Via Canva Pro

Policy Wins Collide With Activation Barriers

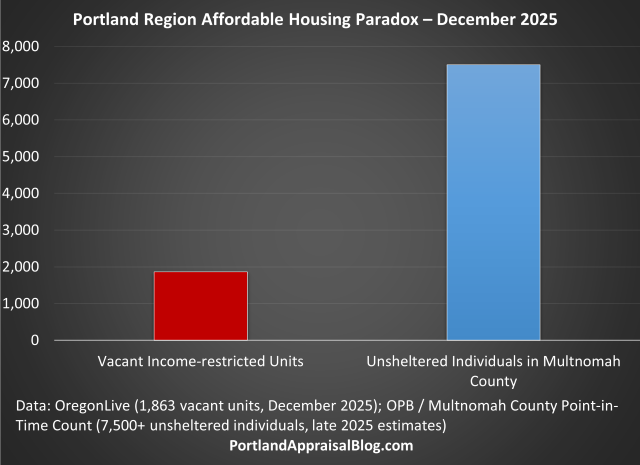

Portland’s affordable housing programs are delivering a classic paradox: policy mechanisms are finally producing new income-restricted units, yet nearly 1,900 completed apartments—representing a 7.4% vacancy rate across the region’s 25,409 subsidized units—sit empty while homelessness continues to climb.

The city’s inclusionary zoning program, which requires or incentivizes developers to reserve a portion of new units for households earning 60% or less of area median income (AMI)—where the FY 2025 median family income for a 4-person household in the Portland-Vancouver-Hillsboro OR-WA MSA is $124,100—has shown measurable improvement in actual unit production after years of refinement. This is a hard-won policy success in a market that has long struggled to integrate affordability into private development.

These gains, however, are being undermined by systemic activation challenges. Home Forward, Multnomah County’s primary administrator of subsidized housing and the Housing Choice Voucher (Section 8) program, faces a $35 million budget shortfall that includes a $14 million cut in federal voucher funding. The agency has paused new voucher issuances, eliminated at least 12 positions, and extended waitlists that already see roughly seven applications for every opening.

Providers cite a combination of administrative delays, rising operational costs, higher post-pandemic eviction rates, and narrowing rent gaps (42% of metro units are now within 10% of market rent) as the main drivers of prolonged vacancies. As Reach Community Development’s executive director noted, “even affordable rents are too high” for many eligible households without deeper subsidies.

Mayor Keith Wilson has explicitly linked these activation failures to the region’s homelessness crisis. Although 890 of a targeted 1,500 new low-barrier shelter beds are now open, many operate at just over 50% occupancy—compared with 87% at existing 24-hour shelters—because permanent housing remains the preferred exit. With more than 7,500 individuals unsheltered in Multnomah County (up over 1,000 since January 2025) and monthly inflows of ~1,400 people outpacing permanent placements of ~1,100, the region continues to see a net increase in homelessness.

Appraisal Implications

These activation failures translate directly into valuation and underwriting risk for professionals across the Portland metro area.

Residential Properties

Inclusionary zoning covenants create deed-restricted comparables that must be segregated from market-rate sales. As the program matures, appraisers in Multnomah, Clackamas, Washington, Columbia, Yamhill, and Clark counties will see a growing volume of these restricted transactions, especially in newer condominium and mixed-use projects—though the highest concentration remains within the City of Portland’s jurisdiction in Multnomah County. With the Q3 2025 median price for detached single-family homes in the region at approximately $600,000—as noted in our Q3 2025 Portland region market update—the gap between market-rate ownership and income-restricted pricing remains stark.

Multifamily and Investment Properties

The 1,863 vacant income-restricted units create an immediate drag on potential gross income and stabilized net operating income (NOI). Projects financed through Low-Income Housing Tax Credits (LIHTC) or subject to inclusionary requirements now face extended lease-up periods—often months rather than weeks—due to public-agency bottlenecks. Recent FHFA increases to 2026 multifamily loan purchase caps may encourage new supply, but activation risks remain a key variable.

Appraisers using the income approach should give heightened scrutiny to:

- Absorption timelines (extend beyond market-rate norms)

- Vacancy allowances (increase for policy-induced vacancy)

- Capitalization rates (higher risk typically justifies higher cap rates)

Lenders and investors underwriting affordable or mixed-income developments must incorporate longer stabilization horizons and potential LIHTC compliance risks into their models.

Market Context

When finished apartments remain offline, the housing-homelessness pipeline stalls, forcing greater reliance on temporary shelter systems even as permanent supply begins to grow.

Resolving this paradox will require targeted investment in administrative capacity and deeper subsidy layers to match completed units with the households who need them most.

Sources & Further Reading

- Nearly 1,900 affordable Portland apartments sit empty (OregonLive)

- Portland’s Inclusionary Zoning Program Is Finally Performing (Sightline Institute)

- Home Forward budget crisis and voucher pause (Oregon Public Broadcasting)

- Portland homelessness and shelter progress update (Oregon Public Broadcasting)

- HUD FY 2025 Income Limits Documentation System – Portland-Vancouver-Hillsboro OR-WA MSA

- IRS Low-Income Housing Tax Credit (Overview)

- FHFA Raises 2026 Multifamily Loan Purchase Caps (Portland Appraisal Blog – December 5, 2025)

- The Portland Region Q3 2025 Market Update (Portland Appraisal Blog)

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.