Photo: Abdur Abdul-Malik, Portland Appraisal Blog

Trees define Portland’s character—from tree-lined residential streets to the vast canopies of Forest Park and Mt. Tabor. The City of Portland’s Title 11 Tree Code establishes comprehensive regulations for tree preservation on private property within city limits.

Portland City Code Chapter 11.00.010 outlines the code’s purpose:

Trees are a fundamental component of the City’s green infrastructure. The chapters within this Title address trees in both development and nondevelopment situations and seek to enhance the quality of the urban forest and optimize the benefits that trees provide. Desired tree benefits include:

1. Providing oxygen and capturing air pollutants and carbon dioxide;

2. Maintaining slope stability and preventing erosion;

3. Filtering stormwater and reducing stormwater runoff;

4. Reducing energy demand and urban heat island through shading of buildings and impervious areas;

5. Providing visual screening and buffering from wind, storms and noise;

6. Sustaining habitat for birds and other wildlife;

7. Providing a source of food for wildlife and people;

8. Maintaining property values and the beauty, character and natural heritage of the City; and

9. Meeting the multi-purposed objectives of the Urban Forest Plan, including reaching and sustaining canopy targets for various urban land environments.

These goals are laudable and align with Portland’s identity as a tree-rich city. Yet real-world implementation has generated significant friction for property owners—permit requirements, mitigation costs, enforcement actions, and occasional liability when protected trees fail.

In Q3 2025 closed detached single-family sales within the City of Portland, “tree” or “trees” appeared in listing remarks for 660 of 1,519 transactions (43%). Properties marketed with tree mentions averaged $678,689—$51,371 higher than those without. After regression-based adjustments for differences in living area ($267.72 per Total SF) and lot acreage ($347,496 per acre), an approximate $23,500 difference remained in favor of the tree-mention cohort. This observational finding—not a controlled paired-sales analysis—suggests the market may reward mature canopy as a contributory amenity in established resale properties. Because listing photographs frequently communicate tree presence more effectively than remarks, and because other influential variables (such as neighborhood, condition, and level of updating) are not controlled for here, the remaining price difference should be viewed as a general market indicator rather than a precise contributory estimate.

Ironically, the same trees that appear to support resale premiums can impose substantial constraints during redevelopment, additions, or even routine ownership.

Trees as Amenity: The Resale Perspective

Mature trees provide shade, privacy, and aesthetic appeal that buyers prize in Portland’s established neighborhoods. The high frequency of tree mentions in marketing remarks (43% in Q3 2025) reflects agent confidence in canopy as a selling point.

Since July 1, 2025, most non-development tree permit applications (routine pruning, removal, or replanting on existing homes) carry no charge—thanks to Portland Climate Emergency Fund support. This relief reduces ongoing maintenance costs for homeowners and reinforces the perceived contributory value of large trees in resale transactions.

Professional care is often required for large specimens to avoid safety issues or violations.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog

Trees as Burden: Real-World Homeowner Experiences

While the code’s environmental intent is clear, enforcement and preservation mandates have created documented challenges for property owners.

In one prominent case, a Southwest Portland family sought removal of a leaning Douglas-fir they considered hazardous. Urban Forestry denied the permit. During the January 2024 ice storm, the tree collapsed onto their home—narrowly missing their young daughter. The family filed suit in April 2025, seeking $4.7 million in damages; the lawsuit remains ongoing as of January 2026.

Similar frustration appears in other accounts: unexpected violation notices and restoration bills, rigid enforcement described as a “nightmare” for residents, and ombudsman investigations into abatement costs shifted to homeowners for trees located far from their property line.

These incidents illustrate the liability risk when protected trees become dangerous—yet removal options remain restricted. Reports nationwide echo warnings: unauthorized tree cutting has led some property owners to severe financial consequences, including liens or loss of equity.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog

Title 11 Fundamentals: Tree Removal Permits and Notice Requirements

Title 11 protects private trees 12 inches or larger in diameter at breast height (DBH—measured 4.5 feet above ground). Lower thresholds (6 inches DBH) apply in environmental overlay zones.

Tree removal permits fall into two categories: Type A (simpler, no public notice) and Type B (public notice and appeal opportunity). Type A covers smaller trees, limited numbers of healthy trees, dead/dying/hazardous trees, and one large healthy non-nuisance tree per residential lot per year.

| Permit Type | Proposal | City/Street or Private | Public Notice/Appeal |

|---|---|---|---|

| A | Any Type A request1 | City/street/ Private | No |

| A | Up to four healthy <20″ diameter nuisance and non-nuisance species trees | City/street | No |

| A | ≥20″ diameter, healthy nuisance or non-nuisance species tree | City/street | No |

| B | More than four healthy >12″ diameter nuisance and non-nuisance species trees | City/street | Yes |

| B | ≥20″ diameter, healthy non-nuisance species tree | Private | Yes2 |

| B | More than four healthy ≥12″ diameter non-nuisance species trees | Private | Yes |

- Note 1: The applicant may appeal any Type A or B permit decision.

- Note 2: No public notice or opportunity for public appeal is required for removal of one healthy non-nuisance species tree ≥20″ diameter per lot per calendar year in any residential zone.

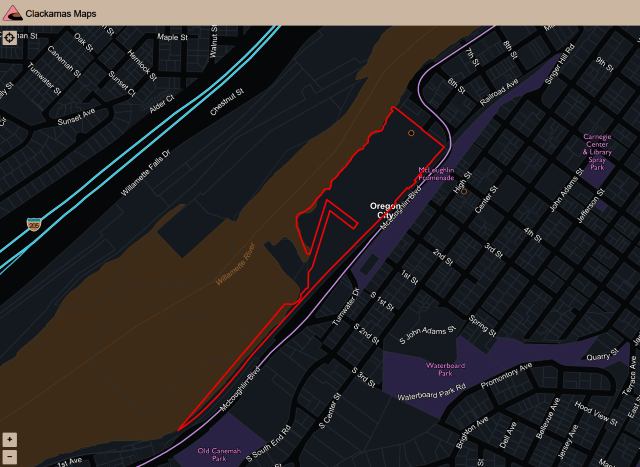

Root Protection Zones and Buildable Area Constraints

During construction, root protection zones (RPZ) extend roughly one foot of radius per inch of trunk diameter. Encroachment is limited, and fencing plus arborist oversight are mandatory.

On typical R-5 or R-2.5 lots, multiple large trees can shrink buildable area by 20–40%, forcing smaller footprints or eliminating partition potential—directly affecting highest and best use for infill or teardown sites.

Photo: Abdur Abdul-Malik, Portland Appraisal Blog

Mitigation and In-Lieu Fees: The Primary Development Cost

When preservation standards are not met (generally one-third of regulated trees), options include on-site replanting or payment into the Tree Planting and Preservation Fund.

The primary development mitigation is the per-inch fee paid to the fund for off-site planting and 5-year establishment. An alternative flat fee per on-site tree applies when partial retention or replanting occurs but full density is not achieved—often used when site constraints limit complete preservation.

Per City Code 11.10.070:

Where allowed by other provisions of this Title, a fee may be paid into the Tree Planting and Preservation Fund in lieu of planting or preserving trees. The fee per tree is the entire cost of establishing a new tree in accordance with standards described by the City Administrator. The cost includes materials and labor necessary to plant the tree, and to maintain it for five years. The fee will be reviewed annually and, if necessary, adjusted to reflect current costs.

Current FY 2025–26 rates (effective July 1, 2025):

| Category | Fee |

|---|---|

| Planting and Establishment Fee in Lieu (primary development mitigation) | $472.00 per DBH inch |

| Planting and Establishment Fee in Lieu (per on-site tree alternative) | $712.00 flat |

| Preservation Fee in Lieu (Private Trees ≥12″ and <20″ DBH) | $1,888.00 per tree |

| Preservation Fee in Lieu (Private Trees ≥20″ DBH) | $472.00 per DBH inch |

| Most non-development applications (removal, replanting, pruning, etc.) | No charge |

A single 24-inch tree removed during development triggers approximately $11,328 in-lieu ($472 × 24). Multiple trees on infill lots commonly total $20,000–$50,000 or more.

These funds support equity-focused plantings—thousands of free yard and street trees in priority neighborhoods, as detailed in the FY 2023 Fund Report.

Enforcement and Penalties

Civil penalties reach $1,000 per tree per day, with restoration fees up to $944 per DBH inch for Heritage Trees (doubled for removal). Liens may be placed on the property.

For example, unauthorized removal of a typical 24-inch Heritage Tree could trigger restoration fees of approximately $22,656 ($944 × 24) plus daily penalties up to $30,000 over 30 days—potentially $50,000 or more in total liability.

Undisclosed prior violations—discoverable via Bureau of Development Services history—can impair marketability and would likely require an adjustment in appraised value.

Heritage Trees: Permanent Deed Encumbrance

Heritage Trees receive elevated protection due to age, size, historical association, or horticultural value. Common designations include Oregon white oaks, European beeches, London planes, and legacy Douglas-firs.

Private trees require owner consent for designation, but once recorded on the deed, the restriction binds all future owners. Removal or significant pruning typically requires City Council approval—a major encumbrance on development feasibility.

Nuisance Trees and Exemptions

Dead, dying, or officially listed nuisance species receive streamlined removal pathways. Certain small lots (<5,000 sq ft) and high-site-coverage scenarios carry lighter standards.

The 2025 Urban Forest Plan: Looking Ahead

Adopted October 22, 2025, the Plan sets ambitious canopy targets (citywide 45% in 40 years; every neighborhood ≥25%) and prioritizes equity in low-canopy areas. Community input emphasized preserving large trees while acknowledging burdens and calling for greater owner rights.

Recommendation #7 explicitly calls for improving City codes to support resilience and urban forest health—signaling Phase 3 Title 11 amendments may adjust preservation standards, mitigation, or incentives in coming years.

Takeaway: Navigating Portland’s Tree Code in Property Valuation

Portland’s urban forest remains one of its greatest assets—delivering shade, beauty, wildlife habitat, and environmental benefits across tree-lined neighborhoods and iconic parks like Forest Park and Mt. Tabor. Title 11’s preservation framework helps sustain this legacy, while mitigation fees fund equity-focused plantings that expand canopy in historically underserved areas.

Yet the code creates meaningful trade-offs for property owners. In resale transactions, mature trees often enhance market appeal and may support modest contributory value—evident in marketing frequency and observational signals from recent sales data. In redevelopment or major improvement scenarios, however, the same trees trigger mitigation costs, root protection constraints, and potential permanent encumbrances—shifting highest and best use and reducing land residual value.

Appraisers reconcile these dual realities through targeted due diligence. Portland Maps provides the tree inventory and Heritage layer for initial screening. Title reports (when available from lenders on purchase transactions) flag recorded Heritage designations. Bureau of Development Services permit history may require direct inquiry if redevelopment potential raises red flags—particularly on infill or teardown lots where prior violations or approved removals can materially affect feasibility. The free PDX Tree Map offers a quick view of city-managed street and park trees for neighborhood context, though private trees (the main Title 11 focus) are not included.

As the 2025 Urban Forest Plan unfolds—with its emphasis on preserving mature trees alongside calls for greater resident cost relief and owner rights—Phase 3 code amendments may refine these balances in coming years. Monitoring regulatory evolution will remain essential for accurate valuation in Portland’s tree-rich market.

Via Canva Pro.

Sources & Further Reading

- Portland City Code Title 11 (Trees): Official Code

- FY 2025–26 Title 11 Trees Fee Schedule (effective July 1, 2025): Fee Schedule

- Portland Urban Forest Plan Executive Summary (October 2025): Plan Summary

- FY 2023 Title 11 Tree Planting and Preservation Fund Report: Fund Report

- Bond family $4.7 million lawsuit coverage (Willamette Week, April 2025): Lawsuit Article

- Bond family KPTV lawsuit coverage (April 2025): Local TV Report

- Bond family initial permit denial and tree failure report (Willamette Week, January 2024): Incident Report

- Rigid enforcement concerns (Willamette Week, March 2025): Enforcement Article

- Ombudsman unexpected bill case (City Ombudsman, September 2024): Ombudsman Report

- Tree regulation updates (Willamette Week Murmurs, June 2025): Regulatory Changes

- Potential fee overhaul discussion (OregonLive, April 2025): Reform Discussion

- Local tree service permit overview: Permit Guide

- Official violation correction process: Violation Guidance

- Heritage Trees species information: Species List

- PDX Tree Map (Portland public tree inventory viewer): Interactive Map

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.