The Pearl District is one of Portland’s urban core neighborhoods. Bordering the Willamette River, the neighborhood used to be dominated by warehouses and railroad yards but is now home to a variety of businesses, art galleries, and housing. The City of Portland offers the following description:

The Pearl is a young neighborhood, its most recent incarnation established in the early 1990s. Its modern persona is heavily influenced by the tenets of New Urbanism, which prizes mixed-use, walkability, diversity, human scale and conservation.

The purchasable housing stock type in the Pearl District can be described in one word: condominiums. Except for one small townhome development, the neighborhood has no other housing type. (All other housing is lease-only in apartment buildings.) So, how has the Pearl District condo market performed over the last 10 years? Let’s crunch some numbers and dig into the stats.

Note: We will only be examining the open market, defined as condo units advertised on RMLS. Off-market private sales will not be included in the following analysis.

PEARL DISTRICT SUMMARY STATISTICS

Taking the 35,000-foot view, we can see the average yearly prices have been steadily declining since 2016:

Average prices this year are essentially the same as they were in 2015. (Ouch.) The main reason for this decline is due to a couple of large high-rise condominium buildings being completed in 2016 and 2018. (We’ll talk more them later in this post.) For now, suffice to say, the completion of those projects has created a glut of units the market is still trying to digest. That combined with high mortgage interest rates and low volume has depressed average sales prices.

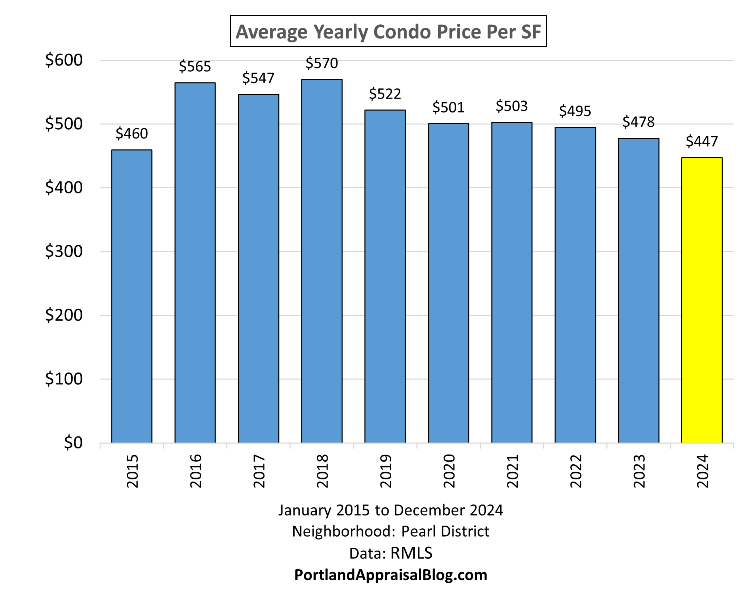

Here is that same info expressed in an average yearly price per square foot:

The contrast between 2015 and 2024 is a bit more pronounced when viewed from a price-per-square-foot vantage point.

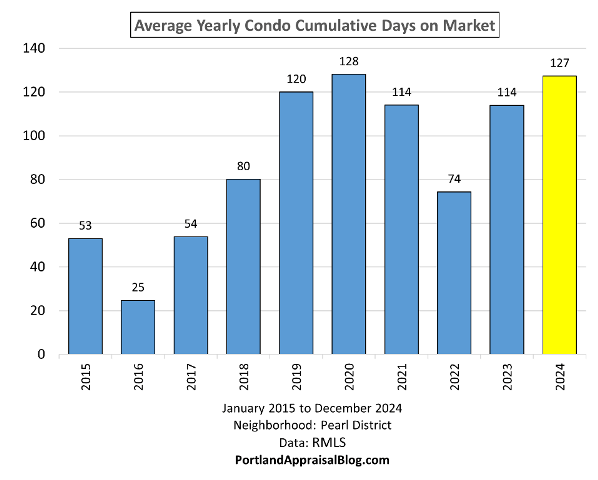

Unsurprisingly, condo units have been steadily spending more time on the market before finding a buyer:

Units have been averaging 3-4 months on the open market before finally selling.

Volume has been trending downwards as the market struggles with the current high interest rate environment:

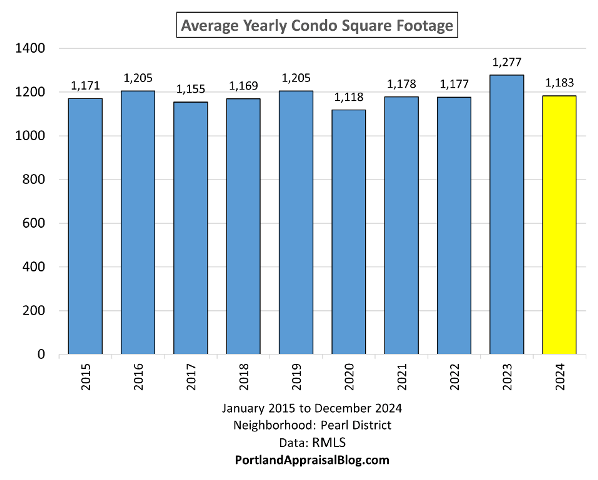

Finally, a look at the average size of the units each year shows no major swings and a general conformity in square footage:

2024 HASN’T BEEN A GREAT YEAR FOR THE PEARL DISTRICT

Using line graphs we can parse the data on a monthly basis for the last four years to see how 2024 compares to the previous three years. Let’s start with the average monthly sales price:

It should be noted the month of December 2024 is dashed as the month is not yet complete as of the post date and trends may slightly change depending on the remaining data. The year 2024 has generally underperformed the prior years. Interestingly, the months of May & June of the year 2022 were the lowest. This was right when the Federal Reserve began spiking the interest rates, with immediate effect on the market.

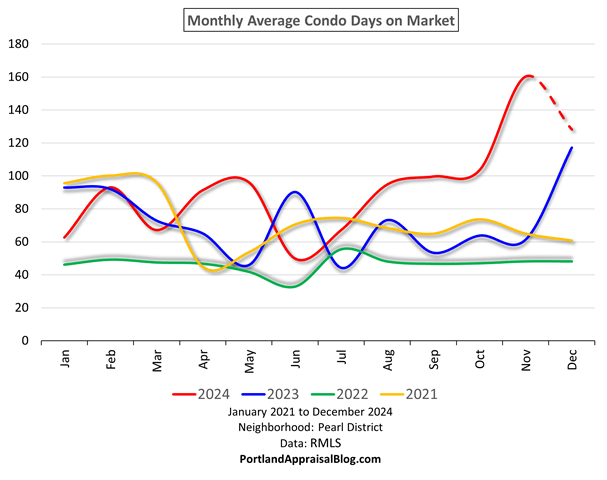

The following shows the monthly days on market:

2024 has pulled away from the previous years and units are having a much harder time selling.

The following shows the sales price to the original list price ratio:

A ratio above 100% is good for sellers, as it typically indicates a “hot” market with competitive bidding. 2024 has seen a sharp drop off since late summer.

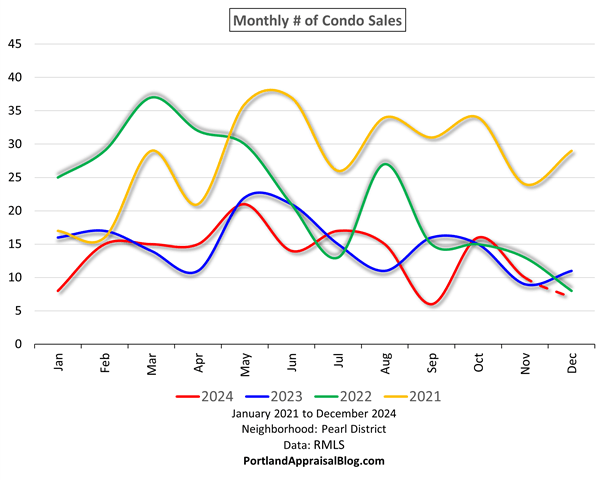

Finally a look at volume:

It’s been neck and neck between 2023 and 2024, but it looks like 2024 will close the year with the lowest monthly winter volume over the last four years.

IMPACT OF MAJOR HIGH-RISE CONDOMINIUMS

The Cosmopolitan is the largest residential tower in the City of Portland. The building is 28 stories, has 343,560 sq. ft. of space, and 150 condo units. It greatly enhances Portland’s skyline. The tower was completed in 2016.

Vista Pearl is also an impressive building, with 21 stories above ground and 153 condo units. Vista was completed in 2018 and is STILL selling units that have never been occupied. (One unoccupied unit sold in early 2024.)

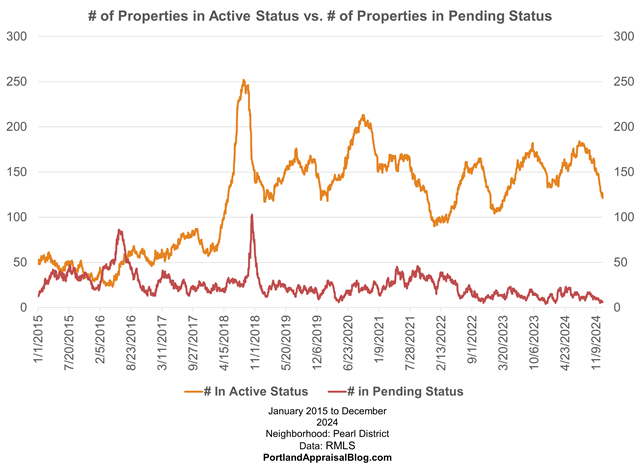

The following graph shows the number of condo units in active status versus the number of units in pending status (under contract) for the entire Pearl District for the last ten years:

When the number of pendings exceed the number of active listings that generally indicates a hot market where demand outstrips supply. The market did a fairly good job absorbing the units from the Cosmopolitan. However, when Vista Pearl came online, the market became glutted. The graph shows a sharp spike in active listings in 2018 when that tower was completed and the inventory levels have remained high ever since.

The two structures compete well against one another. Here is a graph of sales prices from the Cosmopolitan and Vista Pearl:

The flurry of initial sales for each building can be seen on their respective completion dates (2016 & 2018). The general range of initial sales prices were similar. The subsequent years show an intermixture of dots, indicating no clear dominance of one tower over the other. The edge does go to the Cosmopolitan in the rarified heights of luxury condo units. And the air gets quite thin above $3 million, with most of the sales in that range belonging to the Cosmopolitan.

The highest sale in the Cosmopolitan was a 4,472- sq. ft. penthouse unit on the 27th floor. It was originally designed as two condo units, but before the tower was completed the two units were consolidated, creating the largest unit in the complex, with panoramic views. The 27th floor penthouse initially sold for $5,441,294 in 2016 as a new construction. The unit later sold for $6,995,000 in 2019—which is a record on the open market for the last ten years in the Pearl District (the seller never dropped the price and waited 244 days to find a buyer). As of this post date, the unit is back on the market for a more “modest” asking price of $4,500,000. If the penthouse closes at that price, it will represent a 36% drop in value from the previous sale. Photos of the unit are currently available online.

A QUICK LOOK AT THE LUXURY CONDO MARKET IN THE PEARL DISTRICT

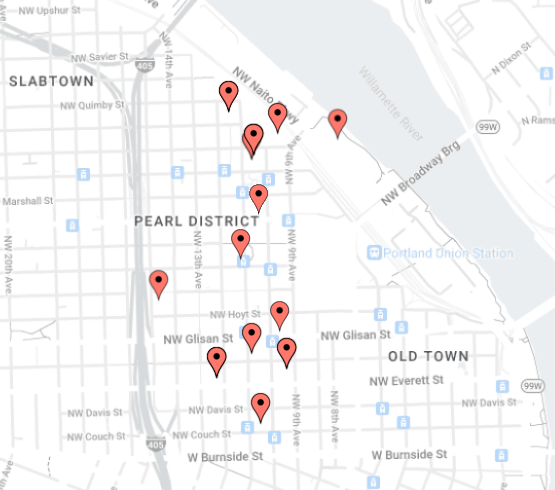

Let’s wrap up our survey of Pearl District condos by examining the luxury market. Here, we define the luxury market as condominiums that sold at or above $2 million. The following map shows where those sales occured:

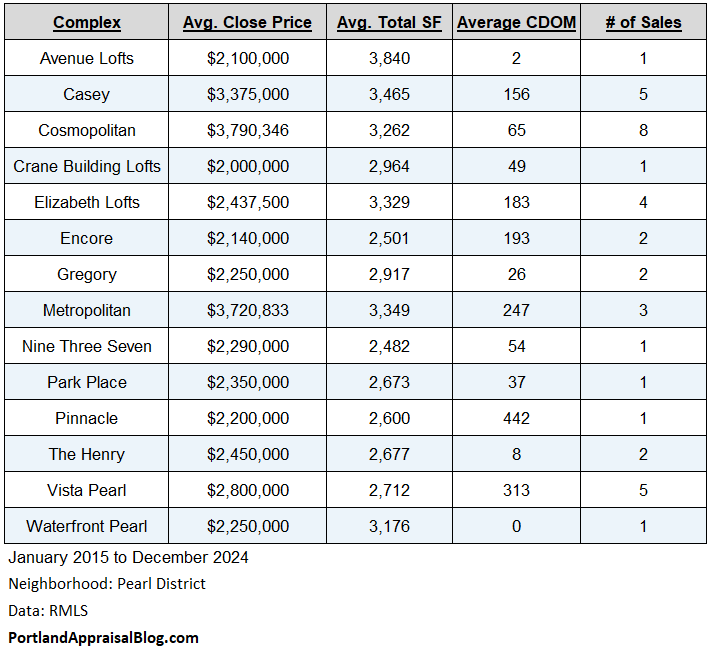

The following table summarizes info about the sales:

Unsurprisingly, the Cosmopolitan is the clear winner, however, the Casey and Metropolitan complexes are close behind in average sales prices, with the Vista Pearl complex claiming 4th place in the luxury condo market.

Thank you for reading the post! I hope you found some useful or interesting nugget of information. Please consider subscribing.

Question: When do you think the Pearl District will finally absorb all the excess inventory?

CODA

Are you an agent and wonder why appraisers always do “x”? Are you a homeowner that got a report and have a question or two about appraisal terminology or methodology? If so, please feel free to contact me. I enjoy interacting with various market participants and am always happy to help out where I can! And if you are in need of any appraisal services, feel free to reach out to us!