You’re a real estate agent and after a lot of back-and-forth, give-and-take, offers and counteroffers, you’ve helped your client negotiate a sweet price for their home. All the work getting the property ready for listing, the extensive marketing, the numerous showings, the sometimes tedious offer evaluations has paid off. There has been a meeting of the minds, the contract has been signed and everyone is anticipating a smooth closing. Shortly before the home is set to close a bright light appears in the sky. Streaking through the atmosphere is a meteor scientists have dubbed “the appraisal”; it came of out nowhere and impacts your deal at hypersonic velocity, obliterating it in an instance. You, the seller, the buyer, the lender—heck, even the mailman, are all shocked the deal has fallen apart. What just happened?

If you are a real estate agent, has this ever happened to you? If so, you’ve probably run through the five stages of grief:

1) Denial—there’s no way that idiot appraiser killed my deal! There must be some mistake.

2) Anger—that idiot appraiser killed my deal!

3) Bargaining—I can fix this!

4) Depression—that idiot appraiser killed my deal. It’s not fair.

5) Acceptance—that idiot appraiser killed my deal. We’ll have to cut price or find another buyer.

The purpose of this blog post is to lend some insight into what an agent should do and not do during the third stage. It is quite possible that you can fix this—but only if the facts are on your side. This post is not a list of tricks to pull over on the appraiser in the hopes you can cajole him/her to change their mind. Given that appraising is part art and part science and is an opinion, it may be that there are important considerations the appraiser has overlooked. How best to frame such considerations? How best to convey the facts? That is what we will consider.

It’s important to note that we’re in this situation in the first place because we didn’t get a cash buyer. There is no law forbidding someone from paying more than the average market participant for a home unless the motive for doing so falls under money laundering, bribery, or some other equally nefarious scheme. That’s not the case here. The buyer loves the home and both buyer and seller feel the price is fair. However, anything other than cash means a lender gets involved and a lender means strings come attached. While lenders can differ considerably in underwriting standards and risk tolerance, most will require an appraisal to make sure the collateral supports the amount being loaned. In many cases even if the appraisal is just few thousand short, the underwriter will not go through with the deal or require the seller to cut the price.

If an agent feels the price is reasonable they have the option of requesting the buyer’s lender get the appraiser to rethink their conclusions. Usually this is done via a document known as a “reconsideration of value” (ROV for short).

Don’t Take it Personally or Get Personal—Don’t Go There

Before we get into the weeds defining ROVs and how to craft them, I think it good to say something that should already be universally understood: don’t take the appraiser’s opinion personally and, please, don’t get personal.

While relatively rare, a number of appraisers can attest, including yours truly, that some agents do seem to take the appraisers opinion as a personal affront and get personal in return. I’ve had some agents get abusive with me and send me either a nastygram or leave me a charming voicemail. Don’t send an appraiser a dead fish and don’t question their parentage or general intelligence. Trust me, appraisers don’t want to “kill your deal.” If the appraiser really has messed up, that’s where the ROV comes in. So, let’s define it.

Recap #0:

Do: Remain professional.

Don’t: Get personal.

What is a Reconsideration of Value?

In short, a reconsideration of value is another appraisal. This is an important point. Anytime an appraiser is asked to proffer an opinion of value (even if it is just to reconsider one already made) it is an appraisal. Therefore, an ROV is a big deal and most appraisers take it seriously.

Richard Hagar, a nationally recognized appraiser and valuation expert, points out the various reasons why an ROV may be necessary:

- To correct a serious mistake of material deficiency in the original report.

- A means of passing along important information not previously disclosed to the appraiser.

- A means of getting the appraiser to consider information that was not available during the original appraisal.

If any of the above points are all valid for your deal it could result in a different value conclusion. However, in 9 cases out of 10, an ROV is often used as a vehicle to influence the appraiser’s opinion of value. (Which is a legal no-no.)

Most appraisers are hard-working professionals who spend a lot of time researching and analyzing market data. Appraisal reports can easily balloon to 50 pages or more with commentary and exhibits. Oftentimes appraisers will embed a short essay/commentary about why their opinion of value doesn’t align with the negotiated sales contract. Read it.

All appraisers have stories about questions they get about their reports that are already answered in the narrative commentary. It’s annoying to say the least. Even more annoying is being given a list of possible comparables only to find you either already used those sales in the original report or talked about why you didn’t. Appraisers, while required to remain neutral and objective, are still human beings. An ROV is going to put an appraiser on the defensive right out of the gate since they are being paid for their opinion and now are being implicitly told that their opinion stinks. Most appraisers are loathe to change their conclusions and will be even less inclined to rethink their conclusions if an ROV is riddled with questions or items already dealt with in the report. It’s okay to question an appraiser’s conclusions/findings, but make sure the ROV shows that you know the appraiser already addressed any item you’re questioning if they did, in fact, address it. It shows professionalism on your part and the appraiser immediately shifts their perspective. Oh, I got a serious one here. Let me dig into this.

Recap #1:

Do: Take ROVs seriously.

Don’t: Use an ROV as a frivolous means to see if you can squeeze a little more money out of the appraisal. Read the report!

Speaking the Same Language—Appraisers are from Mars, Agents Are from Venus

Most loans will fall under federal guidelines and use a definition for market value found on the form report workhorse of the appraisal world—the Fannie Mae 1004 Form.

Virtually all agents are familiar with the Fannie Mae form report. However, many agents (and sadly, more than a few appraisers) have not taken the time to read the definitions and certifications contained in the form. It could save everyone a lot of grief. Remember, the lender is the appraiser’s client and intended user. Not even the borrower is the appraiser’s client. The lender has hired the appraiser to produce a report that conforms to the guidelines set forth by Fannie Mae—and that includes using their definition of market value. It is:

DEFINITION OF MARKET VALUE: The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

(1) buyer and seller are typically motivated;

(2) both parties are well informed or well advised, and each acting in what he or she considers his or her own best interest;

(3) a reasonable time is allowed for exposure in the open market;

(4) payment is made in terms of cash in U. S. dollars or in terms of financial arrangements comparable thereto; and

(5) the price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions* granted by anyone associated with the sale.

There is a lot to unpack here, but let’s just focus on the idea that market value is the most probable price.

A little time may have passed since your last high school/college statistics course. (My growing number of gray hairs can attest to that for me.) The most probable price doesn’t mean the highest price (or the lowest price). It’s the “Goldilocks Price,” the price that is just right.

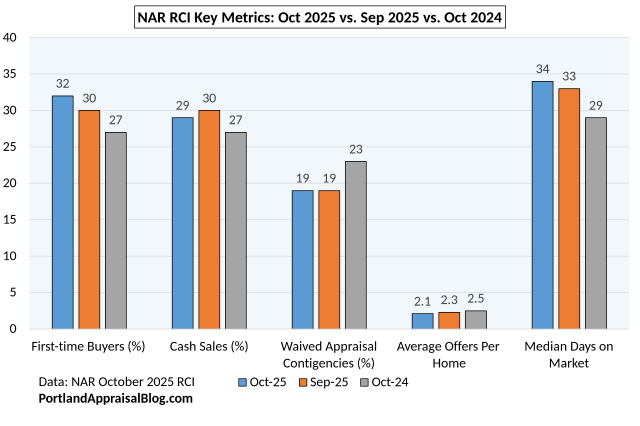

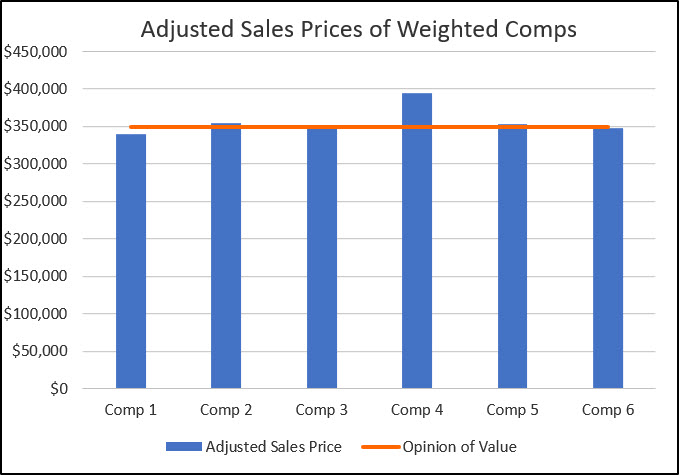

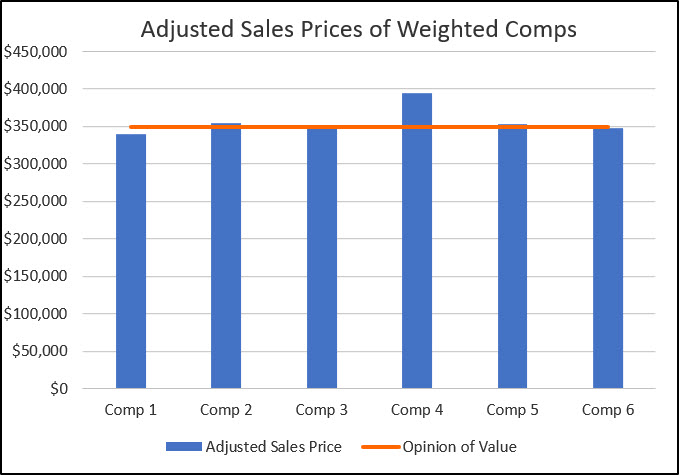

If an appraiser uses comparables that adjust out to something like the illustration below, what conclusion would you draw regarding the most likely price the typical buyer would pay for the subject property?

If your subject’s contract price is more in line with comparable #4, it would be awfully tempting to fixate on that. Appraisers have a saying: one comp does not a market make. It’s why Fannie Mae mandates at least 3 closed sales be used in a report. They want assurances there’s more than one buyer for the subject at the negotiated price. In the above case, the appraiser’s value conclusion ($350,000) is tightly aligned with 5 out of the 6 comparables used. Comparable #4 may represent the maximum value of the subject, but it is not the most likely price for homes similar to the subject.

You may be 100% correct that the subject’s higher contract price has some market support; but if careful analysis shows that price to be outside the most probable range, the appraiser is contractually obligated to go with the most probable.

But what if the market is rapidly changing? That’s a fair point. In that case, review the report to see if a careful discussion has been made of any applicable pending sales. In my own practice, I try and reach out to agents for pendings (and even actives). I have no problem giving weight to a pending sale—especially if I reached the agent and they confirmed the final price is pretty close to the price advertised in MLS. That’s why its good agent practice to return an appraiser’s phone call or reply to any email inquiries.

(Note: Agents differ in interpreting confidentiality requirements for pending sales. I personally never press an agent. Again, many will at least hint if the final price is above or below the published MLS price.)

Keep in mind: an active listing is like a person looking for a date; a pending sale is like a person engaged; a closed sale is like a person who’s walked down the aisle. An engagement ring ain’t nothing, but it ain’t any guarantee either.

The most persuasive package is a strong mix of recent closed sales, some verified pending sales, and perhaps (if you have it) some signed backup offers on the subject. All of that together should strongly indicate what the most probable price for the subject is. In an ROV, if the appraiser failed to do their homework verifying what the pending sales are doing (or doesn’t even talk about them), you can talk to fellow agents and see if they can confirm some details. Then you’ll have factual and relevant information to include in the ROV. Cold hard facts are your best friends.

Recap #2:

Do: Use a “most probable price” definition of market value.

Don’t: Use a “maximum price” definition of market value.

Out of This World Comps—Well, Out of This Neighborhood

Appraisers are given guidelines from Fannie Mae and then usually given additional guidelines from the lender (or the lender’s agent). Some standard comparable guidelines include:

1) Two sales within the last 90 days.

2) No sales over a year.

3) Comps within a mile for urban/suburban properties; within 5 miles for rural properties.

4) “Bracketing” of most major features. (No across-the-board adjustments.)

5) Adjustments be within a certain percentage. (Fannie Mae actually doesn’t require this and lenders shouldn’t either, but it still lingers in some published guidelines.)

It goes on. (Some lender guidelines are over 10 pages long.)

Rules of thumb are okay and may work in many cases, but sometimes appraisers can get tunnel vision and apply guidelines too strictly and miss the forest for the trees.

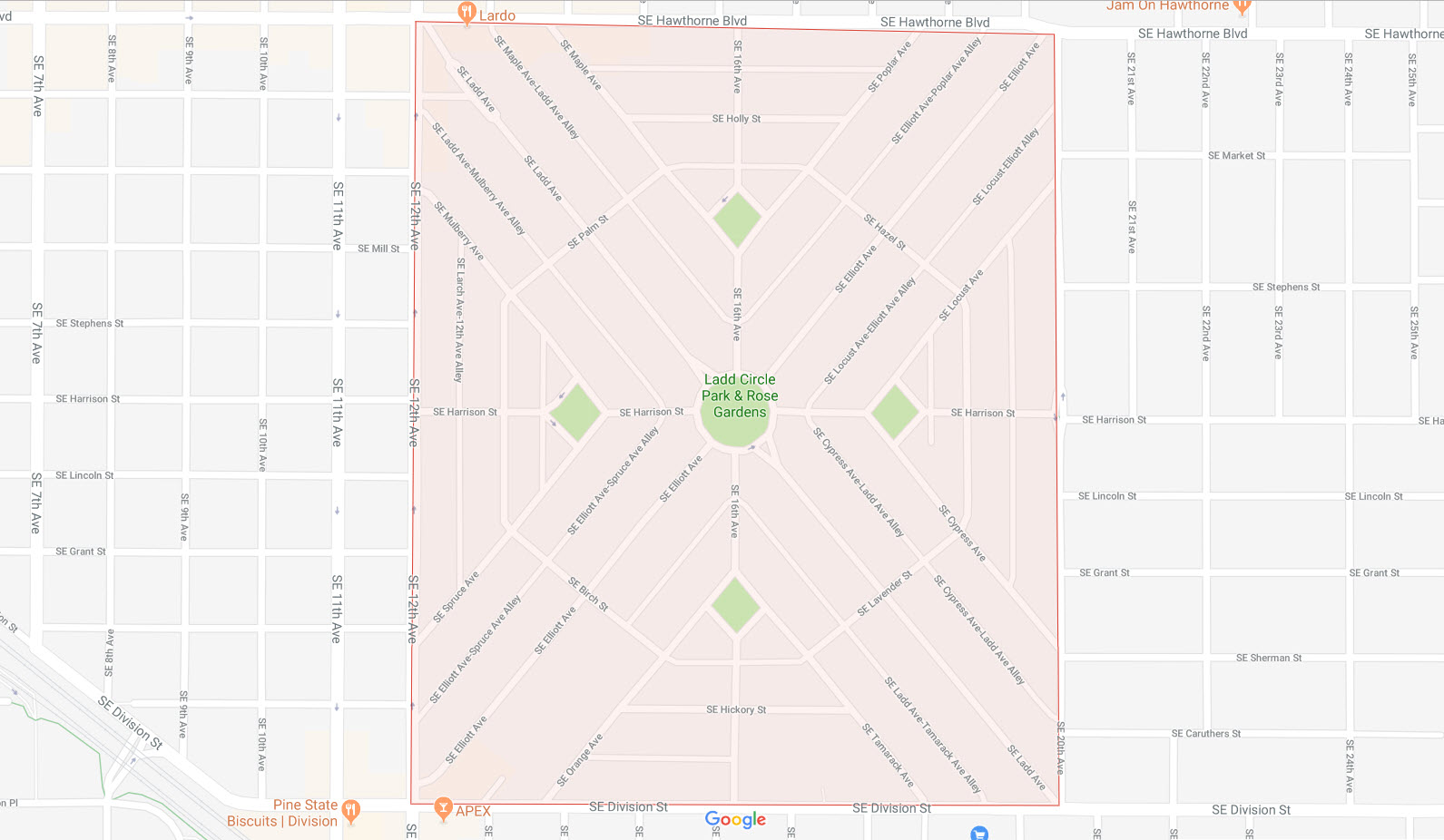

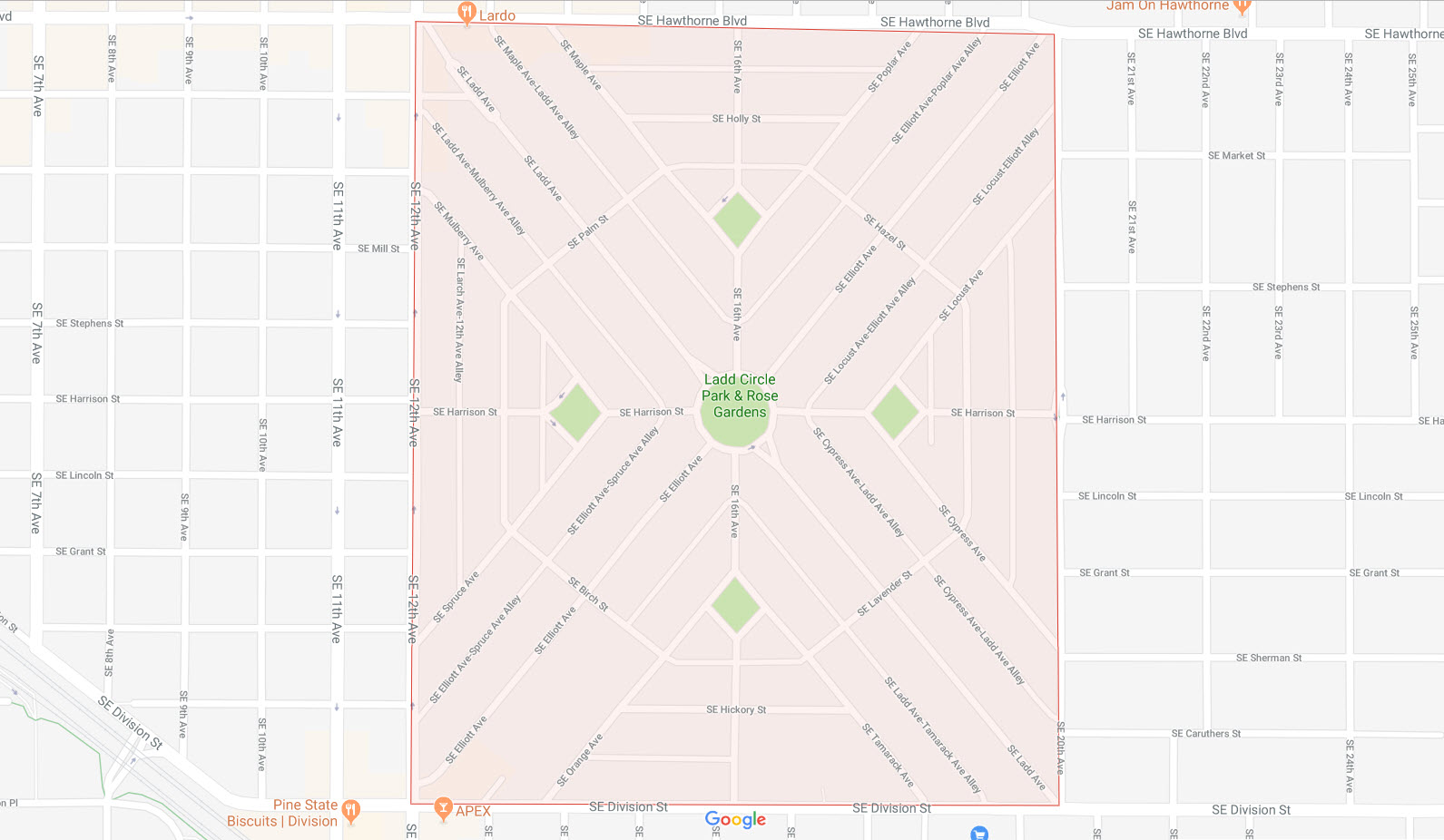

I think we can all agree that Ladd’s Addition is a visually striking neighborhood when viewed from a map:

Imagine you’re the agent for a home in this neighborhood and imagine a report that meets all Fannie Mae and lender guidelines but fails to include a sale from within Ladd’s Addition! If it cuts the price, you wouldn’t be a happy camper. While no appraiser would commit an error that egregious (I hope), all agents are aware of smaller “pocket” neighborhoods that command a premium but may not have had a recent sale.

I often pull all data RMLS has for homes on a subject’s street and immediate pocket area. Yup, all 20 years. This allows me to sniff out if there is some strong locational influence. As an illustration, the graph below shows similar properties from the subject’s pocket area and similar properties from a competing one:

There have been no recent sales in the subject’s pocket area, but the yellow-orange dots depicting sales from the subject’s area are all above the gray dots from a nearby competing area (perhaps where the appraiser pulled all of their comps). This shows that the subject’s area commands a noticeable premium. Did the appraiser include that premium in the report? If not, again, cold hard facts are your best friends.

However, and a word of caution, appraisers often encounter this problem in reverse. They are forwarded sales from areas that command a premium the subject’s neighborhood or pocket area lacks. (I’ve been sent homes from a golf course community for a property in a standard residential tract area.)

Obvious tricks like that shreds your credibility in the ROV and will cause both the appraiser and the lender to take your request less seriously.

Recap #3:

Do: Use clear market data that shows the subject’s neighborhood or pocket area commands a premium.

Don’t: Suggest homes from competing neighborhoods or market areas that you know command a premium the subject’s area lacks.

Superior Comparables—Arnold Schwarzenegger vs. Napoleon Dynamite

If the subject property is one of the nicer homes in the market area, the appraiser should take great care to find sales as similar as possible—even if they violate some of the typical lender guidelines. That might mean going further back in time or a bit farther in distance to find the right comparables. I routinely grid sales 12-24 months old and then use time indexing to bring the value current. For acreage or very unusual properties, 36+ months might be needed. Time indexing is an extremely important tool and one all appraisers should be familiar with.

Don’t be afraid to stay in the neighborhood and pull all available data to see how homes like the subject perform relative to the market area. It might be that a clear case can be made for a higher valuation of the subject.

If the subject has sold multiple times on the open market, a review of those prior sales may show that whenever it is on the market, it commands a premium due to its overall quality or some special amenity or feature(s).

However, if a home is deemed an over-improvement for a neighborhood, it likely suffers from an obsolescence stemming from a lack of conformity to the neighborhood. If most homes are under 3,500 sq. ft. and the subject is 6,500 sq. ft. and all similar homes are located far away, then the property won’t likely bring in the same price as those homes in a more conforming area.

A word of caution: appraisers are used to getting vastly superior properties suggested to them in the hopes of making the contract price. You may have seen this illustration floating around some of the agent forums:

Don’t do that. If your home is Napoleon Dynamite don’t suggest Arnold Schwarzenegger. Again, it reduces your credibility in the eyes of the appraiser and the lender. We need to compare apples to apples as much as possible.

Recap #4:

Do: Suggest similar properties—even if a bit dated or a bit farther away than typical.

Don’t: Suggest vastly superior properties that are in a different market segment than the subject.

Fuzzy Numbers—Did They Remember to Carry the 1?

Appraisers typically use some type of dedicated software package to “grid” comparables and make adjustments for superior or inferior features. While there are some error correction tools, they don’t always catch all mistakes. An examination of the sales grid might show that adjustments are not mathematically consistent. Check the numbers.

Broader issues with the numbers in the grid might be how the adjustments were derived in the first place. That’s a complex topic (and one for another blog post). But check comments in the report to see how some of the more important adjustments were derived.

A word of caution: don’t nitpick. If the appraiser didn’t adjust for a small shed, will that really make or break your deal?

Recap #5:

Do: Check adjustments for mathematical and logical consistency.

Don’t: Nitpick or quibble about minor amenities or features.

What Can You Do Proactively?

If you have an atypical property on your hands, you and your client would greatly benefit from a prelisting appraisal. Having an appraiser give a value opinion prior to listing can help with setting the right price and can point out issues ahead of time. You’ll get a list of comparables an appraiser feels is most relevant to the subject. (You’ll also get an accurate sketch of the subject’s size and dimensions.)

Some agents fear getting a prelisting appraisal “locks” them in somehow. It doesn’t. You may keep it in your back pocket if you want. All appraisals are confidential.

*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~*~

I hope this article is somewhat helpful for agents. There are many other aspects to discuss about ROVs and I will write about the topic some more in the future.

Click here for a one-page summary of this article.