When I appraise 2–4 unit residential income properties in the Portland metro area for estate, trust, or probate purposes, the single largest value depressant is almost always a long-term tenant paying far below-market rent. Oregon’s statewide rent-stabilization law and Portland’s additional relocation-assistance requirements combine to make it expensive and slow for heirs to reset those rents after the original landlord passes away.

How Below-Market Rents Survive Inheritance

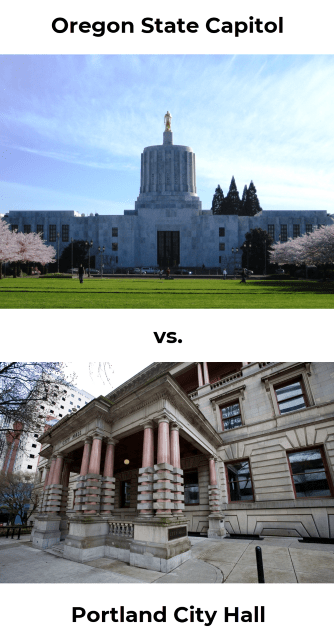

Oregon law limits rent increases to once every 12 months and caps the allowable increase at 7% plus the Consumer Price Index (CPI), with an overall hard cap of 10%. For calendar year 2026, this limit is 9.5%. Certain units—such as regulated affordable housing and buildings less than 15 years old—are exempt. No-cause evictions are prohibited after the tenant’s first year of occupancy.

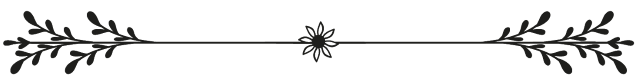

Many inheritors lack the cash or desire to front relocation fees and perform renovations, so the low-rent tenancy often remains in place for years. (I go into more detail in my discussion of Oregon rent control laws and the overlays the City of Portland adds.)

Appraisal Impact: Contract Rent vs. Market Rent

In the income approach for 2–4 unit residential properties, appraisers derive a gross rent multiplier (GRM) by dividing comparable sales prices by their monthly (or annual) scheduled rents, typically resulting in a three-digit figure (e.g., 165–195 in most Portland metro submarkets at present). Appraisers may also cross-check conclusions with a direct capitalization approach when income and expense data are reliable.

That GRM is then applied to the subject property’s actual contract rent. When contract rent lags 20–40% behind market—a common range in inherited portfolios— the indicated value is often proportionally lower than the same property delivered vacant or at market rent.

Example: A duplex with market rent of $2,700 per side ($5,400/month total, $64,800/year) but current contract rent of $2,000 per side ($4,000/month total, $48,000/year) and a reconciled GRM of 180 yields:

- Market-rent value: $5,400 × 180 = $972,000

- Contract-rent value: $4,000 × 180 = $720,000

- Result: $972,000 – $720,000 = $252,000 → Difference of approximately 26% solely due to the locked-in tenancy.

For a real-world illustration, consider a recent North Portland fourplex sale from 2024. This 1966-built property sold for $768,000 with actual gross scheduled income of $58,026 annually ($4,835 monthly average across four 2-bedroom units on month-to-month leases). The listing projected $66,120 in gross income—a 14% increase—highlighting below-market rents with “opportunity for growth.” Using the market-derived monthly GRM of approximately 159 (consistent with the listing’s implied metrics), the contract-rent value aligns with the sale price, while the projected rents suggest a potential value around $875,000, representing a 12–14% discount due to the existing tenancies and regulatory hurdles to realizing that upside.

RMLS multifamily listings display scheduled rents in the public fields, and confidential remarks may note “long-term tenants – below-market rents” as an upfront acknowledgement to a potential purchaser. Savvy buyers and appraisers run the numbers immediately and adjust offers (and appraised values) accordingly.

The Challenge Scales with Unit Count

- Duplexes remain the most manageable. Under Oregon law, a new owner or an immediate family member moving in is a “Qualifying Landlord Reason” for termination. This creates a realistic path to market rent within 12–18 months. Crucially, Portland’s mandatory relocation assistance is generally NOT required if the new owner occupies one unit of a duplex as their primary residence and terminates the tenancy of the second unit. This key exception significantly lowers the cost and risk of resetting the rent on a duplex in the city.

- Triplexes and fourplexes are far harder. While an owner or immediate family member can still reclaim a unit (or units) in a triplex or fourplex for occupancy, this move-in termination does trigger the full Portland relocation assistance payment for each unit vacated. The cost of reclaiming multiple units often becomes the practical—and high-cost statutory—constraint. As a result, at least one protected tenant and their below-market rent often remains in place, sometimes indefinitely.

| Regulatory Scenario | Duplex (Owner-Occupied) | Triplex / Fourplex |

| State Law Termination (Owner Move-In) | Allowed (with 90-day notice) | Allowed (with 90-day notice) |

| Portland Relocation Fee Required? | NO (Exempt under PCC 30.01.085.G.3) | YES (Full fees apply) |

| Cost to Recoup 1 Unit | Minimal (Time/Legal fees) | $4,200 – $4,500+ (plus legal fees) |

Practical Guidance for Heirs and Estate Professionals

Inherited small income properties with long-term, below-market tenants routinely trade at meaningful discounts to physically identical buildings that are vacant or leased at market rates. The regulatory environment creates a durable “locked-in tenancy discount” that survives the death of the original landlord.

Appraisers must document both contract and market rent, then apply the market-derived GRM to the realistic income stream the property actually produces under current law. Understanding this dynamic early avoids surprise when the date-of-death value comes in lower than expected.

In many cases, keeping the stable tenant and modest cash flow is the path of least resistance—and still the highest and best use. Rents can be gradually raised each year until all units are in alignment with the rest of the market, provided increases comply with the annual cap and notice requirements; in Portland, certain increases trigger relocation assistance.

If you are an estate planning attorney, personal representative, or heir handling a 2–4 unit rental in Multnomah, Washington, Clackamas, Yamhill, Columbia, or Hood River counties, reach out. These scenarios are a routine part of my practice.

Sources & Further Reading

- PortlandAppraisalBlog discussion on Oregon 2026 Rent Cap: Post

- PortlandAppraisalBlog discussion on Oregon Rent Laws vs. Portland’s Tenant Protections: Post

- Oregon Residential Landlord and Tenant Act (full chapter): ORS Chapter 90

- Rent Increase Limits & Notice Requirements: ORS 90.323

- Annual Rent Cap Calculation: ORS 90.324

- Termination of Tenancy without Tenant Cause: ORS 90.427

- Portland Renter Additional Protections (City Code 30.01.085): Official City Page

- Portland Mandatory Relocation Assistance Brochure (PDF): Download

- Portland Housing Bureau Relocation Rules & Exemption Form: HOU-3.05

- Oregon Law Help – Eviction & Termination Notices: Guide

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

Question: How have the current rent control laws affected your portfolio?

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about multifamily income properties, GRMs, or income calculations?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.