Photo: Abdur Abdul-Malik, Portland Appraisal Blog

The National Association of Realtors recently reported that the median age of first-time home buyers has reached 40—the highest on record—with their share of purchases falling to a historic low of 21%. These trends are driven by affordability challenges that national indices like NAR’s Housing Affordability Index attempt to measure.

Using NAR’s standard methodology (principal and interest only, 25% qualifying ratio), approximately 28% of Q3 2025 detached single-family sales in the six-county Portland region were affordable to a household earning the area’s median income of $124,100.

In reality, no buyer escapes property taxes or homeowners insurance. When we incorporate actual taxes from listings and a conservative insurance estimate into the full monthly payment (PITI, 28% ratio), affordability drops to 20% for that same benchmark household.

To provide a more accurate local measure, this analysis introduces the Portland Appraisal Blog Affordability Index (PABAI)—a PITI-based index designed for the Portland Region’s residential market. Like traditional housing affordability indices, the PABAI expresses affordability as an index value where 100 means a household at the reference median income can exactly qualify for the typical home under realistic lending conditions. Values below 100 indicate unaffordability. A secondary calculation—the percentage of sales affordable to that reference household—derives directly from the index and serves as the primary insight in this post. For the overall Portland Region benchmark (using HUD’s Area Median Income of $124,100), the PABAI stood at approximately 78—confirming an unaffordable market even before drilling into younger households.

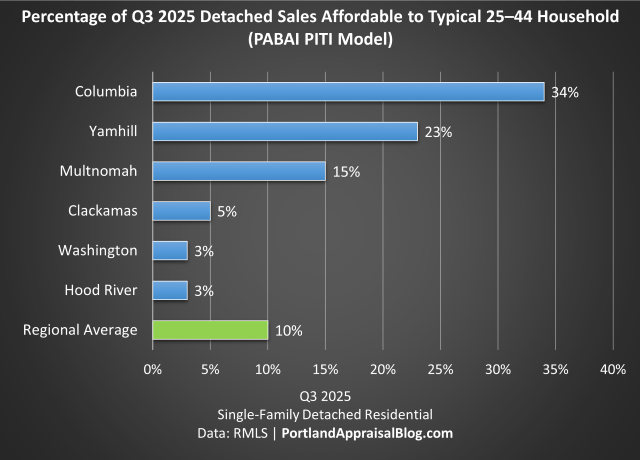

The challenge is even more severe for the cohort most people associate with first-time buyers: households headed by someone aged 25–44. With a median income of approximately $110,000 (2024 American Community Survey estimate), the PABAI drops to 69—meaning the typical younger household fell 31% short, with only 9.8% of Q3 detached sales (460 homes out of 4,682) within reach. The typical $600,000 detached home required roughly $159,000 in household income—45% above the cohort median.

Q3 2025 Affordability for Younger Buyers — County by County

Q3 2025 PABAI modeling reveals stark geographic variation for households aged 25–44.

| County | Median Q3 Price | Required Income for Median Home | % of Sales Affordable: 25–44 Age Group |

|---|---|---|---|

| Columbia | $471,000 | $122,000 | 34% |

| Yamhill | $510,000 | $132,000 | 23% |

| Multnomah | $555,000 | $150,000 | 15% |

| Clackamas | $675,000 | $178,000 | 5% |

| Washington | $625,000 | $165,000 | 3% |

| Hood River | $773,000 | $195,000 | 3% |

| Regional | $600,000 | $159,000 | 10% |

Under the PABAI, outer counties like Columbia (34%) and Yamhill (23%) offered the highest shares of reachable detached homes, but this comes with trade-offs. Homes in these more rural areas typically involve longer commute times to Portland’s core amenities, job markets, and urban services—a key consideration for households prioritizing proximity over initial affordability. More urban Multnomah (15%) outperformed the pricier suburban counties of Washington (3%) and Clackamas (5%). Hood River’s premium inventory made it effectively inaccessible at just 3%.

The suburban counties’ low accessibility reflects their inventory mix. Clackamas County’s average lot size in Q3 sales was 1.07 acres—significantly larger than Washington County’s 0.36 acres or Multnomah’s 0.27 acres—contributing to higher median prices and required incomes well above the 25–44 cohort median. Larger lots and newer improvements demand stronger buyer qualifications, while Multnomah’s denser, older stock provided relatively more options for younger households.

The Realistic Paths to Ownership for Younger Buyers

For most households in their 20s and 30s, entry into the detached-home market in Q3 2025 required one of three things:

- Substantial family assistance (gift for down payment, co-signer, or direct equity help).

- Extreme lifestyle sacrifice (aggressive saving for larger down payment, renting with multiple roommates far longer, minimal discretionary spending).

- Outlier household income (well above the cohort median—e.g., $150,000+ dual incomes early in careers).

Without one of these, even well-qualified younger buyers were effectively priced out until they aged into higher earnings—typically the late 30s or early 40s. Or they had to consider alternative housing options, like condominiums or townhouses.

This dynamic directly explains the national shift toward older first-time buyers and underscores the limited market participation of younger cohorts in the current environment.

Methodology Note

This analysis introduces the Portland Appraisal Blog Affordability Index (PABAI)—a PITI-based metric designed for the Portland region’s residential market (detached single-family, attached homes, condominiums, and manufactured homes on owned land). The PABAI measures the percentage of sales affordable to a reference household under realistic lending conditions. The PABAI can be calculated for distinct property types or the residential market as a whole. For this post, the PABAI is calculated for detached single-family homes only.

Affordability is modeled using a 20% down payment, 28% front-end housing expense ratio (per Freddie Mac guidelines), actual weekly 30-year fixed rates at closing, property taxes from listings, and a conservative 0.40% annual homeowners insurance rate (aligned with 2025 Oregon averages per Bankrate). Unlike national indices that rely on principal and interest only, the PABAI incorporates full PITI for a more accurate reflection of buyer qualification in the Portland region.

For an overall regional benchmark, the PABAI uses HUD’s Area Median Income for a 4-person household in the Portland–Vancouver–Hillsboro MSA ($124,100 as of 2025). In Q3 2025, the PABAI for this benchmark stood at approximately 78—meaning the typical household at the area median income could afford about 20% of detached sales under realistic PITI assumptions.

Reference incomes for specific age cohorts are estimated from the U.S. Census Bureau’s 2024 American Community Survey (Table B19037) using standard linear interpolation on grouped income data. For households aged 25–44, this yields an estimated median of approximately $110,000. This lowers the PABAI to approximately 69 for this age band, placing only 9.8% of Q3 2025 detached sales within reach.

For quarterly market context, see the Q3 2025 detached single-family update.

Sources & Further Reading

- National first-time buyer age and share trends: The Hill opinion piece

- NAR first-time buyer data methodology: NAR Economists’ Outlook blog

- Age-specific median household incomes: U.S. Census Bureau ACS 2024 Table B19037

- 28% housing expense guideline: Freddie Mac Selling Guide Section 5401.1

- Oregon homeowners insurance averages: Bankrate 2025 analysis

- Portland-Vancouver-Hillsboro MSA median income benchmark: HUD 2025 Income Limits

- The Portland Region Q3 2025 Market Update: Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.