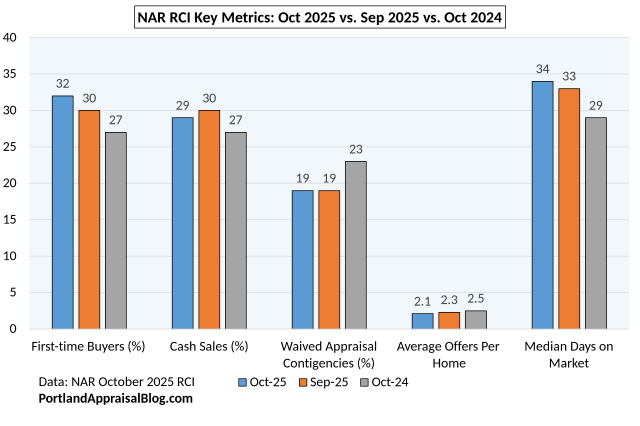

The National Association of REALTORS® (NAR) has released its October 2025 REALTORS® Confidence Index (RCI), revealing a market with subtle shifts that Portland metro real estate professionals should monitor closely. First-time buyers climbed to 32% of transactions, supported by growing inventory and modestly lower rates, though overall confidence dipped—with only 17% of REALTORS® expecting year-over-year buyer traffic increases in the next three months, and 16% for sellers. Cash sales remained steady at 29%, while homes received an average of 2.1 offers, and 19% sold above list price.

For appraisers in the Portland area, these trends suggest more stable comparable sales (comps), but they also highlight persistent risks from contingencies, with 19% of buyers waiving appraisals and 6% of delayed settlements linked to valuation issues. This creates opportunities for thorough, defensible reports that address local market segmentation.

The RCI: A National Pulse with Local Relevance

The RCI draws from a survey of approximately 1,800 REALTORS® conducted November 1–16, 2025, focusing on buyer and seller activity, financing, contingencies, and sentiment. Unlike local MLS data such as RMLS, which tracks completed transactions, the RCI captures forward-looking expectations. In the Portland metro, including Vancouver, WA, combining these insights ensures appraisals reflect both anticipated trends and on-the-ground realities, particularly in cross-border markets.

Key Market Indicators Shaping Appraisals

October’s data points to a gradual easing:

- Median Days on Market (DOM): 34 days (up from 33 in September 2025 and 29 in October 2024).

- First-Time Buyers: 32% of transactions (up from 30% in September 2025 and 27% in October 2024), signaling stronger entry-level demand.

- Cash Sales: 29% (down slightly from 30% in September 2025, up from 27% in October 2024).

- Distressed Sales: 2% (unchanged from prior months).

While days on market are up year over year, the time homes are spending on market is not excessive. There is a bit more time for negotiations. I go into detail about rising days on market in my Portland Region Q3 2025 Market Update.

Buyer Shifts and Contingency Considerations

Buyers are navigating a slightly less competitive landscape, which influences appraisal timelines and risks:

- 20% waived inspection contingencies (flat from September 2025).

- 19% waived appraisal contingencies (flat from September 2025, down from 23% in October 2024)—a trend that eases renegotiation pressures for Portland appraisers.

- 5% completed purchases via virtual tours only (unchanged).

- 82% of purchases occurred in suburban, small town, rural, or resort areas (down from 87% in September 2025).

In Multnomah County and Vancouver, WA, this suburban preference reshapes comp pools, emphasizing the need for carefully defined competitive areas—location matters!

Seller Dynamics: Fewer Offers, More Scrutiny

Sellers are adjusting to softer demand, with implications for pricing and close processes:

- Average offers per home: 2.1 (down from 2.3 in September 2025 and 2.5 in October 2024).

- 19% sold above list price (down from 21% in September 2025, flat from October 2024).

- 2% sold to iBuyers (up from 1% in September 2025).

- Median time to close: 30 days (unchanged).

- 7% of contracts terminated (up from 6% in September 2025).

- 14% experienced delayed settlements (unchanged).

For realtors and lenders in the Portland metro, rising terminations underscore the importance of appraisals backed by solid, verifiable comps. As I detailed in my Portland Region Q3 2025 Market Update, the sales price to original list price ratio has been declining.

Outlook: Tempered Optimism and Suburban Focus

REALTOR® confidence softened amid these changes:

- 17% anticipate buyer traffic growth year over year in the next three months (down from 20% in September 2025).

- 16% expect seller traffic increases (down from 19% in September 2025).

- 29% of buyers prioritized work-from-home features (down from 34% in September 2025).

This aligns with the Portland Region’s ongoing suburban migration, impacting comp selection in Clackamas and Washington Counties. Homeowners and attorneys preparing for transactions should carefully read reports to verify they incorporate these broader sentiment shifts.

Implications for Portland Metro Valuations

The RCI’s blend of buyer gains and fading enthusiasm points to a transitional market: enhanced first-time activity promotes equitable pricing, but elevated terminations (7%) reveal gaps in expectations. For further details, explore the full report here, the main RCI page, or the existing-home sales tie-in. See also my Portland Region Q3 2025 Market Update.

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

Question: Do you think lower mortgage rates will propel the market to new heights?

CODA

Are you an agent in Portland or Clackamas County and wonder why appraisers always do “x”?

A homeowner in Lake Oswego with questions about appraisal contingencies or valuation delays?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or Clackamas County, we’d be glad to assist.