We are well into 2025, but let’s review how the Portland Region’s attached home market performed in 2024. High mortgage interest rates have plagued most segments of the housing market, however, the attached home market was one of the few segments that saw a boost in 2024—largely due to an influx of new construction units.

We will examine how the Portland Region’s attached home market performed as a whole and by individual county. We already examined the 2024 single-family detached and condominium markets and will have a future post dealing with manufactured homes.

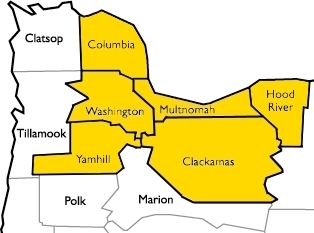

Let’s define the Portland Region as the following six counties: Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill—essentially all counties contiguous with Portland’s home county of Multnomah, plus Yamhill.

DATA HOUSEKEEPING

The information in this post will be based on properties that sold on the open market, defined as listed in RMLS, the primary multiple listing service for the Portland Region. The data was parsed with tools created by the blog author to weed out/correct, among other things, listing errors and misclassifications (e.g. condominium sales hiding in other categories, such as in the attached or detached category).

It is important to note that attached homes are just that: attached; whether on just one or both sides. They also entail ownership of the land the structure sits on. This makes them distinct from condominiums. They are also distinguished from multifamily properties in that each unit is individually owned. With a duplex, for example, there is a single owner, although the owner may rent or occupy each unit as they see fit. The owner cannot sell half of a duplex (one unit). It can get confusing, and the data in RMLS reflects that.

RMLS has five major property categories:

Generally speaking, agents pick the correct property category when inputting a listing—although at times a multifamily property is advertised under the residential category. Where agents run into a bit (or a lot) of trouble is picking the appropriate property type (essentially a subcategory), particularly for residential. Here are the choices RMLS offers under the “Residential” category:

This breakdown seems innocuous enough, but it actually conflates descriptive property characteristics with property ownership types. For instance, condominium is a classification of ownership and condos come in many distinct varieties: detached, attached, townhome style, common wall, or even large converted apartment complexes. This often leads to agents inputting condominiums in many of the other property type categories, including attached.

The reason this is important is condominiums often have distinct mortgage underwriting guidelines and even different reporting forms. Again, with a condominium the property owner does not own the land or even the structure itself, but only the air space within the walls of the unit. The property owner also has an interest in the common elements on the site.

As stated before, attached homes involves ownership of the land under the structure and maintenance of the structure falls upon the owner. An attached home is just like a single-family detached home in rights and responsibilities; the principal difference is whether the structure is completely freestanding or joined at the hip with a neighbor or two.

The blog author has carefully separated out errors in classification. The attached category is full of them! Hundreds of misclassified homes “pollute” the dataset each year. It underscores relying on “raw” or unprocessed data from any MLS system can give a distorted picture and lead to incorrect conclusions.

Finally, RMLS has a listing category, SNL (Sold Not Listed), that allows agents to put properties that were sold off market into the database. Those properties have been excluded from the following analyses.

Portland Region 2024 Attached Homes Overview

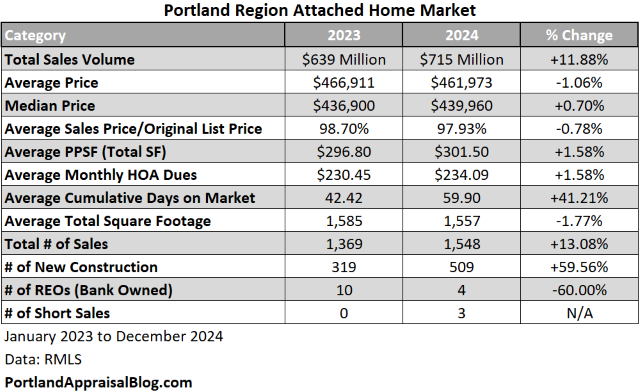

The following table compares 2024 with 2023:

Total sales volume was $715 million, increasing almost 12% from the previous year. Average and median prices barely changed year over year, so the sales volume increase was purely a function of more sales in 2024 (a 13% jump from 2023). Most of that increase was due to nearly 200 more new construction units coming on the market—a nearly 60% jump over 2023!

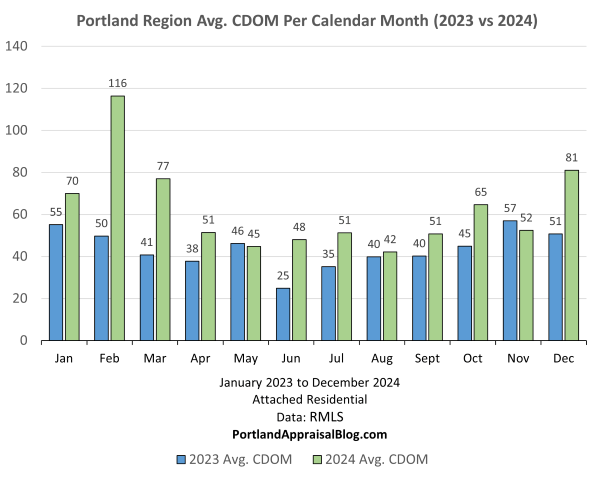

Most of the other stats were flat: sales price to original list price; average price per square foot; monthly HOA dues; and average total square footage only had nominal changes. Attached homes averaged more than 17 extra days on market; confirmation that persistently high mortgage interest rates are making it harder and harder to move homes.

Bank owned sales decreased while three short sales occurred in 2024. Distressed sales represented less than 1% of the entire market.

Let’s dive into the rest of the data with some visuals.

SALES VOLUME

The following is a treemap of attached home sales volume in the Portland Region for the year 2024:

Washington County took the crown, representing 52.3% of the market. Multnomah and Clackamas counties were nearly equal, totaling 24.5% and 20% respectively. Columbia, Hood River, and Yamhill counties represented the crumbs of the market; barely getting over 3% of sales volume combined.

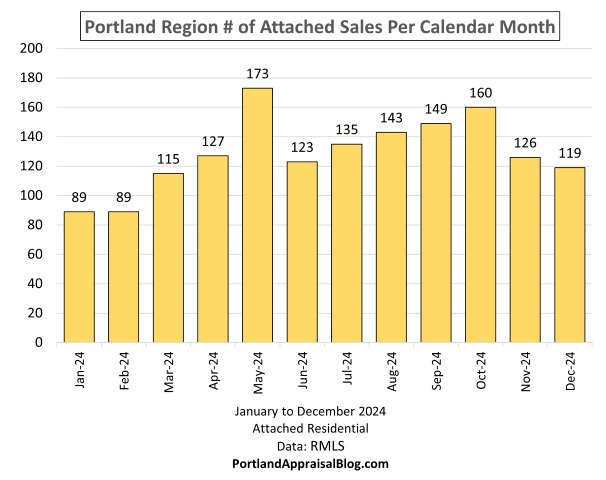

Sales followed a stairstep pattern, gradually increasing until October—with May being the only exception and the peak for the year:

As the following graph shows, 2024 beat 2023 ten out twelve months:

SALES PRICE

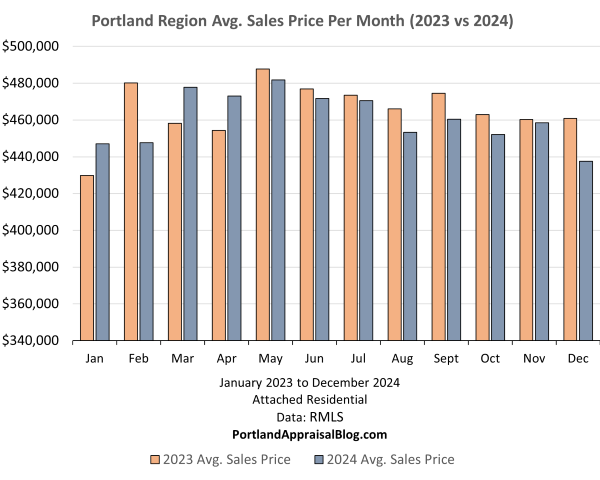

Prices were highest in spring and then gradually declined, with the year’s peak being in May:

2023 was ahead of 2024 for nine out of the twelve months, but generally the two years were close each month:

NEW CONSTRUCTION

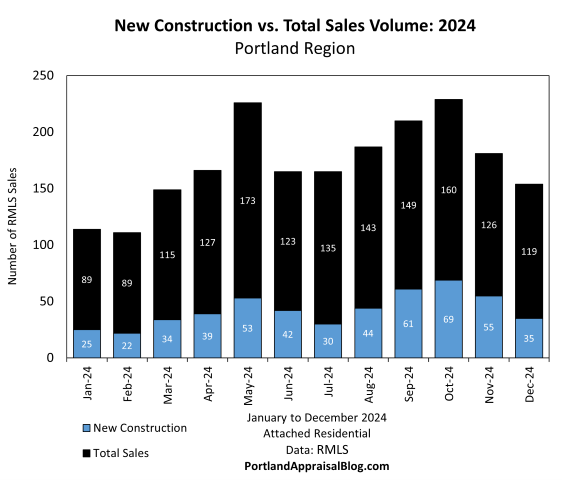

New construction was strong the entire year in 2024, averaging between 22-44% of monthly sales:

Washington County had the biggest share of new attached homes while Multnomah County had the biggest yearly increase (92.3%):

CUMULATIVE DAYS ON MARKET

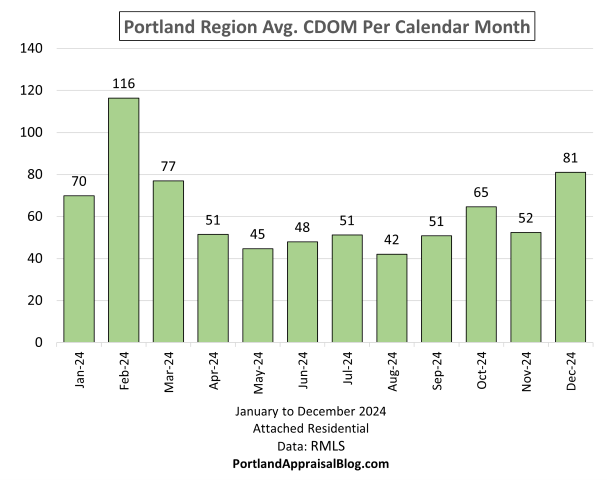

The average cumulative days on market was slightly above two months for the entire year of 2024. Marketing time varied seasonally, with the slowest months being in winter:

Average marketing time was up sharply in 2024 compared to 2023:

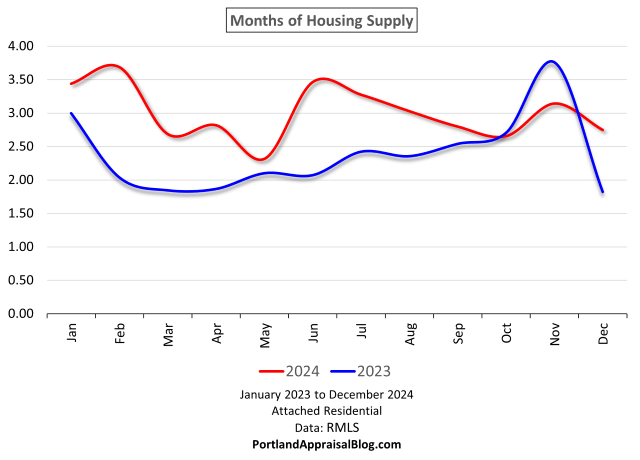

HOUSING SUPPLY

Housing supply tracks how long would it take the market to exhaust all available inventory at the current rate of absorption. For most of 2024 the months of housing supply was near or above 3 months:

2024 was significantly above 2023 in months of housing supply for nearly every month, with the only exception being the month of November:

HOA DUES

HOA dues for the region increased by only 1.6%, with the average being $234. Columbia, Hood River, and Yamhill counties are showing more year-over-year variation, but this is largely due to so few attached home sales in those counties.

MISC STATS

Before concluding our overview of the Portland Region as a whole, let’s look at some miscellaneous stats:

The most expensive attached home that sold on the open market in 2024 in the Portland Region was, surprisingly, a luxury townhome in Hood River with views of the Columbia River. The townhome sold for $1,450,000, has four bedrooms, three bathrooms, and is 2,472 sq. ft. Photos of the townhome are currently available online and may be viewed here.

The least expensive attached home in 2024 was a bank repossession that was actually in decent shape despite some repairs needed. The townhome sold for $157,000 in the Portland Maplewood neighborhood. Prices in the PUD averaged $276,000 over the last four years, so the unit was a good deal.

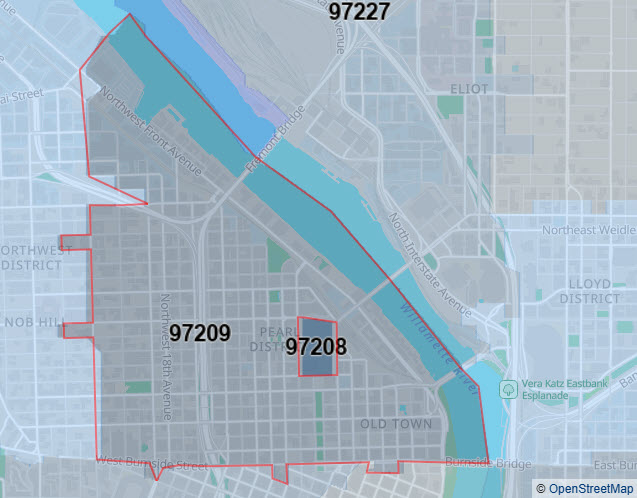

The most expensive ZIP code for 2024 was 97209. This area is located in the Portland Pearl District. While only 3 sales occurred in 2024, the average price was about $1,027,000:

The ZIP code with the highest volume of sales was 97123:

This ZIP code is in Washington County and covers nearly 56 sq. mi. and takes in part of Hillsboro. A total of 213 attached home sales occurred in this ZIP code in 2024.

An attached home in the Northwest Heights neighborhood in Portland took the number one spot for the highest monthly HOA dues at $808. The agent did mention that there is an additional $400 semiannual dues for trail maintenance, making the effective monthly HOA amount about $875. This property is only attached to its neighbor via the garage. The home is 3,403 sq. ft. and sold for $803,437. Photos of the attached home are currently available online and may be viewed here.

Let’s wrap up this post with a quick look at the individual counties comprising the Portland Region. We will examine the three largest counties individually, but will group the three smallest together, as they comprise about 3% of the overall attached home market.

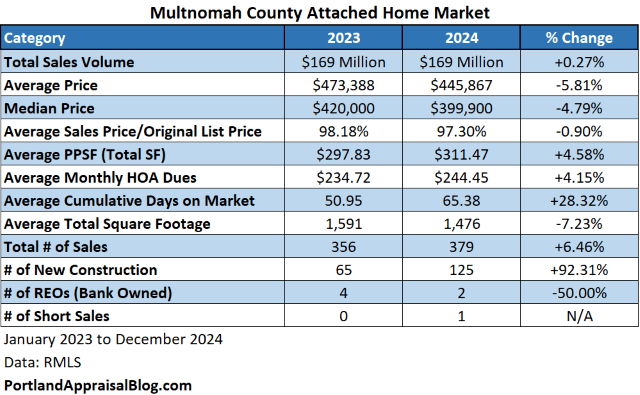

Multnomah County 2024 Stats

Multnomah County contains most of the City of Portland. A sliver of the City of Portland is located in Clackamas and Washington counties. The following table summarizes important metrics for Multnomah County:

Multnomah County saw almost no change in the sales volume dollar amount. Total sales increased 6.5%, while average prices fell by more than almost 6%; this was almost entirely due to the average total square footage declining 7% in 2024. Marketing time spiked over 28%. New construction comprised a third of the market and was almost double the number over the previous year. HOA dues ticked upwards by 4.2% in 2024.

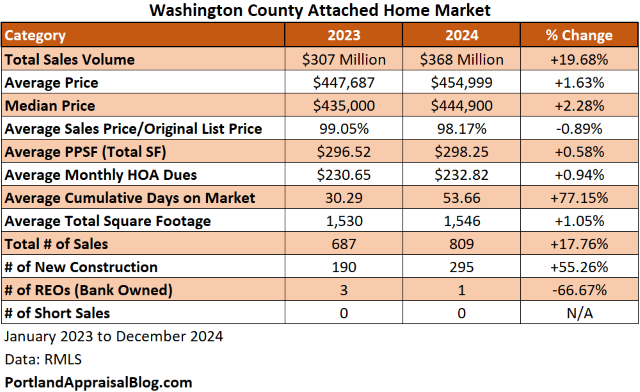

Washington County 2024 Stats

Washington County contains many properties with a Portland address that are outside official city limits and are under county control. The biggest city in Washington County, Hillsboro, saw 269 attached home sales in 2024. The following table summarizes important metrics for Washington County:

The total sales volume dollar amount increased by almost 20%, which is similar to the increase in the total number of sales (~18%). New construction sharply increased by 55% in 2024 compared to the previous year and was 36% of the overall attached home market. Average monthly HOA dues were flat year over year. Marketing time saw a 77% jump; however, this is distorted somewhat by the large percentage of new construction homes, which often have longer marketing times.

Clackamas County 2024 Stats

Clackamas County, despite having has many rural portions, has a decent amount of attached home activity. The cities of Happy Valley and Wilsonville had about 1/3rd of the sales. The following table summarizes important metrics for Clackamas County:

The Clackamas attached home sales volume dollar amount was up 11% in 2024. This tracks the increase in total sales (+12.7%). Average prices were slightly down, but so was the average total square footage of homes selling. Monthly HOA dues saw a nearly 4% bump (or about $10). There was very little distressed sale activity in this county over the last two years.

Columbia, Hood River, & Yamhill Counties 2024 Stats

Given how little of the attached market occurs in these three counties, they have been lumped together:

The total sales volume dollar amount slid nearly 4%, while the total square footage averaged 4.8% higher; this indicates a genuine decline in attached home prices in the three-county block. Marketing time was up by almost 20 days.

That wraps up our look at the Portland Region 2024 attached home market!

Thank you for reading the post! I hope you found some useful or interesting nugget of information. Please consider subscribing.

Question: Do you think 2025 will see more of the same in the attached home market or will prices increase for the region?

CODA

Are you an agent and wonder why appraisers always do “x”? Are you a homeowner that got a report and have a question or two about appraisal terminology or methodology? If so, please feel free to contact me. I enjoy interacting with various market participants and am always happy to help out where I can! And if you are in need of any appraisal services, feel free to reach out to us!