Photo: Portland Appraisal Blog (CC BY-SA 4.0)

Site work is underway on a corner parking lot in Northeast Portland’s vibrant Alberta Arts District, where eight new townhomes are rising directly opposite the historic Alberta Abbey.

The Alberta Alive Townhomes project, located at the northwest corner of NE Alberta Street and NE Mallory Avenue in the King neighborhood, will deliver permanently affordable three-bedroom homes through the Proud Ground community land trust model.

Image: Google Maps

Lead developer Community Development Partners (CDP), in partnership with Self Enhancement Inc. (SEI) and Proud Ground, has begun early site preparation. The project architect is Scott Edwards Architecture, with Owen Gabbert, LLC serving as general contractor. The three-story units will each offer 3 bedrooms, 2.5 baths, private porches, fenced yards, and dedicated parking—approximately 1,275 square feet of living space—in an all-electric design with sloped roofs to accommodate future solar panels, targeting Earth Advantage Platinum certification. Completion is anticipated in fall 2026, with home sales expected in spring 2027.

Photo: Portland Appraisal Blog (CC BY-SA 4.0)

During a recent site visit, the blog author had the opportunity to speak briefly with John, site supervisor for general contractor Owen Gabbert, LLC. With experience on numerous affordable housing initiatives, including Habitat for Humanity builds, John’s passion for creating homes for families in need was readily apparent. He expressed optimism about the City of Portland’s current commitment to affordable housing and highlighted the role of recent system development charge (SDC) waivers in helping accelerate much-needed projects. John also pointed out an environmental benefit specific to this site: the former parking lot generated higher sewer fees due to impervious-surface runoff, and the new townhomes—with permeable features and reduced hardscape—will lessen the impact on the sewer system, delivering a double win for housing supply and infrastructure.

Photo: Portland Appraisal Blog

Market Context in King and Humboldt Neighborhoods

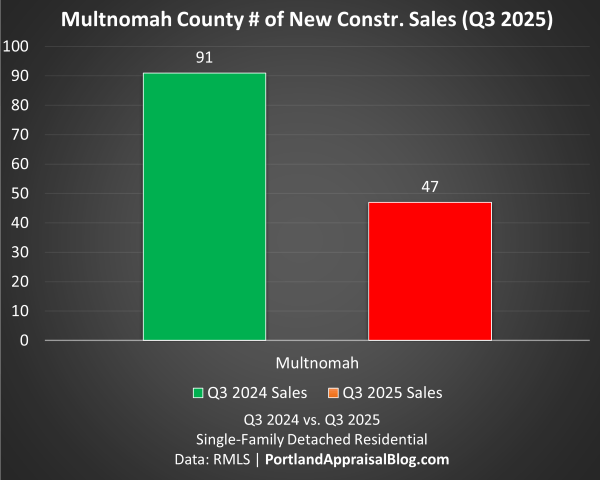

From an appraisal perspective, the King and Humboldt neighborhoods surrounding the Alberta Alive site continue to show robust demand for family-sized attached homes. Over the past four years, three-bedroom fee-simple units have averaged $574,900 in closed sales, with an average of approximately 1,650 square feet and $355 per square foot (24 sales, RMLS data). Notably, new-construction sales in this attached segment remain rare, with only four recorded over the same period.

For broader perspective, the 2024 Portland Region Attached Housing Market in Review reported an average sale price of $445,867 for non-condo attached homes across all of Multnomah County. The higher average in King and Humboldt illustrates the location premium associated with the Alberta Arts District and surrounding high-opportunity areas.

The eight new Alberta Alive Townhomes, at 1,275 square feet, are more compact than existing townhomes in the neighborhoods surveyed, indicating a tradeoff between size and quality. These townhomes—offering comparable three-bedroom layouts with modern amenities—deliver Earth Advantage-certified construction at prices restricted to households earning no more than 80% of area median income. This is made possible through the Proud Ground community land trust model and an approximate $217,000 per-unit contribution from the Portland Housing Bureau ($1.73 million toward the $6.03 million total development cost).

Appraisal Considerations for Community Land Trust Properties

The Alberta Alive Townhomes operate under a community land trust (CLT) structure in which buyers own the improvements (the townhome building) in fee-simple, but the underlying land remains owned by Proud Ground and is subject to a long-term ground lease. This legal arrangement imposes resale price restrictions and income qualifications to preserve affordability for future buyers.

As a result, these units do not serve as direct comparables for unrestricted fee-simple attached housing in the open market. Appraisers valuing nearby conventional townhomes must distinguish the hypothetical unrestricted market value of similar improvements from the encumbered resale price dictated by the ground lease.

That said, the introduction of high-quality new construction in a historically disinvested corridor can still provide positive externalities. Such projects often contribute to neighborhood stabilization and may exert an upward anchoring influence on surrounding market-rate properties.

For prioritized families—particularly those with historic ties to North/Northeast Portland or displaced descendants under the N/NE Preference Policy—Alberta Alive creates access to high-quality homeownership on terms that would otherwise be unattainable at market rates.

While the CLT structure enables meaningful wealth-building through mortgage principal reduction, limited appreciation, and potential intergenerational transfer, it intentionally caps resale prices to preserve permanent affordability—meaning owners forgo the full market upside available in unrestricted sales nearby.

Portland Appraisal Blog will keep an eye on this project’s progress and eventual absorption by the market.

Sources & Further Reading

- Alberta Alive Townhomes project overview: Community Development Partners

- Alberta Alive Townhomes Project Announcement: Portland Housing Bureau

- Construction begins on Alberta Alive Townhomes: Portland Housing Bureau

- Metro Abbey Lot Townhomes: Fact Sheet

- N/NE Housing Preference Policy: Portland Housing Bureau

- Proud Ground community land trust: Proud Ground

- Building Certifications: Earth Advantage

- The 2024 Portland Region Attached Housing Market in Review: Portland Appraisal Blog

- Portland’s Temporary SDC Exemption for New Housing Units (2025–2028): Portland Appraisal Blog

Thanks for reading—I hope you found a useful insight or an unexpected nugget along the way. If you enjoyed the post, please consider subscribing for future updates.

CODA

Are you an agent in Portland who wonders why appraisers always do “x”?

A homeowner with questions about appraiser methodology?

If so, feel free to reach out—I enjoy connecting with market participants across Portland and the surrounding counties, and am always happy to help where I can.

And if you’re in need of appraisal services in Portland or anywhere in the Portland Region, we’d be glad to assist.