Photo: Ajay Suresh via Wikimedia Commons (CC BY 2.0)

FHFA Announces 2026 Conforming Loan Limit Adjustments

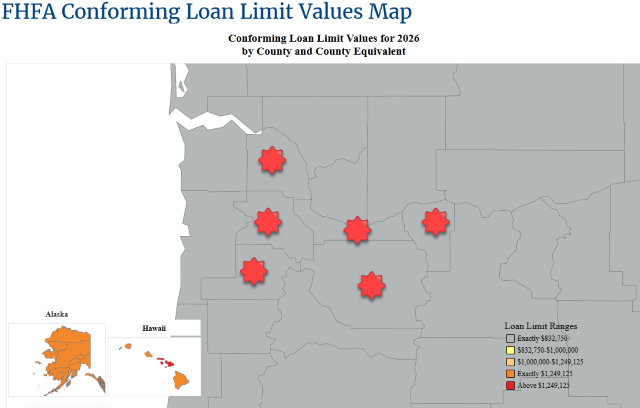

The Federal Housing Finance Agency (FHFA) has released its annual conforming loan limit values for 2026, effective January 1 for mortgages acquired by Fannie Mae and Freddie Mac. The baseline limit for one-unit properties increases to $832,750 — up $26,250 from the 2025 figure of $806,500 — reflecting a 3.26% rise in the national House Price Index from the third quarter of 2024 to the third quarter of 2025.

All counties in Oregon and the Portland-Vancouver-Hillsboro MSA remain at the baseline limit; no high-cost ceiling applies in our region.

Appraisal Implications for the Portland Region

In Q3 2025 alone, 99 residential properties in the six-county region closed between $806,501 and $832,750. Of those, 70 were financed conventionally — transactions that would have required jumbo terms in 2025 but will now stay fully conforming in 2026.

Across the full quarter (4,682 total SFR detached-class closings):

- 85.48 % (4,002 sales) closed under $900,000

- Only 14.52 % (680 sales) closed at or above $900,000

- The single busiest upper-tier band was $800,000 – $899,999 with 367 sales

Market Context from Q3 2025 Actual Sales

| Price Band | # of Sales | % of Total Market | Avg Close Price | Avg CDOM |

|---|---|---|---|---|

| $800k– $899k | 367 | 7.84 % | $847,313 | 51 days |

| $806,501 – $832,750 | 99 | 2.11 % | $820,864 | 49 days |

| ≥ $900k | 680 | 14.52 % | ≈ $1,340,000+ | 72+ days |

For appraisers, lenders, realtors, estate planners, and attorneys, the 2026’s higher limit removes friction from one of the region’s most active price segments and keeps 85+% of transactions comfortably conforming.

Sources & Further Reading

- FHFA Announces Conforming Loan Limit Values for 2026

- FHFA Conforming Loan Limit Addendum for Calendar Year

- 2026 FHFA Conforming Loan Limit FAQs for 2026

- FHFA Conforming Loan Limit Values Interactive Map

- Portland Region Q3 2025 Market Update

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.