Photo: Abdur Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

The 2025 Portland Region attached homes market entered the year on solid footing, supported by steady demand, a consistent flow of new construction, and a segment that has largely settled into its post-rate-shock rhythm. After several years of adjustment to higher borrowing costs, attached homes now behave in a more predictable way: functional, resilient, and shaped as much by deliberate buyer selectivity as by broader economic conditions.

This segment occupies a distinctive middle ground in the region’s housing landscape. Fee-simple ownership of both the dwelling and underlying land provides a measure of autonomy and equity-building potential similar to detached homes, while the high prevalence of mandatory HOA dues introduces condominium-like shared responsibilities and carrying-cost considerations. This hybrid nature influences buyer decision-making, particularly when association fees, maintenance obligations, or restrictions factor into total ownership affordability.

New construction remained a key stabilizing force, infusing the market with modern townhomes and rowhouses that appealed to buyers seeking updated features and efficiency in suburban and edge-urban locations. At the same time, resale inventory reflected greater heterogeneity—from older rowhouses to newer planned-unit developments—requiring careful attention to comparable selection and valuation adjustments.

Buyers exercised greater selectivity, prioritizing pricing alignment, condition, location, and overall carrying costs. This manifested in extended marketing times for some properties and a subtle shift toward more balanced conditions, though the market avoided the sharper softening observed in the condominium segment. Affordability for attached homes held near equilibrium, with the Portland Appraisal Blog Affordability Index (PABAI) indicating that typical household income was nearly sufficient to qualify under prevailing rates, taxes, insurance, and HOA dues—placing the segment more attainable than detached homes but not as affordable as condominiums.

Taken together, 2025 reads as a transition year for attached homes: a market still on stable ground, but beginning to lean toward buyers as supply loosens and selectivity increases. The sections that follow document these dynamics in detail, drawing on cleaned RMLS data to provide a clear, reference-grade record of the year.

Table of Contents

- Data Housekeeping

- Portland Region 2025 Overview

- Multnomah County 2025 Stats

- Washington County 2025 Stats

- Clackamas County 2025 Stats

- Yamhill County 2025 Stats

- Columbia County 2025 Stats

- Hood River 2025 Stats

- Closing Thoughts

- Sources & Further Reading

- Coda

Data Housekeeping

The Portland Region in this update comprises the six Oregon counties of Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill. These counties form a contiguous housing ecosystem centered on Portland—Multnomah as the core home county, with the others tightly integrated through commuting patterns, economic ties, and shared market dynamics (e.g., Yamhill’s strong connection via Highway 99W and wine-country adjacency). Beyond Yamhill, the MLS system changes, further distinguishing this six-county area from broader geographic aggregations. For a detailed overview—including county profiles, population data, key value influencers, and why this definition differs from the official seven-county Portland–Vancouver–Hillsboro MSA—see my dedicated page: The Portland Region – Six-County Market Area Overview.

Via SunCatcherStudio

All data is sourced from RMLS and reflects open-market detached single-family residential sales (excluding condominiums, detached homes, and multifamily). SNL (“Sold Not Listed”) entries—off-market transactions entered retroactively—have been excluded to preserve consistency with true market activity.

All figures have undergone my standard cleaning process to address common RMLS accuracy challenges, including misclassifications (e.g., condos listed as attached), square footage/price typos, incomplete fields, status/date mismatches, and non-representative entries. For a detailed overview of these issues, their impact on market analysis, and how I mitigate them through automated flagging, cross-verification, and manual review, see my dedicated page: RMLS Data Accuracy Challenges.

It is important to note that attached homes are just that: attached; whether on just one or both sides. They also entail ownership of the land the structure sits on. This makes them distinct from condominiums. They are also differentiated from multifamily properties in that each unit is individually owned. With a duplex, for example, there is a single owner, although the owner may rent or occupy each unit as they see fit. The owner cannot sell half of a duplex (one unit). It can get confusing, and the data in RMLS reflects that.

An attached home is just like a single-family detached home in rights and responsibilities; the principal difference is whether the structure is completely freestanding or joined at the hip with a neighbor or two. While an attached home is often located in an HOA and may even be physically indistinguishable from a townhome-style condominium, they are not condos, and are more similar to detached homes in all the categories that matter.

Portland Region 2025 Overview

2025 saw a continuation in the surge of new construction in the attached home segment. Despite the greater share of new units, average and median prices softened.

Overall Regional Trends

The table below summarizes key metrics for attached single-family residential sales in the Portland Region (Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill counties) for 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $715.1 Million | $758.4 Million | +6.05% |

| Average Price | $461,973 | $460,764 | -0.26% |

| Median Price | $439,960 | $435,000 | -1.13% |

| Avg SP/OLP | 97.93% | 97.00% | -0.94% |

| Avg PPSF (TSF) | $301.50 | $291.76 | -3.23% |

| Avg HOA Dues | $234.09 | $236.84 | +1.18% |

| Avg Age (Yrs) | 16.29 | 15.69 | -3.67% |

| Avg CDOM | 59.90 | 68.36 | +14.13% |

| Avg Total SF | 1,557 | 1,598 | +2.60% |

| Total # of Sales | 1,548 | 1,646 | +6.33% |

| # of New Constr. | 509 | 640 | +25.74% |

| Avg Supply (Mos.) | 3.00 | 3.98 | +32.54% |

| # of REOs | 4 | 7 | +75.00% |

| # of Short Sales | 3 | 2 | -33.33% |

Single-Family Attached Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

Key Observations From the Aggregate Data

The 2025 attached‑home market remained functional and well‑supplied, with new construction shaping both the composition of sales and the overall performance of the segment. Several themes stand out when interpreting the year‑over‑year changes:

- New construction was the primary engine of market stability. The segment saw a meaningful increase in total sales, and roughly a quarter more new‑construction units closed compared to the prior year. These newly built townhomes and rowhouses made up a substantial share of all 2025 activity and were largely responsible for keeping overall volume in positive territory. Without this influx of fresh inventory, total sales would likely have been flat.

- The average age of sold homes declined due to the shift in mix. With so many new units entering the pipeline, the average age of attached homes sold moved several percent lower. This reflects a compositional shift toward recently completed properties rather than any broad change in the region’s existing housing stock.

- Average and median prices edged down as supply loosened. Both measures posted low‑single‑digit declines, consistent with a market where buyers had more options and more time. The combination of increased new‑construction supply and a noticeable rise in months of housing supply placed gentle downward pressure on pricing. These movements reflect a shift toward balance rather than any sign of distress.

- Price per square foot fell more sharply, influenced partly by larger average unit sizes. PPSF declined by a few percentage points, outpacing the modest softening in overall prices. Part of this movement stems from slightly larger average square footage—an expected outcome when new construction makes up a bigger share of the sold mix. In years with size stability, PPSF tracks price movement more directly; in 2025, the compositional effect played a meaningful role.

- HOA dues showed minimal upward movement—a notable bright spot for affordability. Average dues increased by just over one percent, a restrained change compared to the sharper increases seen in the condominium segment. For the majority of attached homes with mandatory dues, this stability helped keep total ownership costs predictable and prevented additional affordability pressure.

- Distressed sales remained negligible. REO and short‑sale activity together amounted to single‑digit counts in a market with more than 1,600 closings. Their minimal presence reinforces the broader picture of a segment without systemic financial strain, even as marketing times lengthened and supply increased.

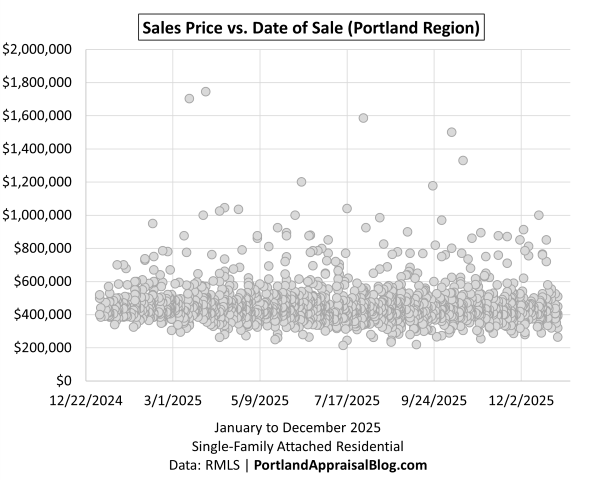

Portland Region Scatter Plots

To visualize the distribution of individual attached homes sales prices across 2025, the following scatter plots show sales price against date of sale. The first graph displays the full range of transactions, while the second focuses on the $800k or less range.

The full‑market scatter of 2025 attached‑home sales offers a clear visual sense of how this segment behaved across the year. Most sales cluster in a tight horizontal band between the mid‑$400s up to $600k, reflecting the segment’s characteristic price stability and relatively narrow product range. Unlike detached homes, which stretch from distressed fixers to luxury outliers, or condos, which include everything from micro‑units to penthouses, attached homes tend to occupy a consistent middle band. That uniformity is immediately visible here.

One of the most notable features of the scatter is the absence of deep entry‑level pricing. No sales fall below the $200,000 mark, and the lower edge of the distribution remains remarkably stable throughout the year. This is a structural trait of the segment: attached homes rarely include the very small, distressed, or legacy units that populate the lower ends of the condo and detached markets. The result is a natural price floor that keeps the distribution compact and predictable.

Within that band, a subtle downward drift emerges as the year progresses. Early‑year sales tend to sit slightly higher in the cluster, while late‑year sales settle modestly lower. The slope is gentle, but it aligns with the broader story of 2025: more supply, more new construction, and more buyer selectivity. The scatter shows a market that remained functional and well‑supplied, but one that softened at the margins as the year moved on.

A handful of higher‑priced outliers appear above the main band, many of them tied to new construction. But even these upper‑end sales do not distort the overall pattern. The segment’s pricing structure remains anchored in the middle of the market, with new construction reinforcing that center rather than pulling it upward.

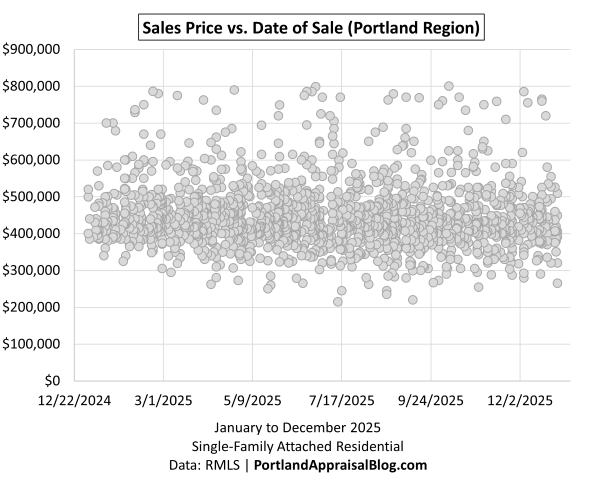

Zooming in on sales priced at $800,000 or less we have:

When the scatter is narrowed to sales at $800,000 or less, the shape of the attached‑home market becomes even clearer. Nearly the entire dataset remains intact—97.6% of all 2025 attached sales fall at or below $800k—which means this zoomed‑in view isn’t a subset so much as a more legible rendering of the full market. The upper‑end outliers fall away, but the core structure of the distribution stays exactly the same.

What emerges is a dense, disciplined band of activity stretching from the low‑$300s to the upper‑$700s, with the vast majority of sales clustering between roughly $400,000 and $600,000. This is the heart of the attached segment.

The downward tilt that was only faintly visible in the full‑range scatter becomes more apparent here. Early‑year sales sit slightly higher within the band, while late‑year sales drift modestly lower. It’s a gentle slope, but it reinforces the broader theme of 2025: a market still on solid footing, but gradually softening as supply increased and buyers became more selective. The scatter shows this visually in a way that tables alone cannot.

Bottom-line Summary

The attached‑home segment in 2025 presents a clear, consistent picture: a market still functioning well, but gradually shifting under the weight of expanded supply and persistently high interest rates. The regional overview table shows modest price erosion, a noticeable rise in months of housing supply, and a meaningful increase in new‑construction deliveries—all signals that the tight conditions of prior years have begun to ease. The scatterplots reinforce this story visually. The segment maintained a firm price floor and a concentrated middle band, but the gentle downward drift across the year reflects buyers taking more time, exercising more discretion, and benefiting from a wider set of options.

New construction played a central role in this transition. It supported overall sales volume and refreshed the inventory, yet it did so without distorting the pricing structure; most new units landed squarely within the core price band. The result is a market that remains orderly and well‑supplied, but one that is unmistakably edging toward buyer‑favored conditions. Prices have not broken sharply, and the segment is not yet in a buyer’s market, but the combination of elevated rates, increased choice, and softening at the margins points to a landscape where buyers hold a bit more leverage than they did a year ago.

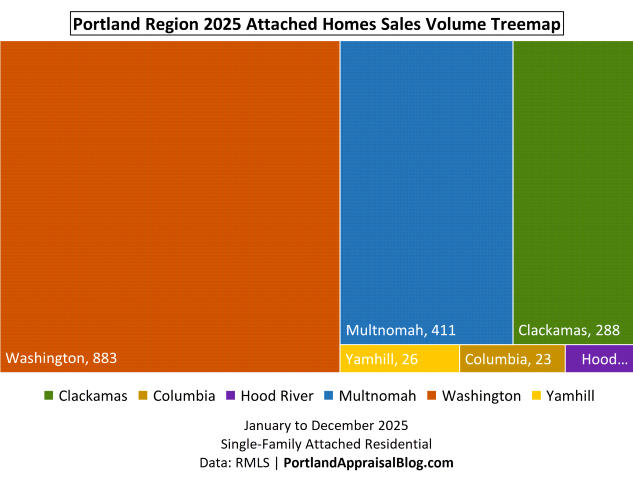

Sales Volume

A treemap visualizing the distribution of attached homes sales by county in 2025 clearly illustrates the market’s geographic concentration.

The sales‑volume treemap underscores how geographically concentrated the attached‑home market remains. Washington County once again carried the segment, accounting for more than half of all 2025 attached sales. Its dominance reflects both the depth of its attached‑home inventory and the steady stream of new construction that continued to shape the year’s activity. Multnomah County followed at roughly a quarter of all sales, with Clackamas contributing another meaningful share. Together, these three counties made up more than ninety‑six percent of the region’s attached‑home transactions—a level of concentration that has become a defining feature of this segment.

The remaining counties—Yamhill, Columbia, and Hood River—registered only small numbers of sales, consistent with their limited attached‑home stock and slower pace of new development. Their presence in the treemap is more about completeness than influence; they round out the regional picture but do not materially shape the segment’s behavior.

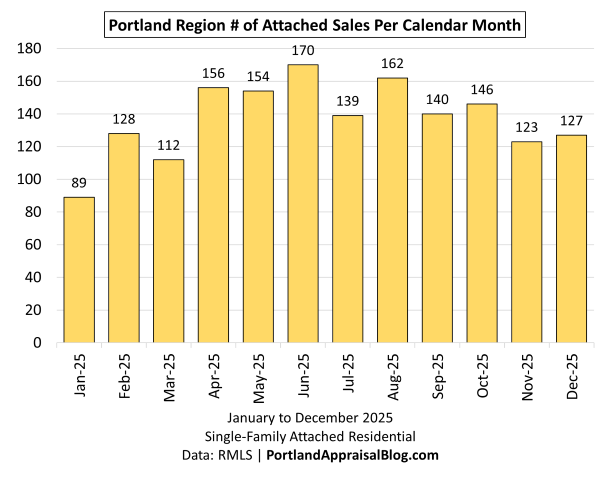

The following bar chart shows monthly sales volume for 2025:

Monthly sales activity in 2025 followed a seasonal arc, with a slow winter start, a steady rise into late spring, and a clear peak in early summer. June marked the high point for the year, reflecting the traditional convergence of buyer activity, new listings, and new‑construction deliveries. From April through October, the market moved in a remarkably stable band.

What stands out in this cycle is the strength of the late‑year months. November and December often taper more sharply, but in 2025 they held up better than expected. A significant share of that resilience came from new construction, which made up a large portion of the closings in those months and helped offset the seasonal slowdown. This pattern aligns with the broader theme of the year: increased supply—especially from new deliveries—gave buyers more options and kept transaction volume moving even as higher interest rates continued to weigh on affordability.

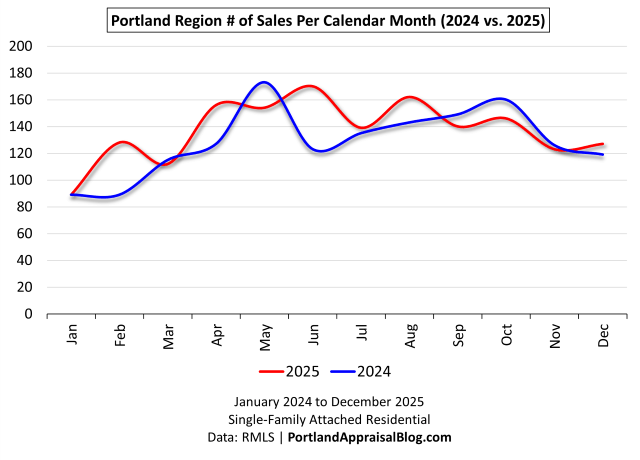

The line graph below compares monthly sales volume across the twelve months for 2024 and 2025.

The year‑over‑year comparison highlights the greater 2025 attached segment activity, even though both years followed broadly similar seasonal patterns. The two lines track closely through the early months, but 2025 begins to pull ahead in February and maintains that advantage through most of the year. The spring and early‑summer stretch is where the difference is most visible: April, June, and August all posted noticeably higher volumes in 2025, reflecting the impact of expanded inventory—particularly from new construction—and a buyer pool that remained engaged despite elevated interest rates.

What’s striking is that 2025 didn’t outperform 2024 because of a single outsized month. Instead, it was a series of steady, incremental gains across the middle of the year that pushed the annual total higher. Even in months where 2025 dipped slightly below 2024—May, September, October, and November—the differences were modest and quickly offset by stronger performance elsewhere. December 2025 finished ahead of the prior year, helped by a substantial share of new‑construction closings that kept volume slightly above 2024.

Sales Price

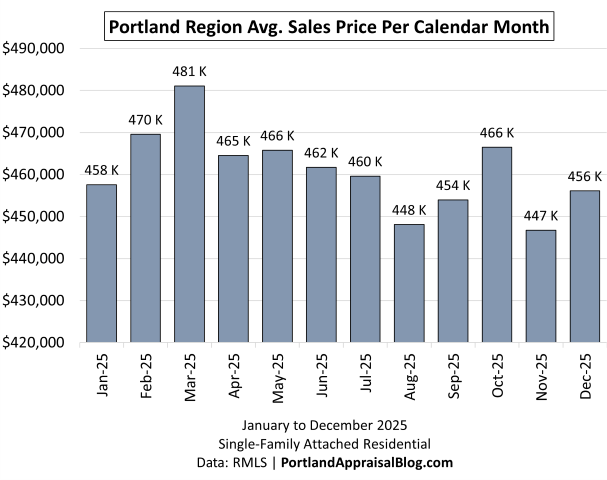

The following bar chart shows average monthly sales price for 2025:

Average pricing in 2025 moved within a remarkably narrow range, which is one of the defining characteristics of the attached segment. Monthly averages hovered close to the annual mean of roughly $461,000, with only modest fluctuations from one month to the next. The early spring months posted the highest averages of the year, but even those peaks were measured rather than dramatic. As the year progressed, prices drifted gently lower, reflecting the same softening seen in the scatterplots and the broader regional metrics.

What’s notable is how contained the movement is. Even in months where the average dipped—most visibly in August and November—the declines were incremental rather than abrupt. This stability mirrors the segment’s structural consistency: attached homes tend to be more uniform in size, age, and configuration, and the market rarely experiences the sharp swings that can appear in detached or condo segments. The late‑year averages also show the influence of new construction, which helped support pricing even as the market tilted toward buyers.

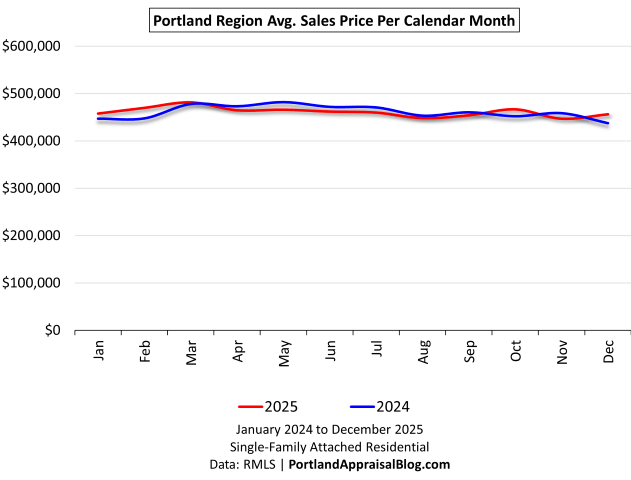

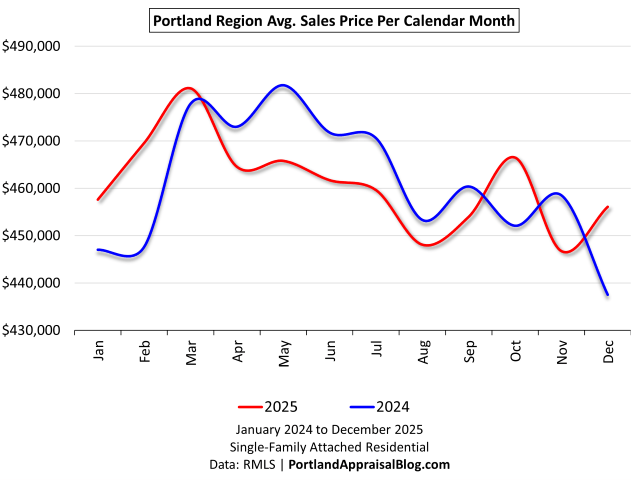

The line graph below compares average monthly sales prices across the twelve months for 2024 and 2025.

The year‑over‑year comparison shows just how stable pricing has been in the attached segment. The two lines move almost in unison, with only modest month‑to‑month differences and no meaningful divergence across the calendar year. Both years follow the same gentle seasonal rhythm, and both remain anchored within a narrow price band that reflects the segment’s structural consistency. At this scale, the line appears almost flat, underscoring how little volatility the market experienced despite elevated interest rates and shifting supply conditions.

Zooming in we have:

Once the scale tightens, the subtle differences between 2024 and 2025 come into focus. Both years still move within a narrow band, but the month‑to‑month shifts become more visible. In 2025, prices rise a bit more sharply the first three months before easing through spring, summer and early fall, while 2024 shows a smoother arc with a gentler spring peak and a more pronounced slide into year‑end. 2024 was ahead of 2025 seven out of twelve months, with average and median prices slightly down in 2025.

New Construction

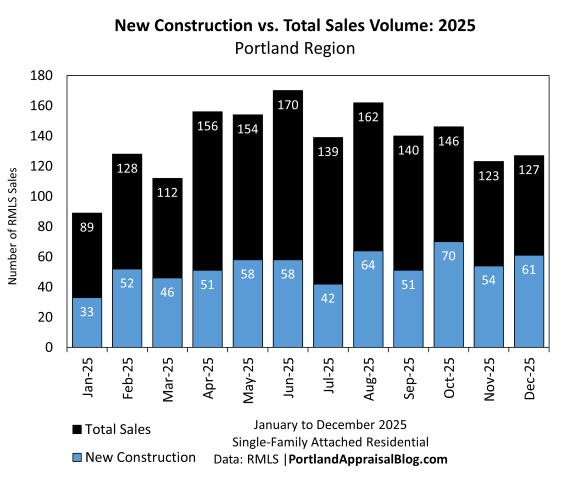

The bar graph below shows monthly total attached homes sales for 2025, with new construction volume nested within each bar to illustrate the portion of sales that were newly built.

The comparison between new‑construction closings and total monthly sales makes clear just how central new deliveries were to the attached segment in 2025. New construction consistently accounted for a substantial share of activity throughout the year, often representing a third or more of all monthly sales. In several months—most notably October, November, and December—new construction made up close to half of all closings, providing a meaningful buffer against the seasonal slowdown that typically appears late in the year.

What stands out is the steadiness of this contribution. Rather than appearing in isolated bursts, new‑construction sales were present in every month and moved in tandem with the broader market. This pattern reflects both the ongoing build‑out of attached housing in the region and the role these units played in keeping transaction volume healthy despite elevated interest rates. The segment’s overall resilience in 2025 is closely tied to this pipeline of new supply, which expanded buyer choice and helped maintain momentum even as the market tilted gradually toward buyer‑favored conditions.

The chart ultimately reinforces a theme that appears throughout the annual: new construction didn’t distort the pricing structure, but it did shape the year’s activity. It supported volume, refreshed inventory, and played an outsized role in the late‑year months, helping the market finish stronger than it otherwise might have.

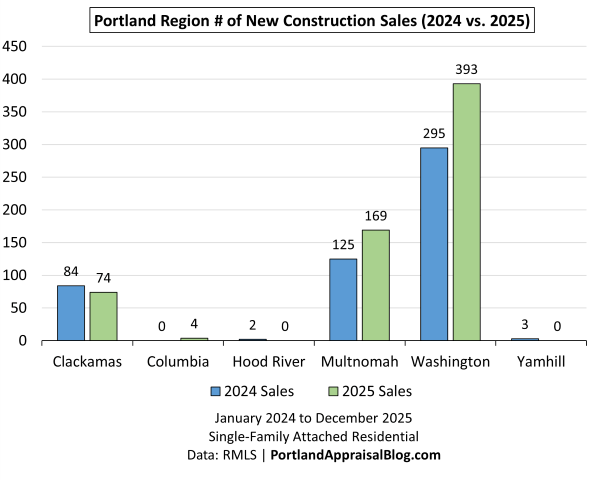

The bar graph below shows the number of new construction closings by county, with side-by-side bars for 2024 and 2025.

The county‑level comparison highlights how unevenly distributed new‑construction activity is across the region—and how much of the segment’s growth in 2025 came from just two counties. Washington and Multnomah together accounted for virtually all of the increase in new‑construction closings, with both counties posting strong year‑over‑year gains. Washington County, in particular, expanded its lead, reflecting the depth of its development pipeline and its role as the region’s primary engine for attached‑home production. Multnomah also saw a meaningful increase, driven by infill projects and the continued build‑out of attached housing in its growth corridors.

The remaining counties played only a marginal role. Clackamas saw a modest decline, while Columbia and Hood River posted very small numbers that reflect their limited attached‑home inventory rather than any meaningful shift in market conditions. Yamhill recorded no new‑construction closings in 2025, consistent with its historically small footprint in this segment.

What the chart ultimately shows is a highly concentrated pattern: nearly all new‑construction activity occurred in the three core counties, and within that group, Washington and Multnomah carried almost the entire load. This concentration mirrors the broader sales‑volume distribution and reinforces a central theme of the annual—new construction was a major driver of 2025 activity, but its impact was geographically focused, shaping the market most strongly where development pipelines were already established.

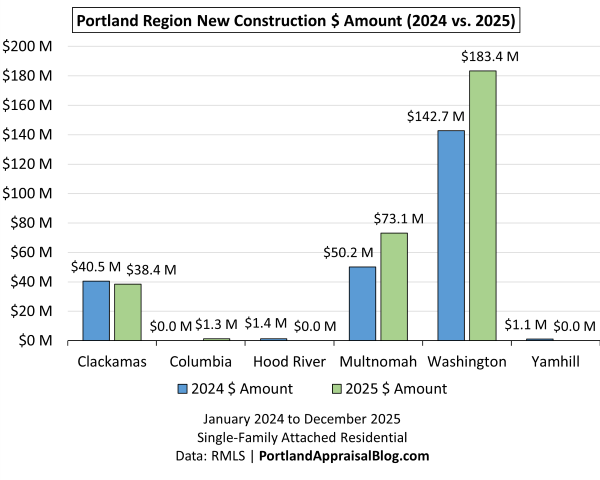

The table below shows new construction sales volume by dollar amount for 2025 compared with 2024.

| County | 2024 $ Amount | 2025 $ Amount | % Change | % of Total 2025 $ Amount |

|---|---|---|---|---|

| Clackamas | $40,515,719 | $38,358,610 | -5.32% | 5.05% |

| Columbia | $0 | $1,344,800 | — | 0.18% |

| Hood River | $1,393,303 | $0 | -100.00% | 0.00% |

| Multnomah | $50,170,781 | $73,147,412 | 45.80% | 9.64% |

| Washington | $142,679,777 | $183,397,934 | 28.54% | 24.16% |

| Yamhill | $1,126,000 | $0 | -100.00% | 0.00% |

| Sum | $235,885,580 | $296,248,756 | +25.59% | 39.03% |

Data: RMLS | PortlandAppraisalBlog.com

The following double bar chart provides the above table information at a glance:

The dollar‑volume comparison shows just how much financial weight new construction carried in 2025. Builders collectively brought in roughly $60 million more than the prior year—a substantial jump that reflects both higher unit counts and the continued shift toward more affordable attached‑home formats. Washington and Multnomah counties were responsible for nearly all of that increase. Washington alone accounted for about 62% of all new‑construction dollars, and nearly a quarter of the region’s entire attached‑home dollar volume, underscoring its role as the center of gravity for new development.

Multnomah also posted a strong gain, driven by steady infill activity and the ongoing build‑out of attached housing in its established corridors. Clackamas softened slightly, and the remaining counties contributed only marginal amounts, reinforcing the highly concentrated nature of new‑construction activity in this segment.

New construction represented nearly 39% of all attached‑home sales in 2025—far higher than the roughly 11% share seen in the detached segment. That disparity speaks to a clear market pivot: with elevated rates and inflation pressuring affordability, buyers gravitated toward smaller, more attainable new homes, and builders responded accordingly. The attached segment became the primary outlet for new supply that could meet buyers at a workable price point.

Average prices add another layer to the story. Washington County—the dominant producer—actually saw its average new‑construction price dip year over year. Given its outsized influence, that decline helped pull down the aggregate pricing trend for the entire segment. Some of this softening may reflect the broader economic backdrop, including the localized effects of the Intel layoffs in Hillsboro, which introduced additional caution into the westside market. When the county that produces the majority of new attached homes experiences even a modest price shift, the impact shows up in the regional numbers.

Cumulative Days on Market

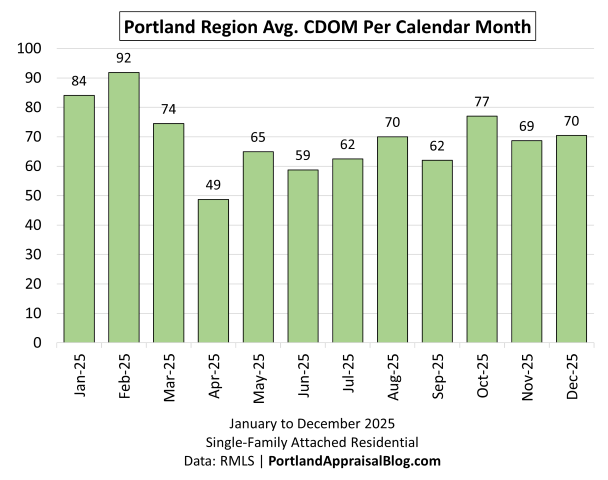

The bar chart below compares average cumulative days on market (CDOM) throughout 2025.

Average CDOM in 2025 followed a familiar seasonal pattern, but with a slightly longer tail than in tighter years. The winter months opened with elevated market times, reflecting both leftover 2024 inventory and the slower pace typical of the season. Conditions improved sharply in April—the low point for the year—as new listings were priced more competitively and buyers were more active. From there, CDOM settled into a middle band through summer and early fall, with only modest month‑to‑month movement.

The late‑year uptick is notable but not alarming. October posted one of the higher averages of the year, and November and December remained elevated compared to the spring lows. This pattern aligns with the broader dynamics shaping the segment: increased supply, more new‑construction options, and buyers taking more time to evaluate choices in a higher‑rate environment. The attached segment remained functional and well‑supplied, but the longer market times—especially compared to the spring trough—signal a market gradually easing toward buyer‑favored conditions.

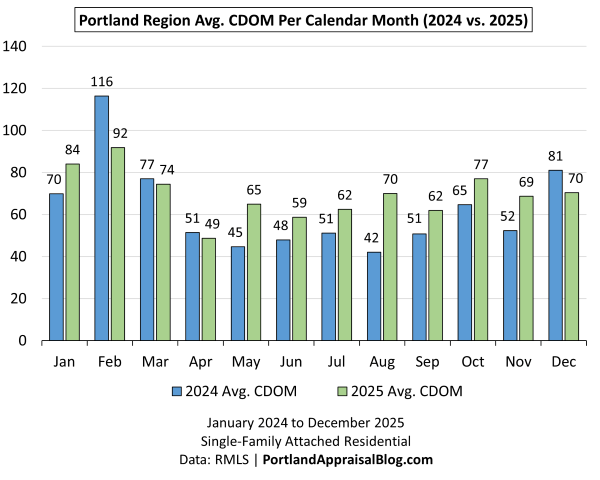

The bar chart below compares cumulative days on market for 2024 and 2025.

The year‑over‑year comparison shows a clear shift toward longer market times in 2025. While both years follow the same seasonal rhythm—winter highs, a sharp spring improvement, and a gradual rise into fall—the 2025 bars sit noticeably higher through most of the calendar. The spring trough is still present, but it’s not as deep, and the summer and early‑fall months show some of the largest gaps between the two years. August, in particular, stands out as a moment where buyers took significantly more time than they did the year before.

This pattern aligns with the broader dynamics shaping the segment. Expanded inventory, a heavier flow of new‑construction options, and persistently high interest rates all contributed to a more deliberate pace among buyers. Homes still sold, but they required more exposure, more showings, and more patience from sellers. The late‑year months illustrate this well: 2025 remained elevated relative to 2024 even as new‑construction closings helped keep overall activity moving.

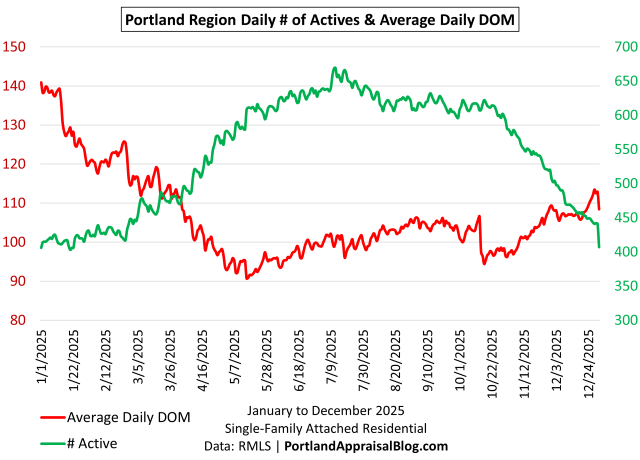

The following dual-axis chart illustrates two interrelated indicators of market health for single-family attached homes in the Portland Region throughout 2025: the number of active listings each day (green line, right axis) and the average daily Days on Market (DOM) of those active listings (red line, left axis):

This metric reflects the average current listing history (DOM) of the active inventory pool only—typically ranging from 400 to 650 units on any given day—and is distinct from cumulative DOM or final time-to-sale for closed transactions.

Because well-priced and competitively positioned properties sell quickly and exit the active pool, the average DOM is disproportionately influenced by lingering inventory. The chart therefore serves as a real-time snapshot of stale inventory levels, pricing discipline, and buyer selectivity across the year.

The chart reveals a clear inverse seasonal pattern between active inventory volume and average daily DOM.

Active listings (green) started the year relatively low (~400–450 units in January–February), rose steadily through spring and early summer to a peak of approximately 650–680 units (mid-May through July), then gradually declined into the 450–500 range by December. This mid-year swell reflects the typical seasonal influx of new listings, including a significant portion of newly completed townhomes and rowhouses.

Average daily DOM (red) moved in the opposite direction: beginning around 140 days in early January, it declined sharply through spring to a trough of ~90–95 days in late spring/summer, remained relatively stable through early fall, then rose gradually to ~110–115 days by year-end (with a brief dip in mid-November before the final uptick).

This inverse relationship is driven by compositional effects in the active pool. During the peak listing/closing season (late spring through summer), a higher volume of fresh, competitively priced units entered the market. These sold quickly, contributed little to the average DOM, and kept the metric low. In contrast, fall and winter saw fewer new listings and more selective buyers, allowing properties to linger longer. These stale units accumulated in the shrinking active pool and pulled the average DOM higher—particularly noticeable in the late-year rise despite thinning supply.

The pattern underscores a key takeaway for sellers and listing agents: misalignment on pricing or presentation can result in extended exposure, especially during lower-volume seasons.

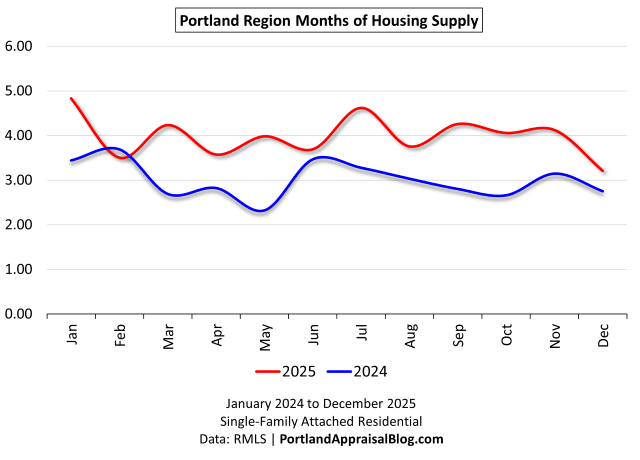

Housing Supply

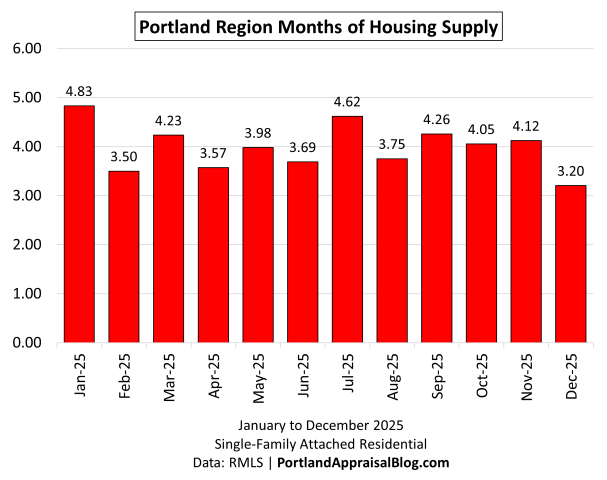

Months of supply (MOS) represents the number of months it would take to absorb current active inventory at the prevailing sales pace, assuming no new listings enter the market. The following bar chart shows MOS by calendar month for 2025:

Months of supply in 2025 moved within a relatively tight band, but the overall pattern points to a market operating with more breathing room than in prior years. The year opened with elevated supply levels, reflecting both leftover winter inventory and the steady flow of new construction that has become a defining feature of the attached segment. Conditions tightened briefly in February and April, but the broader trend is one of stability rather than compression.

Through the middle of the year, supply hovered around the four‑month mark—high enough to give buyers meaningful choice, but not so high as to signal oversupply. July and September posted some of the higher readings of the year, consistent with the slower pace reflected in the CDOM charts and the gradual softening seen in the pricing metrics. Even so, the market remained functional: listings continued to move, and the supply levels never drifted into territory that would indicate a breakdown in demand.

The late‑year dip in December is typical for the season, but it also reflects the influence of new‑construction closings, which helped keep inventory from accumulating as sharply as it might have in a purely resale‑driven environment.

The line graph below compares months of supply for 2024 (blue line) and 2025 (red line), with a full y-axis scale to show true proportional differences:

The year‑over‑year comparison shows a clear expansion in supply throughout 2025. While both years follow the same seasonal pattern—tightening in early spring, loosening through summer, and a modest late‑year dip—the 2025 line sits noticeably higher in nearly every month. The difference is especially pronounced from March through November, where supply levels in 2025 consistently ran one to two months above the prior year.

This shift reflects the combined influence of expanded inventory, a heavier flow of new‑construction listings, and a more deliberate pace among buyers navigating elevated interest rates. The attached segment remained orderly and functional, but the additional supply gave buyers more choice and more time, contributing to the longer market times seen in the CDOM charts. Even the December reading, while lower than the fall peak, remained above 2024 levels, underscoring how persistent the year‑over‑year increase was.

Overall, the comparison reinforces the broader theme of the annual: 2025 was a year where the attached segment operated with more breathing room. Supply didn’t spike into overshoot territory, but it expanded enough to shift the balance of leverage subtly toward buyers and to support the gradual softening visible in the pricing metrics.

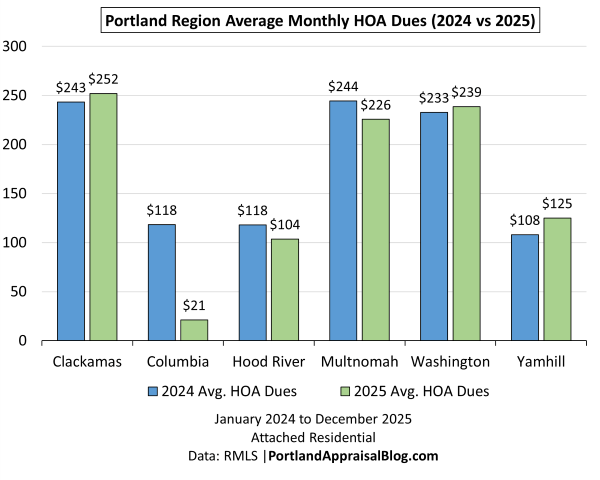

HOA Dues

While not all attached homes are located in an HOA with mandatory dues, a significant number are:

| # of Attached Homes Reporting HOA Dues |

|---|

| 1,295 |

| 78.68% of Sales |

The bar chart below compares average monthly HOA dues (for reporting sales) for 2024 and 2025:

HOA dues in the attached segment remained remarkably stable in 2025, especially compared to the sharp increases seen in the condo market. With nearly 79% of all attached‑home sales reporting dues, this is a meaningful metric for understanding the real carrying cost of the segment—and the year‑over‑year changes were modest. Most counties saw only small adjustments, and the regional pattern reflects a market where dues are largely predictable and tied to routine maintenance rather than major capital projects.

The county‑level shifts tell a nuanced story. Washington and Clackamas posted slight increases, consistent with normal operating‑cost inflation. Multnomah, by contrast, saw a small decline, which helped offset increases elsewhere and contributed to the segment’s overall affordability profile. The outlier counties—Columbia, Hood River, and Yamhill—show more volatility, but their sample sizes are too small to influence regional trends in any meaningful way.

What stands out most is how restrained these changes are. In a year where interest rates and inflation continued to pressure buyers, the stability of HOA dues provided a measure of predictability that helped support demand. This is especially important in a segment where dues are common and where buyers are often comparing attached homes not only to detached options but also to townhome‑style condos with much higher monthly obligations.

Overall, the HOA landscape in 2025 reinforces the broader theme of the annual: the attached segment remained one of the most accessible pathways into new or newer housing, with dues that stayed manageable even as other cost pressures mounted.

Histograms

Histograms offer a unique and powerful perspective on the attached homes market that traditional summary statistics and bar charts cannot fully capture: they reveal the underlying shape, spread, and clustering of the data, exposing patterns, skewness, tails, and bifurcations that averages and medians alone obscure.

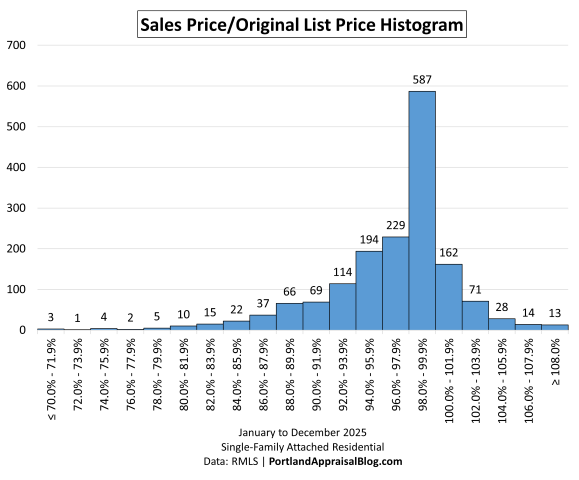

The following histogram shows the distribution of sales price as a percentage of original list price in 2025:

The histogram of Sales Price to Original List Price (SP/OLP) ratios for 2025 attached home sales in the Portland Region reveals a strongly right-skewed distribution centered on high negotiation success for sellers, with the overwhelming majority of transactions closing at or very close to asking price.

The peak bin—98.0%–99.9% SP/OLP—contains 587 sales, or 35.66% of the total 1,646 transactions. This single bin alone accounts for more than one-third of all closings, underscoring how competitively positioned attached homes moved in 2025. The adjacent bins reinforce this: 96.0%–97.9% (229 sales, 13.91%), 94.0%–95.9% (194 sales, 11.79%), and 100.0%–101.9% (162 sales, 9.84%) together push the concentration around the 96–102% range to nearly half the market.

Cumulatively:

- Approximately 46.8% of sales closed below 98% SP/OLP (771 transactions), indicating some level of negotiation or concessions in nearly half the market.

- Roughly 45.5% closed between 98% and under 102% (a tight band around full price or slight premiums).

- Only 7.65% was at or above 102% SP/OLP (above full asking), and just 0.79% reached ≥108%—showing limited instances of bidding wars or aggressive over-asking closes.

The left tail (below 90% SP/OLP) is thin: only ~10% of sales fell below 90%, and the extreme low end (<80%) is negligible (15 transactions total). This distribution reflects good seller leverage in the attached segment overall, but with clear evidence of buyer pushback in a softening environment: the modal (peak) outcome is 98–99.9% (modest concessions), and the right tail thins rapidly above 101.9%.

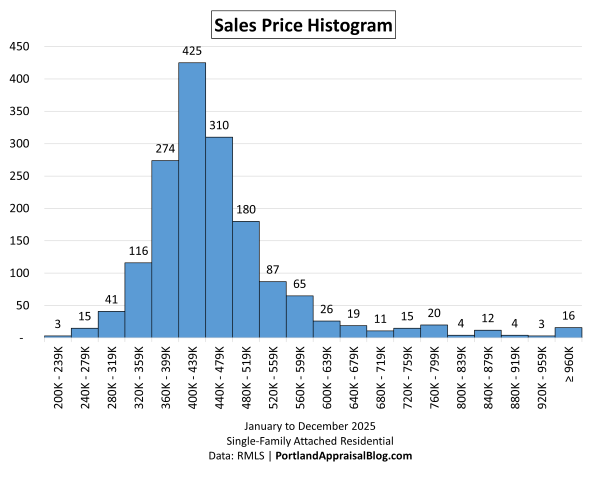

The following histogram shows the distribution of sales prices of attached homes in 2025:

The histogram of sales prices for single-family attached residential properties in the Portland Region during 2025 shows a classic bell-shaped distribution centered firmly in the mid-$400k range. The largest share of transactions—425 sales, or 25.82% of the total 1,646—closed in the $400,000–$439,999 bin, marking this as the clear peak for townhomes and rowhouses in suburban and edge-urban locations.

The distribution remains tightly concentrated around this peak. The bins immediately below and above—$360,000–$399,999 (274 sales, 16.65%) and $440,000–$479,999 (310 sales, 18.83%)—together account for an additional 35.48% of sales, meaning roughly 61% of all attached homes sold between $360,000 and $479,000. This narrow ~$120k window captures the vast majority of the market.

Lower price ranges taper off quickly. Below $400,000, only about 27.3% of sales occurred (449 transactions), and activity below $320,000 was minimal at just 3.58% (59 sales). The segment shows no meaningful volume in the low $200k range, with only 3 sales falling in the $200,000–$239,999 bin. On the upper end, volume in prices drop off sharply at or above $600,000, where just 7.9% of sales (130 transactions) took place, and only 16 sales reached or exceeded $960,000 (0.97%).

The slight left skew within the mid-range—more volume below $440,000 than above—aligns with the modest downward pressure seen in average and median prices and the more noticeable PPSF decline. This pattern reflects the influence of competitively priced new construction units entering the market and increased buyer selectivity amid higher months of supply and longer average marketing times.

The consistent floor at or above $320,000 for the dense portion of the distribution highlights the structural support in attached homes: fee-simple ownership of land and structure, minimum practical sizes for townhomes and rowhouses, and HOA/maintenance responsibilities that prevent the deep low-end pricing occasionally seen in condominiums or distressed detached properties.

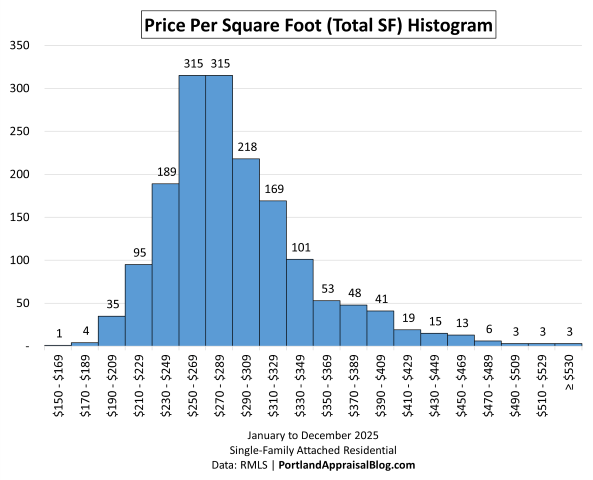

The following histogram shows the distribution of price per square foot for attached homes in 2025:

The histogram of price per square foot (PPSF, based on total square footage) for single-family attached residential sales in the Portland Region during 2025 shows a strong central peak in the $250 to under $290 range, with the distribution skewed slightly left.

The two highest bins are tied: $250–$269 and $270–$289, each with 315 sales and 19.14% of the total 1,646 transactions. These two adjacent ranges together capture 38.28% of all closings, making the $250–$289 PPSF interval the clear core of the market for attached homes.

The peak concentration extends on either side:

- Below the peak, the $230–$249 bin has 189 sales (11.48%), and the $290–$309 bin has 218 sales (13.24%).

- Taken together, the four bins from $230 to $309 account for 63% of sales (1,037 transactions).

Lower PPSF ranges fall off steadily. Below $230 per square foot, only about 8.2% of sales occurred (135 transactions), with activity below $210 minimal at just 2.43% (40 sales). The extreme low end ($150–$169) has only 1 sale (0.06%).

On the upper end, PPSF drops off more quickly at $330. Sales at or above $330 per square foot represent roughly 18.53% of the market (305 transactions), with very thin volume above $410 (only 1.15% at $410–$429 and lower thereafter). Only 3 sales reached or exceeded $530 per square foot (0.18%).

The modest left skew within the mid-range—more volume in the $250–$289 peak and below than above—aligns with the compositional effects discussed earlier: average total square footage rose +2.60% to 1,598 SF, and the influx of newer, slightly larger units from construction helped pull representative PPSF levels lower.

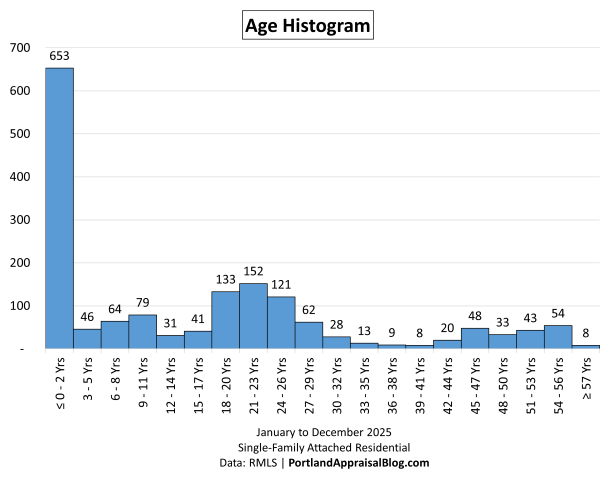

The following histogram shows the distribution of age for attached homes in 2025:

The histogram of actual age (years since original construction) for single-family attached residential sales in the Portland Region during 2025 shows a strongly unimodal distribution with an overwhelming peak in very recent construction and a noticeable secondary concentration in properties originally built 18–26 years ago.

The dominant bin—0–2 years—contains 653 sales, or 39.67% of the total 1,646 transactions. This single range accounts for nearly 40% of all closings, reflecting the significant role new construction played in sustaining volume and freshness in the attached segment throughout 2025. The next few bins remain modest: 3–5 years (46 sales, 2.79%), 6–8 years (64 sales, 3.89%), 9–11 years (79 sales, 4.80%), and 12–14 years (31 sales, 1.88%). Together, properties 14 years old or newer represent roughly 53.04% of sales (873 transactions), underscoring how recent inventory dominated the market.

A secondary cluster appears in the 18–26 year range (original construction roughly 1999–2007), with notable peaks at 18–20 years (133 sales, 8.08%), 21–23 years (152 sales, 9.23%), and 24–26 years (121 sales, 7.35%). These three bins alone account for 24.66% of sales (406 transactions), representing the largest group of older attached homes that traded.

Beyond 26 years, volume drops off sharply and remains thin. Properties 27 years and older make up only 19.81% of sales (326 transactions), with no single bin exceeding 62 sales (27–29 years, 3.77%). The oldest group (≥57 years) has just 8 sales (0.49%), showing very limited turnover among truly vintage attached structures.

This unimodal pattern—39.67% under 3 years old—directly ties to the new construction influx discussed earlier: the surge in fresh units lowered average age to 15.69 years. The relative scarcity of mid-age (15–17 years) and older (27+ years) sales highlights how attached homes tend to cluster around building cycles rather than a smooth age distribution.

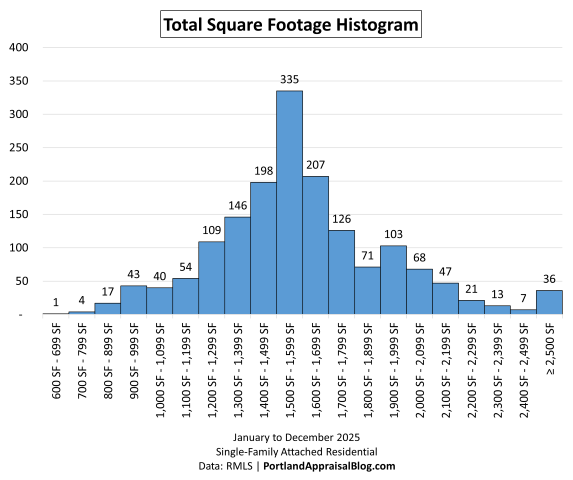

The following histogram shows the distribution of total square footage for attached homes in 2025:

The histogram of total square footage for single-family attached residential sales in the Portland Region during 2025 shows a clear central peak in the 1,500–1,599 SF range, with the distribution skewed slightly left within the mid-size band.

The dominant bin—1,500–1,599 SF—contains 335 sales, or 20.35% of the total 1,646 transactions. This single range captures the largest share of closings, reflecting the typical size for modern townhomes and rowhouses in the region.

The peak concentration extends on either side. The adjacent bins of 1,400–1,499 SF (198 sales) and 1,600–1,699 SF (207 sales) add another 24.61%. Taken together, the three bins from 1,400 to 1,699 SF account for 44.96% of sales (740 transactions), forming the core mid-size heart of the segment.

Lower square footage ranges taper off steadily. Below 1,400 SF, roughly 25.15% of sales occurred (414 transactions), with activity below 900 SF minimal.

On the upper end, square footage drops off more quickly above 1,700 SF. Sales at or above 1,700 SF represent 29.89% of the market (492 transactions), with volume thinning further at or above 2,000 SF to 11.66% (192 sales).

The consistent concentration around 1,400–1,699 SF highlights the practical size norms for attached homes: efficient layouts that balance livability, land constraints, and HOA/shared-element considerations without extending into the larger footprints common in detached single-family properties.

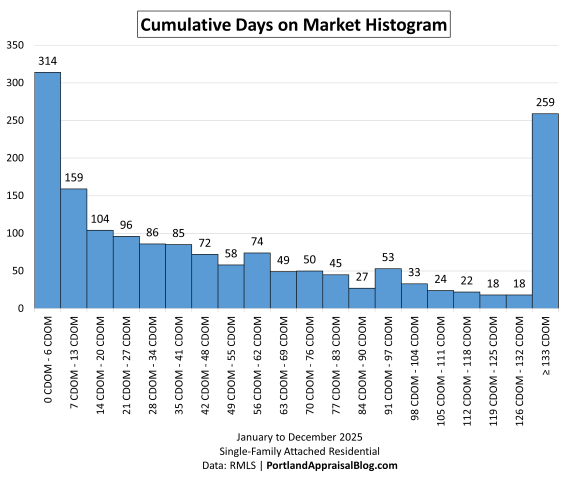

The following histogram shows the distribution of cumulative days on market for attached homes in 2025:

The histogram of cumulative days on market (CDOM) for single-family attached residential sales in the Portland Region during 2025 shows a distribution with a pronounced left-side peak in very short marketing times and a secondary spike in extremely long exposure, giving the appearance of bimodality when binned into 20 groups.

The dominant left-side peak falls in the 0–6 CDOM bin, with 314 sales or 19.08% of the total 1,646 transactions. This reflects the segment’s core of well-priced, competitively positioned properties that sell very quickly, often within the first week of listing.

The core short-to-moderate range (0–55 days) accounts for 59.17% of sales (974 transactions). This broad group covers everything from immediate sales to marketing times that draw closer to the regional average CDOM of 68.36 days.

Marketing times that approach the regional average and extend to about double that level (56–132 days) represent 25.09% of sales (413 transactions). These properties experienced extended exposure—often due to pricing, condition, location, or HOA-related factors—but still closed without reaching the extreme tail.

The long right-side tail (≥133 days) contains 259 sales or 15.74% of transactions. This extreme marketing time bookend captures the properties that lingered well beyond double the regional average, sometimes for hundreds of days (with the full spread in this bin reaching up to 2,017 days). When binned coarsely, this tail creates the visual appearance of a secondary mode at the far right, even though the underlying data is a long, continuous tail rather than a true symmetric peak.

The overall shape—strong concentration in very short CDOM, a moderate middle tail of extended but not extreme marketing times, and a notable spike in the long-tail extreme—reflects buyer selectivity in a softening environment. Well-positioned properties moved fast, while mispriced or challenged units (high HOA dues, outdated features, or location drawbacks) accumulated longer exposure, particularly in the ≥133 day group.

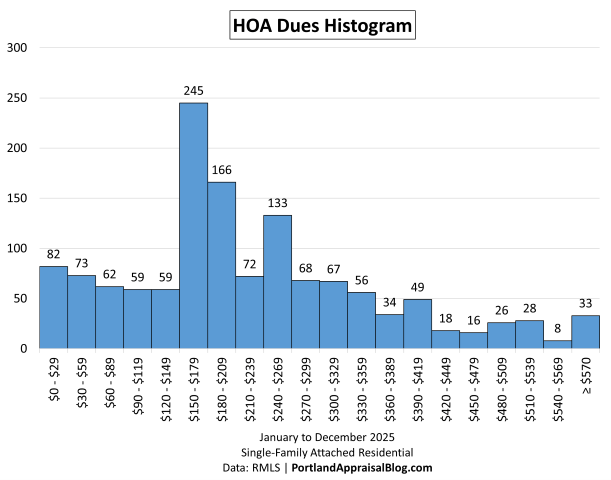

The following histogram shows the distribution of monthly HOA dues for attached homes in 2025:

The histogram of monthly HOA dues (for properties reporting non-zero dues) in single-family attached residential sales in the Portland Region during 2025 shows a strong central peak in the $150–$179 range, with the distribution skewed slightly right within the mid-to-higher dues band.

The dominant bin—$150–$179—contains 245 sales, or 18.92% of the 1,295 transactions reporting non-zero HOA dues. This single range captures the largest share of closings, reflecting the typical monthly fee level for attached homes with mandatory associations in the region.

The peak concentration extends on either side. The adjacent bins of $120–$149 (59 sales, 4.56%) and $180–$209 (166 sales, 12.82%) add another 17.37%. Taken together, the three bins from $120 to $209 account for 36.29% of reported dues sales (470 transactions), forming the core mid-range heart of the distribution.

Lower dues ranges taper off steadily. Below $150 per month, roughly 21.31% of sales occurred (276 transactions), with activity below $90 minimal.

On the higher end, dues drop off more quickly above $300. Sales at or above $300 per month represent 25.87% of the market (335 transactions), with volume thinning further at or above $420 (only 9.96%, 129 sales). Only 33 sales reached or exceeded $570 per month (2.55%).

The distribution is left-skewed—more volume in the $150–$209 peak and below than above—aligns with the modest HOA increase observed earlier (+1.18% to $236.84 average). This pattern reflects the prevalence of moderate dues in newer and suburban attached communities, where associations provide amenities without escalating to condo-like levels.

The consistent concentration around $150–$209 highlights the practical dues norms for attached homes: fees that cover shared maintenance and amenities while remaining manageable for buyers, especially compared to the sharper increases seen in the condominium segment.

Miscellaneous Statistics & Standout Transactions

Here are some of the most notable outliers and extremes from the 2025 Portland Region attached homes market—numbers that illustrate the full range of the data and the extremes buyers and appraisers encounter.

Lowest Sales Price: $215,000—3-bedroom, 2.1-bathroom unit. The lowest price was obtained by a fixer townhouse in Portland that closed as a cash sale. Unlike the condo and detached segments of the housing market, attached homes have a much higher “floor” of prices. The 1,224-sq. ft. home was purchased by a flipper and renovated. Photos of this property (in its renovated state) are currently available online.

Highest Sales Price: $1,745,000—The highest price obtained by an attached home in 2025 was a new construction property in Lake Oswego. The attached home is 3,390 sq. ft. and has 4 bedrooms and 5 bathrooms. The interior has high-quality finishes. Photos of this property are currently available online.

Lowest Price Per Square Foot: $154.99—The lowest price was obtained by a fixer townhouse in Portland that sold for $460,000. The property is 2,968 sq. ft. and has 3 bedrooms and 3.1 bathrooms. The home needed a lot of work and sold to a flipper who later obtained $759,490 for the renovated townhome. Photos of this property (in its renovated state) are currently available online.

Highest Price Per Square Foot: $597.61—5-bedroom, 2.1-bathroom. The highest price was obtained by a modern townhouse in Hood River that sold for $1,500,000. The property has good views of the Columbia River. Photos of this property are currently available online.

Longest CDOM: 2,017 days—3-bedroom, 2.1-bathroom end-unit townhome-style in Sandy (Clackamas County). This property had a curious listing history. It was a new construction in a subdivision but apparently was held back from sale by the builder; perhaps as a model to show as the other units sold. Portland Appraisal Blog tried to reach out to the agents. The buyer’s agent did respond, but didn’t have much information to share. The agent did confirm the unit was rented at the time of the sale. So, it’s possible someone connected to the builder was occupying the unit as a rental until the subdivision finally sold out. Photos of this property are currently available online.

Smallest Attached Home: 655 SF—1-bedroom, 1-bathroom unit in King City (Washington County). This property sold in an age-restricted (55+) community. The home sold for $245,000 and had reported monthly HOA dues of $186. Photos of this property are currently available online.

Largest Attached Home: 3,510 SF—4-bedroom, 4.2-bathroom townhouse in Lake Oswego. This property is a newer construction and sold for $1,585,000. The townhome has quality finishes. Photos of this property are currently available online.

Largest Lot: 0.26 acres—2-bedroom, 2-bathroom townhouse in Wilsonville (Clackamas County). The property is located in the the golf course community Charbonneau and sold for $750,000. Photos of this property are currently available online.

Highest Monthly HOA Dues: $840—3-bedroom, 2.1-bathroom attached home in Portland. The home is 3,373 sq. ft. The high dues cover exterior elements of the property, such as stucco siding and the roof, as well as landscaping. In addition, there is a semiannual $400 charge that covers trails, playground, and community events. Photos of this property are currently available online.

Highest Monthly HOA Dues Per SF: $0.63—2-bedroom, 1-bathroom end-unit property. The home is 1,092 sq. ft. with monthly HOA dues of $693. While the home sold for $262,400, the HOA dues are a reminder that monthly carrying costs for some relatively low-priced units can be drastically affected by HOA dues. Photos of this property are currently available online.

With the regional aggregate trends, graphs, monthly patterns, histogram analysis, and notable outliers covered, the remainder of this update turns to a county-level breakdown. The following sections present year-over-year comparisons for each of the six counties in the Portland Region—Multnomah, Washington, Clackamas, Yamhill, Columbia, and Hood River. Each county snapshot includes key metrics, commentary on local drivers, and any segment-specific observations that help explain broader regional patterns.

Multnomah County 2025 Stats

Multnomah County, encompassing the City of Portland and its immediate surroundings, accounted for 24.97% of all attached‑home sales in the region in 2025, making it the second‑largest contributor behind Washington County and serving as the secondary hub of the regional attached homes segment.

The table below summarizes key metrics for Multnomah County attached single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $169.0 Million | $190.3 Million | +12.64% |

| Average Price | $445,867 | $463,103 | +3.87% |

| Median Price | $399,900 | $415,995 | +4.02% |

| Avg SP/OLP | 97.30% | 97.62% | +0.33% |

| Avg PPSF (TSF) | $311.47 | $299.50 | -3.85% |

| Avg HOA Dues | $244.45 | $225.72 | -7.66% |

| Avg Age (Yrs) | 17.00 | 14.34 | -15.67% |

| Avg CDOM | 65.38 | 59.98 | -8.26% |

| Avg Total SF | 1,476 | 1,582 | +7.18% |

| Total # of Sales | 379 | 411 | +8.44% |

| # of New Constr. | 125 | 169 | +35.20% |

| # of REOs | 2 | 3 | +50.00% |

| # of Short Sales | 1 | 0 | -100.00% |

Single-Family Attached Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

The segment posted a solid year overall, with both sales volume and prices moving higher. Total dollar volume rose nearly 13%, supported by an 8% increase in closed sales and a modest gain in both average and median prices. (Newer and slightly larger homes also contributed to the increase.) The pricing environment here was steadier than in some of the surrounding counties, reflecting a mix of infill development, established neighborhoods, and a broad range of attached‑home types. The yearly gains meant that sellers netted nearly an additional $22 million—almost the exact increase in new construction dollar volume gains.

A few metrics stand out. New‑construction activity increased sharply, rising more than 35% year over year, and helped pull the average age of sold homes down meaningfully. That younger inventory mix also contributed to the increase in average square footage, which climbed more than 7%. Market times improved as well, with average CDOM falling by about 8%, suggesting that buyers responded to the refreshed inventory and more competitive pricing.

Multnomah was also one of the few counties where HOA dues declined, offering a small but notable affordability offset in a year where carrying costs remained top of mind for buyers. The slight improvement in the average sale‑to‑original‑list‑price ratio reinforces the picture of a segment that remained orderly and well‑priced, even as the broader market shifted toward more balanced conditions.

Overall, Multnomah’s attached‑home market in 2025 was defined by steady demand, a meaningful infusion of newer product, and pricing that moved upward without overheating—an environment that helped anchor the region’s overall performance.

The following table shows the geographic distribution of attached homes sales in Multnomah County:

| City | Avg Price | Avg PPSF | # of Sales | % of Sales |

|---|---|---|---|---|

| Fairview | $366,808 | $232.37 | 15 | 3.65% |

| Gresham | $404,927 | $250.67 | 138 | 33.58% |

| Lake Oswego | $559,760 | $247.06 | 5 | 1.22% |

| Portland | $502,040 | $333.43 | 246 | 59.85% |

| Troutdale | $378,971 | $251.00 | 7 | 1.70% |

| Avg/Sum | $463,103 | $299.50 | 411 | — |

Data: RMLS | PortlandAppraisalBlog.com

The city distribution inside Multnomah County shows a market anchored almost entirely by Portland and Gresham, which together account for more than 93% of all attached‑home sales in 2025. Portland represents nearly 60% of the county’s activity and continues to set the pricing tone. Its higher average price and significantly higher PPSF reflect closer‑in locations, infill townhome development, and a broader mix of attached product types. The size profile of Portland’s inventory adds important context: resales averaged 1,654 square feet, while new‑construction attached homes averaged 1,233 square feet. That gap helps explain why Portland’s PPSF remains elevated even as its average price sits between the region’s most expensive and most affordable cities. The newer product coming online is smaller and designed to meet buyers at a more attainable price point. Because all new construction outside Gresham occurred in Portland, this mix of smaller new units and larger resale units plays a direct role in shaping the countywide averages for age, size, and PPSF.

Gresham plays a very different but equally important role. It contributed 138 sales, representing more than a third of the county’s total, and delivered 105 new‑construction closings in 2025. That pipeline makes Gresham the county’s primary source of newer, larger, and more affordably priced attached homes. The size profile here moves in the opposite direction of Portland: new‑construction attached homes averaged 1,652 square feet, while resales averaged 1,543 square feet. The newer product is not only larger but also positioned at a lower price point, which helps explain Gresham’s lower average price and PPSF despite its substantial share of total sales. It is the part of the county where buyers can still find newer, larger homes at approachable price levels, and that affordability profile is a major reason Gresham continues to carry so much of the county’s volume.

Fairview, Troutdale, and Lake Oswego contribute only small numbers of sales, and their averages move around more because of their limited sample sizes. They do not materially influence the countywide trends, but they round out the picture of a county where the attached‑home market is highly concentrated in two cities with distinct roles. Portland drives pricing and sheer volume, while Gresham drives new‑construction activity and affordability. Together, they explain the shape and direction of Multnomah County’s attached‑home segment in 2025, and the size differentials between new and resale product in each city help clarify why the countywide metrics moved the way they did.

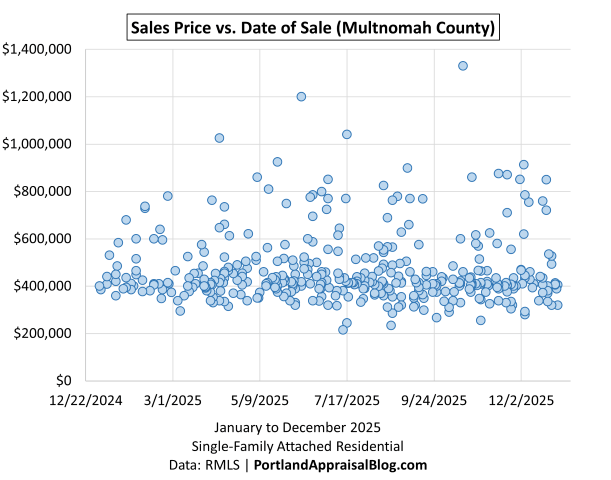

The following is a scatter plot of all Multnomah County sales in 2025 (sales price vs. date of sale):

The scatter plot for Multnomah County shows why the county’s pricing metrics can rise year over year while PPSF still trends downward. The overall level of prices is higher than in 2024, and the upper half of the distribution remains well populated throughout the year. But the tilt in the cloud of points is unmistakable: the early‑year sales sit slightly higher on the vertical axis, while the later‑year sales settle into a lower band. That downward slope mirrors the modest softening seen in the regional charts and helps explain why PPSF declined even as average and median prices increased.

The pattern suggests that the market was still capable of producing higher‑end sales, but those sales were more common earlier in the year. As the year progressed, the mix shifted toward more mid‑range transactions, and the upper‑end outliers became less frequent. Because PPSF is sensitive to both price and size, this subtle change in the distribution is enough to pull the metric down even in a year where total dollar volume and average price moved higher.

Washington County 2025 Stats

Washington County is the largest attached‑home market in the region, accounting for over half of all attached‑home activity.

The table below summarizes key metrics for Washington County attached single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $368.1 Million | $393.4 Million | +6.88% |

| Average Price | $454,999 | $445,530 | -2.08% |

| Median Price | $444,900 | $438,500 | -1.44% |

| Avg SP/OLP | 98.17% | 96.88% | -1.31% |

| Avg PPSF (TSF) | $298.25 | $289.02 | -3.09% |

| Avg HOA Dues | $232.82 | $238.75 | +2.55% |

| Avg Age (Yrs) | 15.61 | 15.30 | -1.95% |

| Avg CDOM | 53.66 | 67.35 | +25.50% |

| Avg Total SF | 1,546 | 1,562 | +1.06% |

| Total # of Sales | 809 | 883 | +9.15% |

| # of New Constr. | 295 | 393 | +33.22% |

| # of REOs | 1 | 3 | +200.00% |

| # of Short Sales | 0 | 1 | — |

Single-Family Attached Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

Washington County is the dominant attached‑home market in the region, accounting for 883 of the 1,646 attached‑home sales in 2025, or 53.65% of all activity. Total dollar volume rose to $393.4 million, an increase of $25.3 million from 2024, even though both the average and median prices declined slightly. The average price dipped to $445,530, and the median settled at $438,500, reflecting a shift in the mix and a softer demand environment. The county’s pricing metrics were likely influenced in part by the well‑publicized Intel layoffs, which introduced uncertainty into the westside employment base. Buyers facing job instability or reduced confidence are less likely to enter the market, and that dynamic can reduce upward pricing pressure even when sales volume remains strong.

Sales activity itself increased by 74 transactions, and new‑construction closings rose from 295 to 393, showing that supply continued to expand. But pricing softened across several indicators. The average sale‑to‑original‑list‑price ratio declined from 98.17% to 96.88%, and average PPSF fell from $298.25 to $289.02. Market times lengthened meaningfully, with average CDOM rising from 53.66 to 67.35 days. These shifts align with a market where buyers had more options, sellers had to price more competitively, and some households delayed purchases due to employment uncertainty.

The following table shows the geographic distribution of attached homes sales in Washington County:

| City | Avg Price | Avg PPSF | # of Sales | % of Sales |

|---|---|---|---|---|

| Beaverton | $408,094 | $288.73 | 200 | 22.65% |

| Cornelius | $411,946 | $271.49 | 35 | 3.96% |

| Forest Grove | $423,374 | $281.61 | 39 | 4.42% |

| Hillsboro | $455,385 | $287.30 | 275 | 31.14% |

| King City | $378,550 | $309.58 | 10 | 1.13% |

| North Plains | $414,390 | $276.66 | 20 | 2.27% |

| Portland | $473,309 | $304.04 | 150 | 16.99% |

| Sherwood | $420,754 | $278.29 | 28 | 3.17% |

| Tigard | $477,425 | $294.01 | 87 | 9.85% |

| Tualatin | $493,246 | $265.78 | 39 | 4.42% |

| Avg/Sum | $445,530 | $289.03 | 883 | — |

The city‑level distribution shows how varied Washington County’s attached‑home segment is. Hillsboro and Beaverton together produced 475 sales, more than half of the county’s total. Hillsboro alone delivered 275 sales, including 175 new‑construction closings, making it the county’s largest source of new supply. Beaverton contributed 200 sales, with 29 of them new construction, and posted an average price of $408,094. The unincorporated portion of Washington County with a Portland address added 150 sales at an average of $473,309, and Tigard contributed 87 sales at $477,425. The remaining cities—Cornelius, Forest Grove, King City, North Plains, Sherwood, and Tualatin—each play smaller roles but collectively round out the county’s mix of attached‑home product.

New construction is central to understanding Washington County’s 2025 results. The county delivered 393 new‑construction sales, and those units averaged 1,631 square feet, compared to 1,507 square feet for resales. The size differential is consistent across most cities. Hillsboro’s new construction averaged 1,627 square feet, while its resales averaged 1,564. Tigard’s new construction averaged 1,685 square feet, compared to 1,597 for resales. Tualatin’s new construction averaged 1,900 square feet, while its resales averaged 1,653. These larger new units help explain why the countywide average square footage increased slightly even as prices softened. The age profile also reflects this dynamic: the average year built for new construction was 2025, while the resale stock averaged 1998, producing a blended countywide age of 15.30 years.

The PPSF patterns across cities align with the size and age mix. Portland, Tigard, and King City posted the highest PPSF figures—$304.04, $294.01, and $309.58, respectively—while Cornelius, Forest Grove, and Tualatin posted lower PPSF values tied to larger average sizes and newer construction. The countywide PPSF decline of $9.23 year over year reflects a shift toward larger, newer units and a softer demand environment rather than a broad price reset.

Overall, Washington County’s attached‑home market in 2025 was defined by expanding new‑construction activity, a modest softening in pricing metrics, and a meaningful increase in market times. As the region’s largest and most diverse attached‑home segment, Washington County’s mix of substantial new supply, shifting buyer sentiment, and employment‑related uncertainty explains nearly all of the year‑over‑year changes in price, PPSF, size, and CDOM.

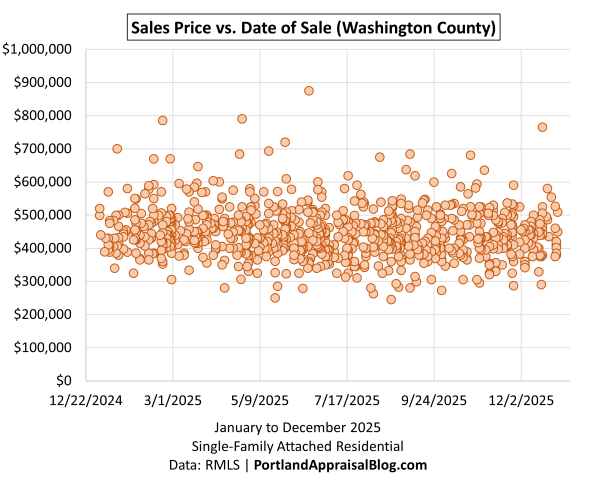

The following is a scatter plot of all Washington County sales in 2025 (sales price vs. date of sale):

The Washington County scatter plot shows a pattern that aligns closely with the county’s year‑over‑year pricing results. Prices are still capable of reaching the upper ranges, but the distribution of sales shifts noticeably as the year progresses. Early‑year transactions include more sales in the higher price bands, while the later months show a denser cluster in the mid‑range. That subtle downward tilt in the cloud of points mirrors the countywide decline in both average price and PPSF.

The shape of the scatter also reflects the softer demand environment that emerged during the year. Washington County absorbed a significant number of Intel‑related layoffs, and employment uncertainty tends to reduce the number of buyers willing to stretch into higher price tiers. Even though total sales increased to 883, the composition of those sales changed. Fewer upper‑end transactions later in the year, combined with a larger share of mid‑range new‑construction closings, naturally pulled the averages down.

This shift in the distribution helps explain why PPSF fell from $298.25 to $289.02 even as the county delivered 393 new‑construction units averaging 1,631 square feet. Larger new homes at mid‑range prices, paired with fewer late‑year high‑end sales, create exactly the kind of tilt visible in the scatter.

Taken together, the scatter reinforces the broader story: Washington County remained active and productive, but the momentum softened as the year went on, and the mix of sales shifted just enough to influence the countywide pricing metrics.

Clackamas County 2025 Stats

Clackamas County is the region’s third‑largest attached‑home market.

The table below summarizes key metrics for Clackamas County attached single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $155.2 Million | $146.0 Million | -5.96% |

| Average Price | $500,739 | $506,874 | +1.23% |

| Median Price | $464,980 | $454,993 | -2.15% |

| Avg SP/OLP | 98.21% | 96.79% | -1.45% |

| Avg PPSF (TSF) | $297.67 | $288.54 | -3.07% |

| Avg HOA Dues | $243.36 | $252.08 | +3.58% |

| Avg Age (Yrs) | 16.59 | 17.75 | +7.03% |

| Avg CDOM | 69.84 | 84.50 | +20.98% |

| Avg Total SF | 1,693 | 1,747 | +3.21% |

| Total # of Sales | 310 | 288 | -7.10% |

| # of New Constr. | 84 | 74 | -11.90% |

| # of REOs | 0 | 1 | — |

| # of Short Sales | 1 | 1 | 0.00% |

Single-Family Attached Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

Clackamas County accounted for 288 of the 1,646 attached‑home sales in 2025, or 17.50% of all activity, and about 19.25% of total dollar volume at $146.0 million. Compared to 2024, total volume slipped by $9.2 million, and sales declined from 310 to 288, even as the average price edged up from $500,739 to $506,874. The median price moved the other direction, dipping from $464,980 to $454,993, which points to a subtle shift in the mix rather than a broad upward push in pricing. At the same time, the average sale‑to‑original‑list‑price ratio eased from 98.21% to 96.79%, average PPSF fell from $297.67 to $288.54, and average CDOM stretched from 69.84 to 84.50 days, all consistent with a market that required more negotiation and more time to get to closing.

The following table shows the geographic distribution of attached homes sales in Clackamas County:

| City | Avg Price | Avg PPSF | # of Sales | % of Sales |

|---|---|---|---|---|

| Canby | $354,600 | $276.37 | 14 | 4.86% |

| Clackamas | $448,586 | $270.67 | 14 | 4.86% |

| Damascus | $402,873 | $244.02 | 11 | 3.82% |

| Happy Valley | $457,235 | $273.09 | 73 | 25.35% |

| Lake Oswego | $741,039 | $358.45 | 34 | 11.81% |

| Milwaukie | $464,130 | $260.87 | 18 | 6.25% |

| Oregon City | $450,318 | $263.42 | 22 | 7.64% |

| Sandy | $369,457 | $237.72 | 29 | 10.07% |

| West Linn | $533,103 | $285.32 | 18 | 6.25% |

| Wilsonville | $615,189 | $334.38 | 50 | 17.36% |

| Other | $479,800 | $279.38 | 5 | 1.74% |

| Avg/Sum | $506,874 | $288.55 | 288 | — |

Data: RMLS | PortlandAppraisalBlog.com

The city‑level distribution shows how segmented the Clackamas attached‑home market is. Happy Valley is the clear volume anchor, with 73 sales and 25.35% of the county’s activity at an average price of $457,235. Wilsonville follows with 50 sales and 17.36% of the market at a much higher average price of $615,189 and an average PPSF of $334.38. Lake Oswego contributes 34 sales at the top of the price spectrum, with an average of $741,039 and the highest PPSF in the public table at $358.45. Sandy adds 29 sales at an average of $369,457, while Oregon City, Milwaukie, and West Linn each contribute between 18 and 22 sales, with average prices ranging from the mid‑$400,000s to the low‑$500,000s. Canby, Clackamas, and Damascus round out the core group with smaller shares and more moderate pricing. Together, these cities create a county profile that spans everything from more affordable suburban product to some of the region’s highest‑priced attached homes.

New construction plays a smaller but still important role in Clackamas than in Washington County. Countywide, new‑construction closings declined from 84 in 2024 to 74 in 2025. New‑construction activity was highly concentrated: Happy Valley delivered 49 new‑construction sales, Milwaukie added 16, and smaller numbers appeared in Lake Oswego, Molalla, Oregon City, West Linn, and Wilsonville. On average, new‑construction attached homes in Clackamas closed at $518,360, with an average size of 1,776 square feet and an average PPSF of $286.66. Resales, by comparison, averaged $502,902, 1,737 square feet, and $289.20 per square foot. The countywide averages—$506,874, 1,747 square feet, and $288.54 per square foot—sit right between those two cohorts, which is exactly what you would expect from a blend of slightly larger, newer units and a somewhat older resale stock. The average year built for resales is 2001 and 2025 for new construction, which translates to a combined average age of 17.75 years in the county summary.

Overall, Clackamas County’s attached‑home market in 2025 was defined by slightly higher average prices, softer PPSF, longer market times, and a modest pullback in both total sales and new‑construction volume. The county remains a meaningful share of the regional attached‑home segment, offering a wide range of price points and product types, from more affordable options in places like Canby, Sandy, and Damascus to high‑end attached homes in Lake Oswego and Wilsonville that sit near the top of the regional price spectrum

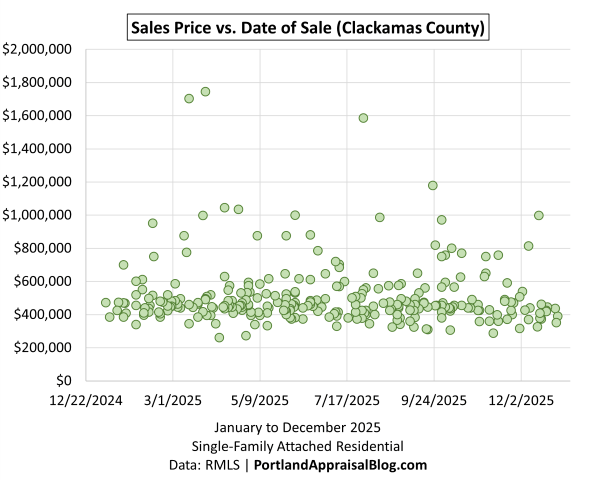

The following is a scatter plot of all Clackamas County sales in 2025 (sales price vs. date of sale):

The Clackamas County scatter plot shows a distribution that aligns closely with the county’s year‑over‑year results. Prices remain capable of reaching the upper ranges—including a handful of sales above the one‑million‑dollar mark—but the bulk of activity sits between the mid‑$300,000s and the mid‑$600,000s. What stands out is the subtle shift in the mix as the year progresses. Early‑year sales include more transactions in the higher price bands, while the later months show a denser cluster in the middle of the range. That tilt in the cloud of points mirrors the countywide decline in PPSF from $297.67 to $288.54, even as the average price increased slightly to $506,874.

The scatter also reflects the broader softening visible in the county’s other metrics. Market times lengthened to 84.50 days, the sale‑to‑original‑list‑price ratio eased to 96.79%, and total sales slipped from 310 to 288. Fewer upper‑end transactions later in the year, combined with a modest reduction in new‑construction closings, naturally pull the averages down and help explain why PPSF declined despite a small increase in average square footage.

Taken together, the scatter reinforces the same theme present throughout the Clackamas section: the market remained active and capable of producing higher‑end sales, but the momentum softened as the year went on, and the composition of sales shifted just enough to influence the countywide pricing metrics.

Yamhill County 2025 Stats

Yamhill is a largely rural county and consequently had less than 2% of the attached home sales volume.

The table below summarizes key metrics for Yamhill County attached single-family residential sales in 2025 compared with 2024.

| Category | 2024 | 2025 | % Change |

|---|---|---|---|

| Total $ Volume | $12.47 Million | $10.16 Million | -18.47% |

| Average Price | $389,559 | $390,922 | +0.35% |

| Median Price | $397,500 | $379,305 | -4.58% |

| Avg SP/OLP | 96.54% | 97.22% | +0.70% |

| Avg PPSF (TSF) | $276.62 | $294.25 | +6.37% |

| Avg HOA Dues | $108.16 | $125.12 | +15.69% |

| Avg Age (Yrs) | 24.25 | 27.96 | +15.31% |

| Avg CDOM | 64.84 | 57.85 | -10.79% |

| Avg Total SF | 1,454 | 1,370 | -5.74% |

| Total # of Sales | 32 | 26 | -18.75% |

| # of New Constr. | 3 | 0 | -100.00% |

| # of REOs | 1 | 0 | -100.00% |

| # of Short Sales | 1 | 0 | -100.00% |

Single-Family Attached Residential | 2024 & 2025

Data: RMLS | PortlandAppraisalBlog.com

Yamhill County is a very small slice of the regional attached‑home market, with 26 sales in 2025, or 1.58% of all attached‑home transactions and about 1.34% of total dollar volume at $10.16 million. With such a limited sample, year‑over‑year changes need to be read cautiously, but a few patterns are still clear. Total sales fell from 32 to 26, and volume declined by about $2.3 million, yet the average price held essentially flat at $390,922, and the median price slipped to $379,305. At the same time, average PPSF increased from $276.62 to $294.25, average size declined from 1,454 to 1,370 square feet, and average CDOM improved from 64.84 to 57.85 days, suggesting that the smaller number of sales that did occur tended to be slightly smaller, higher‑priced on a per‑square‑foot basis, and reasonably well absorbed.

The following table shows the geographic distribution of attached homes sales in Yamhill County:

| City | Avg Price | Avg PPSF | # of Sales | % of Sales |

|---|---|---|---|---|

| Dayton | $334,500 | $273.06 | 2 | 7.69% |

| McMinnville | $419,444 | $295.67 | 14 | 53.85% |

| Newberg | $363,050 | $303.01 | 8 | 30.77% |

| Sheridan | $375,000 | $217.77 | 1 | 3.85% |

| Yamhill | $343,375 | $323.33 | 1 | 3.85% |

| Avg/Sum | $390,922 | $294.26 | 26 | — |

Data: RMLS | PortlandAppraisalBlog.com

The city breakdown underscores how concentrated the activity is. McMinnville accounts for 14 of the 26 sales at an average price of $419,444 and an average PPSF of $295.67, while Newberg adds 8 sales at $363,050 and $303.01 per square foot. Dayton contributes 2 sales, and Sheridan and Yamhill each contribute 1, with averages that can move significantly based on a single transaction. Across the county, the average year built is 1997, the average home size is 1,370 square feet, and there were no new‑construction closings in 2025, so all of the metrics reflect a purely resale market.

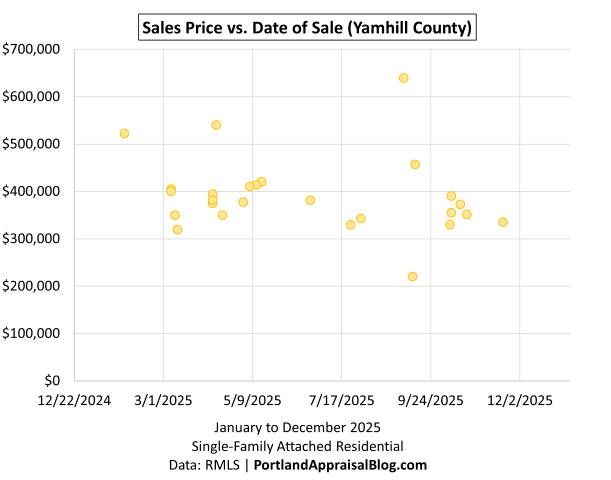

The following is a scatter plot of all Yamhill County sales in 2025:

The Yamhill County scatter plot reflects the realities of a very small market, where individual transactions can influence the yearly metrics more than in larger counties. Most sales cluster between the low‑$300,000s and the mid‑$400,000s, with only a few points extending above that range. The distribution remains relatively steady throughout the year, without a pronounced early‑year or late‑year tilt, which is consistent with the county’s stable average price of $390,922 and the modest decline in median price. With no new‑construction closings in 2025, every point on the chart represents resale activity.

Overall, the scatter reinforces the same theme present in the county tables: Yamhill’s attached‑home segment is small, steady, and shaped more by the specific properties that come to market than by large‑scale trends.

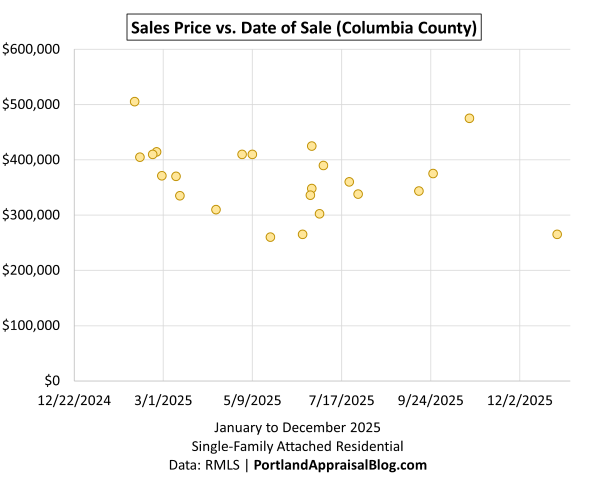

Columbia County 2025 Stats