Photo: Abdur, Abdul-Malik, Portland Appraisal Blog (CC BY-SA 4.0)

Condominiums have long been viewed as an ideal downsizing option for seniors seeking lower-maintenance ownership, potential aging-in-place features, and proximity to urban amenities. National narratives—including recent discussions of a “silver tsunami” of baby boomer downsizers—often highlight condos as a key solution for older households looking to “rightsize.”

Yet Q3 2025 condominium closed-sales data from the Portland Region reveals a starkly different reality for seniors reliant on typical fixed incomes.

Using the Portland Appraisal Blog Affordability Index (PABAI)—a distribution-averaged metric calculated individually for each transaction based on actual sale price, reported HOA dues, and property taxes, combined with current mortgage rates, insurance estimates, and a conservative 20% down payment with 28% qualifying ratio—only 5.4% of the 651 condominium sales (35 units) generated a monthly carrying cost affordable on a median senior household income of approximately $68,284.

This analysis focuses exclusively on single-family residential class condominiums across the Portland Region—the six-county area that is the focus of this blog.

The Equity Divide in the Condo Market

Financing terms, as reported by listing agents in RMLS, tell much of the story (see table below). Cash purchasers accounted for 33.8% of transactions (220 sales) and paid the highest average price ($407,000) while accepting the highest average monthly HOA dues ($669). Conventional financing dominated another 54.1%, reflecting buyers with strong credit and often substantial down payments.

| Financing Type | % of Sales | # Sales | Avg Close Price | Avg Monthly HOA |

|---|---|---|---|---|

| Cash | 33.8% | 220 | $407,000 | $669 |

| Conv. | 54.1% | 352 | $365,000 | $460 |

| FHA | 8.0% | 52 | $283,000 | $403 |

| VA | 2.6% | 17 | $340,000 | $356 |

Data: RMLS | Portland Appraisal Blog

In contrast, FHA financing—typically associated with lower down payments and more income-sensitive qualification—represented only 8.0% of sales, with an average close price of $283,000 and more moderate HOA dues ($403 monthly).

This segmentation underscores a clear divide: equity-rich seniors downsizing from detached homes can readily access the market, often paying cash or leveraging large down payments to absorb elevated carrying costs. Seniors without significant prior home equity, reliant primarily on Social Security, pensions, or modest retirement savings, face severe barriers.

Price Distribution and the Narrow Affordable Tier

Q3 2025 condominium sales clustered heavily in the $200,000–$400,000 range, but the truly affordable segment for median senior incomes proved far smaller.

| Price Band | # Sales | % of Total | Avg Close Price | Avg Year Built | Avg Monthly HOA |

|---|---|---|---|---|---|

| Under $200k | 53 | 8% | $164,000 | 1968 | $461 |

| $200–299k | 216 | 33% | $255,000 | 1984 | $500 |

| $300–399k | 203 | 31% | $346,000 | 1997 | $431 |

| $400–499k | 89 | 14% | $443,000 | 1999 | $492 |

| $500k+ | 90 | 14% | $779,000 | 1997 | $889 |

Data: RMLS | Portland Appraisal Blog

The 35 units affordable under conservative PABAI assumptions were overwhelmingly concentrated in the under-$200,000 and lower $200,000–$299,000 bands—older, smaller properties that appear accessible on purchase price alone.

Age, Obsolescence, and Elevated Carrying Costs

Older condominiums—many conversions of pre-1970 apartment buildings — present particular valuation challenges. The table below excludes new construction deliveries, as agent-reported HOA dues for newly completed projects are often provisional or incomplete.

| Year Built Bracket | # Sales | Avg Close Price | Avg Sq Ft | Avg Monthly HOA | Avg HOA per Sq Ft |

|---|---|---|---|---|---|

| Pre-1970 | 95 | $304,000 | 977 | $572 | $0.67 |

| 1970–1989 | 194 | $309,000 | 1,146 | $575 | $0.52 |

| 1990–1999 | 43 | $388,000 | 1,117 | $555 | $0.52 |

| 2000–2009 | 199 | $443,000 | 1,265 | $661 | $0.54 |

| 2010+ | 51 | $474,000 | 1,394 | $284 | $0.26 |

Data: RMLS | Portland Appraisal Blog

Pre-1970 stock carries the highest average HOA dues per square foot ($0.67), reflecting ongoing capital needs for aging systems, reserves, and occasional special assessments. This elevated recurring cost creates meaningful external obsolescence for income-constrained buyers, even when entry prices appear lower.

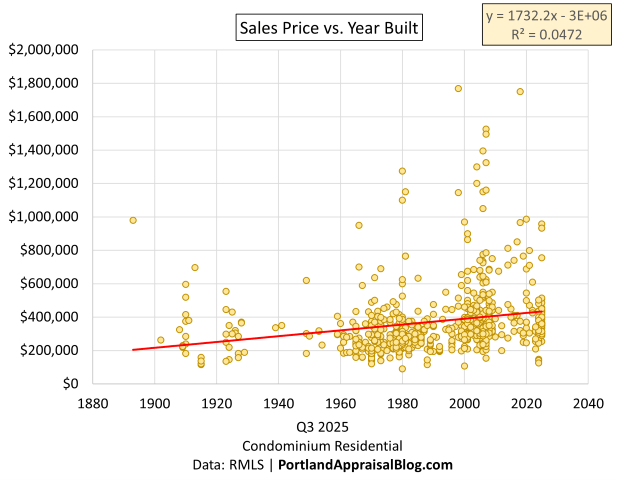

A scatterplot of sales price against year built further illustrates this dynamic. While newer construction generally commands higher prices, the weak correlation (R² = 0.047) confirms that factors beyond age—location, views, amenities, and building quality—dominate value. Older units cluster at lower prices, yet as shown above, they often carry disproportionately high recurring costs.

County-Level Consistency

The challenge persists across the Portland Region:

| County | # Sales | % Affordable for Seniors |

|---|---|---|

| Multnomah | 426 | 6.3% |

| Washington | 144 | 3.5% |

| Clackamas | 69 | 4.4% |

| Portland Region Total | 651 | 5.4% |

Data: RMLS | Portland Appraisal Blog

No county offers a meaningful suburban relief valve for fixed-income seniors. (Over 98% of Q3 2025 condominium sales occurred in the three counties in the table above.)

Even FHA Terms Do Not Meaningfully Expand Access

Conventional wisdom might suggest FHA financing—with 3.5% down payments and more lenient debt-to-income ratios—would open the market wider for seniors with limited savings. Yet when mortgage insurance premium (0.55% annual) and the resulting larger loan are included, the share of affordable units actually declines to 3.8%.

Higher principal and interest, combined with permanent MIP, outweigh the benefits of lower upfront equity for households with constrained monthly cash flow.

Appraiser Perspective: Comparable Selection and Reconciliation Challenges

When appraising condominiums, comparable selection must account for competitive market segments defined by building age, location, complex-specific amenities, and HOA structure. Units in markedly different projects—for example, a 1960s conversion versus a 2000s high-amenity tower—are rarely direct substitutes.

Differences in functional utility, functional obsolescence, and market-perceived recurring costs often require careful adjustments or exclusion from the primary grid.

Conclusion

While condominiums remain a logical theoretical choice for seniors seeking reduced maintenance and urban access, Q3 2025 condo data demonstrates that ownership is realistically attainable only for those with substantial prior home equity. For senior households reliant primarily on fixed incomes near the median, monthly carrying costs—particularly in older stock with higher HOA burdens—render the vast majority of the market out of reach without additional equity or savings.

Many will continue to rely on rental options or supportive housing models, such as the recently opened Julia West House in Portland, which provides dedicated affordable senior housing.

Via Canva Pro

Sources & Further Reading

- The Portland Appraisal Blog Affordability Index: PABAI

- National Association of REALTORS discussion of senior downsizing trends: Original Article

- Age-specific median household incomes: U.S. Census Bureau ACS 2024 Table B19037

- Recent coverage of Julia West House supportive senior housing opening: Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.