As the Portland metro area navigates a shortened week of real estate developments, themes of cautious optimism in homebuying blend with tightening rental regulations and professional safeguards against bias. First-time buyers are edging back into the market, even as confidence dips slightly, while Oregon’s actions on rent pricing and unspent funds signal a push toward affordability. In the Portland–Vancouver region, these shifts underscore the need for appraisers and other real estate professionals to stay abreast of changes and the evolving valuation landscape.

Table of Contents

- Monday, November 24: NAR RCI Shows Rising First-Time Buyers

- Tuesday, November 25: Oregon Joins $7 Million Settlement with Greystar

- Wednesday, November 26: Oregon’s New 7-Hour Anti-Bias CE Requirement

- Thursday, November 27: $21 Million in Unspent Rental Fees Discovered

- Friday, November 28: FHFA Q3 2025 House Price Index Trends

- Saturday, November 29: Oregon Sets 2026 Rent Cap at 9.5%

Monday, November 24: NAR RCI Shows Rising First-Time Buyers

The National Association of REALTORS®’ October 2025 REALTORS® Confidence Index reveals a notable uptick in first-time buyer activity across the Portland metro area, capturing 32% of transactions amid modestly lower interest rates and expanding inventory. This marks a shift from prior months, even as overall REALTORS® confidence tempered, with just 17% anticipating higher buyer traffic. Median days on market held steady at 34, while cash sales accounted for 29% of deals, homes drew an average of 2.1 offers, and 19% closed above list price.

For appraisers in the Portland region, these patterns point to steadier comparable sales pools, though they also flag potential risks from waived contingencies—19% of buyers skipped appraisals—and a strong tilt toward suburban purchases at 82%. This segmentation demands careful reporting, especially in areas like Multnomah County and Vancouver, WA, where defensible adjustments for local preferences become essential. The week’s buyer momentum sets a grounded tone, reminding professionals to measure market value without injecting undue optimism.

Tuesday, November 25: Oregon Joins $7 Million Settlement with Greystar

Oregon joined eight other states in proposing a $7 million settlement against Greystar Management Services for alleged misuse of RealPage software in coordinating rent hikes, affecting roughly 19,000 Portland apartments—equivalent to 10% of the region’s multifamily stock. If finalized, the agreement would prohibit Greystar from exchanging non-public rent data or following RealPage’s algorithmic suggestions, echoing a parallel U.S. Department of Justice decree limiting the software’s practices for three years. Such curbs could ease rental pressures starting in 2026, with appraisers watching for cap rate shifts in larger apartment complexes and steadier gross revenue forecasts.

In the Portland metro, this intervention highlights ongoing scrutiny of tech-driven pricing, potentially softening rents by 5–8% and delivering $110–$176 in monthly relief to affected households—translating to $4,000–$10,600 over three to five years. For income property valuations, the changes reinforce the importance of conservative income projections, particularly for smaller multifamily assets where GRMs might stabilize. This development folds into broader affordability efforts, bridging national antitrust moves with local tenant protections.

Wednesday, November 26: Oregon’s New 7-Hour Anti-Bias CE Requirement

Starting January 1, 2026, Oregon mandates a one-time 7-hour continuing education course on Valuation Bias and Fair Housing for all licensed appraisers, followed by at least 4 hours in every two-year renewal cycle—without expanding the existing 28-hour total. Codified in OAR 161-010-0010, the requirement targets unconscious biases in comp selection, adjustments, and reporting to uphold USPAP’s call for credible, impartial analyses. In the Portland metro, this will likely yield more transparent reports, aiding homeowners, realtors, attorneys, and lenders in reviewing decisions on over-improved properties or reconsiderations of value.

Appraisers don’t generate market value—they document it—and this training bolsters accountability by encouraging explicit justification of valuation choices. For regional stakeholders, expect enhanced scrutiny on equitable practices, especially in diverse neighborhoods where bias could potentially skew outcomes. The measure ensures Portland professionals are in compliance with national appraiser ethical standards, fostering trust in an era of heightened regulatory focus.

Thursday, November 27: $21 Million in Unspent Rental Fees Discovered

A Portland city audit uncovered $21 million in uncollected or unallocated rental-registry fees earmarked for emergency aid and eviction prevention, despite monthly filings of 800 to 1,200 cases in Multnomah County. The shortfall stems from tracking lapses and delays, overlapping with the resignation of Portland Housing Bureau Director Helmi Hisserich, who departed with a $241,000 severance after administrative leave. Redeploying these funds could bolster tenant supports, indirectly stabilizing occupancy in rental properties across the Portland region.

For single- to four-unit residential appraisals, the revelation carries little direct valuation impact, though it amplifies persistent affordability strains. In multifamily commercial contexts, however, improved assistance might lower vacancy risks and lift net operating income, supporting firmer asset values. This episode underscores administrative hurdles in housing policy, urging appraisers to factor in such externalities when projecting long-term stability.

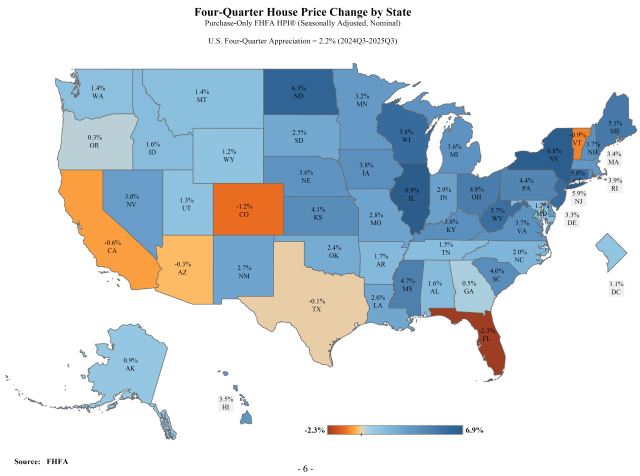

Friday, November 28: FHFA Q3 2025 House Price Index Trends

The Federal Housing Finance Agency’s Q3 2025 House Price Index reports a subdued national uptick of 0.2% quarter-over-quarter and 2.2% year-over-year, while Oregon lagged with just 0.31% annual growth and a –0.16% quarterly dip, placing 45th among states. Within the Portland–Vancouver–Hillsboro MSA—spanning Clackamas, Columbia, Multnomah, Washington, and Yamhill counties in Oregon, plus Clark and Skamania in Washington—the purchase-only index edged up 0.16% quarterly and 1.51% annually, buoyed by Clark County’s momentum despite a –0.36% all-transactions quarterly pullback. Local medians (calculated by PortlandAppraisalBlog in the six-county Oregon-only region) held flat at $600,000, with unchanged sales volume and days on market climbing 13% to 52, mirroring the index’s conservative trajectory.

This repeat-sales methodology draws on conforming mortgages from Fannie Mae and Freddie Mac, integrating appraised values from refinances to ground the data—affirming appraisers’ pivotal role in shaping reliable benchmarks. In the Portland metro, the modest gains advocate for restrained adjustments, aligning with extended market times and steady comps. The report reinforces a narrative of equilibrium, where national moderation meets regional resilience.

Saturday, November 29: Oregon Sets 2026 Rent Cap at 9.5%

Oregon’s 2026 rent increase limit stands at 9.5% for most residential rentals in the Portland metro, effective January 1 and pegged as the lower of 10% or 7% plus the Consumer Price Index for All Urban Consumers, West Region (All Items) from the prior year—easing from 10.0% in 2025. Governed by ORS 90.323, the cap covers single-family homes, apartments, and smaller multifamily units, exempting new leases, fixed terms, and larger complexes over 30 units (capped at 6% under ORS 90.600). Current medians hover at $1,987 for two-bedrooms per RentCafe and $1,772 overall via Zillow, with neighborhoods ranging $1,800–$2,400.

This predictability aids appraisers in forecasting income for rental conversions and multifamily holdings, benefiting homeowners, investors, realtors, and lenders alike. In a demand-heavy market, the adjustment tempers escalation while syncing with inflation, potentially steadying GRMs and occupancy assumptions. It caps a week of rental-focused reforms, offering a clearer lens for valuation in Oregon’s urban core.

Week’s Blog Posts & Further Reading Links

- Monday Brief: NAR RCI Shows Rising First-Time Buyers Amid Cooling Confidence

- Tuesday Brief: Oregon Joins $7 Million Proposed Settlement with Greystar Over RealPage Rent-Setting Practices

- Wednesday Brief: Oregon’s New 7-Hour Anti-Bias CE Requirement Starts January 1, 2026

- Thursday Brief: $21M in Unspent Rental Fees Discovered

- Friday Brief: FHFA Q3 2025 House Price Index: National Trends, Oregon Context, and the Role of Appraisers

- Saturday Brief: Oregon Sets 2026 Rent Cap at 9.5%

- PortlandAppraisalBlog Q3 2025 Market Update: Post

Closing Remarks

This week’s briefs weave a tapestry of measured progress in the Portland real estate landscape—from invigorated first-time buyer shares to regulatory reins on rents and pricing algorithms. Rental affordability takes center stage with settlements, unspent funds, and a dialed-back cap, potentially easing pressures on multifamily valuations while the FHFA index signals subdued but steady price growth in the Portland–Vancouver MSA. Layered atop new anti-bias training, these elements highlight an industry honing its precision amid national headwinds, ensuring appraisals reflect a market that’s resilient yet restrained.

For professionals and stakeholders, the convergence underscores the value of localized insights: suburban demand bolsters entry-level comps, while policy tweaks demand vigilant income modeling. As 2025 draws to a close, the region positions itself for 2026 with tools for equitable, data-driven decisions.

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

Question: Which story interested you the most?

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.

Happy Thanksgiving!

Are you putting this together now? Looks like a pretty big time commitment….

Joe Lynch, SRA, MNAA Past President, Real Estate Appraisers Association, Corporate Board Past President, Real Estate Appraisers Association, Sacramento Chapter Joseph Lynch Appraisal Services 2022 Affiliate of the Year, Yolo Association of Realtors http://josephlynchappraisal.com/ 712 Del Oro St Woodland, CA 95695 (530) 304-8471

LikeLike

Yes. I am learning how to batch stories and schedule them and am becoming more efficient. But the dividends are the research is enhancing my knowledge of the local market!

LikeLike