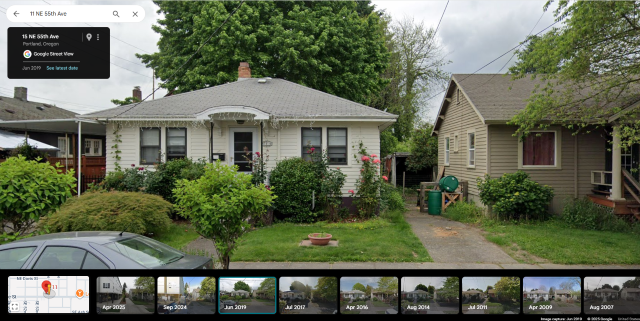

11 NE 55th Ave, Portland, Oregon – December 2025

Photo: Abdur Abdul-Malik, Certified Residential Appraiser

Easing Regulatory Barriers to Mid-Rise Infill

The City of Portland’s Bureau of Development Services, in coordination with Portland Fire & Rescue, approved a final Building Code Guide (BCG 25–10) on October 22, 2025, that permits single-exit stairwells in certain apartment buildings up to four stories in height. This guide implements a provision already adopted within the 2025 Oregon Structural Specialty Code (OSSC), removing a significant regulatory barrier that often rendered mid-rise infill housing financially and physically impractical on constrained urban lots throughout the Portland metro area.

This code clarification aligns Portland with the practices of progressive code adopters, including Seattle and various international jurisdictions, which have successfully and safely utilized single-stair designs for decades. The change is particularly relevant for infill sites—common in Portland’s established neighborhoods—where lot width or depth previously made the mandatory two-stairwell design economically unfeasible.

The economic advantage is substantial: traditional two-stair designs can consume 13–16% of the total floor area for circulation (stairs and hallways). A single-stair “point access block” can reduce circulation space to as little as 6.5% of the floor area, effectively converting otherwise unusable common space into leasable or saleable residential square footage. The push to allow this type of construction illuminates the entangled intersection between safety, housing affordability, and building codes at a national level. This efficiency boost is key to making medium-density projects feasible in high-cost urban environments. The new allowance is expected to have a greater impact on Multi-Dwelling (RM) zones than on the R2.5–R20 zones, where unit counts are generally capped at six.

Appraisal Implications for Real Estate Valuation

The finalization of single-exit guidelines has direct implications for certified residential appraisers (CRs), lenders, and real estate professionals in the Portland region.

Multifamily Development and the CR 4-Unit Limit

The new guideline creates a direct compliance challenge for CRs. CRs are restricted to appraising residential properties containing four or fewer units.

The 16-unit apartment building at 11 NE 55th Ave provides a perfect case study: it is constructed on a 5,000 sq. ft. lot, which is a standard lot size for Portland. While this specific site is zoned CM2 (Commercial Mixed Use 2), it is a very common setup in transitional zones like RM1 or RM2 and makes for a warning of the complexities residential appraisers will now face on an increasing number of sites throughout the City of Portland. A comprehensive and thorough highest and best use analysis (H&BU) will be even more paramount for CRs going forward.

The Land Sale vs. Home Sale Trap (The H&BU Pitfall):

Here is what existed on the site prior:

Portland, Oregon – circa 2019 (Google Street View archive)

Photo: Google Street View (public domain)

Note the home to the right of the subject. That neighboring home has RM2 zoning and still exists to this day. For the sake of illustration, let’s pretend the subject itself was located in the same RM2 zone. (The problem would also exist if it were in the RM1 zone.) I have always been wary of appraising properties in RM1 and RM2 zones due to the potential of unit density exceeding my license scope. However, in some select areas, a careful highest and best use analysis shows four units or less is still the market preference, or perhaps the only options feasible. Constructing an apartment building like the subject in an RM1 or RM2 zone was more difficult prior to the recent zoning change. A residential appraiser viewing the subject’s original home could easily come to the conclusion that the H&BU is still residential, as that conforms to the next door property. However, the financial data proves the site’s H&BU shifted long ago:

- Negative Value: The original house effectively had negative value, as the developer purchased the site for $650,000 in early 2024, intending only to demolish the structure and build up.

- Land Value: The $650,000 purchase price was solely a land sale based on the potential to build high density—a potential maximized by the single-stair allowance.

- The New H&BU: The resulting 16-unit asset, listed at over $3.3 million, confirms the H&BU is a multifamily property that requires a Certified General (CG) Appraiser.

Portland, Oregon – 2025 (Google Earth aerial)

Imagery ©2025 Google, Map data ©2025

- Pro Forma Income: Because the building is new and actively offering rental concessions (e.g., free rent) to tenants, the listing’s financial figures are projected (pro forma). It has a Projected Gross Annual Income of $256,005 and a Pro Forma Cap Rate of 5.17%—financial metrics based on achieving full market rents and directly tied to the single-stair design’s efficiency. Appraising such a property requires a lease-up analysis and would necessitate a Certified General Appraiser to determine both the As-Is and As-Stabilized values.

- Risk Area (RM1 & RM2): The greatest risk for CRs lies in Transitional Multi-Dwelling zones (like RM1 or RM2). These zones can get complicated quickly, and the single-stair allowance now pushes the practical development cap far beyond the CR’s 4-unit limit, even on small parcels.

- Required Due Diligence: CRs must perform careful due diligence when analyzing the H&BU of transitional or infill parcels. If the H&BU conclusion is a multi-unit property exceeding four units, the assignment falls outside the scope of a CR license, and the assignment must be transferred to a Certified General Appraiser.

This apartment building on the street (made possible by the single-stair allowance) has now greatly complicated any future appraisals for the adjacent home. The adjacent home sits on a lot the same size (5,000 sq. ft.).

NE 55th Ave (North Tabor), Portland, Oregon – December 2025

Photo: Abdur Abdul-Malik, Certified Residential Appraiser

An appraisal on this home would now need to take into account the potential to remove the dwelling and place a 16-unit apartment building on the site. The apartment building next door, even though in a different zoning, proved that such a structure is physically possible on a 5,000 sq. ft. lot. Now, with the zoning law change, such a structure is also much more likely to be greenlit following a formal review by the planning department. Even if all the structures on this street were residential homes, a CR can no longer assume four units or less is the H&BU if the zoning is RM1 or RM2.

Density Rules Every Portland Appraiser Needs Tattooed on Their Forearm

In most of Portland’s multi-dwelling zones (RM1–RM4 and RX) there is no maximum density—only minimums. The City’s own table spells it out clearly:

| Zone | Maximum Density | Minimum Density (base) |

|---|---|---|

| RM1 | None | 1 unit per 2,500 sf |

| RM2 | None | 1 unit per 1,450 sf |

| RM3 | None | 1 unit per 1,000 sf |

| RM4 | None | 1 unit per 1,000 sf |

| RX | None | 1 unit per 500 sf |

| RMP | 1 per 1,500 sf (bonus to 1 per 1,000 sf) | 1 per 1,875 sf |

On a typical 5,000 sq ft lot with no overlays:

- RM1 → minimum 2 units, no upper limit

- RM2 → minimum 3–4 units, no upper limit

Highest-and-Best-Use Reality Check for Certified Residential Appraisers

Unless a site in RM1, RM2, RM3, RM4, or RX has obvious, insurmountable physical or regulatory constraints (steep topography, protected trees requiring preservation, environmental overlay zones, landslide hazard, historic designation, or similar), a credible H&BU analysis can no longer conclude that single-family, duplex, triplex, or fourplex development is the concluded use without first testing a multifamily pro forma that likely exceeds four units.

Doing so risks an incomplete analysis and, more critically, completing a valuation that falls outside the Certified Residential license scope.

Appraisers: be careful!

Land Value and Investment Properties

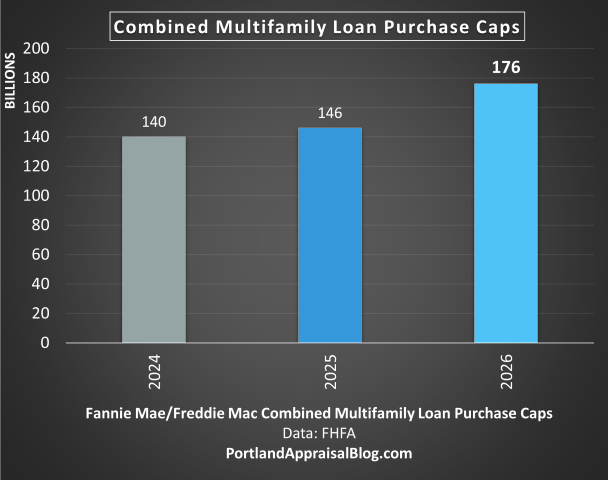

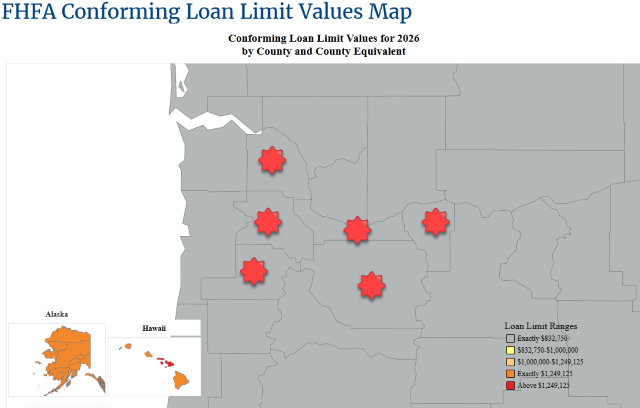

The zoning change also directly affects land value and the as-completed project feasibility by allowing for a more efficient and profitable building design. This local regulatory shift also aligns with supporting federal policy, such as the Federal Housing Finance Agency (FHFA) increasing the combined volume cap for Fannie Mae and Freddie Mac’s multifamily loan purchases to $176 billion for 2026.

Market Context

Portland continues to grapple with a housing shortage, making any code modification that reduces hard construction barriers on infill parcels a necessary and impactful step. The North Tabor neighborhood where this property is located is appealing for investors, characterized by an urban-suburban mix and a high proportion of renters. This demographic composition and investor demand underscores the high asking price for turnkey rental assets like the new construction apartment building in our case study.

For lenders, realtors, estate planners, and attorneys, it is crucial to recognize that the appraisal of these new single-stair buildings will require a deep understanding of the regulatory context. Appraisers must accurately reflect the specific size, unit count, and advanced fire-safety features required by the Building Code Guide 25–10 to ensure a credible valuation and appropriate comparable selection.

Sources & Further Reading

- New Portland guidelines for single-stair apartment buildings: News

- New guidelines approval: Announcement

- Oregon Structural Specialty Code (OSSC): Adoption Process

- 2025 Oregon Structural Specialty Code, Chapter 1: Full Text

- Single-Exit Apartment Design Benefits: Analysis

- FHFA Multifamily Loan Caps for 2026: PortlandAppraisalBlog

- Single Stair, Many Questions: NFPA Journal Article

- Portland Maps Zoning Detail: 11 NE 55th Ave

- North Tabor Demographic & Renter % Data: Portland Maps

- Video Tour: 11 NE 55th Ave

- Historical Google Street View: 11 NE 55th Ave

- Portland’s multifamily zoning code: PDF

- Portland’s multifamily zoning density table: PDF

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner, lawyer, or estate planner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.