Via Canva Pro

HUD Announces 2026 FHA Loan Limits

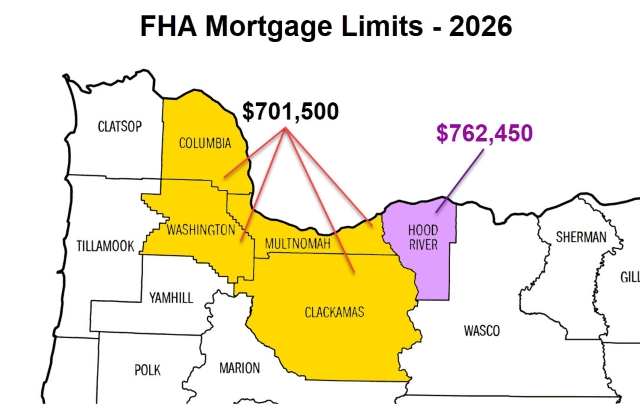

The Federal Housing Administration has released its 2026 loan limits. In the Portland–Vancouver–Hillsboro MSA (38900)—covering Clackamas, Columbia, Multnomah, Washington, and Yamhill counties in Oregon, plus Clark and Skamania in Washington—the new one-unit limit increases from $695,750 in 2025 to $701,500 in 2026, a rise of $5,750 (0.83%).

Hood River County is not part of this MSA and retains its 2025 limit of $762,450 (unchanged for 2026). No detached SFR sales in Hood River County reported FHA financing in Q3 2025.

Appraisal & Lending Implications

In addition to developing an opinion of value, appraisers on FHA assignments focus primarily on identifying property deficiencies or conditions that could render a home ineligible for financing—lenders handle the loan-to-value calculations against the limit using the appraised value alongside borrower qualifications.

The modest increase means approximately 48 additional detached homes that closed in Q3 2025 now fall within FHA-insured financing eligibility. Lenders handling FHA assignments with case numbers assigned on or after January 1, 2026, will apply the new $701,500 ceiling across the core Portland metro counties.

Q3 2025 Context – Detached Single-Family Residences

RMLS data for Q3 2025 detached SFR closings in the region illustrate the practical effect:

- 48 detached homes closed between $695,751 and $701,500—previously above the 2025 limit.

- Only 2 of these 48 reported FHA financing (likely large down-payment exceptions). Now, all 48 would be eligible under the 2026 limit.

- Above $701,500, FHA usage drops to 0.71% (11 of 1,548 sales).

Source: HUD

2026 FHA one-unit loan limits by county. The Portland–Vancouver–Hillsboro MSA (yellow) rises to $701,500; Hood River County (purple) remains $762,450.

For broader Q3 2025 market trends, see the most recent quarterly update.

Sources & Further Reading

- FHA Announces New 2026 Loan Limits: HUD No. 25-145

- FHA Mortgage Limits: HUD Search Tool

- The Portland Region Q3 2025 Market Update: PortlandAppraisalBlog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.