Photo: Portland Appraisal Blog (CC BY-SA 4.0)

The Portland region’s housing market remains cautious entering late 2025, with new construction activity down sharply and permitting challenges persisting. Against this backdrop, local and state leaders are advancing targeted reforms to ease regulatory barriers and incentivize production—though staffing reductions at the city’s permitting bureau highlight short-term friction.

Market Challenges and Permitting Strain

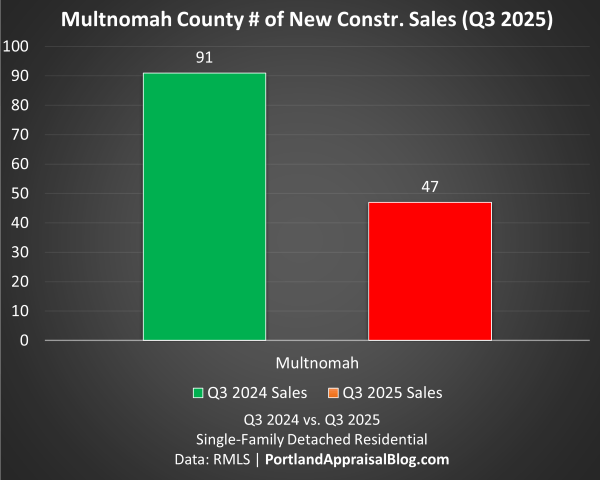

Third-quarter data for the Portland region showed new construction sales falling 25% year-over-year, comprising just 9% of total single-family transactions—with a steep decline in Multnomah County, where sales dropped roughly 48% (from 91 to 47).

Builders retreated amid financing constraints and longer marketing times, with average days on market rising to nearly 52 and luxury segments seeing extended exposure. This slowdown directly impacted the Portland Bureau of Development Services, which relies almost entirely on permit fees for funding. Reduced construction activity led to revenue shortfalls of approximately $3 million per month earlier in the year, prompting cuts of 72 positions—about 15% of staff. Fewer reviewers and inspectors risk further delays in approvals, creating a challenging cycle just as reform efforts aim to accelerate entitlements.

Portland’s Design Review and Unified Strategy Advances

In response, the Portland City Council unanimously approved a resolution in December directing the city administrator to study reforms to the design review process, including potential moratoriums and exemptions for housing projects. The 120-day report—due by April 2026—will analyze economic impacts over the past and next five years, review overlay zones and guidelines, and propose code changes to balance efficiency with design standards.

These steps align closely with the city’s Unified Housing Strategy outlined in a December memo, which prioritizes permitting improvements: streamlining user experience, consolidating processes under a single authority, expediting affordable projects, and exploring funding model reforms. The strategy also emphasizes production goals through incentives like Inclusionary Housing expansions, rezoning for capacity in corridors and centers, and support for office-to-residential conversions.

Statewide Support and Broader Momentum

State-level actions provide reinforcement. The 2025 legislative session extended Oregon’s Vertical Housing Tax Exemption program through 2031, continuing partial property tax relief for mixed-use vertical projects with affordable components. Gov. Tina Kotek has also called for broader permitting and land use streamlining, including fast-track options for job-creating developments and clearer timelines to reduce appeals and delays.

Complementing these, recent state zoning progress—such as the new OHNA model code adopted earlier this month—offers cities tools for neighborhood-scale multifamily development. (See yesterday’s brief for details.)

Appraisal Implications

For appraisers in the Portland metro area, these layered reforms signal potential shifts in development pipelines over the coming years. Short-term, bureau staffing reductions may extend entitlement timelines, affecting feasibility analyses for proposed construction or renovation assignments. Longer-term, successful streamlining and incentives could gradually increase multifamily and mixed-use supply, influencing comparable selection—particularly for vertical or conversion projects qualifying under the extended tax exemption. Monitoring implementation will be key, as market caution persists and measurable production gains may lag into 2026–2027.

Sources & Further Reading

- Portland design review reform resolution and study approval: DJC Oregon (Dec 9)

- Design review moratorium study green light: DJC Oregon (Dec 11)

- Unified Housing Strategy December 2025 memo: Portland.gov PDF

- Portland Bureau of Development Services job cuts: KGW News

- Oregon 2025 legislative extensions including Vertical Housing: Oregon Real Estate Agency

- Gov. Kotek permitting streamlining push: Portland Tribune

- Oregon Model Code Enables Neighborhood-Scale Apartments: PortlandAppraisalBlog

- Portland’s Temporary SDC Exemption for New Housing Units (2025–2028): PortlandAppraisalBlog

- The Portland Region Q3 2025 Market Update: Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland and wonder why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.