Stock photo via Canva Pro

FHFA Announces $176 Billion in 2026 Multifamily Loan Purchase Caps

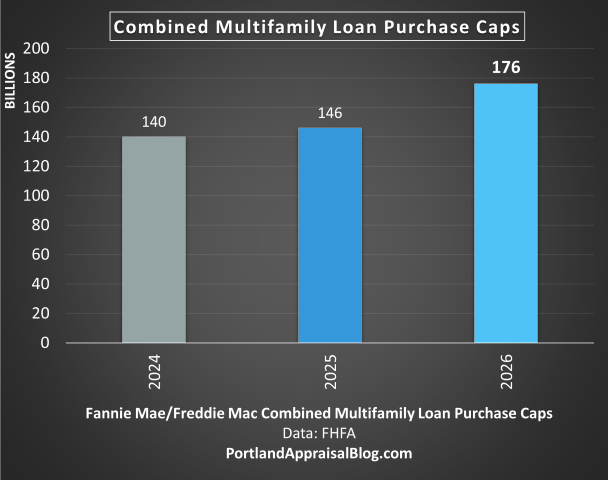

The Federal Housing Finance Agency (FHFA), regulator of Fannie Mae and Freddie Mac (the Enterprises), has set the annual multifamily loan purchase caps for 2026 at $88 billion for each Enterprise, resulting in a combined total of $176 billion in financing capacity. This figure represents a robust increase of more than 20% from the $73 billion cap per Enterprise in 2025. The expanded capacity is intended to maintain liquidity in the multifamily market, especially as lending activity is projected to stabilize and as older loans mature, requiring refinancing.

For perspective, the combined cap was $140 billion in 2024 ($70 billion each) and $146 billion in 2025 ($73 billion each). The nearly $30 billion increase between 2025 and 2026 is a strong signal of anticipated market strength.

The FHFA confirmed that the caps are a floor, not a ceiling. FHFA Director William J. Pulte stated the agency will monitor lending activity throughout the year and has the discretion to increase the caps further if warranted by market conditions, but will not reduce them—a policy designed to prevent disruption in rental housing finance.

Crucially, the mission-driven focus remains a key mandate: at least 50% of the Enterprises’ multifamily loan purchases must qualify as mission-driven affordable housing.

Data: FHFA | Chart: PortlandAppraisalBlog.com

Mission-Driven Focus and Exemptions

The FHFA has maintained specific provisions to support underserved segments of the market:

- Workforce Housing Exemption: Loans financing workforce housing—properties with rent or income restrictions for at least 10 years or the loan term, typically targeting tenants earning 80% to 120% of area median income (AMI)—are exempt from the volume caps and count fully toward the mission-driven threshold if at least 20% of units meet affordability criteria.

- Affordability Requirements: The mission-driven criteria also include properties with regulatory agreements (e.g., Low-Income Housing Tax Credit/LIHTC), those in rural areas, and financing for small-scale affordable units in high-cost or cost-burdened markets. The FHFA has also recently complemented these purchase limits by doubling the annual LIHTC investment cap to $2 billion per Enterprise, which could accelerate multifamily construction starts in 2026.

This commitment to affordability ensures that a substantial portion of the capital is directed toward maintaining and increasing the supply of rental housing for lower- and moderate-income residents, a critical need nationwide and across the Portland region.

Appraisal and Valuation Implications for the Portland Region

The increased national lending capacity for multifamily properties has subtle yet important implications for certified residential and commercial appraisers, as well as the homeowners, lenders, and investors they serve across the Portland–Vancouver metro area.

Residential Properties (1–4 Units)

For residential stakeholders, the robust federal support for multifamily lending indirectly influences the single-family market. By increasing the capital flow for new and existing rental properties, the FHFA action helps stabilize the rental supply, which in turn can ease demand pressure that might otherwise shift to single-family inventory in high-demand areas.

In Oregon and Washington counties, including Multnomah, Washington, and Clark, this broader stability aids in appraising the smaller, 2–4 unit residential income properties often financed through conventional Fannie Mae/Freddie Mac channels. Appraisers should note that in the income approach, the assurance of strong capital markets for rental housing—particularly those properties meeting workforce housing needs—provides a stabilizing factor for Gross Rent Multipliers (GRMs) and capitalization rates used in valuation. This financing stability offers a necessary counterbalance to the volatility introduced by local regulations, such as Oregon’s statewide rent increase limits (set at 9.5% for 2026) and Portland’s mandatory relocation assistance policies (triggered by a 10% rent increase or higher). Crucially, the 9.5% state cap means the state maximum increase does not automatically trigger the significant financial liability of relocation assistance within Portland city limits.

Commercial / Multifamily (5+ Units)

For the commercial and investment real estate segment, which includes properties with five or more units, the increased $176 billion cap is a clear positive. It reinforces the Enterprises as a reliable, deep source of capital in the Portland–Vancouver corridor, where investment sales have been concentrated in Vancouver, Milwaukie, and Hillsboro/Beaverton submarkets.

Appraisers valuing these assets should incorporate the following:

- Cap Rate Stability: The strong financing capacity acts as a floor, limiting upward pressure on capitalization rates that might otherwise result from tighter credit conditions.

- Workforce Housing Marketability: The explicit cap exemption for workforce housing loans is highly relevant. Appraisers must consider a property’s potential eligibility for this favorable financing when assessing its highest and best use and marketability, especially in submarkets facing high rent growth or in communities like those in Cowlitz and Skamania counties where mission-driven initiatives promote long-term affordability.

- Market Context: The assurance of this funding stream is timely, as the Portland metro multifamily market currently faces an elevated vacancy rate (ranging from approximately 5.5% to 7.5%, with higher rates for luxury Class A units) due to a wave of recent new deliveries. However, the pipeline is slowing significantly (new construction starts down over 50%), suggesting this capital will be available precisely as the market rebalances and conditions tighten.

Market Context

The FHFA’s decision to increase the combined cap to $176 billion is broadly supported by industry groups like the Mortgage Bankers Association (MBA) and the National Association of Home Builders (NAHB). This federal framework is expected to bolster the long-term rental stability that is crucial for the Portland metro area. The increased lending capacity comes at a pivotal time, mitigating the risk of a future housing shortage that could result from the current dramatic slowdown in new development across the region. The decision aligns the national financial framework with the local market’s need for capital, particularly for mission-driven and workforce housing, which remains a consistent demand factor for appraisers to consider.

Sources & Further Reading

- FHFA: News Release

- FHFA: Multifamily Cap & Definitions

- FHFA: 2025 Multifamily Fact Sheet

- Multi-Housing News: Article

- MBA: Statement

- NAHB: Statement

- PortlandAppraisalBlog: Oregon 2026 Rent Cap

- Oregon Laws Definition of Area Median Income: AMI

- Portland Mandatory Renter Relocation Assistance: Portland.gov

- Northmarq: Multifamily Sales in Portland

- HFO: Multifamily Outlook 2025–2026

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner, lawyer, or estate planner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.