Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

The former Blue Heron Paper Mill site at Willamette Falls in Oregon City has long exemplified the valuation challenges posed by contaminated industrial brownfields. After the mill’s 2011 closure and subsequent bankruptcy, the ~22-acre riverfront parcel endured years of vacancy, burdened by functional obsolescence, deferred maintenance, and significant environmental liabilities that deterred conventional market participants.

In August 2019, the Confederated Tribes of Grand Ronde acquired the property for a recorded $15.25 million. This transaction stands out for appraisers as a clear illustration of investment value—the worth of a property to a particular purchaser based on individual motivations—and value-in-use, where non-economic factors such as cultural and ancestral significance justify a substantial premium over typical market indicators.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

Site History and Market Perception

The property’s ownership and valuation history underscores the stagnation under conventional private ownership:

| Year | Event | Recorded Price / RMV |

|---|---|---|

| 2000 | Acquired by Blue Heron Paper Company from Smurfit Newsprint Corp. | $2.5 million |

| 2011 | Mill closure and Chapter 11 bankruptcy filing | — |

| 2014 | Bankruptcy court sale to private developer (Falls Legacy LLC) | $2.2 million |

| 2018–2019 | Clackamas County Real Market Value (pre-sale, per contemporaneous reporting) | ~$2.9 million (improvements minimal) |

| August 2019 | Acquired by Confederated Tribes of Grand Ronde | $15.25 million |

| Recent years | Clackamas County Real Market Value (post-acquisition) | ~$3.6–$4.3 million (land-focused) |

| 2021–2024 | Phased demolition and remediation (approximately 40% of structures removed by 2024) | — |

| Recent | Oregon City master plan approval (GLUA240002) | — |

Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

Appraisal Implications—Investment Value and Value-in-Use

The $15.25 million purchase price—nearly seven times the 2014 bankruptcy sale and well above the assessor’s reported Real Market Value immediately preceding the transaction—reflects investment value driven by the Tribe’s profound cultural connection to Willamette Falls, a sacred ancestral homeland and traditional fishing ground. This non-economic value-in-use enabled the Tribe to overcome remediation and holding-cost barriers that had stalled private redevelopment efforts for years.

Appraisers reconciling such sales must distinguish investment value (or value-in-use) from market value derived from arms-length transactions among typical participants. Limited comparable sales for culturally significant or heavily contaminated riverfront parcels often require significant adjustments for buyer motivation, extraordinary assumptions regarding cleanup feasibility, and bracketing with more conventional industrial land comps.

This situation parallels a more recent Portland case explored on this blog: the 1803 Fund’s adaptive reuse plans for historic grain silos along the Willamette River. In both instances, a buyer with specific motivation recognized potential in a functionally obsolete industrial asset that had deterred conventional market participants—ultimately enabling a highest and best use shift through targeted redevelopment.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

Current Progress and the Tumwata Village Vision

Recent site visits confirm active transformation: demolition equipment, including excavators, is visibly engaged in clearing remaining structures.

Phased demolition began in 2021, with multiple rounds completed by 2024 removing approximately 40% of the former mill buildings. Remediation continues in coordination with state and federal environmental agencies.

A major fire in January 2025 destroyed one of the larger remaining buildings on the site (the former mill’s three-story structure). The incident, ruled arson and unrelated to demolition activities, did not delay the overall redevelopment timeline. Progress has continued steadily, as evidenced by recent infrastructure planning and the current state of the property.

Renamed Tumwata Village, the redevelopment proposes a mixed‑use cultural district that weaves together public access trails, ecological restoration of the riverbank and lagoon, tribal gathering spaces, and a modest mix of commercial and hospitality uses—all grounded in the site’s ancestral significance. By prioritizing riverfront restoration and new trail connections, the plan could open up rare land‑based vantage points of Willamette Falls, a natural landmark that today is mostly viewed from commercial boat tours or distant overlooks. If fully realized, the transformation would support the Confederated Tribes of Grand Ronde in cultural reclamation and long‑term stewardship, while giving Oregon City and the broader public renewed access to a stretch of the falls long closed off by industrial operations.

Oregon City’s recent approval of the master plan (GLUA240002) formalizes this highest and best use shift from interim speculative hold to culturally driven redevelopment.

Readers interested in detailed conceptual plans and site renderings can review the Tribe’s 2022 design report.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

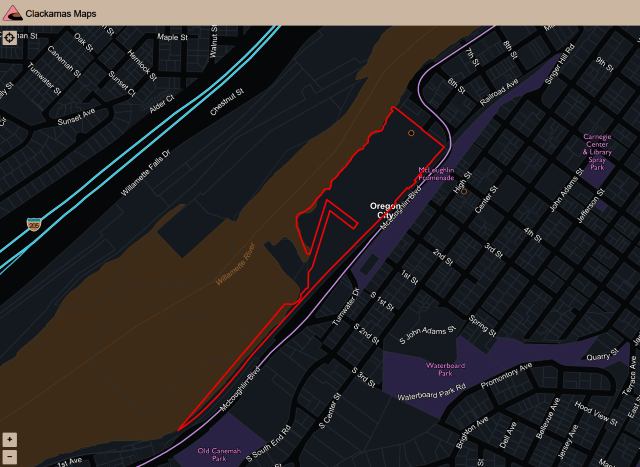

Source: Clackamas County Maps.

Takeaway

The Tumwata Village acquisition serves as a compelling case study in investment value and value-in-use. When a purchaser’s motivations—here rooted in cultural reclamation—align with a property’s unique attributes, transaction prices can far exceed indicators derived from conventional market behavior. Appraisers must remain alert to these distinctions, employing careful reconciliation techniques and appropriate adjustments when comparable data is limited.

Ultimately, the project illustrates how buyer-specific utility can reverse long-standing obsolescence, shifting a site’s highest and best use in ways the open market alone could not achieve. If realized, the vision promises not only tribal stewardship of ancestral lands but also broader public access to one of Oregon’s most iconic natural features—offering land-based and proximate views of Willamette Falls where few currently exist.

Sources & Further Reading

- Tumwata Village: Official website

- Confederated Tribes of Grand Ronde acquisition announcement and cultural context: Tumwata Village Project Update

- Tumwata Village vision and conceptual design report: 2022 Conceptual Design Report (PDF)

- Tribe buys Blue Heron Paper Mill site: Smoke Signals article

- Pre-sale Real Market Value context ($2.9 million): OregonLive (archived via Wayback Machine)

- Recent demolition progress reporting: OPB – June 2024 article

- Reporting on January 2025 fire: OPB – January 2025 article

- Oregon City master plan approval: Notice of Decision (GLUA240002)

- 1803 Fund adaptive reuse plans for Portland grain silos: PortlandAppraisalBlog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.