Photo: Steven Walling via Wikimedia Commons (CC BY 2.0)

As 2025 draws to a close, Block 216—Portland’s tallest residential tower at 460 feet and 35 stories—stands as a prominent feature of the downtown skyline. Completed in 2023–2024, the mixed-use project includes The Ritz-Carlton, Portland hotel on the lower floors and 132 branded luxury condominiums above, marketed as the Ritz-Carlton Residences, Portland.

Launched with considerable optimism for a post-pandemic downtown revival, the residences were positioned as the pinnacle of urban luxury living—complete with Ritz-Carlton service access, premium finishes, and panoramic views. Original list prices ranged from $850,000 to $7,850,000.

Yet the market response has been markedly different. As of December 31, 2025, only 11 units have closed. The original developer transferred the unsold inventory to the lender via deed in lieu of foreclosure in summer 2025, and Christie’s International Real Estate Evergreen was appointed exclusive brokerage in December 2025, with significant price reductions (starting at 50%) scheduled for January 2026.

This appraisal deep dive examines the project’s sales and listing history through RMLS data, placing it within the broader context of the Portland Downtown condominium market and highlighting key valuation principles brought into sharp relief.

Timeline of Key Developments

- 2019–2023: Block 216 construction and pre-sales period. Residences marketed under Ritz-Carlton branding license as ultra-luxury product with hotel amenity access.

- 2024: Tower completion and public launch of condominium sales under LUXE Forbes Global Properties. Phased marketing begins.

- Late 2023–early 2025: Eleven closings recorded in RMLS, eight of which show 0 days on market (indicative of off-market or exclusive arrangements).

- Summer 2025: Developer executes deed in lieu of foreclosure, transferring bulk unsold inventory to lender Ready Capital—a project-level transaction, not individual buyer foreclosures. Public records confirm the hotel portions of Block 216 transferred to a lender REO entity in July 2025.

- December 2025: Christie’s International Real Estate Evergreen appointed exclusive brokerage; major price repositioning announced for January 2026.

The Portland Downtown Condominium Market: A Soft Backdrop

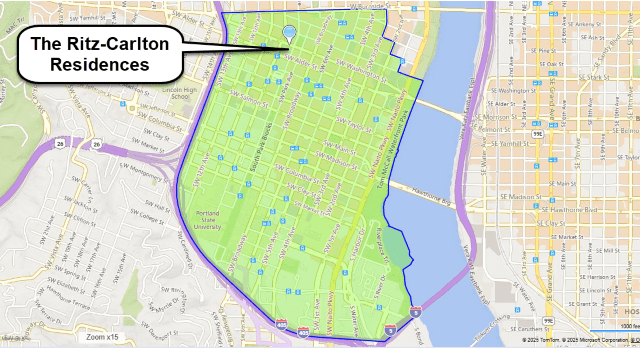

The Ritz-Carlton Residences are located in the City of Portland’s “Portland Downtown” neighborhood—the central area immediately south of the Pearl District, encompassing the West End and cultural district around Pioneer Courthouse Square and the South Park Blocks.

Map via Bing Maps

This area offers exceptional walkability and proximity to cultural institutions, but the condominium market has remained soft for years. From 2022–2025, 482 condominium sales closed in the neighborhood at an average price of $407,358 and $372 per square foot. Units averaged 1,109 square feet in size, with an average year built of 1982 and average monthly HOA fees of $784.

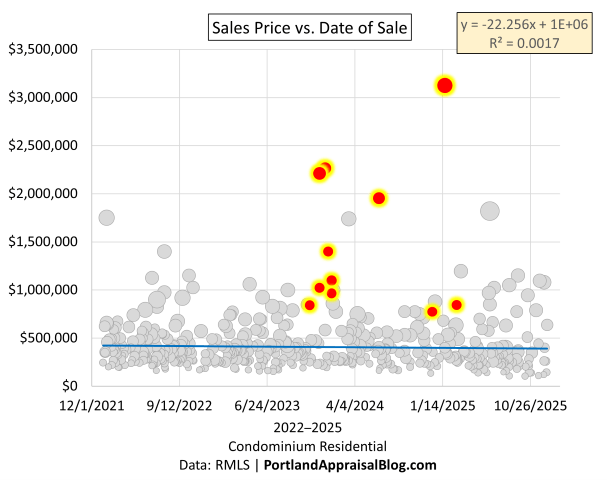

The scatterplot below illustrates the price distribution over time:

Sales prices have shown remarkable stability—remaining largely in the $200,000–$1.2 million range, with the historical high (prior to Block 216) at $3.065 million from a 2017 transaction. This stagnation reflects persistent oversupply and slow absorption in the urban core.

The table below quantifies the contrast between the neighborhood and the Ritz-Carlton Residences:

| Metric | Portland Downtown (482 sales) | Ritz-Carlton (11 sales) | Insight |

|---|---|---|---|

| Avg Close Price | $407,358 | $1,500,364 | Ritz closed at 3.7× the neighborhood average. |

| Avg PPSF | $372.27 | $1,052.73 | Ritz realized 2.8× higher PPSF—still far above neighborhood norm. |

| SP/OLP % | 93.29% | 84.48% | Ritz required significantly larger price reductions from original list to close. |

| Avg Year Built | 1982 | 2023 | Ritz is brand-new vs. 40+ year-old neighborhood average. |

| Avg Total SF | 1,109 | 1,363 | Ritz units larger on average. |

| Avg HOA Monthly | $784 | $2,402 | Ritz HOA 3× higher—significant carrying cost difference. |

| Avg CDOM | 114 | 25 | Skewed by Ritz exclusives; real public marketing time much longer. |

The Ritz-Carlton Residences: Pricing Premise vs. Market Reality

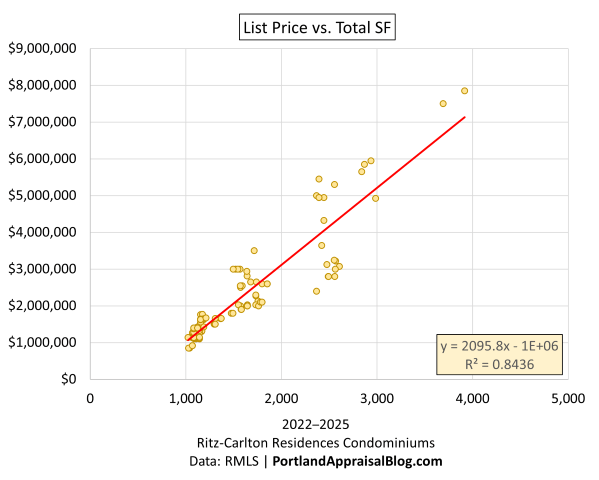

Of the 132 total residences, 71 distinct units were publicly marketed in phases—full release of floors 21–23 (the “entry-level” tiers) and selective listings on higher floors. These 71 units generated 105 separate listing records in RMLS, with a median of 145 days per active spell and many accumulating 400+ cumulative days across repeated expirations and re-lists.

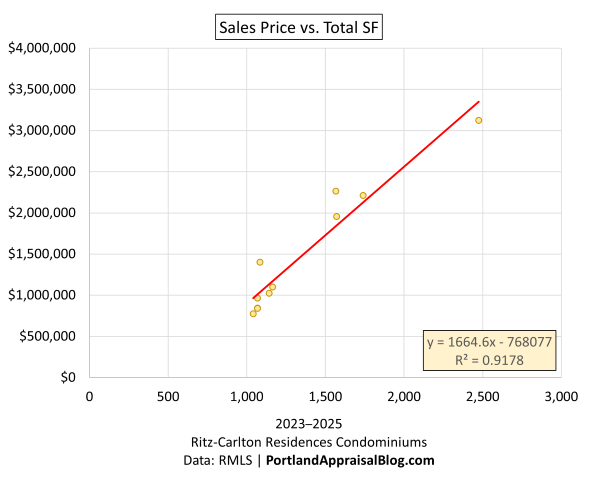

Only 11 closings were recorded:

- Average sold price $1,500,364 (average reduction of $274,000 from original list price per unit).

- Average PPSF $1,053 (marginal trend from regression ~$1,665).

These closings occurred between late 2023 and February 2025, with no additional sales recorded in the remainder of the year.

The developer’s original pricing was highly disciplined and size-driven:

The closed sales followed a similar pattern but at a lower level:

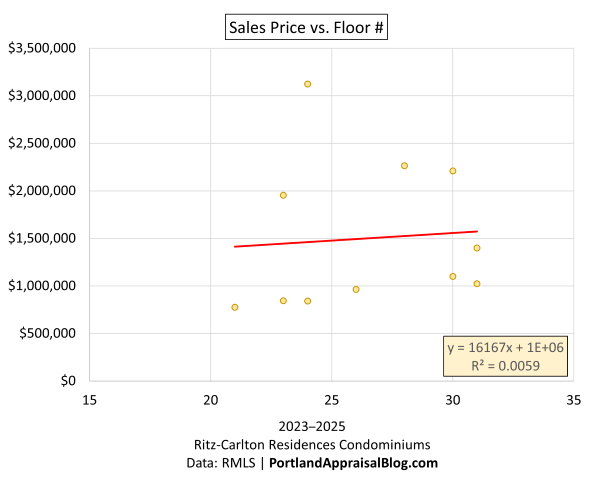

Among the 11 closed sales (primarily on floors 21–31), no discernible premium for higher floors was observed in realized prices:

Notably, eight of the 11 closings showed 0 days on market—likely off-market or exclusive arrangements. The publicly marketed units faced far greater resistance.

The Inclusionary Housing Obligation and Additional External Pressure

Portland’s Inclusionary Housing program requires new residential developments of 20 or more units to either include affordable units or pay a fee-in-lieu. For Block 216, the developer initially proposed 26 on-site affordable units during the entitlement phase but switched to the fee option in 2023.

On-site inclusion proved functionally challenging: even with restricted sale prices, the project’s elevated monthly HOA dues (averaging $2,402 across closed sales) and luxury service model would likely exceed income qualifications for targeted buyers. The calculated fee-in-lieu obligation totaled approximately $7.8 million (base plus interest) and was due December 31, 2025.

Following the summer 2025 deed-in-lieu transfer to lender Ready Capital, uncertainty remains regarding collection of this amount. As of the post date, it is unknown whether the fee has been paid. If unpaid, it would represent an additional external factor appraisers must consider—a financial encumbrance separate from the physical improvements that may influence marketability and value reconciliation for both unsold inventory and existing ownerships.

Appraiser Perspective: The Principle of Conformity and External Obsolescence

The original pricing strategy for the Ritz-Carlton Residences appears to have been calibrated to the Pearl District rather than the property’s actual location in Portland Downtown. The Pearl has demonstrated a proven ceiling around $7 million for top-tier condominiums, as detailed in an earlier Portland Appraisal Blog post analyzing that market over the past decade. In contrast, the highest condominium sale in the Portland Downtown neighborhood prior to Block 216 was $3.065 million in 2017.

By listing units up to $7.85 million, the developer effectively positioned the project outside the neighborhood’s historical range of conformity—a principle of appraisal theory that holds value is maximized when a property aligns with prevailing market expectations in its location. The resulting resistance illustrates how site-specific external factors can override new construction, branding, and amenity premiums.

This pricing strategy mirrors a common challenge appraisers encounter when reviewing sale transactions or proposed listings: comparable sales selected from superior or more established submarkets to support an optimistic value conclusion. The uniform price reductions required on closed sales (average $274,000 reduction from original list price per unit) and prolonged adverse listing history on the unsold inventory further demonstrate concentrated external obsolescence within an already challenged submarket.

Outlook and Implications for Owners and Lenders

The January 2026 price repositioning may improve absorption at levels more aligned with neighborhood norms. However, the influx of discounted intra-building comparable sales could create reconciliation challenges for appraisals of the existing 11 ownerships—particularly the eight early exclusive buyers who closed near original asks.

Lenders and owners of recently purchased units should monitor upcoming sales closely, as distressed marketing conditions on remaining inventory can influence market value indications even for arms-length prior transactions.

For developers and lenders contemplating future high-rise condominium projects in the urban core, the Block 216 experience underscores the importance of grounding pricing premises in location-specific comparable data rather than aspirational benchmarks from adjacent submarkets.

Sources & Further Reading

- Christie’s International Real Estate Evergreen appointment and price repositioning announcement: Press Release

- Ready Capital secures ownership via deed in lieu (summer 2025): Investor Relations News

- KGW coverage of price reductions and brokerage change: Article

- Willamette Week on lender taking possession: Article

- Street Roots on inclusionary housing fee and deadline: Article

- Portland Inclusionary Housing Program overview and requirements: City of Portland

- Block 216 hotel unit ownership transfer (July 2025): Multnomah County Property Records (search Account P727368)

- The Portland Pearl District Condo Market – The Last 10 Years (2015–2024): Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.