Via Canva Pro

Earlier this month, Redfin highlighted Portland as one of the stronger markets nationally for starter-home activity, defining starter homes as sales in the 5th–35th percentile by price. We adopt the same percentile convention here for consistency.

Redfin’s reported median of approximately $420,000 for Portland starter homes includes all property types (condos, townhomes, and single-family). Focusing solely on detached single-family residences—a popular choice across the region, including for many urban buyers seeking yard space and privacy over attached ownership—Q3 2025 RMLS data for the 5th–35th percentile tier shows an average close price of $469,000.

Few would be surprised that new construction plays a limited role in true entry-level pricing—after all, building costs remain elevated. Yet the data shows builders are still delivering a modest but meaningful number of brand-new homes into this tier (about 4.2% of starter sales, compared to 9.1% across the full market). This demonstrates that, through efficient design, infill strategies, and lot divisions, new product can compete in the lower price bands.

Local buyers want to know: how much home does a starter budget actually buy? This analysis examines square footage, lot size, build era, and location differences across counties—revealing a market dominated by mid-century homes with a modest but noteworthy presence of brand-new construction.

How Much Home a Starter Budget Buys by County

The table below summarizes Q3 2025 closed sales for detached single-family homes in the 5th–35th percentile across the core Portland Region counties (Hood River row excluded due to only two qualifying sales).

| County | Avg Close Price | Avg Yr Built | Avg Total SF | Avg Acres | # of Sales |

|---|---|---|---|---|---|

| Clackamas | $474,738 | 1965 | 1,553 | 0.279 | 256 |

| Columbia | $457,108 | 1983 | 1,774 | 0.617 | 58 |

| Mult. | $459,909 | 1951 | 1,591 | 0.163 | 666 |

| Wash. | $488,954 | 1976 | 1,495 | 0.154 | 323 |

| Yamhill | $453,522 | 1981 | 1,532 | 0.197 | 113 |

| Grand Total | $468,595 | 1963 | 1,565 | 0.203 | 1,418 |

Multnomah County drives nearly half the volume, delivering the oldest average build year (1951). Washington County posts the highest average prices and hosts the most new construction. Outer counties like Columbia and Yamhill provide newer homes on larger parcels, though with far fewer transactions.

Surprisingly, across the region, starter homes are very similar in average price. The standard numerical metrics which are easy to see in RMLS, (e.g. total square footage, lot size, year built, etc.), are not the primary determinant of value. As we shall see, what matters more is quality, condition, and overall site & functional utility. Buyers in the starter home tier make conscious trade-offs between older homes with larger lots and newer homes with little to no functional backyard.

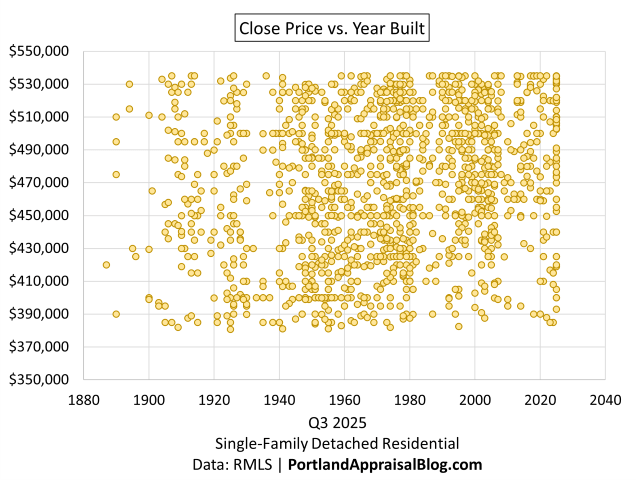

Of all the standard numeric metrics, total square footage shows one of the stronger relationships with price in the starter tier—though the influence is still modest.

Note: The Y-axis begins at $350,000 to allow for better viewing of the dataset.

Larger homes tend to sell for higher prices, though with considerable variation—most sales fall between 1,200 and 2,000 square feet. The very slight tilt to the right indicates a weak but present relationship between starter home size and close price. The coefficient of determination (R2) for this graph is 0.1253, meaning total square footage explains only about 12.5% of the variation in price. Since total square footage is often one of the primary determinants of value in the broader housing market, this is a big clue that the size of the home isn’t the primary factor for buyers looking to enter the starter home market.

The Historical Supply Pattern: Lot Size and Build Era

Portland’s entry-level inventory bears the clear imprint of the post-war building boom.

A polynomial trendline highlights the peak lot sizes during the 1940s–1950s post-war era, followed by a steady decline that began in the early 1960s and accelerated in recent decades. The pattern reflects an era when generous lots were standard, followed by shrinking parcels as land values rose, urban growth boundaries took effect, and lot divisions became common. Buyers choosing older starter homes today typically gain significantly more outdoor space than those selecting new construction.

New Construction: A Modest but Noteworthy Presence

While new homes account for only 4.2% of starter-tier sales, their ability to reach this price range in a high-cost building environment remains impressive.

| Segment | Avg Close Price | Avg Total SF | Avg Acres | # of Sales |

|---|---|---|---|---|

| Existing | $467,996 | 1,569 | 0.207 | 1,359 |

| New | $482,387 | 1,479 | 0.107 | 59 |

| Grand Total | $468,595 | 1,565 | 0.203 | 1,418 |

New homes sell for only about 3% more than existing ones despite brand-new condition, but deliver less interior space and roughly half the land.

Buying a new home in the starter tier is akin to buying a new car on a tight budget: you gain the benefits of fresh systems, modern design, and warranty peace of mind, but often in a smaller package with fewer amenities compared to a well-maintained used model from a higher trim line.

| County | Avg Close Price | Avg Yr Built | Avg Total SF | Avg Acres | # of Sales |

|---|---|---|---|---|---|

| Clackamas | $489,803 | 2025 | 1,606 | 0.154 | 8 |

| Columbia | $420,000 | 2025 | 1,458 | 0.130 | 2 |

| Mult. | $450,820 | 2025 | 1,098 | 0.088 | 18 |

| Wash. | $509,366 | 2025 | 1,699 | 0.079 | 25 |

| Yamhill | $475,578 | 2025 | 1,540 | 0.216 | 6 |

| Grand Total | $482,387 | 2025 | 1,479 | 0.107 | 59 |

For buyers, this creates a clear choice: a brand-new home with modern efficiency but typically on a very small lot—often with minimal or no usable yard space, especially in Multnomah and Washington counties where most new construction occurs—or an existing mid-century home that generally offers significantly more land and outdoor space, albeit with the potential challenges of older systems and layouts. This trade-off is particularly relevant for growing families or those prioritizing play areas, gardens, or privacy.

Appraisal Insights and Challenges

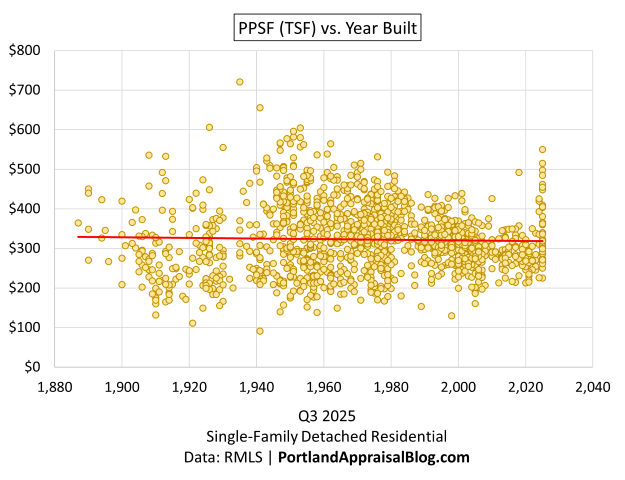

One of the most revealing patterns appears when plotting close price against build year.

Note: The Y-axis begins at $350,000 to allow for better viewing of the dataset.

The remarkably consistent price band across decades illustrates that chronological age has little direct influence on value in the Portland Region’s entry-level segment.

In this tier, actual age correlates weakly with sales price because buyers weigh multiple factors:

- Functional obsolescence in mid-century stock (outdated floor plans, smaller kitchens/bathrooms, less efficient systems) is often mitigated by updates and strong location appeal.

- Effective age and condition drive far more of the value than the original build date.

- Lot size and site utility frequently favor older homes; the smaller parcels common in new construction require substantial negative adjustments that offset much of the credit for new condition.

- Comparable selection remains within county, where abundant mid-century comps in Multnomah, Clackamas, and Washington provide solid support — but thinner volume in outer counties demands careful bracketing.

- When appraising a new-construction home in this tier—where truly similar recent sales are still limited and down approximately 25% year-over-year in Q3 2025 (with Multnomah County off 48%)—appraisers typically rely on other relatively recent builds (often within 10 years) and apply appropriate adjustments for differences in site characteristics, size, and location.

The same pattern holds when looking at the data from a price-per-square-foot lens, but with a slight twist:

From the 1950s onward, PPSF becomes progressively more compressed—older homes exhibit wide spreads driven by dramatic differences in condition, updates, historic appeal, and location premiums, while mid-era and late-20th-century stock tightens as market expectations and remodeling homogenize perceived value.

Brand-new 2025 homes, however, break this decades-long compression pattern. Their PPSF spreads out again, reflecting greater influence from location-driven land costs and builder-specific choices (e.g., finishes, lot configuration) rather than the uniformity imposed by age and updates on existing stock. In effect, today’s entry-level new construction reintroduces variation that mirrors pre-1950 homes—but for different reasons: land value dominance and strategic specs to hit price points, rather than condition swings. This underscores why new-construction starter homes often form their own submarket. Appraisers valuing them face a narrower but distinct comp pool.

These dynamics show that the starter home market is not uniform and the appraiser needs to carefully delineate the competitive market segment to avoid having to make large adjustments between disparate properties. One technique appraisers often employ is to use similar, but older sales when recent data is thin and make an appropriate market conditions adjustment.

Conclusion

The Portland Region’s Q3 2025 starter-home segment continues to rely predominantly on mid-century inventory on lots larger than anything new we’re building today—a pattern unlikely to shift dramatically in 2026 absent major changes in new supply. (Although the City of Portland is certainly trying to incentivize new projects with SDC waivers.) The modest foothold of new construction shows builders adapting through infill and efficient design, but at the clear cost of site size and outdoor space.

For buyers, the choice boils down to priorities: modern and low-maintenance on a small lot, or more space and yard with the realities of an older home. For appraisers, lenders, and agents, recognizing how effective age, site utility, location, and condition outweigh chronological age remains key to accurate valuation in this segment.

Sources & Further Reading

- Starter-Home Sales Climb 5%: Redfin News

- The Portland Region Q3 2025 Market Update: Portland Appraisal Blog

- Portland’s Temporary SDC Exemption for New Housing Units (2025–2028): Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.