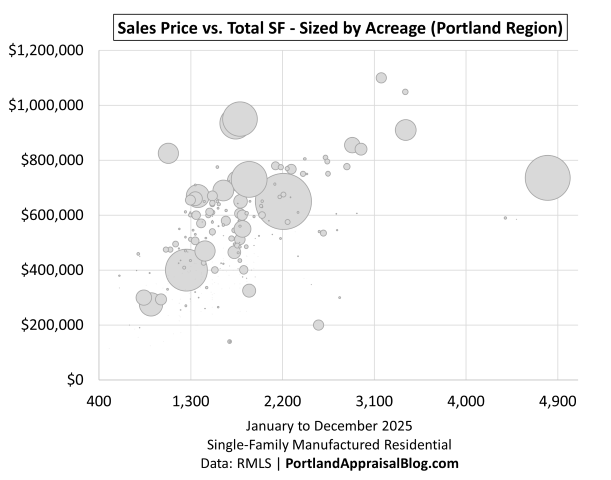

To visualize three important variables at one, the following scatter plot shows sales price versus total square footage with each dot sized by acreage (lot size):

The 2025 size‑based scatter shows a manufactured‑home market that organized itself with unusual clarity. Across the full range of square footage, the points form a coherent upward pattern: larger homes generally commanded higher prices, and the relationship holds consistently enough that the trendline is visible even without drawing it. This is not always the case in the MFH segment, where condition, setting, and acreage can create wide vertical dispersion. In 2025, the market behaved with a steadiness that mirrors the tempo seen in the sales‑price‑vs‑date-of-sale scatter.

Acreage adds a second layer of structure. Larger parcels appear as noticeably larger bubbles, and they tend to sit above the main body of the scatter. This is the classic manufactured‑home dynamic: land can elevate a property well beyond what its square footage alone would suggest. But the acreage premium shows up in a controlled, predictable way. The largest bubbles cluster in the upper half of the chart, but they do not distort the overall shape. Instead, they reinforce the idea that land remains a meaningful value driver without overwhelming the distribution.

The middle of the market—roughly 1,200 to 1,800 square feet and $300K to $600K—forms a dense, stable band that anchors the entire chart. This is where most of the region’s manufactured‑home stock lives, and the consistency of this band supports the conclusion that 2025 was a balanced, demand‑supported year. There is no hollowing out, no thinning, and no sign of a collapsing floor. The lower band remains present across the full range of square footage, but it does not expand downward or show distress. Older homes, modest parcels, and properties needing work appear where expected, but they do not dominate the distribution.

One of the more interesting features of the scatter is the presence of larger parcels at lower price points. Several sizable bubbles sit below the main trendline, showing that an eagle‑eyed and patient buyer can still acquire meaningful acreage at a reasonable price—especially when the home is older, dated, or in need of repair. This is a uniquely manufactured‑home phenomenon and one of the few remaining pathways to acreage ownership at accessible price levels.

A closer look at the three largest‑SF outliers: Three points sit well to the right of the main cluster. Yes, there are three, one is on a small lot and is nearly invisible! These three sales are the largest homes in the dataset and each has a clear, logical explanation once examined:

- A 42.62‑acre North Plains fixer (cash) sits far below the trendline because the home contributed little value and the buyer was effectively purchasing the land. Its position reflects a classic land‑first MFH transaction.

- A 0.64‑acre Multnomah sale (FHA) is nearly invisible on the scatter plot. The home is 4,495 SF and was designed for high‑occupancy use, with seven bedrooms, three bathrooms, dual entrances, and a layout suitable for care‑facility, sober‑living, or multigenerational configurations. Despite its size, the home sits on just over half an acre and sold with FHA financing. Its position on the scatter reflects the market’s tendency to discount institutional or cash‑flow‑oriented layouts, which offer utility but do not command the same price premium as conventional single‑family square footage.

- A 2.5‑acre cash sale falls between the other two. This home is 4,385‑SF and combines a 2004 manufactured home with a 2006 stick‑built addition, creating a dual‑living layout. The home sold for cash and includes a barn, shop, multiple utility rooms, and extensive outdoor improvements. Its position on the scatter reflects the market’s tendency to discount unconventional or hybrid layouts, even when the overall utility and acreage are significant.

Bottom-line Summary

Taken together, the aggregate tables and the two regional scatter plots point to a manufactured‑home market that moved with steady, internally consistent momentum throughout 2025. Sales volume was up and prices held firm across the full range of the segment, with a stable mid‑band anchoring the year and no evidence of a collapsing floor or late‑year volatility. The sales‑price‑versus‑date scatter shows a smooth seasonal rhythm with a mild tightening in the second half of the year, while the size‑and‑acreage scatter reveals a market that valued square footage and land in predictable ways, even as it produced the occasional outlier that is characteristic of this segment.

The overall picture is one of broad‑based stability: genuine demand, a coherent price structure, and a distribution shaped more by steady buyer behavior than by mix shifts or one‑off anomalies. The county‑level sections that follow show how each sub‑market contributed to this regional pattern, and why the composite view looks as orderly as it does. But before we examine the individual counties let’s consider a variety of graphs to illuminate the regional data.

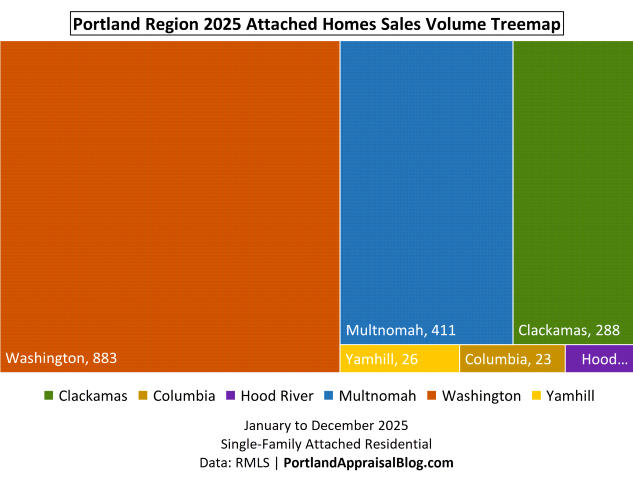

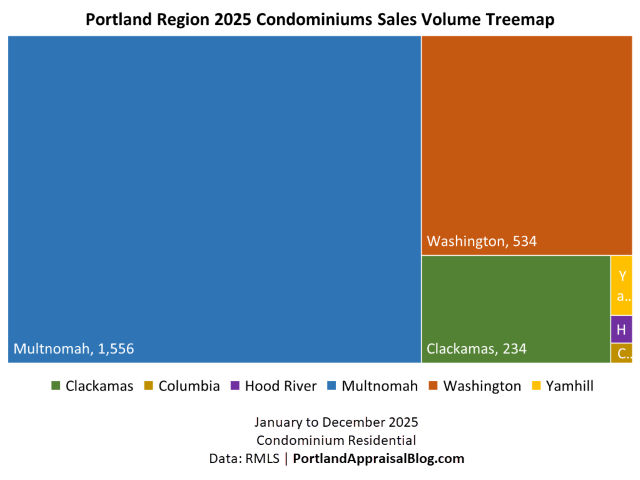

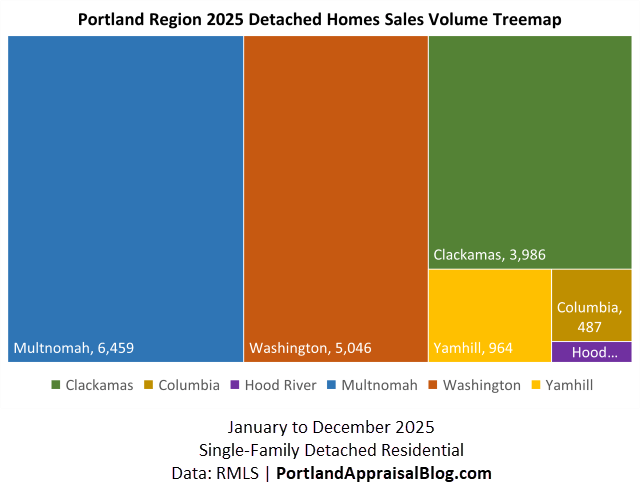

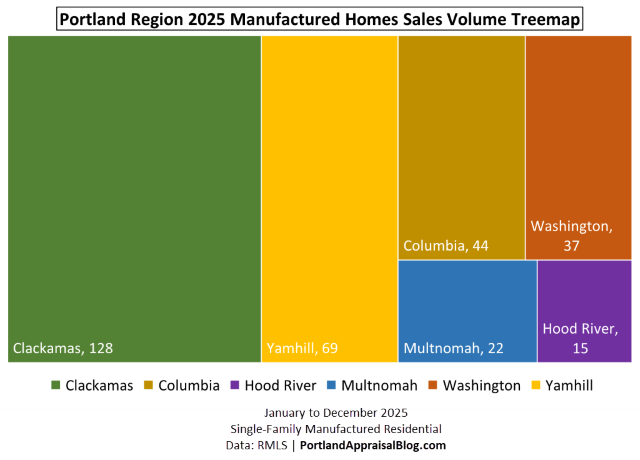

Sales Volume

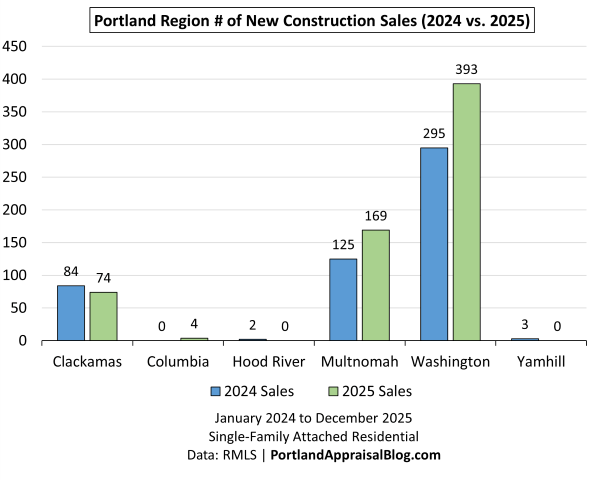

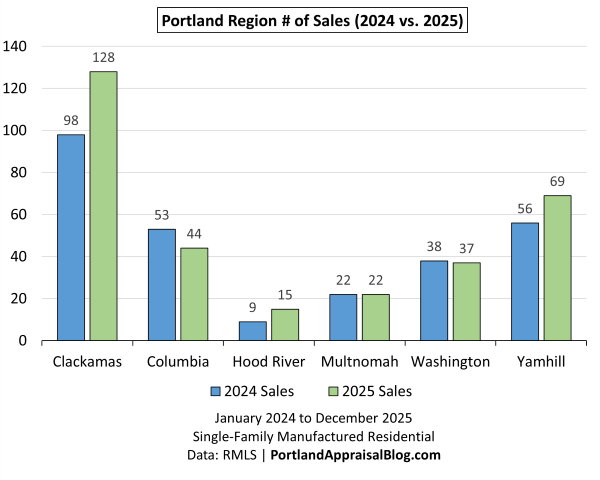

A treemap visualizing the distribution of manufactured homes sales by county in 2025 clearly illustrates the market’s geographic dispersion in this housing segment.

Manufactured‑home activity in 2025 followed a geographic pattern that is completely different from every other housing segment in the Portland region. In detached, attached, and condominium housing, the Big Three counties—Clackamas, Washington, and Multnomah—account for 90% to 99% of all sales. Manufactured homes break that rule entirely. The outlying counties carry a disproportionate share of the activity, and the market’s center of gravity shifts decisively away from the urban core.

Clackamas led the region with 128 sales, forming the largest block of activity and anchoring the year’s volume. But the next‑largest contributor was not Washington or Multnomah—it was Yamhill, with 69 sales. Columbia followed with 44, and only then do Washington (37) and Multnomah (22) appear. Hood River, with 15 sales, rounded out the region. This distribution is not an anomaly; it reflects the structural reality of the segment. Manufactured homes are more common in rural and semi‑rural settings, where larger parcels, lower land costs, and flexible siting options support a broader range of housing stock.

Year‑over‑year changes reinforce the same pattern:

Clackamas and Yamhill both posted meaningful increases in 2025, Hood River grew from a small base, Columbia softened slightly, and Washington and Multnomah held steady. The uneven movement across counties is another way this segment diverges from the rest of the housing market, where the Big Three typically move in near‑unison and dominate the regional totals.

Despite the differences in scale, no county experienced a collapse in activity, and the overall regional volume increased from the prior year. This stability in the volume distribution is one of the reasons the 2025 scatter plots appear so orderly: the market was active, balanced, and supported by steady buyer participation across all twelve months.

This volume structure sets the stage for the analyses that follow. The counties with the largest footprints shape the regional trendlines, while the smaller counties introduce the nuances, acreage dynamics, and outliers that give the manufactured‑home segment its distinctive character.

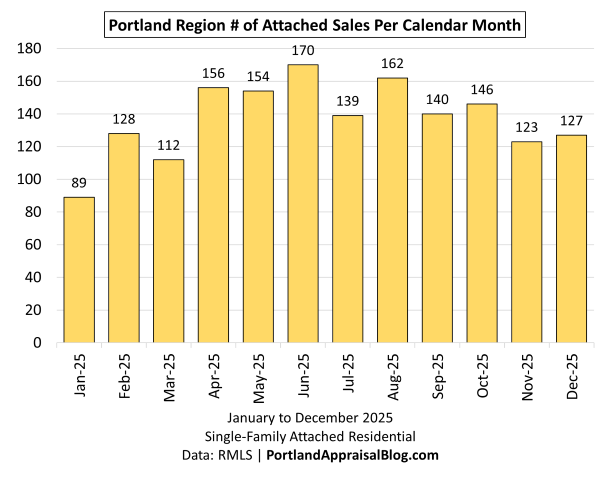

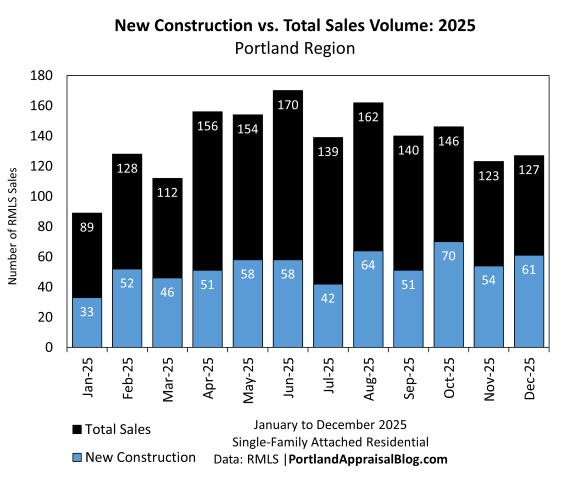

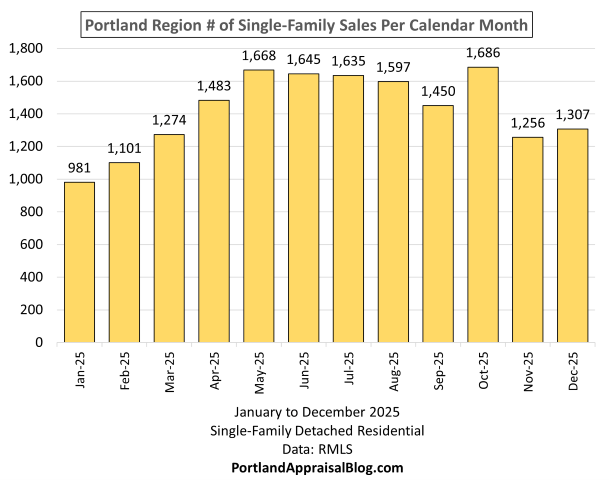

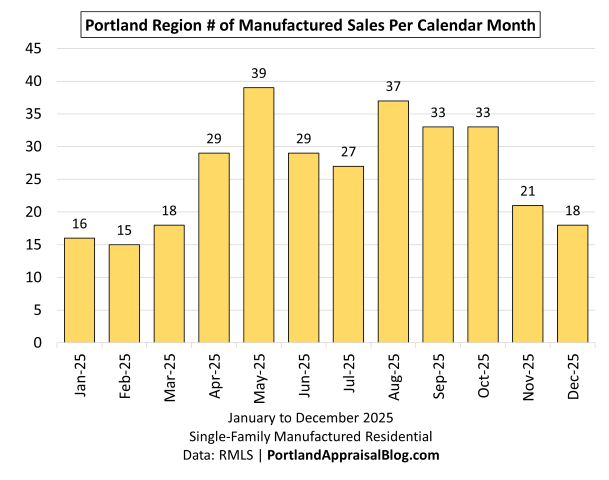

The following bar chart shows monthly sales volume for 2025:

The 2025 manufactured‑home market followed a classic seasonal pattern, with a slow winter start, a strong spring buildup, and a broad summer plateau that carried through early fall. January, February, and March posted modest activity, each in the mid‑teens to high‑teens, which is typical for this segment and reflects both weather constraints and the slower pace of rural and semi‑rural transactions. Activity accelerated sharply in April and peaked in May at 39 sales—the high point of the year and the moment when all counties were contributing meaningful volume.

The summer months held that momentum. June, July, August, September, and October all posted between 27 and 37 sales, forming a stable mid‑year band that kept the regional scatter plots well‑populated and prevented the kind of thin‑data volatility that can appear in smaller segments. This broad plateau is one of the reasons the 2025 price‑versus‑date scatter reads as smooth and orderly: the market had consistent participation across the warm months.

Volume tapered in November and December, returning to the high‑teens and low‑twenties. This decline mirrors the seasonal slowdown seen in detached and attached housing, but the manufactured‑home segment tends to soften a bit earlier and more noticeably because rural and acreage‑oriented transactions are more sensitive to weather, daylight, and site‑access conditions.

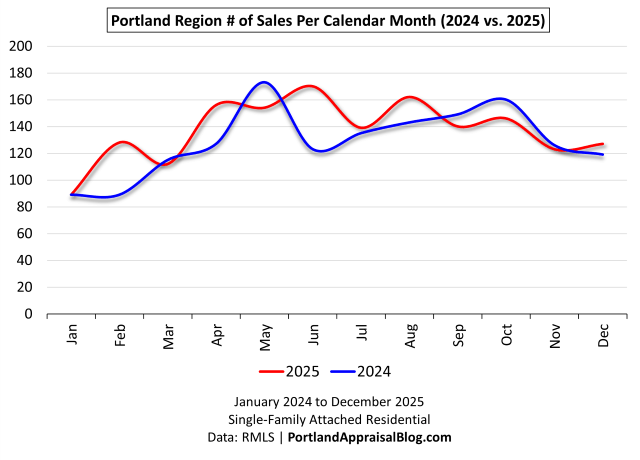

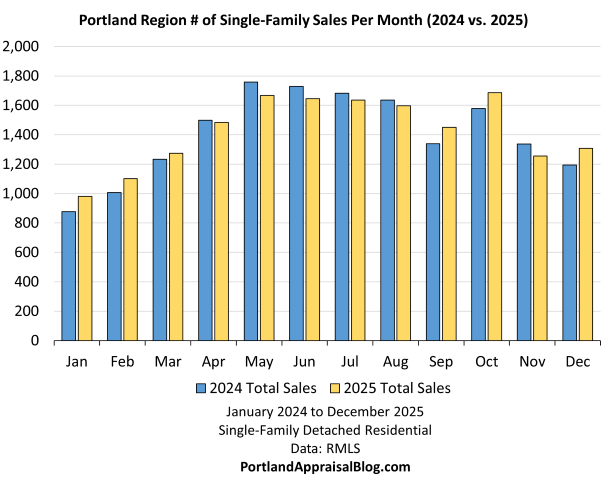

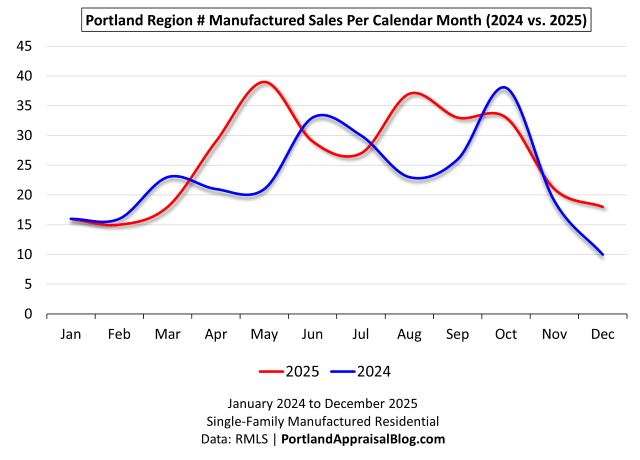

The line graph below compares monthly sales volume across the twelve months for 2024 and 2025.

The month‑by‑month comparison shows that 2025 was not just a stronger year in total volume—it was a more consistent and better‑balanced year across the calendar. Both years start in the mid‑teens, but the paths diverge quickly. In 2024, activity rose unevenly, with a strong March and June, a soft late summer, and a pronounced spike in October. By contrast, 2025 followed a smoother seasonal arc: a slow winter, a clear spring buildup, and a broad summer plateau that carried through early fall.

Several months illustrate this shift clearly. April and May 2025 were substantially stronger than the prior year, with May reaching 39 sales—nearly double the 2024 figure. August and September also outperformed their 2024 counterparts, reinforcing the sense of steady mid‑year demand. Even the late‑year slowdown behaved differently. While both years tapered in November and December, 2025 maintained higher activity, avoiding the sharp drop seen in December 2024.

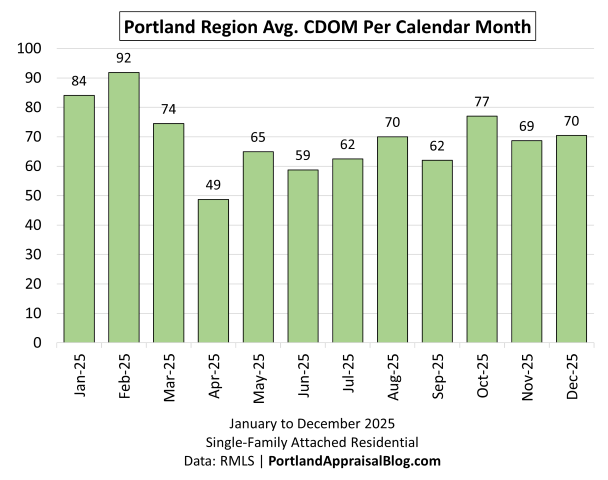

Sales Price

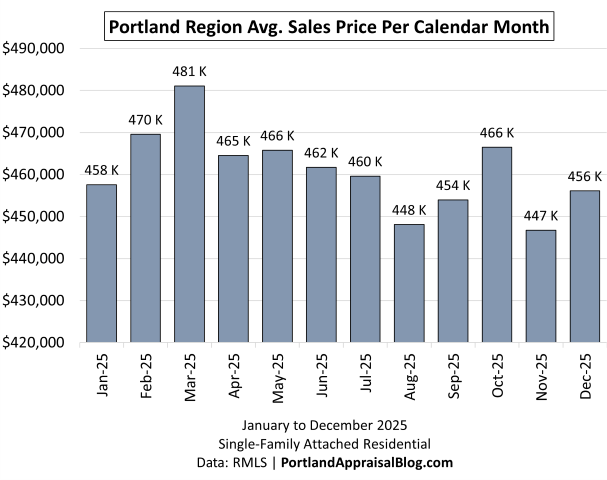

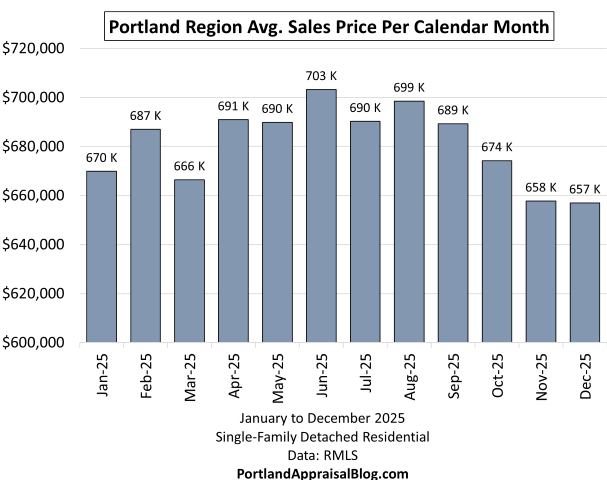

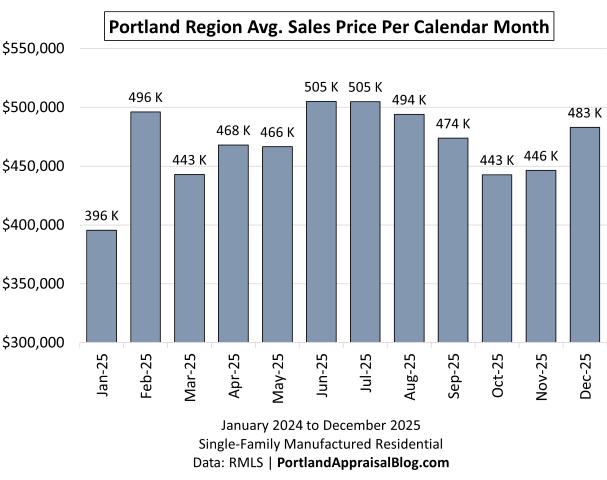

The following bar chart shows average monthly sales price for 2025:

Average prices in 2025 followed a smooth, well‑behaved seasonal arc that reflects a stable, demand‑supported manufactured‑home market. The year opened softly at $396K in January, which is typical for this segment given winter weather, rural access constraints, and limited buyer activity. Prices rose sharply in February to $496K and settled into the mid‑$400Ks through March, establishing the early‑spring lift that carried into the main selling season.

From April through August, the market held a steady mid‑year plateau. Monthly averages ranged from the high‑$460Ks to just over $500K, with June and July tied for the year’s peak at $505K. This consistency mirrors the strong mid‑year sales volume and is one of the reasons the price‑versus‑date scatter appears so orderly. The market had enough activity—and enough diversity of properties—to produce a stable pricing band without the volatility that can appear in smaller or more rural datasets.

Prices eased gently in September and October, returning to the mid‑$400Ks, but the decline was modest and short‑lived. November held firm at $446K, and December closed the year strongly at $483K, reversing the fall softness and signaling that buyer willingness remained intact even as the seasonal slowdown set in.

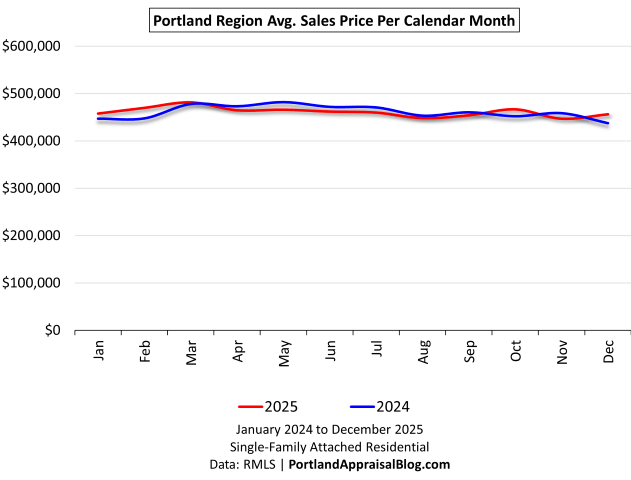

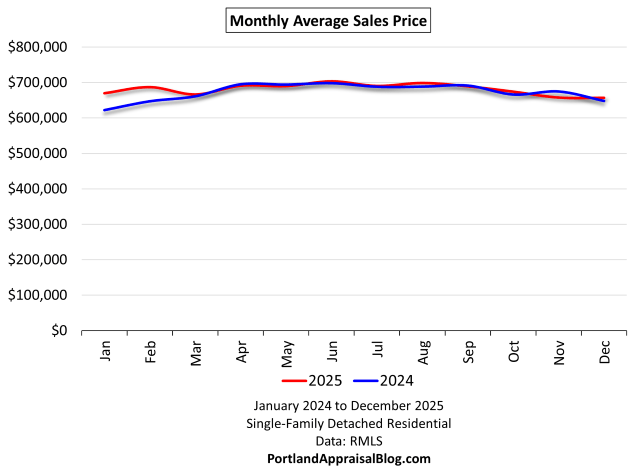

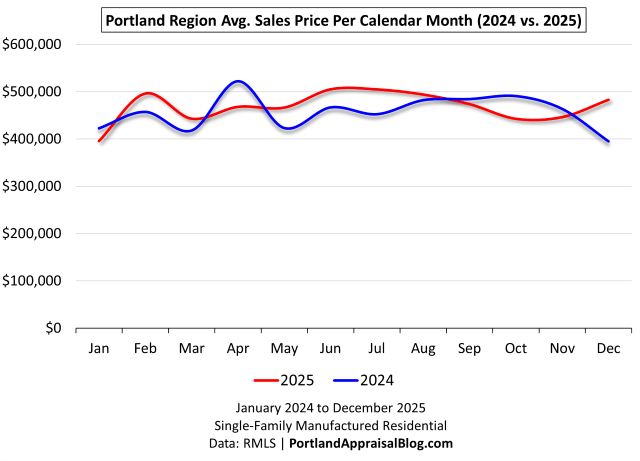

The line graph below compares average monthly sales prices across the twelve months for 2024 and 2025.

The year‑over‑year comparison shows two very different pricing rhythms. 2024 moved with sharper swings, including a pronounced April spike and a steep December drop, while 2025 followed a smoother, more stable seasonal arc with a firm close to the year. The contrast between the two lines reinforces the broader theme of 2025 as a steadier, more demand‑supported market.

Several months illustrate the divergence clearly. January and February opened with a reversal of roles: 2024 began higher in January, but 2025 surged ahead in February with a jump to $496K. Through spring, the two years traded places—2024 peaked at $522K in April, while 2025 held a more moderate but consistent mid‑$400K to mid‑$500K range. By early summer, 2025 had clearly taken the lead, with June and July both landing just above $500K, compared to mid‑$400Ks in 2024.

The late‑summer and early‑fall months show the same pattern. August and September were tighter between the two years, but 2025 maintained a slight edge. October and November flipped again, with 2024 briefly rising above 2025, but the difference was modest and short‑lived. The most striking contrast appears in December: 2025 closed at $482,952, while 2024 fell to $394,887, its lowest point of the year. That strong finish in 2025 reinforces the stability seen in the scatter plots and confirms that the market ended the year with pricing confidence rather than seasonal weakness.

Across the full calendar, 2025 shows a smoother, more coherent price structure, with fewer abrupt shifts and a stronger mid‑year plateau. The 2024 line, by comparison, reflects a more volatile pattern shaped by mix, timing, and thinner winter volume.

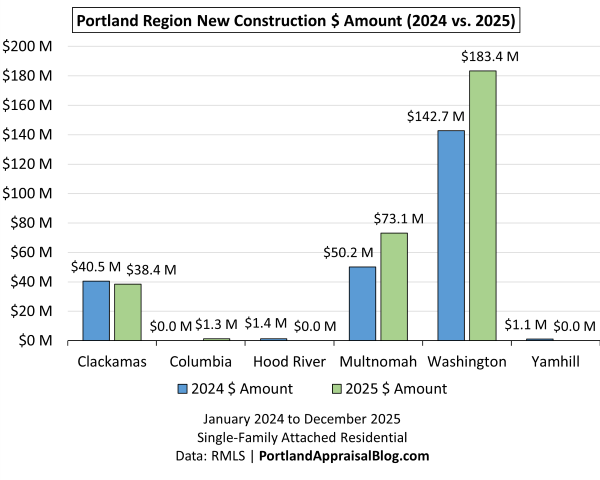

Cumulative Days on Market

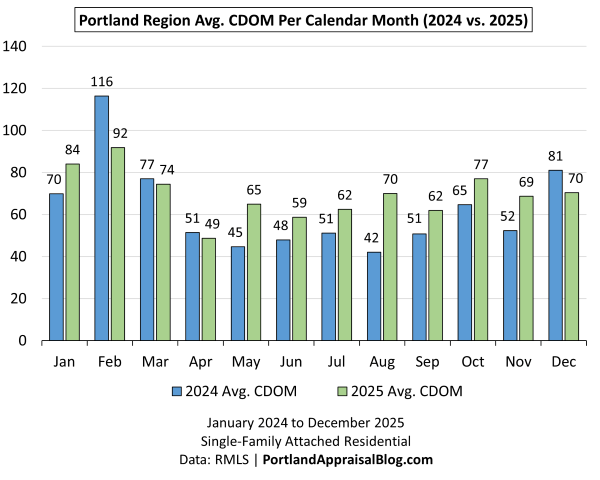

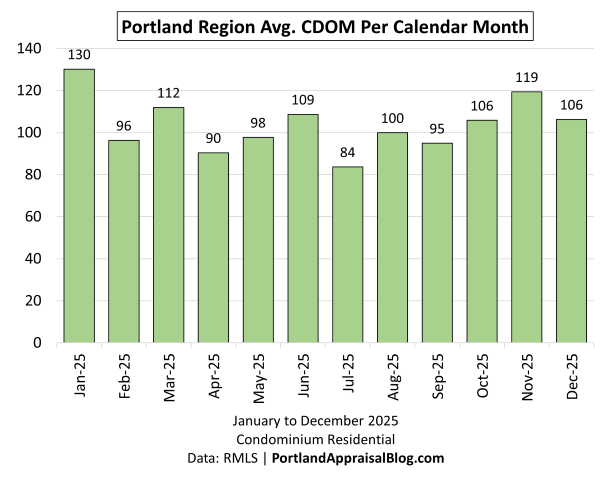

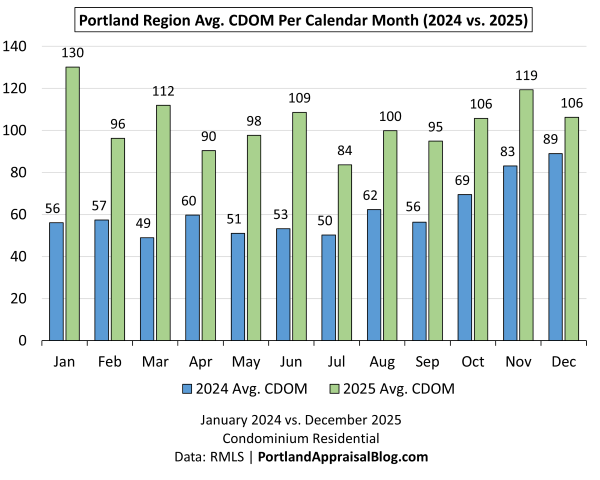

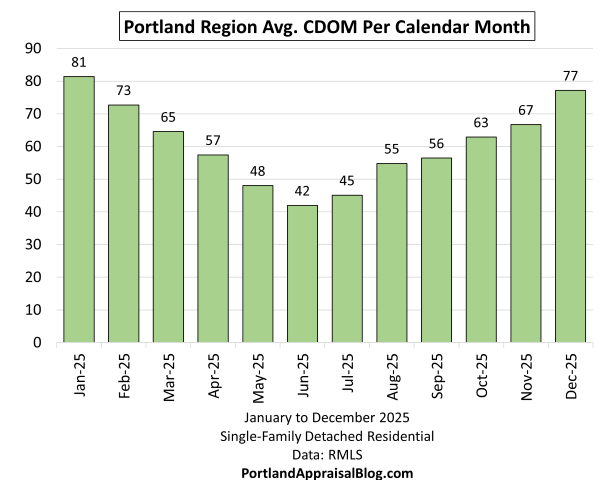

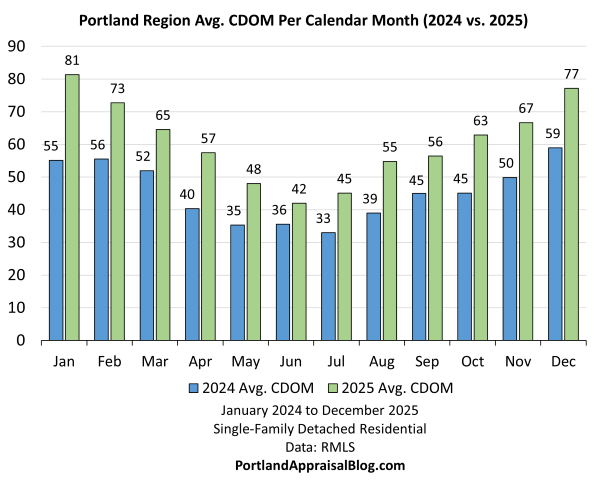

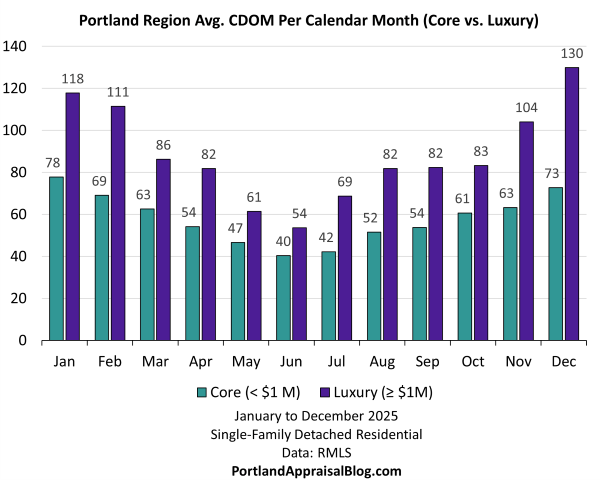

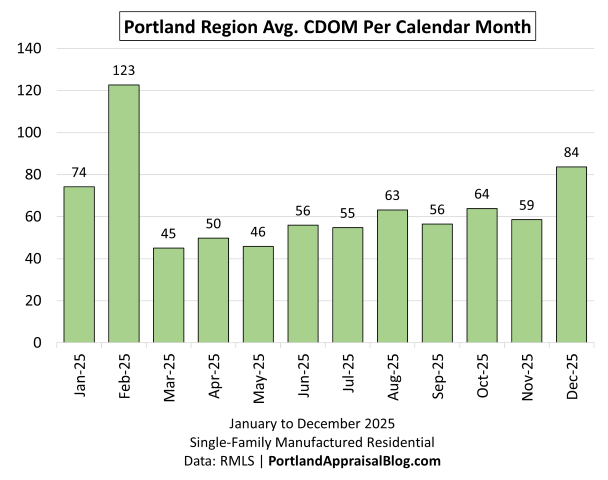

The bar chart below compares average cumulative days on market (CDOM) throughout 2025.

Cumulative Days on Market in 2025 followed a seasonal pattern that is typical for the manufactured‑home segment, but with enough mid‑year stability to reinforce the broader theme of a steady, demand‑supported market. January opened at 74 days—elevated but not unusual for winter, when rural access, weather, and buyer activity all slow. February spiked to 123 days, the highest point of the year, driven by a small number of older listings finally clearing. This kind of early‑year cleanup is common in this segment and does not indicate weakening demand.

From March through October, the market settled into a remarkably consistent mid‑year band. CDOM ranged from the mid‑40s to mid‑60s, with March at 45 days, April at 50, and May at 46. Even as volume increased in the spring and summer, marketing times remained stable, suggesting that buyers were active and well‑matched to available inventory. The summer months—June through August—held between 55 and 63 days, and September and October stayed in the mid‑50s to mid‑60s. This eight‑month stretch of steady CDOM is one of the clearest indicators that the 2025 market was functioning smoothly.

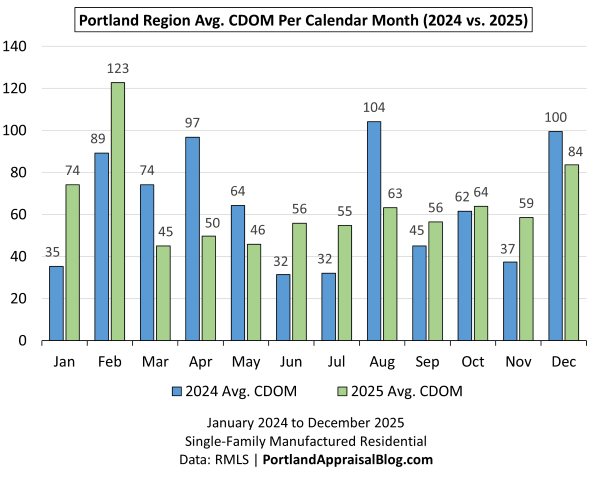

The bar chart below compares cumulative days on market for 2024 and 2025.

The year‑over‑year comparison shows that while the shape of CDOM changed noticeably between 2024 and 2025, the overall level barely moved. The annual averages were 60.55 days in 2024 and 61.03 days in 2025—a difference of less than half a day. In a small segment like manufactured homes, this is exactly what you expect: the monthly pattern can shift dramatically depending on which slow listings clear when, but the underlying market tempo remains stable.

The month‑to‑month behavior is where the two years diverge. Early 2025 opened with elevated winter CDOM—74 days in January and 123 in February—driven by a handful of older listings finally closing out. In contrast, 2024 began unusually low before rising into the 80–90‑day range. Spring flipped the pattern again: 2025 settled quickly into the mid‑40s to mid‑50s, while 2024 spiked to 97 days in April. Summer showed the same contrast, with 2025 holding steady in the mid‑50s to low‑60s and 2024 swinging from the low‑30s in June and July to 104 days in August.

Despite these very different seasonal shapes, both years ultimately lived in the same CDOM neighborhood. Neither year shows evidence of systemic softening, prolonged marketing times, or inventory backing up. Even the late‑year divergence—2024 ending at 100 days versus 84 in 2025—reflects timing and mix rather than a structural shift in demand. Manufactured‑home markets often show sharper winter variability due to rural access, weather, and financing logistics, and both years behaved within that normal envelope.

The key takeaway is that 2025 wasn’t meaningfully “faster” or “slower” than 2024. It was simply smoother. The mid‑year band in 2025 was more stable, the volatility was lower, and the seasonal rhythm was more predictable. The nearly identical annual averages underscore that the manufactured‑home market maintained a consistent, balanced tempo across both years.

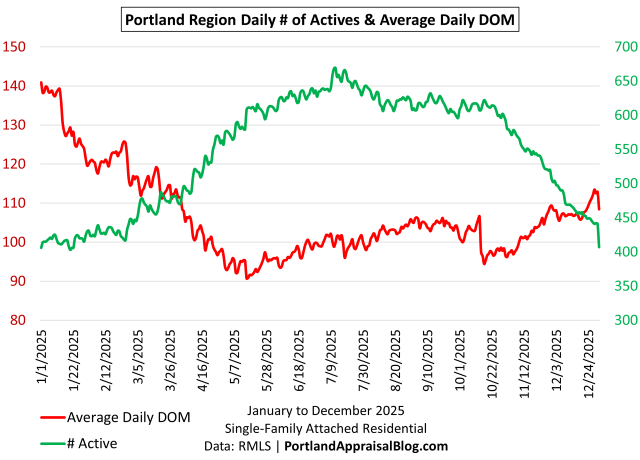

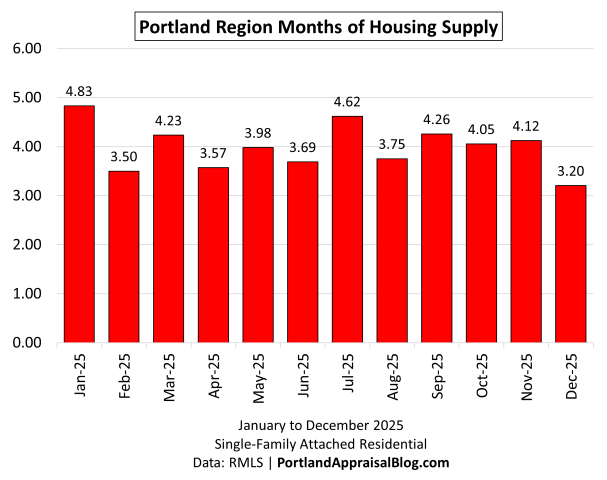

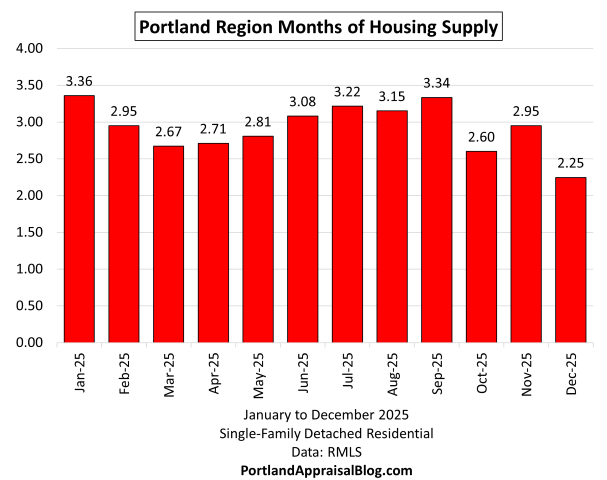

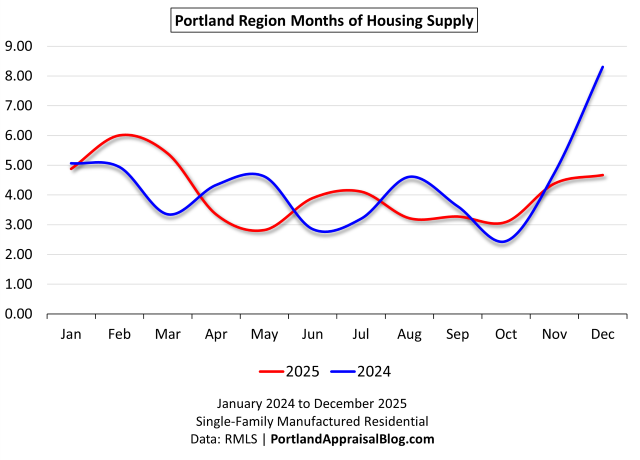

Housing Supply

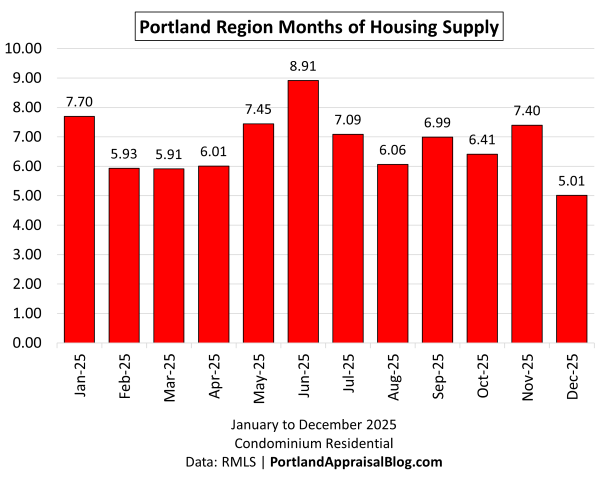

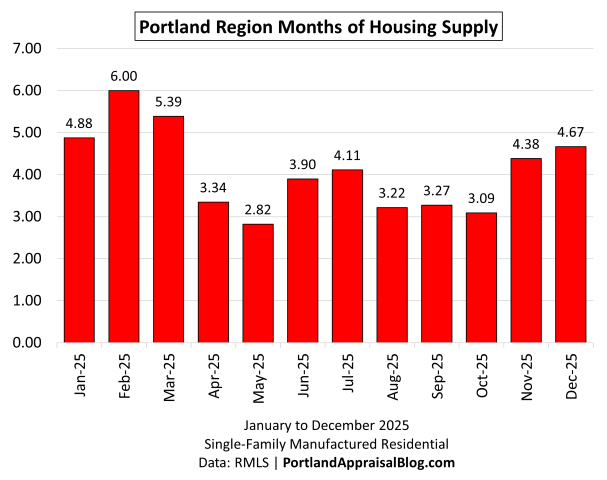

Months of supply (MOS) represents the number of months it would take to absorb current active inventory at the prevailing sales pace, assuming no new listings enter the market. The following bar chart shows MOS by calendar month for 2025:

Months of Housing Supply in 2025 moved through a clean, seasonal arc that mirrors the stability seen in pricing, volume, and CDOM. The year opened with elevated winter supply—4.88 months in January and 6.00 months in February—a normal pattern for manufactured homes, where rural access, weather, and slower buyer activity tend to stretch inventory relative to sales. From there, supply tightened quickly as spring demand arrived. March dropped to 5.39 months, and April fell sharply to 3.34 months, setting up the strongest stretch of the year.

The core of the market—May through October—held a remarkably stable band between roughly 2.8 and 4.1 months. May posted the year’s low at 2.82 months, reflecting strong absorption and a well‑matched buyer pool. June and July rose modestly into the 3.9–4.1 range, and August through October settled into a tight cluster between 3.09 and 3.27 months. This six‑month plateau is one of the clearest indicators that the 2025 manufactured‑home market was balanced and functioning smoothly. Supply was neither constrained nor excessive; it simply tracked demand in a predictable, orderly way.

The late‑year rise—4.38 months in November and 4.67 months in December—is exactly what you expect in this segment. Manufactured homes often see sharper winter slowdowns due to siting logistics, inspections, and financing timelines, and 2025 behaved squarely within that normal envelope. Importantly, even the year‑end levels remained moderate. There was no sign of inventory backing up or buyers stepping away.

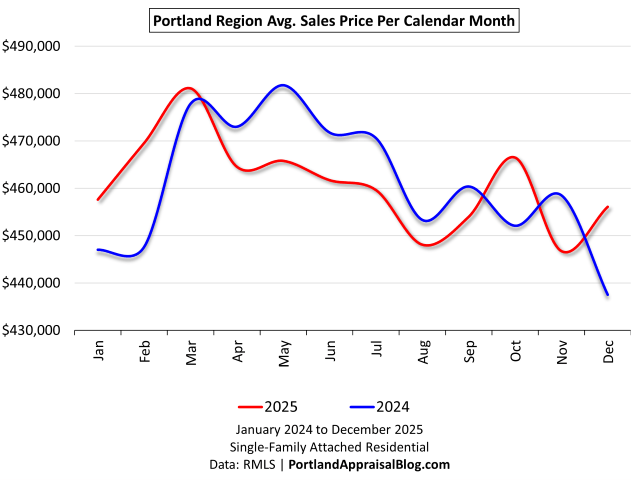

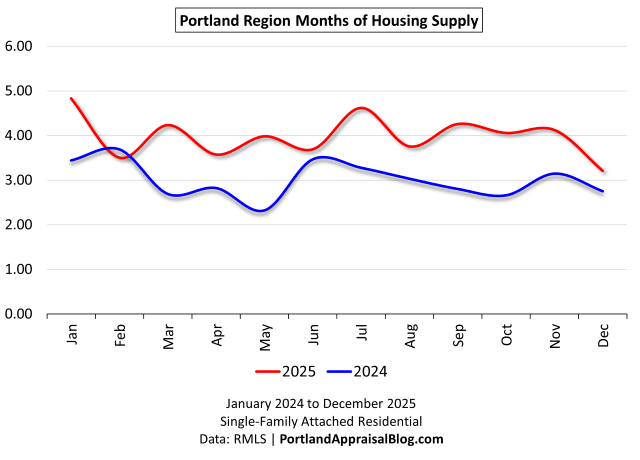

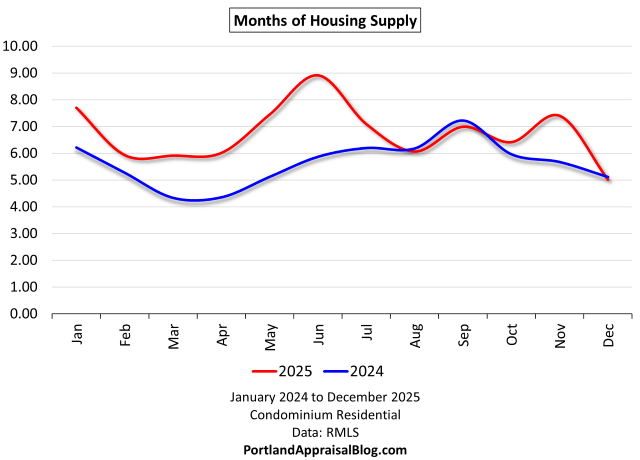

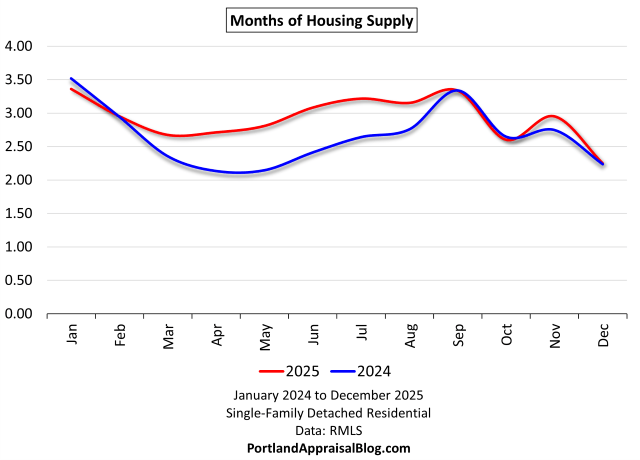

The line graph below compares months of supply for 2024 (blue line) and 2025 (red line), with a full y-axis scale to show true proportional differences:

The year‑over‑year comparison shows that while the month‑to‑month pattern of housing supply shifted noticeably between 2024 and 2025, the overall level of inventory remained almost identical. The annual averages were 4.34 months in 2024 and 4.09 months in 2025, a difference of just a quarter of a month. In a small segment like manufactured homes—where a handful of listings can swing a single month—this near‑match in annual supply is expected. What changed was the seasonal shape, not the underlying balance between listings and sales.

The two years diverged early. January and February 2025 opened with 4.88 and 6.00 months of supply, while 2024 began slightly lower at 5.06 and 4.94. By March, the pattern flipped: 2025 eased to 5.39 months, while 2024 tightened sharply to 3.35. Spring continued the alternating rhythm. April and May 2025 dropped to 3.34 and 2.82 months, reflecting strong absorption, while 2024 rose to 4.33 and 4.62. Summer followed the same back‑and‑forth dynamic. June and July 2025 held at 3.90 and 4.11 months, compared to 2.85 and 3.20 in 2024, before August reversed the relationship again with 3.22 months in 2025 versus 4.61 in 2024. Through early fall, 2025 held a tight, stable band between 3.09 and 3.27 months, while 2024 ranged from 3.62 down to 2.45.

The most dramatic difference appears in December. Supply spiked to 8.30 months in 2024, the highest point across both years, while December 2025 closed at 4.67 months, elevated but still within a normal seasonal range. This single month accounts for much of the visual gap between the two lines and reflects timing and mix rather than a structural imbalance.

Despite the month‑to‑month volatility, both years lived in the same overall supply environment. Neither shows evidence of inventory backing up or buyers stepping away. The mid‑year plateau in 2025—roughly three to four months of supply from May through October—reinforces the broader theme of a balanced, well‑functioning market. The 2024 line, by contrast, is more jagged, shaped by thinner volume and a few months where slower listings accumulated. The nearly identical annual averages—4.34 vs. 4.09 months—underscore that the manufactured‑home market maintained a consistent, stable supply profile across both years, even as the monthly curves took different paths.

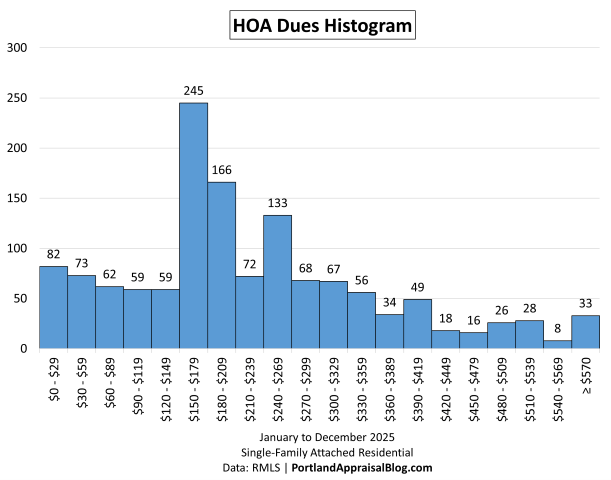

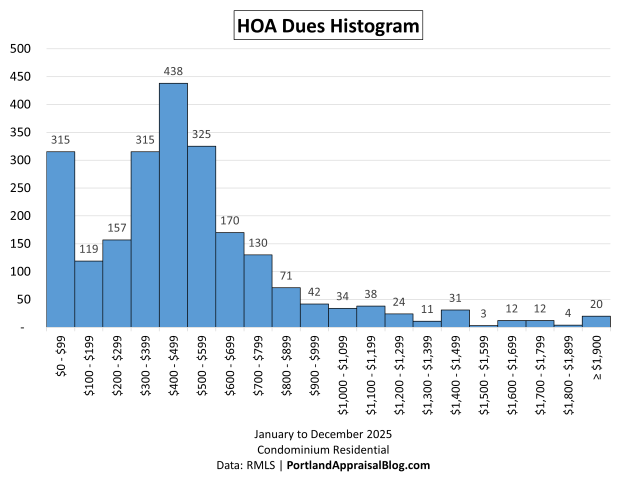

Histograms

Histograms offer a unique and powerful perspective on the manufactured homes market that traditional summary statistics and bar charts cannot fully capture: they reveal the underlying shape, spread, and clustering of the data, exposing patterns, skewness, tails, and bifurcations that averages and medians alone obscure.

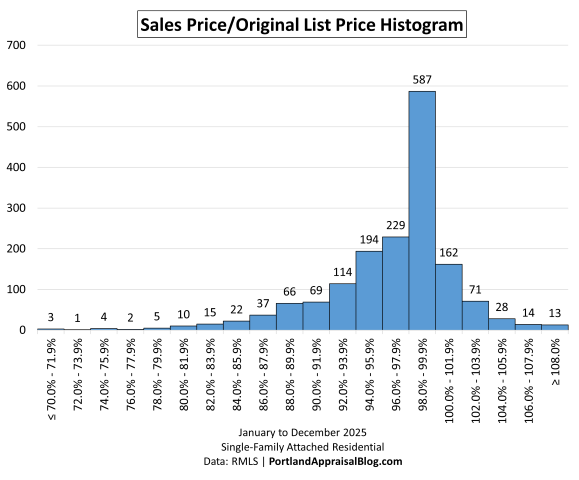

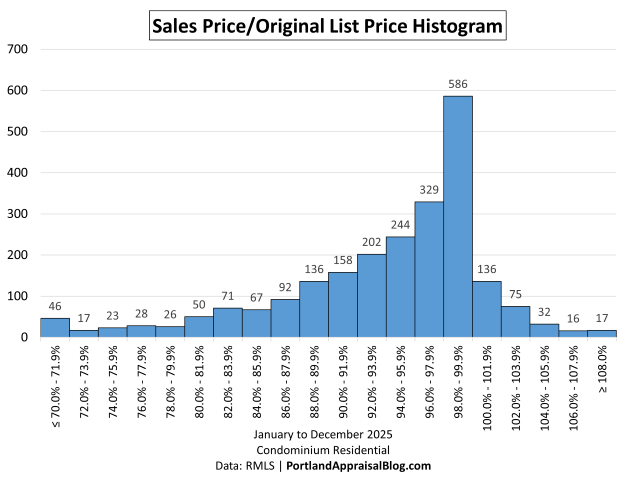

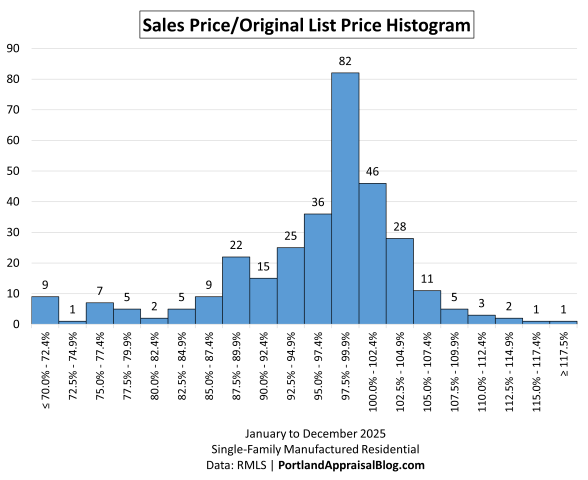

The following histogram shows the distribution of sales price as a percentage of original list price in 2025:

The distribution of sale‑to‑list ratios in 2025 shows a market that centered tightly around full price, with most transactions occurring in a narrow band and only light activity at the extremes. The single largest bin—97.5% to 99.9%—contains 82 sales (26.03%), and the surrounding bins at 95.0%–97.4%, 100.0%–102.4%, and 102.5%–104.9% add another substantial block of activity. Once aggregated, the full 95% to <105% band contains 192 sales, representing 60.95% of all transactions. This is the clearest signal in the dataset: the manufactured‑home market in 2025 rewarded accurate pricing with highly predictable outcomes, and most homes sold within just a few percentage points of their original list price.

Below‑list activity was present but modest. All bins under 90% of list total 60 sales (19.05%), spread thinly across many small ranges. No single low‑ratio bin dominates, and the counts taper quickly as ratios fall. These cases likely reflect idiosyncratic situations—condition issues, location constraints, or listings that began overpriced and required significant repositioning—rather than a structural pattern of deep discounting.

The upper tail behaves similarly. At 105% or above, the combined bins total 23 sales (7.3%), with each individual range containing only a handful of transactions. These are the occasional competitive situations where buyers stretched above list—clean acreage, desirable settings, or well‑prepared homes—but they remain the exception rather than the rule.

Taken together, the histogram shows a market with a very stable pricing center and only light activity at the extremes. The dominant pattern is straightforward: nearly two‑thirds of all manufactured‑home sales closed within 5% of the original list price, and the remaining third is split between modest under‑list adjustments and a small number of above‑list outcomes. The distribution reinforces the broader theme of the 2025 manufactured‑home market—steady demand, accurate pricing, and predictable negotiation dynamics.

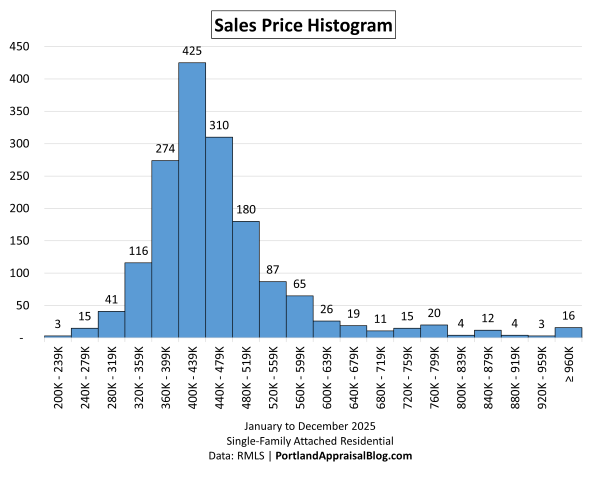

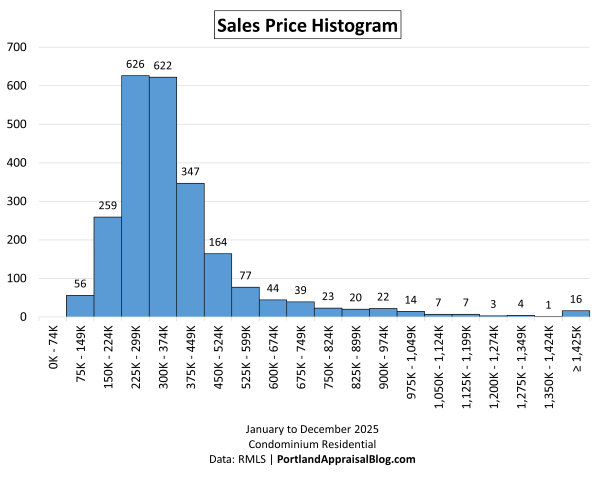

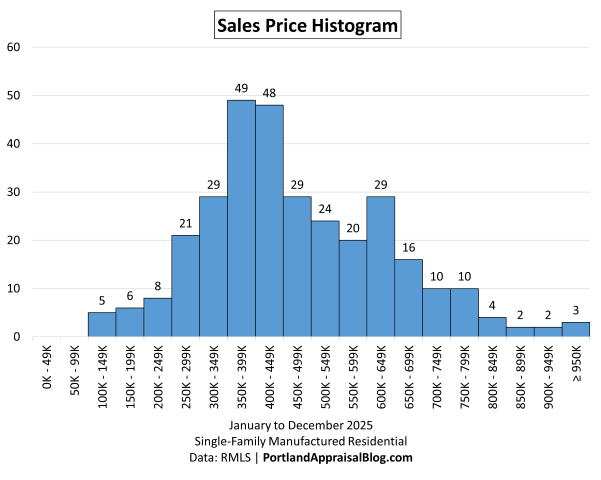

The following histogram shows the distribution of sales prices of manufactured homes in 2025:

The 2025 sales‑price histogram shows a market with a clear middle, a long but orderly tail, and no distortive spikes—exactly what you want to see in a manufactured‑home dataset of this size. The distribution builds gradually from the low end, peaks cleanly in the mid‑price ranges, and then tapers in a predictable pattern as prices rise.

The lower bins are thin, with 5 sales (1.59%) in the $100K–$149K range and 6 sales (1.90%) in the $150K–$199K range. Activity begins to take shape in the $200K–$249K and $250K–$299K bins, which together account for 29 sales (9.21%). But the market doesn’t truly concentrate until the $300Ks and $400Ks, where the core of the distribution sits. The $300K–$349K bin contains 29 sales (9.21%), and the $350K–$399K and $400K–$449K bins contain 49 (15.56%) and 48 (15.24%) sales respectively. These two adjacent bins form the single largest block in the histogram, representing more than 30% of all 2025 manufactured‑home sales. This is the pricing center of gravity for the year.

Above that, the distribution steps down gradually. The $450K–$499K bin holds 29 sales (9.21%), and the $500K–$549K and $550K–$599K bins add another 24 (7.62%) and 20 (6.35%) sales. The $600K–$649K bin rises again to 29 sales (9.21%), reflecting the presence of higher‑quality acreage properties that routinely trade in this range. Beyond $650K, the counts taper as expected: 16 sales (5.08%) in the $650K–$699K range, 10 (3.17%) each in the $700K–$749K and $750K–$799K bins, and then small, isolated counts in the $800Ks and $900Ks. The upper tail ends with 3 sales (0.95%) at or above $950K.

The overall shape is exactly what a healthy manufactured‑home market should look like: a strong, well‑defined middle; a gradual taper on both sides; and no evidence of clustering at distressed price points or runaway concentration at the high end.

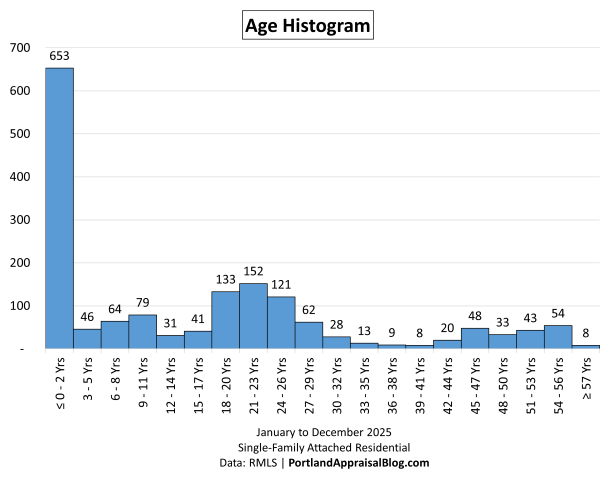

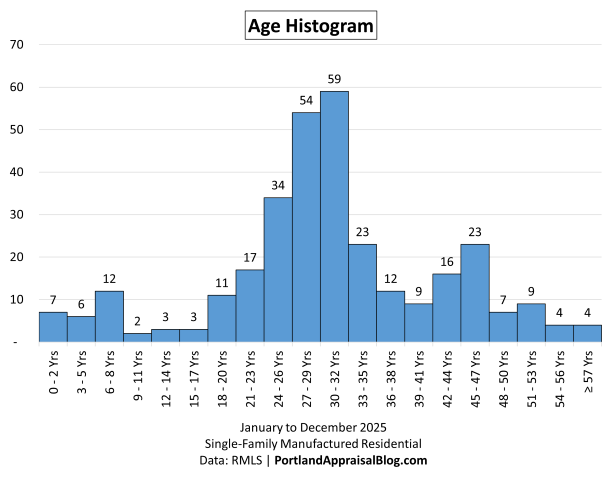

The following histogram shows the distribution of age for manufactured homes in 2025:

The age distribution for 2025 manufactured‑home sales forms a broad mid‑life plateau centered on homes built roughly 27–32 years ago. The 27–29 year bin accounts for 17.14% of all sales, and the 30–32 year bin adds another 18.73%, placing more than a third of the year’s activity in this single five‑year span. The average age of 30.50 years sits directly within this peak, reflecting the era when a large share of the region’s manufactured stock was built.

Surrounding this core, the bins from 24–47 years make up 73.02% of all 2025 sales, underscoring how strongly the market is anchored in this construction era. Even when the 27–32 year peak is removed, the remaining bins in that same 24–47 year window still represent 37.14% of the dataset, showing that the “shoulders” of the distribution are almost as large as the rest of the histogram combined. This structure reflects the region’s development history: a substantial wave of manufactured‑home construction in the late 1980s and early 1990s, followed by steadier, thinner additions in later decades.

The younger end of the distribution is modest, with only small counts in the 0–2, 3–5, and 6–8 year bins. This reflects the limited pipeline of new or recent construction manufactured homes entering the resale market each year. The older tail behaves similarly, tapering gradually through the 36–53 year bins and ending with just four sales each in the 54–56 and 57+ year ranges. Both tails are present but light, reinforcing that the market is driven primarily by mid‑life homes with predictable turnover and stable buyer demand.

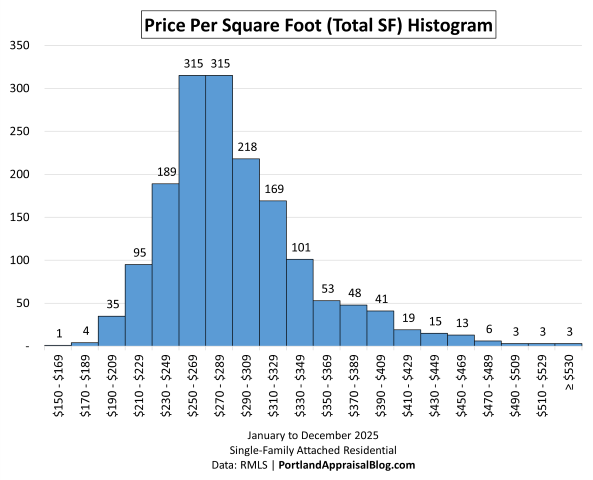

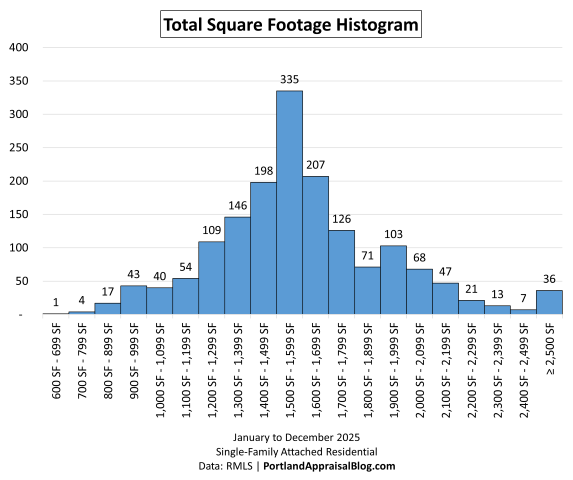

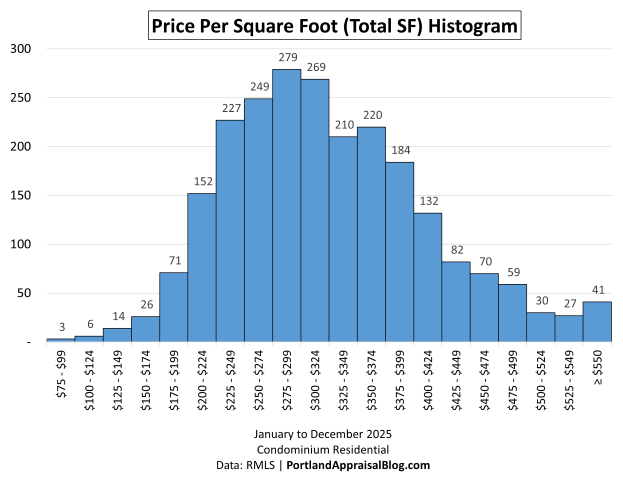

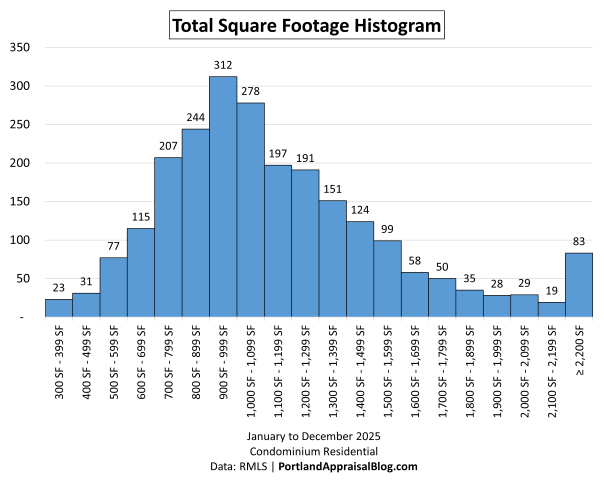

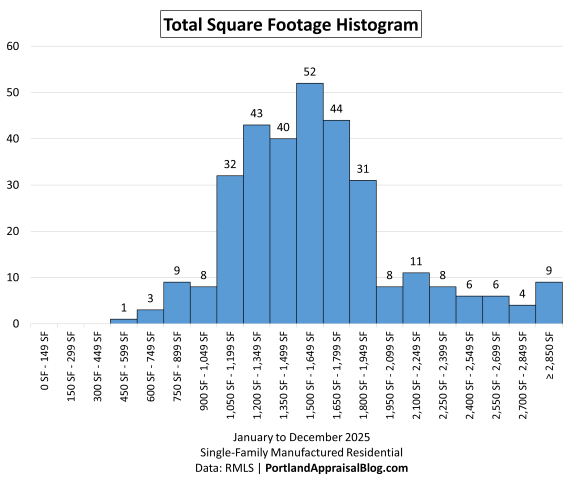

The following histogram shows the distribution of total square footage for manufactured homes in 2025:

The 2025 square‑footage distribution is anchored firmly in the mid‑size ranges, and the average of 1,629 square feet for 2025 sits directly within the broad plateau that defines the market. The single largest bin is 1,500–1,649 SF, representing 16.51% of all sales, and it is surrounded by similarly strong activity in the 1,200–1,349 SF (13.65%), 1,350–1,499 SF (12.70%), and 1,650–1,799 SF (13.97%) ranges. When combined with the 1,800–1,949 SF bin (9.84%), this mid‑range cluster forms a dominant block: the 1,050–1,949 SF span accounts for 242 sales, or 76.83% of the entire market. This is the structural center of the manufactured‑home segment in 2025.

Below this core, smaller homes taper in gradually. Units under 1,050 SF total 21 sales (6.67%), with modest representation in the 750–899 SF and 900–1,049 SF bins and only isolated activity below 750 square feet. Very small units under 600 square feet are nearly absent, reflecting the limited presence of tiny or cottage‑style manufactured homes in the resale market.

Above the mid‑range plateau, the distribution steps down in a predictable pattern. The 1,950–2,399 SF bins show steady but modest activity, and the upper tail continues through the 2,400–2,699 SF ranges before tapering to the 2,700–2,849 SF and 2,850+ SF bins. Larger homes remain a small share of the market, but they appear consistently enough to form a recognizable tail rather than isolated outliers.

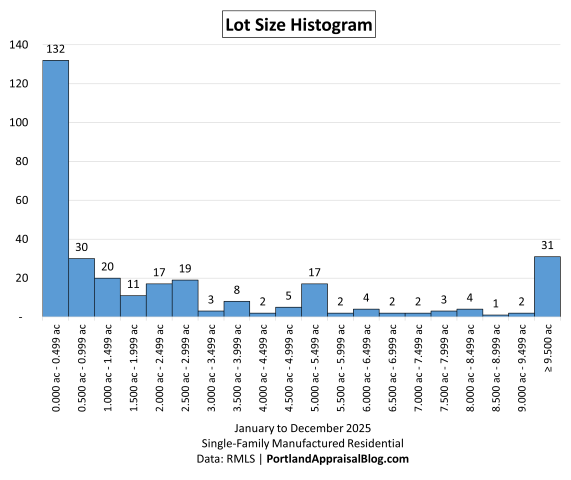

The following histogram shows the distribution of lot size for manufactured homes in 2025:

The 2025 lot‑size distribution shows a market split between small parcels and acreage properties, with a long upper tail that reflects the rural and semi‑rural settings common in this segment. The average lot size of 3.44 acres for 2025 sits well above the median bins, pulled upward by a relatively small number of large‑acreage properties.

The most common range by far is 0.000–0.499 acres, representing 41.90% of all sales. These are smaller‑scale parcels where the home itself drives most of the value. The next several bins—0.500–0.999 acres (9.52%), 1.000–1.499 acres (6.35%), and 1.500–1.999 acres (3.49%)—add another block of modest‑sized lots, placing the majority of 2025 sales on parcels under two acres.

Beyond that point, the distribution transitions into a broad acreage band. The 2.000–2.499 and 2.500–2.999 acre bins account for 5.40% and 6.03% of sales, and the 3.000–3.999 acre ranges add smaller but steady counts. These mid‑acreage parcels reflect the region’s rural inventory—properties with more land utility, outbuildings, or agricultural potential.

The upper tail is long and structurally important. Individual bins from 4.000–4.499 acres through 9.000–9.499 acres each contain only a handful of sales, but the final bin—≥ 9.500 acres, with 31 sales (9.84%)—is large for a specific reason. It is not a natural cluster at 9.5 acres; it is the catch‑all category for the entire long tail of acreage parcels, including properties extending far beyond the histogram’s visible range. Because the chart is limited to 20 bins, all parcels larger than 9.5 acres are compressed into this single bucket, which explains its size and why the average lot size reaches 3.44 acres even though most homes sell on small lots.

The overall shape is a classic manufactured‑home pattern: a dense small‑lot core, a broad mid‑acreage band, and a long, open‑ended tail where large rural parcels trade in small but meaningful numbers. This structure aligns with the pricing, age, and square‑footage distributions already documented, reinforcing the diversity of settings in which manufactured homes operate across the region.

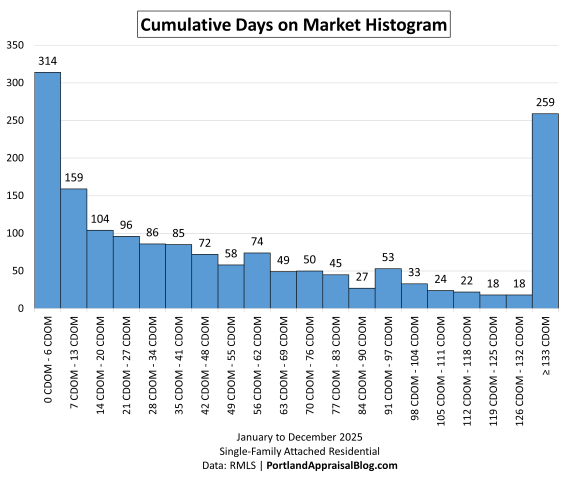

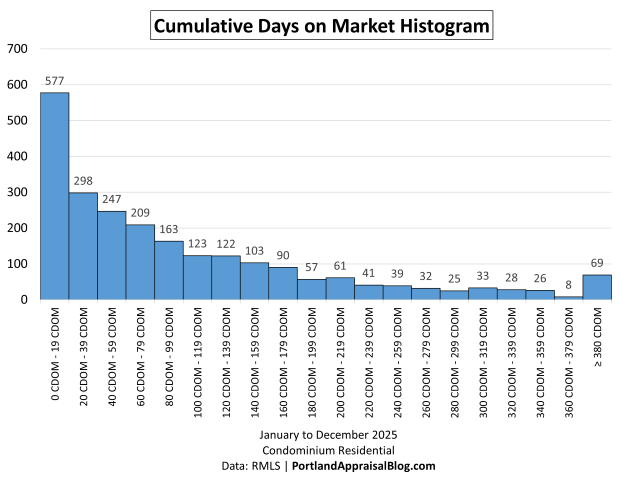

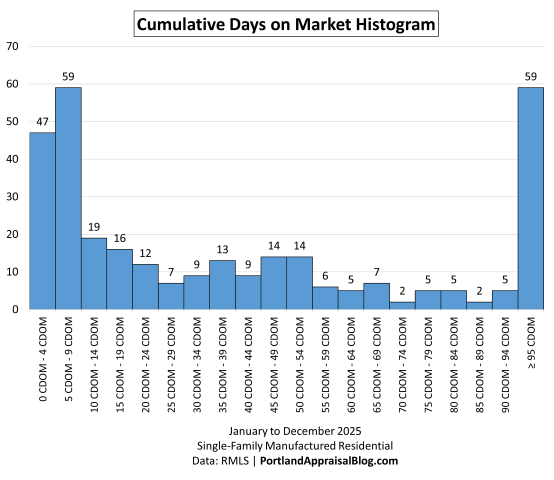

The following histogram shows the distribution of cumulative days on market for manufactured homes in 2026:

The CDOM distribution for 2025 shows a market with a strong, fast‑moving core and a structurally long tail, and the average of 61.03 days for 2025 sits right at the hinge point between those two regimes. The first two bins—0–4 days (14.92%) and 5–9 days (18.73%)—together account for one‑third of all sales, reflecting listings that were priced correctly and absorbed quickly. The next several bins through roughly 30 days add another steady block of activity, with 10–14 days (6.03%), 15–19 days (5.08%), 20–24 days (3.81%), and 25–29 days (2.22%) forming a smooth taper. This early portion of the histogram captures the bulk of the market’s normal turnover (50.79%).

From 30 to about 60 days, the distribution remains relatively stable and evenly populated. Bins such as 35–39 days (4.13%), 40–44 days (2.86%), 45–49 days (4.44%), and 50–54 days (4.44%) show that mid‑range marketing times were common and not indicative of distress. These ranges represent listings that required modest repositioning or simply needed more exposure time, but still behaved predictably within the broader flow of the market.

The upper tail begins around 60 days and extends outward in small but persistent increments. Individual bins from 60–64 days (1.59%) through 90–94 days (1.59%) each contain only a handful of sales, but they form a continuous sequence of slower‑moving listings. The final bin—≥ 95 days, with 59 sales (18.73%)—is large for a structural reason. It is not a natural cluster at 95–100 days; it is the catch‑all category for the entire long tail, which in 2025 extended all the way to a maximum of 712 cumulative days on market. Because the histogram is limited to 20 bins, every listing beyond 95 days is compressed into this single bucket, which explains its size and why the average CDOM reaches 61.03 days even though most sales occur well below that threshold (the median is 27 days).

The overall shape is consistent with a healthy manufactured‑home market: a fast‑moving core, a stable mid‑range, and a long but thin tail of slower‑moving listings that reflect unique property characteristics, pricing adjustments, or atypical circumstances.

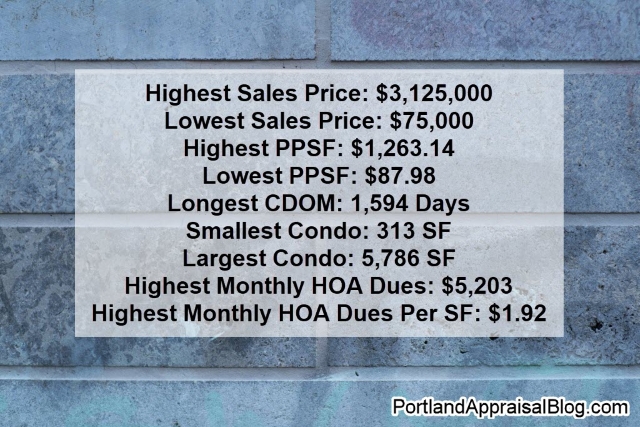

Miscellaneous Statistics & Standout Transactions

Here are some of the most notable outliers and extremes from the 2025 Portland Region attached homes market—numbers that illustrate the full range of the data and the extremes buyers and appraisers encounter.

Lowest Sales Price: $115,000—1-bedroom, 1.0-bathroom unit. This manufactured home in Vernonia (Columbia County) predates the current HUD codes and is a compact unit offering a distinct bedroom and living space on a 0.10-acre lot. This unit offers home and land ownership at an affordable price point. Photos of this property are currently available online.

Highest Sales Price: $1,100,000—Two manufactured homes in Canby, Oregon (Clackamas County). This sale involved two homes on one 10.03-acre lot. One home is 1,497 sq. ft. and the other is 1,671 sq. ft. The property has a number of outbuildings and the site offers a lot of flexibility for the owner. Photos of this property are currently available online.

Longest CDOM: 712 days—3-bedroom, 2.0-bathroom home in Mulino, Oregon (Clackamas County). This 1,820-sq. ft. property sold as a heavy fixer, which accounts for why it took so long to close. The unit is situated on 8.27 acres. The land likely represented a significant portion of the value. Photos of this property are currently available online.

Smallest Manufactured Home: 500 SF—1-bedroom, 1.0-bathroom unit. This is the same home as the lowest-priced sale. This property took the crown in two categories!

Largest Manufactured Home: 4,800 SF—3-bedroom, 2.0-bathroom unit in North Plains, Oregon (Washington County). This property is a triple-wide behemoth with solar panels! It is located on a 42.62-acre site and most of the lot is used for merchantable timber. Exterior photos of this property are currently available online.

Largest Lot: 53.39 acres—3-bedroom, 2.0-bathroom unit in Clatskanie, Oregon (Columbia County). This 2,209-sq. ft. home sold as a fixer. The site has several outbuildings and 40 acres of timber. The site is mostly gentle slope, making for a very usable plat. Photos of this property are currently available online.

With the regional aggregate trends, graphs, monthly patterns, histogram analysis, and notable outliers covered, the remainder of this update turns to a county-level breakdown. The following sections present year-over-year comparisons for each of the six counties in the Portland Region—Multnomah, Washington, Clackamas, Yamhill, Columbia, and Hood River. Each county snapshot includes key metrics, commentary on local drivers, and any segment-specific observations that help explain broader regional patterns.

Multnomah County 2025 Stats

Multnomah County represented 6.98% of the total 2025 manufactured home market.

The table below summarizes key metrics for Multnomah County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $9.07 Million | $10.27 Million | +13.23% |

| Average Price | $412,132 | $466,676 | +13.23% |

| Median Price | $390,500 | $404,000 | +3.46% |

| Avg SP/OLP | 98.09% | 95.09% | -3.05% |

| Avg PPSF (TSF) | $256.83 | $332.86 | +29.60% |

| Avg Lot Size (ac) | 1.58 | 2.94 | +85.53% |

| Avg Age (Yrs) | 28.50 | 31.41 | +10.21% |

| Avg CDOM | 66.05 | 70.50 | +6.74% |

| Avg Total SF | 1,635 | 1,540 | -5.84% |

| Total # of Sales | 22 | 22 | 0.00% |

| # of New Constr. | 0 | 0 | — |

| # of REOs | 1 | 0 | -100.00% |

| # of Short Sales | 0 | 0 | — |

Multnomah County continues to play a marginal role in the Portland Region’s manufactured housing market on owned land, with exactly 22 sales in 2025—unchanged from 2024. This persistent low volume reflects the county’s urban character: scarce acreage parcels, zoning restrictions, and competition from higher-density or site-built uses limit opportunities for affixed manufactured homes.

Despite flat transaction count, dollar volume increased 13.23% to $10.27 million, driven by a corresponding 13.23% rise in average price to $466,676 (median up 3.46% to $404,000). Notably, average home size declined slightly, while average lot size nearly doubled (+85.53% to 2.94 acres). The shift toward larger parcels—concentrated in outer rural pockets—lifted total values and contributed to a sharp 29.60% increase in average PPSF, even as the improvements themselves remained modest. Market time lengthened modestly (average CDOM +6.74%), and sales-to-list ratios fell to 95.09% (-3.05%), consistent with the negotiation dynamics typical of acreage properties.

No new construction or distressed sales occurred in 2025, keeping the segment clean and conventional. In this county dominated by the Portland urban core, manufactured homes on owned land most often function as an interim or affordability solution on remaining larger parcels.

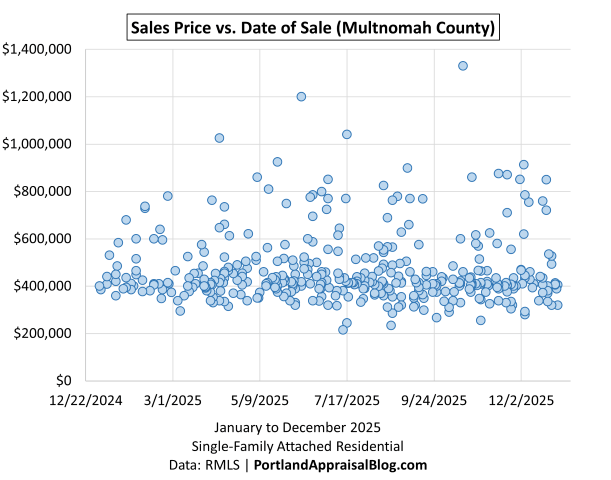

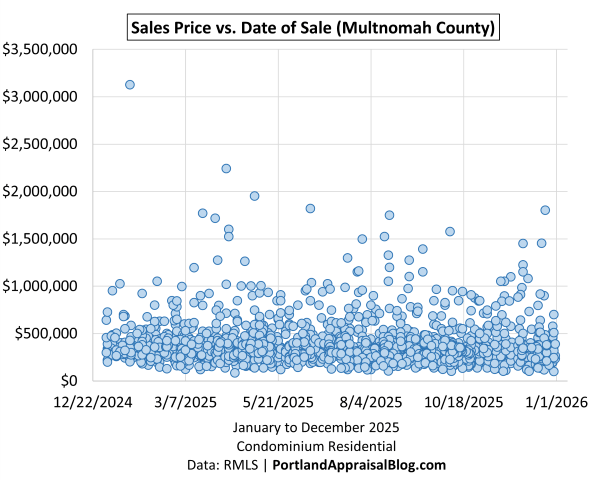

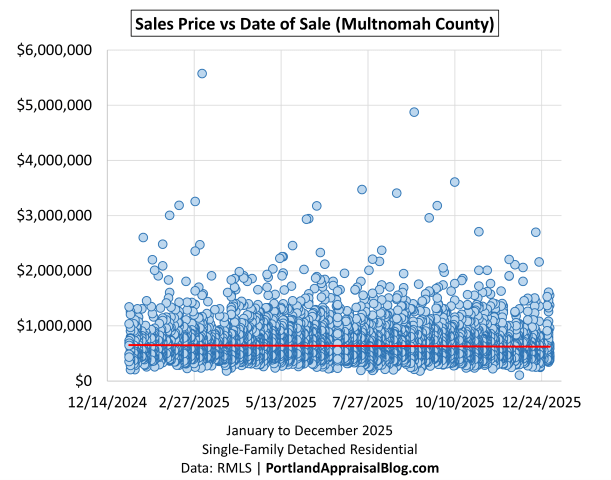

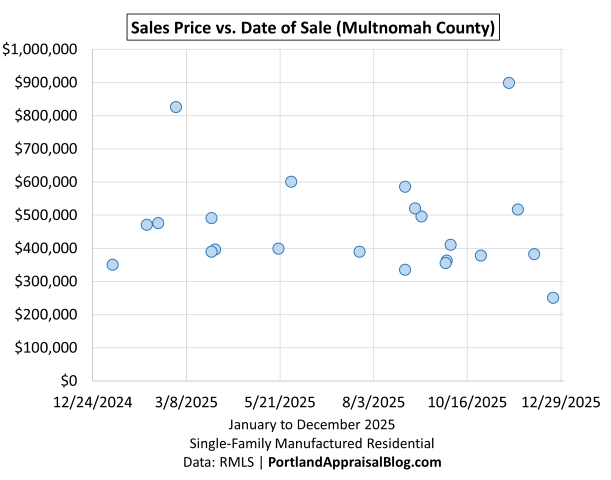

The following is a scatter plot of all Multnomah County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Multnomah County reveals a noticeable downward pattern across 2025. This is likely due to a compositional shift in lot size as the year progressed. The larger lots supported elevated prices early on, followed by a general shift toward smaller parcels later in the year—contributing to overall price stability with a downward tilt despite the modest YoY gains in averages.

Washington County 2025 Stats

Washington County represented 11.75% of the total 2025 manufactured home market.

The table below summarizes key metrics for Washington County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $18.05 Million | $19.59 Million | +8.54% |

| Average Price | $474,884 | $529,362 | +11.47% |

| Median Price | $422,500 | $485,000 | +14.79% |

| Avg SP/OLP | 97.11% | 96.69% | -0.43% |

| Avg PPSF (TSF) | $329.95 | $317.46 | -3.79% |

| Avg Lot Size (ac) | 2.52 | 4.38 | +73.55% |

| Avg Age (Yrs) | 26.92 | 33.22 | +23.38% |

| Avg CDOM | 56.03 | 54.11 | -3.42% |

| Avg Total SF | 1,496 | 1,778 | +18.87% |

| Total # of Sales | 38 | 37 | -2.63% |

| # of New Constr. | 0 | 0 | — |

| # of REOs | 0 | 0 | — |

| # of Short Sales | 0 | 0 | — |

Washington County ranks as a solid mid-tier contributor to the Portland Region manufactured housing market on owned land, with 37 sales in 2025—down slightly from 38 in 2024 (see the county summary table above). This modest decline in volume still places Washington among the more active counties for affixed manufactured homes, reflecting its mix of suburban and rural pockets where acreage remains somewhat available compared to urban Multnomah.

Dollar volume increased 8.54% to $19.59 million, supported by stronger per-unit pricing: average price rose 11.47% to $529,362, and median price climbed 14.79% to $485,000. The price gains were driven primarily by larger and newer inventory—average lot size jumped 73.55% to 4.38 acres, and average home size grew 18.87% to 1,778 SF—while average PPSF eased slightly (-3.79% to $317.46), a reminder that total value in this segment is heavily influenced by land contribution rather than improvement size alone. Homes also aged noticeably (average +23.38% to 33.22 years), consistent with limited new production. Market absorption improved modestly (average cumulative DOM -3.42% to 54.11 days), and sales-to-list ratios remained stable at 96.69% (-0.43%), typical for acreage properties.

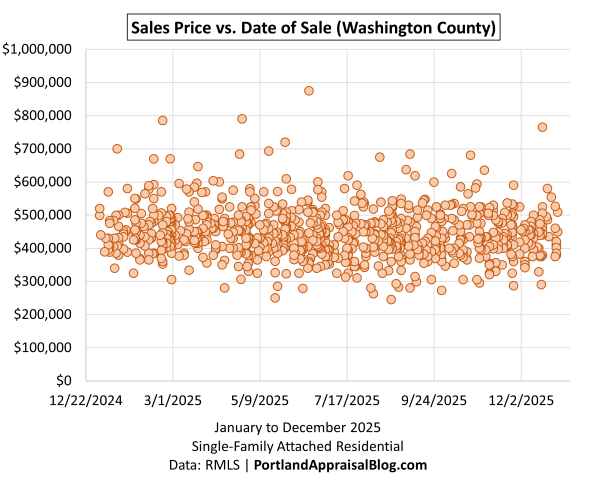

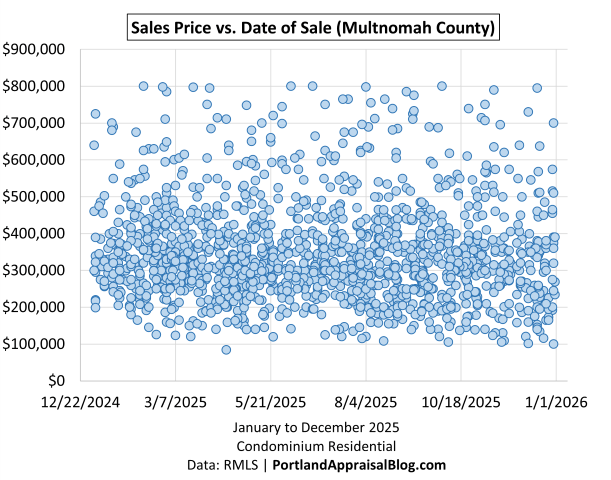

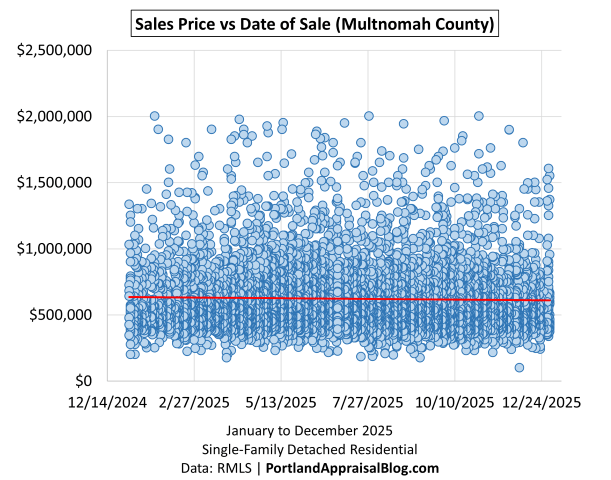

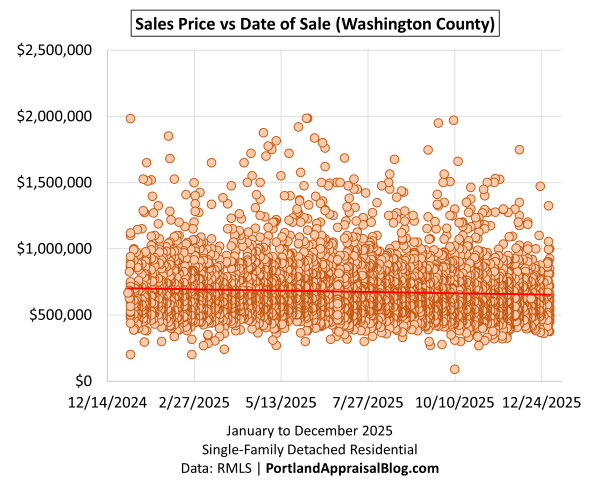

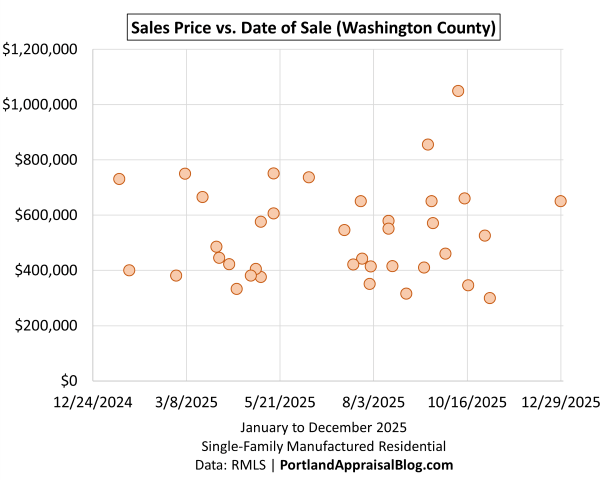

The following is a scatter plot of all Washington County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Washington County shows consistent activity throughout 2025, with prices spanning roughly $300,000 to over $1,000,000 and no strong seasonal or directional trend. A couple of higher-end sales ($800K+ range) appear in late summer/early fall, while mid-range sales ($400K–$700K) dominate the bulk of transactions. This even distribution aligns with the county’s balanced pricing gains despite the slight drop in unit count.

No new construction or distressed sales occurred in 2025, keeping the segment entirely resale. Washington County’s manufactured home market benefits from its position between urban constraints and rural acreage opportunities, allowing larger parcels to support elevated values in a segment where land often outweighs the home itself in the valuation equation.

Clackamas County 2025 Stats

Clackamas County represented 40.63% of the total 2025 manufactured home market.

The table below summarizes key metrics for Clackamas County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $49.8 Million | $64.10 Million | +28.70% |

| Average Price | $508,188 | $500,743 | -1.47% |

| Median Price | $491,601 | $450,000 | -8.46% |

| Avg SP/OLP | 96.47% | 96.43% | -0.04% |

| Avg PPSF (TSF) | $314.19 | $311.37 | -0.90% |

| Avg Lot Size (ac) | 4.04 | 3.13 | -22.59% |

| Avg Age (Yrs) | 27.35 | 28.73 | +5.04% |

| Avg CDOM | 51.48 | 57.95 | +12.56% |

| Avg Total SF | 1,663 | 1,676 | +0.78% |

| Total # of Sales | 98 | 128 | +30.61% |

| # of New Constr. | 2 | 3 | +50.00% |

| # of REOs | 1 | 2 | +100.00% |

| # of Short Sales | 0 | 0 | — |

Clackamas County dominates the Portland Region manufactured housing market on owned land, accounting for 128 sales in 2025 and $64.10 million in volume (43.20%). Sales count surged 30.61% from 98 in 2024, driving a 28.70% increase in dollar volume and cementing Clackamas as the clear leader in this segment.

Despite the robust volume growth, per-unit pricing softened modestly: average price fell 1.47% to $500,743, and median price declined 8.46% to $450,000. Average PPSF remained nearly flat (-0.90% to $311.37), while average lot size decreased 22.59% to 3.13 acres. The smaller average parcels likely contributed to the price softening by reducing land contribution, even as home size stayed stable (+0.78% to 1,676 SF) and age increased slightly (+5.04% to 28.73 years). Market time lengthened (average cumulative DOM +12.56% to 57.95 days), and sales-to-list ratios held steady at 96.43% (-0.04%). New construction remained minimal (3 units), and distressed activity was limited to 2 REOs.

Clackamas County’s average price hewed closely to 2024 levels, remaining essentially neutral in the dataset. With the county representing over 40% of regional sales volume, its stability anchored the market and allowed stronger price gains in smaller-volume counties to modestly lift the regional average.

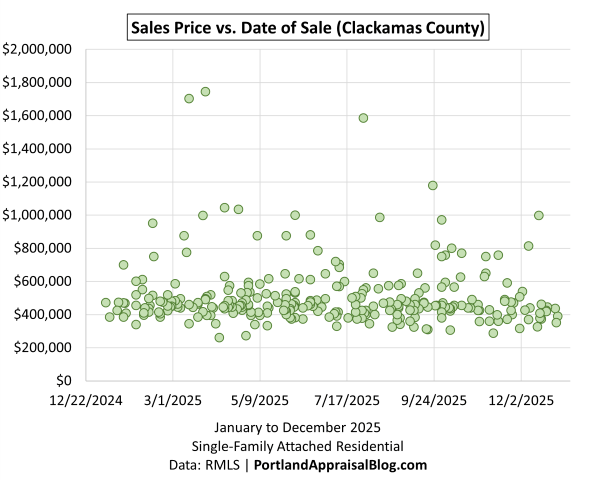

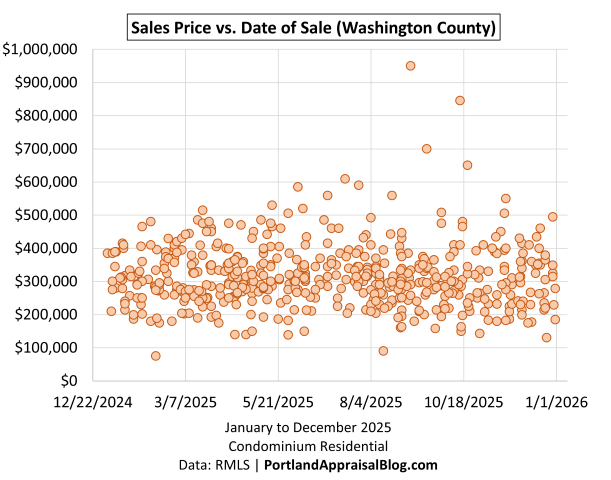

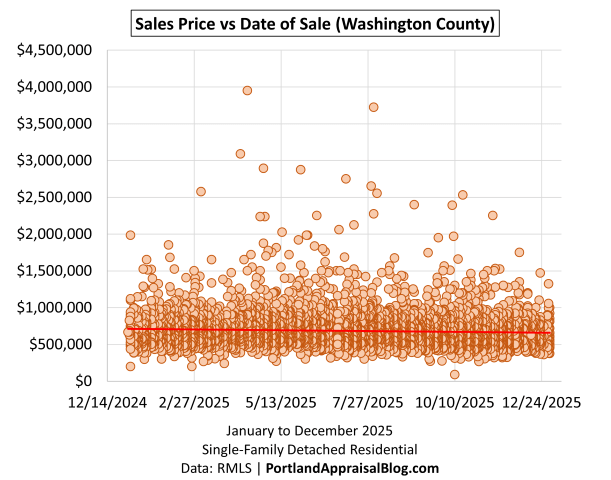

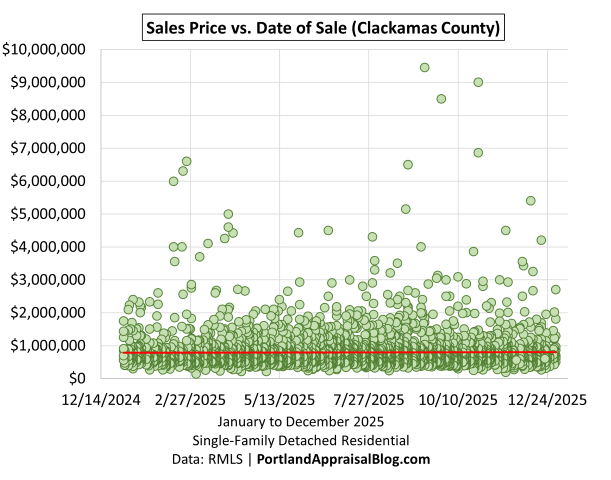

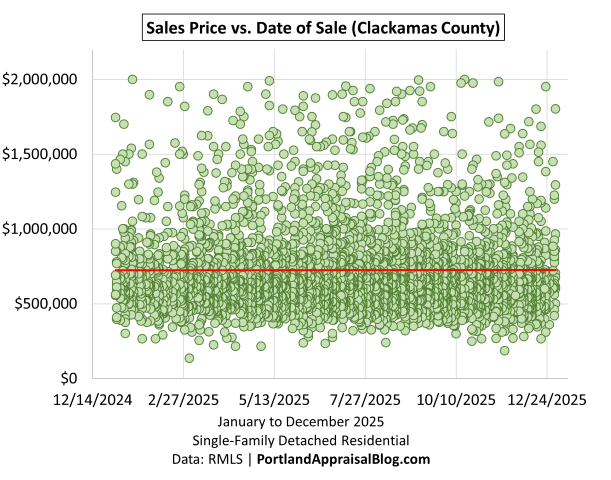

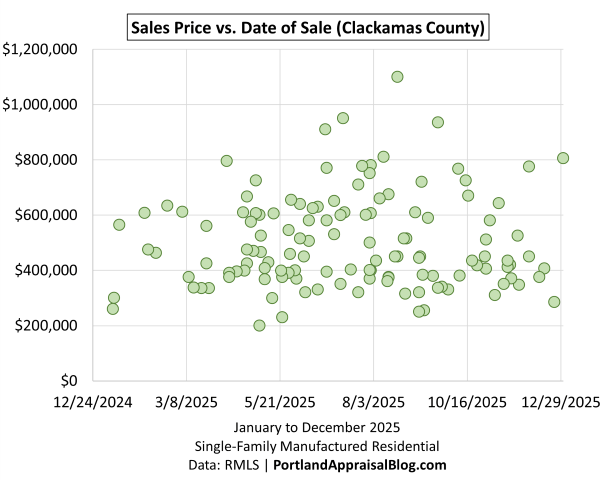

The following is a scatter plot of all Clackamas County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Clackamas County shows consistent activity throughout 2025, with prices ranging from approximately $200,000 to over $1,100,000 and a subtle upward tilt in the latter half of the year. Higher-value sales (more points in the $600,000–$900,000+ range) become more prevalent from mid-year onward, reflecting a gradual increase in home size closing later in the period. This pattern helps offset some of the modest per-unit price softening seen in the annual averages.

Clackamas County’s leadership in manufactured home sales stems from its relative abundance of rural and semi-rural parcels compared to more urban counties. It represents the engine of the region’s manufactured homes market.

Yamhill County 2025 Stats

Yamhill County represented 21.90% of the total 2025 manufactured home market.

The table below summarizes key metrics for Yamhill County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $25.43 Million | $29.35 Million | +15.45% |

| Average Price | $454,037 | $425,431 | -6.30% |

| Median Price | $407,500 | $410,000 | +0.61% |

| Avg SP/OLP | 96.33% | 97.60% | +1.32% |

| Avg PPSF (TSF) | $288.51 | $270.53 | -6.23% |

| Avg Lot Size (ac) | 3.13 | 2.99 | -4.34% |

| Avg Age (Yrs) | 29.75 | 31.80 | +6.88% |

| Avg CDOM | 54.38 | 50.88 | -6.42% |

| Avg Total SF | 1,604 | 1,579 | -1.55% |

| Total # of Sales | 56 | 69 | +23.21% |

| # of New Constr. | 0 | 0 | — |

| # of REOs | 2 | 1 | -50.00% |

| # of Short Sales | 0 | 0 | — |

Yamhill County ranks as the second-most active market for manufactured homes on owned land in the Portland Region, with 69 sales in 2025—up 23.21% from 56 in 2024—and $29.35 million in volume (+15.45%). This solid rebound in transaction activity underscores the county’s appeal for rural and semi-rural acreage buyers, where manufactured homes remain a viable affordability option.

Despite the volume strength, per-unit pricing softened: average price declined 6.30% to $425,431, while the median held nearly flat (+0.61% to $410,000). Average PPSF fell 6.23% to $270.53, reflecting slightly smaller homes (-1.55% to 1,579 SF) and marginally reduced lot size (-4.34% to 2.99 acres), combined with an older inventory base (+6.88% to 31.80 years). Absorption improved noticeably (average cumulative DOM -6.42% to 50.88 days—the fastest among the six counties), and sales-to-list ratios edged higher to 97.60% (+1.32%), suggesting relatively efficient pricing negotiations for acreage properties.

No new construction occurred, and distressed activity was minimal (one REO). Yamhill County’s manufactured home market benefits from its rural character and relative availability of acreage compared to more urban counties, though land contribution remains the primary valuation driver.

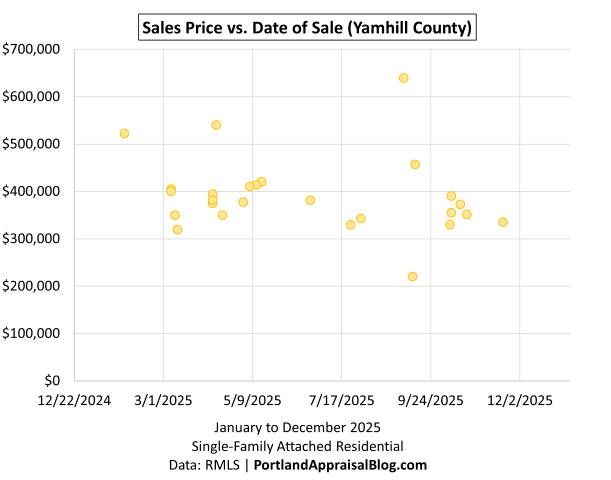

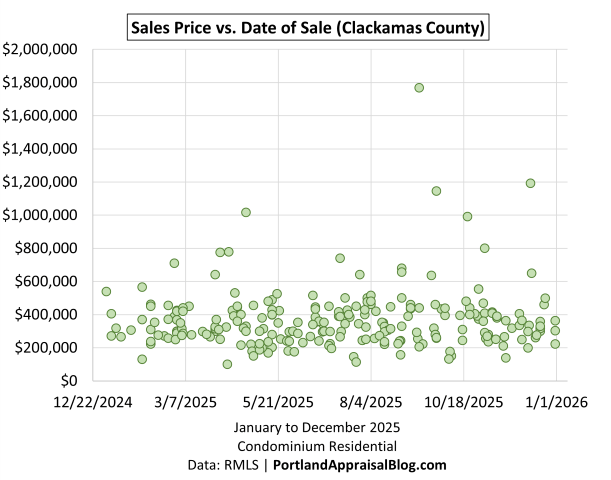

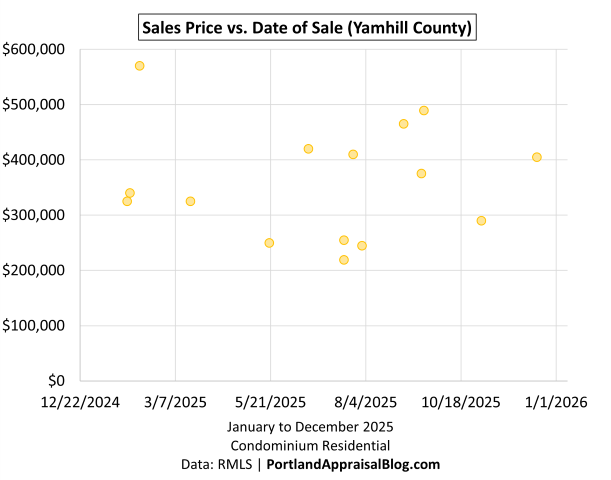

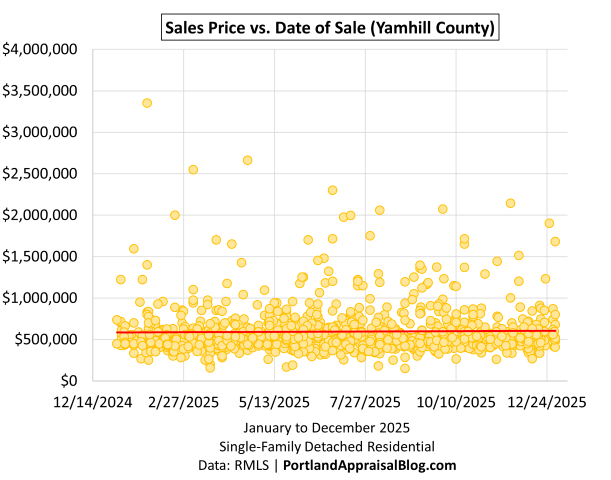

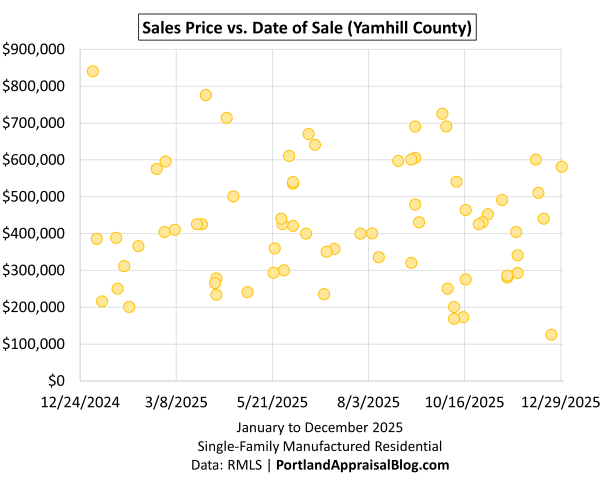

The following is a scatter plot of all Yamhill County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Yamhill County illustrates consistent activity throughout 2025, with prices ranging from approximately $100,000 to nearly $900,000 and the bulk clustering between $300,000 and $600,000. Higher-value sales appear scattered across the year without a dominant trend, reflecting the county’s mix of rural larger-lot parcels (supporting occasional $600K+ closings) and more modest suburban or small-lot transactions that drive much of the volume. The even monthly distribution aligns with the strong unit growth and quicker market time.

Columbia County 2025 Stats

Columbia County represented 13.97% of the total 2025 manufactured home market.

The table below summarizes key metrics for Columbia County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $20.98 Million | $16.94 Million | -19.27% |

| Average Price | $395,896 | $384,984 | -2.76% |

| Median Price | $373,500 | $375,000 | +0.40% |

| Avg SP/OLP | 96.83% | 93.90% | -3.03% |

| Avg PPSF (TSF) | $256.28 | $262.81 | +2.55% |

| Avg Lot Size (ac) | 4.66 | 5.20 | +11.70% |

| Avg Age (Yrs) | 29.04 | 32.23 | +10.98% |

| Avg CDOM | 89.19 | 81.73 | -8.37% |

| Avg Total SF | 1,581 | 1,484 | -6.09% |

| Total # of Sales | 53 | 44 | -16.98% |

| # of New Constr. | 1 | 1 | 0.00% |

| # of REOs | 3 | 1 | -66.67% |

| # of Short Sales | 0 | 0 | — |

Columbia County represents a distinctly rural segment of the Portland Region manufactured housing market on owned land, with 44 sales in 2025—down 16.98% from 53 in 2024—and $16.94 million in volume (-19.27%). This volume contraction reflects the county’s remote location and limited buyer pool.

Per-unit pricing showed mild softening: average price declined 2.76% to $384,984, while the median remained essentially flat (+0.40% to $375,000). Average PPSF edged up modestly (+2.55% to $262.81), supported by larger average lot size (+11.70% to 5.20 acres—the highest among the six counties) despite smaller homes (-6.09% to 1,484 SF) and an older inventory (+10.98% to 32.23 years). Market time improved (-8.37% to 81.73 cumulative DOM), though Columbia retained the longest average days on market among the counties. Sales-to-list ratios fell to 93.90% (-3.03%), indicating greater negotiation room typical of more isolated acreage properties. New construction was negligible (1 unit), and distressed activity reduced to one REO.

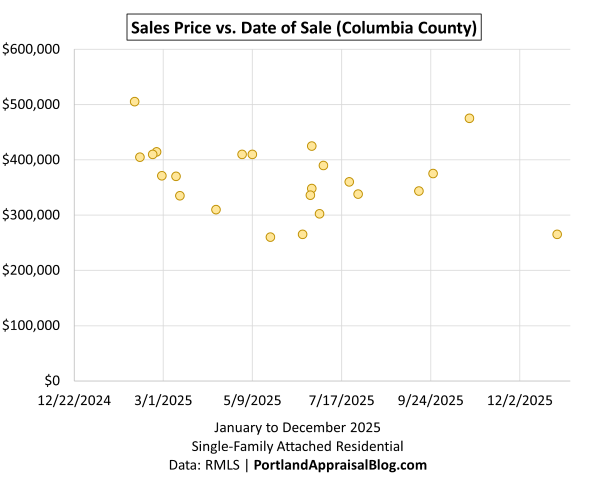

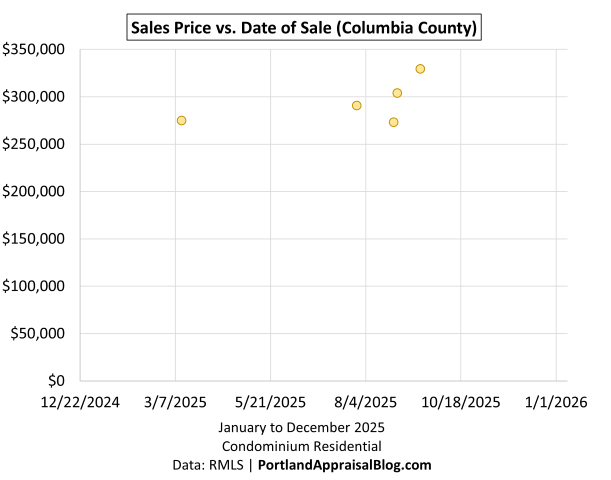

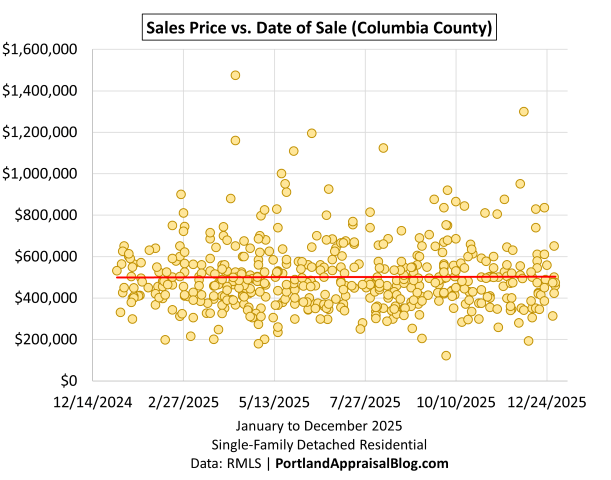

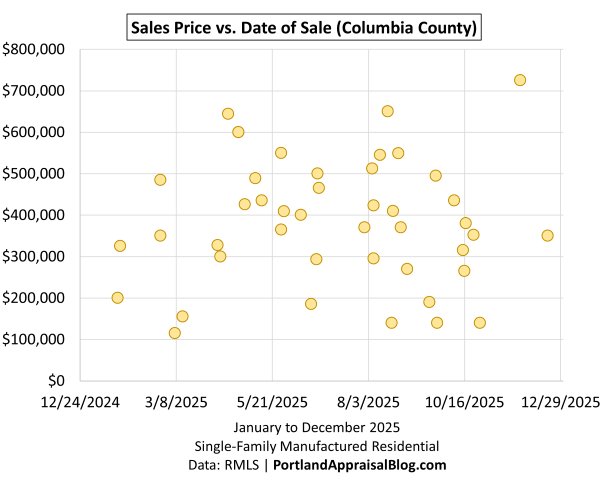

The following is a scatter plot of all Columbia County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Columbia County illustrates steady but sparse activity throughout 2025, with prices ranging from $115,000 to $725,000 and the majority clustering between $300,000 and $600,000. Higher-value sales appear scattered across the year without a clear trend, reflecting the county’s rural character and large-lot dominance, while lower-end transactions (some on small parcels) contribute to the lower tail. The even monthly distribution aligns with the improved absorption despite the overall volume decline.

Hood River County 2025 Stats

Hood River County represented 4.76% of the total 2025 manufactured home market.

The table below summarizes key metrics for Hood River County manufactured single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $4.30 Million | $8.13 Million | +88.92% |

| Average Price | $477,994 | $541,809 | +13.35% |

| Median Price | $499,000 | $560,000 | +12.22% |

| Avg SP/OLP | 95.20% | 93.56% | -1.72% |

| Avg PPSF (TSF) | $321.86 | $335.87 | +4.35% |

| Avg Lot Size (ac) | 1.22 | 1.35 | +10.58% |

| Avg Age (Yrs) | 27.56 | 26.47 | -3.95% |

| Avg CDOM | 34.78 | 76.47 | +119.87% |

| Avg Total SF | 1,639 | 1,650 | +0.68% |

| Total # of Sales | 9 | 15 | +66.67% |

| # of New Constr. | 0 | 0 | — |

| # of REOs | 0 | 0 | — |

| # of Short Sales | 0 | 0 | — |

Hood River County represents the smallest but most premium segment of the Portland Region manufactured housing market on owned land, with 15 sales in 2025—up 66.67% from 9 in 2024—and $8.13 million in volume (+88.92%). Despite the low absolute numbers, this rebound reflects renewed interest in the area’s scenic appeal and limited supply of suitable parcels.

Per-unit pricing advanced solidly: average price increased 13.35% to $541,809, and median price rose 12.22% to $560,000—the highest county medians in the region. Average PPSF climbed 4.35% to $335.87 (also the highest), supported by slightly larger lots (+10.58% to 1.35 acres—the smallest average acreage) and stable home size (+0.68% to 1,650 SF). Homes were marginally younger (-3.95% to 26.47 years—the youngest average age), suggesting a mix that included relatively recent builds. Market time extended significantly (+119.87% to 76.47 cumulative DOM), likely due to the county’s remote location and selective buyer pool, while sales-to-list ratios dipped to 93.56% (-1.72%), indicating greater negotiation room on premium properties. No new construction or distressed sales occurred.

Hood River County’s manufactured home market benefits from its unique location in the Columbia River Gorge, where demand for views, recreation, and limited supply drives premium per-unit values despite smaller average lots and extended market time.

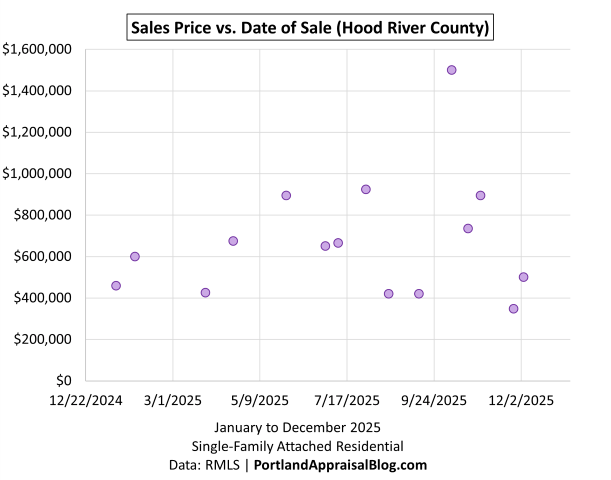

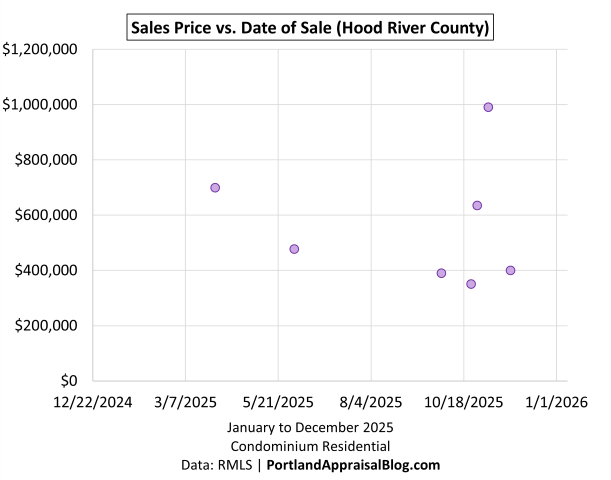

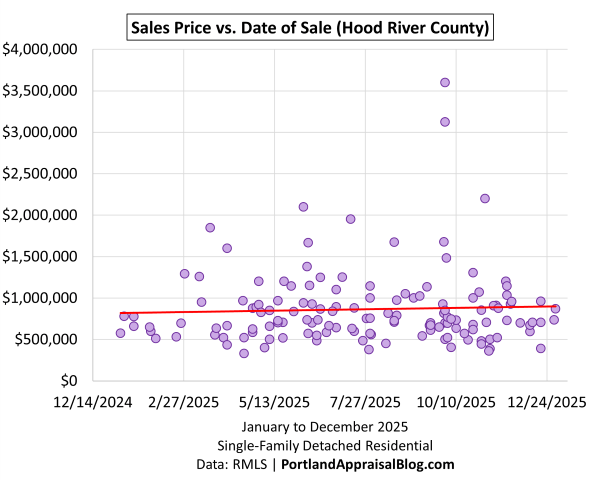

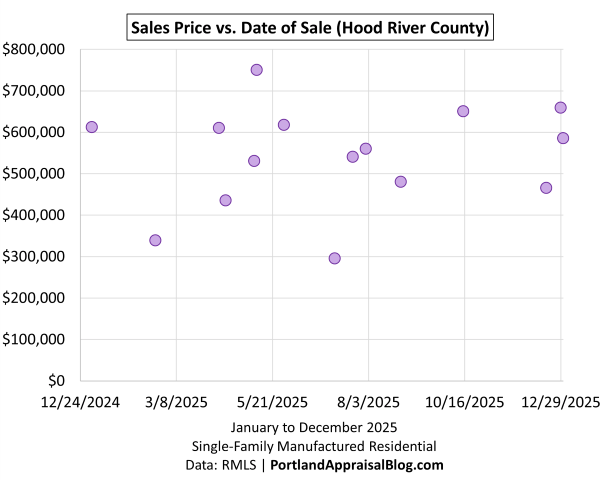

The following is a scatter plot of all Hood River County sales in 2025 (sales price vs. date of sale):

The Sales Price vs. Date of Sale scatter for Hood River County shows sparse but steady activity throughout 2025, with prices ranging from $295,000 to $750,000 and the majority clustering between $500,000 and $700,000. Higher-value sales appear scattered across the year without a dominant trend, consistent with the county’s limited inventory and scenic/river-proximity premiums that support elevated pricing even on smaller parcels.

Closing Thoughts

2025 proved to be a year of quiet resilience and uneven recovery for manufactured homes on owned land in the Portland Region. Transaction volume rebounded strongly to 315 sales—essentially returning to 2023 levels after the softer 2024—and total dollar volume rose 16.25% to $148.4 million; putting nearly $21 million more dollars in sellers’ hands. Per-unit pricing held firm with modest gains and PPSF edged up, even as inventory continued to age and new construction remained negligible (just 4 units region-wide).

The year highlighted the segment’s rural character: Clackamas, Yamhill, and Columbia together accounted for ~74% of dollar volume and ~77% of sales, driven by acreage availability that buffered value despite macro pressures. Land contribution remained the dominant valuation driver across counties—diluting PPSF in larger-parcel sales while supporting total prices, especially in premium locations like Hood River (highest avg/median prices and PPSF) and rural pockets in Washington and Columbia (largest average lots). Heterogeneity persisted, with small-sample volatility in lower-volume counties (Multnomah, Hood River) and longer market times in remote areas, yet quicker absorption in Yamhill and Washington.

Distress stayed minimal (4 REOs, zero short sales), and the segment earned its place as the second-most affordable housing type per the Portland Appraisal Blog Affordability Index (PABAI 111.67), trailing only condominiums.

Manufactured homes on owned land continue to serve as a practical affordability pathway and, in many cases, an interim use on rural parcels where site-built homes are viewed as the highest and best use. There were 1,199 acreage site-built sales in 2025; when combined with the 153 manufactured homes on at least 1 acre of land, that yields 1,352 total acreage sales. Manufactured homes thus comprised 11.32% of the acreage market—almost eight times their approximate share of overall regional housing sales volume.

Looking to 2026, key questions include whether sustained rate relief and rural demand will sustain or accelerate volume, whether limited new production will further age the inventory, and how evolving land-use policies might affect acreage availability in outer counties. The niche’s resilience through 2025 suggests it will remain an important, if specialized, component of regional housing options.

What trends do you expect to see in 2026? I’d love to hear your thoughts—feel free to reply here or reach out directly.

Sources & Further Reading

All data presented in this annual review is sourced directly from RMLS and has been subjected to our rigorous cleaning and validation process to ensure reliability for manufactured residential analysis in the six-county Portland Region. The trends, comparisons, and commentary are the result of original appraisal expertise and independent analysis—not aggregated from secondary sources or news summaries.

- The Portland Region – Six-County Market Area Overview: Portland Appraisal Blog

- RMLS Data Challenges: Portland Appraisal Blog

- The 2024 Portland Region Manufactured Housing Market in Review: Portland Appraisal Blog

- Portland Affordability Index – PABAI: A Realistic Housing Qualification Metric for the Portland Region: Portland Appraisal Blog

Coda

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.