A topic I covered before in this blog has been expanded into a video post. Check it out!

A topic I covered before in this blog has been expanded into a video post. Check it out!

We are about to close out Q3 2025, but let’s take a look back and see how the Portland Region single-family detached home market performed in Q2 2025 versus Q2 2024.

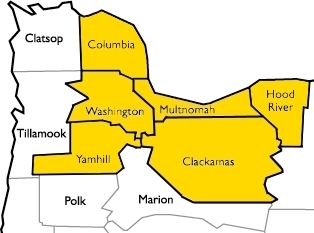

Let’s define the Portland Region as the following six counties: Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill—essentially all counties contiguous with Portland’s home county of Multnomah, plus Yamhill.

DATA HOUSEKEEPING

The information in this post will be based on properties that sold on the open market, defined as listed in RMLS, the primary multiple listing service for the Portland Region. The data was parsed with tools created by the blog author to weed out/correct, among other things, listing errors and misclassifications (e.g. land or condominium sales in the single-family category). RMLS has a listing category, SNL, “Sold Not Listed,” that allows agents to put properties that were sold off market into the database. Those properties have been excluded from the following analyses.

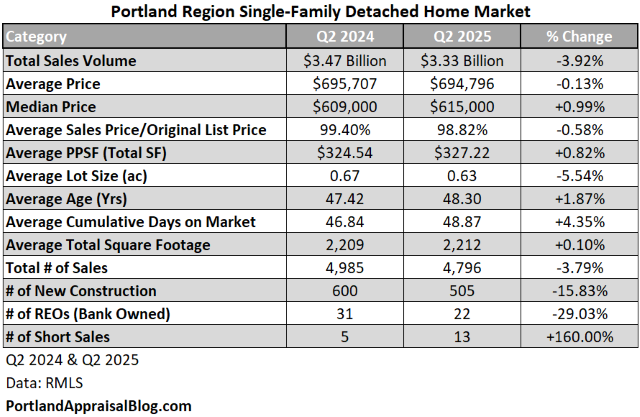

Q2 2025 was nearly the same in most important metrics. The following table compares the two quarters:

Not a lot changed from Q2 2024 to Q2 2025. The total sales volume dollar amount was slightly down in the second quarter versus the previous year. The 3.9% drop almost perfectly mirrors the drop in the number of sales.

The average home price in Q2 2025 was $694,796, which is almost identical to the average price in Q2 2024. A nearly $700,000 price tag continues to challenge median-income earners in the Portland region.

The composition of the sales remained steady; the average lot size decreased by 5.5% and the average home size barely changed at all. Homes were, on average, about 48 years old. There was a noticeable drop in the number of new construction sales (approximately 16%)—the high interest rate environment continues to weigh on the market.

Distressed sales, as a whole, were almost the same in the second quarter of 2025 compared to the second quarter of 2024, with one fewer occurrence. REOs and short sales represented just 0.73% of the market.

Let’s parse the data with some visuals.

SALES VOLUME

The following is a treemap of sales volume in the Portland Region for Q2 2025:

Multnomah County had the most sales, representing nearly 39% of the market. Clackamas, Multnomah, and Washington counties (the “Big Three” of the area) comprised the bulk of the housing market, with nearly 91% of the volume.

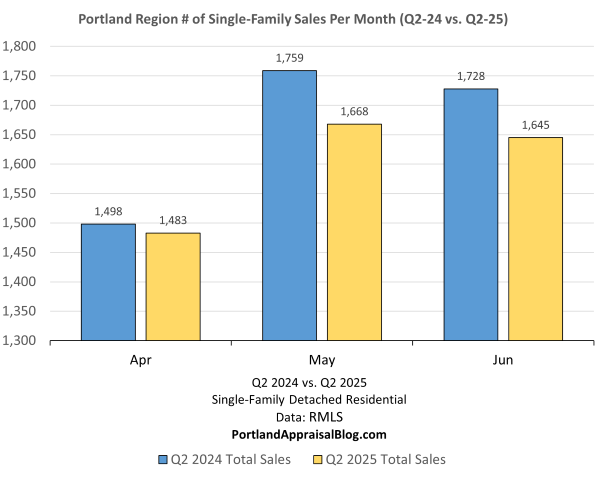

Sales volume was near parity in April, but Q2 2025 lagged behind Q2 2024 for the months of May and June:

SALES PRICE

Q2 2025 was just a sliver below Q2 2024 for April and May and took the crown in June. The average of the three months only placed Q2 2025 about $1,000 below Q2 2024:

NEW CONSTRUCTION

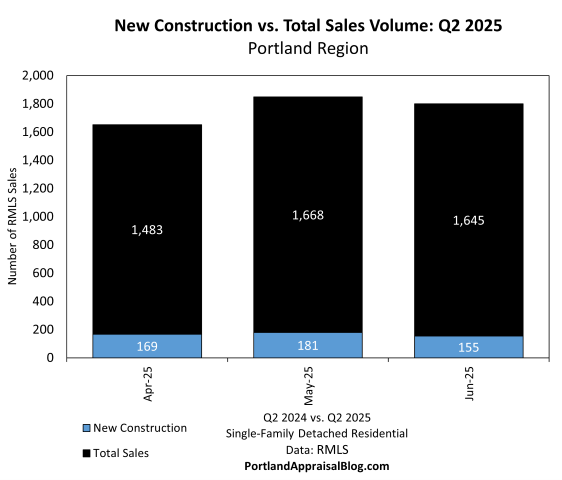

New construction was 10.5% of the overall market in Q2 2025:

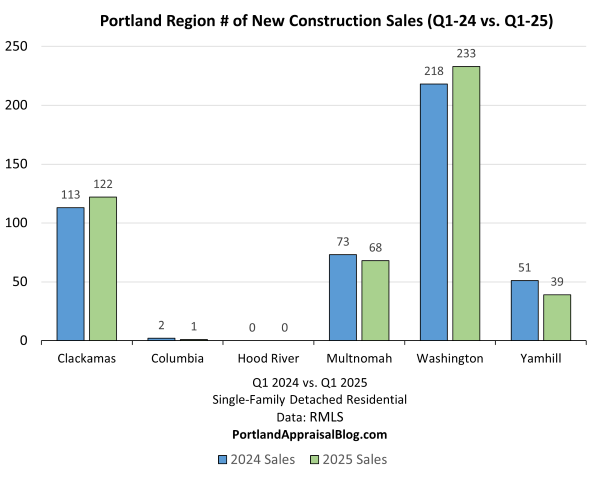

2024 beat 2025 in most counties, with only trivial exceptions coming from Columbia and Hood River:

Washington County dominated the new construction market at 54%. Clackamas County took second place with about 23% of the market and Multnomah came in third at 16%. The Big Three accounted for 93% of the new construction market.

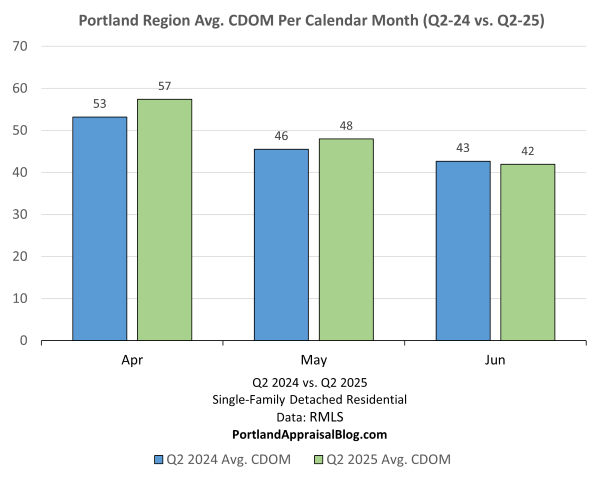

CUMULATIVE DAYS ON MARKET

The average cumulative days on market was up in Q2 2025 two months out of three compared to Q2 2024. The overall rise was modest, averaging approximately 2 additional days for the quarter compared to the previous year:

MISC STATS

Before concluding our overview of the Portland Region as a whole, let’s look at some miscellaneous stats:

The most expensive home that sold on the open market in the Portland Region was a lakefront property located on Oswego Lake. The home sold for $4,500,000, has four bedrooms, four full bathrooms and one half bathroom, is on 0.19 acres and is 6,337 sq. ft. Photos of the property are currently available online and may be viewed here.

The least expensive home was a fixer located in Amity, a city in Yamhill County. The home has rented at the time of the sale, but no interior photos were published online. The home is 1,528 sq. ft. and has a 0.21-acre lot. Exterior photos of the property are currently available online and may be viewed here.

The largest home sold in Q2 2025 was a 9,500-sq. ft. residence that is currently used as a bed and breakfast. The Franziska Haus B&B has 10 bedrooms and 10 bathrooms. The property is situated in Dundee, Oregon, providing convenient accommodations for visitors looking to do wine tasting in the area. The B&B could potentially be used as a private residence with little to no alteration of the interior. Photos of the property are currently available online and may be viewed here.

The smallest home sold in Q2 2025 was a property in Dayton, Oregon. The home is 460 sq. ft. and sits on 4.9 acres. The home is really just a functional apartment attached to one of the two large shops on the site. It is very likely the new owner will be constructing a new residence and turning the apartment into an accessory dwelling unit. Photos of the property are currently available online and may be viewed here.

The property with the largest lot that sold in Q2 2025 is located in North Plains, Oregon. The property has a 90.9-acre lot with a 4,335 sq. ft. home. Most of the lot is sloped and heavily forested. Photos of the property are currently available online and may be viewed here.

Finally, the last miscellaneous Q2 2025 stat belongs to a home that took a cumulative total of 1,047 days to sell. The home is 6,403 sq. ft. and has a 0.85-acre lot. The property is located in an unincorporated part of Multnomah County, south of the City of Portland. The home has good views of the city. The property was listed on 05/19/2022 and was on the market on and off until it sold on 06/06/2025. The initial list price was $3,750,000 and it closed for $2,938,750 as a cash sale. Photos of the property are currently available online and may be viewed here.

Let’s wrap up this post with a quick look at the six individual counties comprising the Portland Region. We will examine them in the order of largest number of sales to the smallest.

Multnomah County contains most of the City of Portland. (Very tiny portions of the City of Portland are located in Clackamas and Washington counties.) The following table summarizes important metrics for Multnomah County:

Multnomah County had an increase in the sales volume dollar amount despite the number of home sales being about the same quarter over quarter. The average and median sales prices are up partly due to an increase in the total square footage of homes selling and an average larger lot size. However, even accounting for that influence, Q2 2025 in Multnomah County was stronger than Q2 2024.

New construction was 4.4% of the Multnomah market, which is healthy given how mature the Portland market is; 59% of new construction was in the City of Portland and 30% was in the City of Gresham:

Distressed sales made up less than 1% of the Multnomah market n Q2 2025.

Washington County contains many properties with a Portland address that are outside official city limits and are under county control. The following table summarizes important metrics for Washington County:

The total sales volume dollar amount slipped below $1 billion in Q2 2025, this was due to a slump in sales, with the number of homes sold dropping almost 10%. Average and median prices were essentially unchanged from Q2 2024.

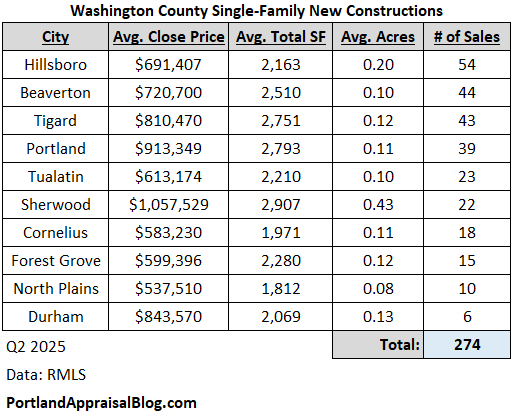

Washington County has the most new construction activity in the Portland Region. While fewer new construction homes closed in Q2 2025 compared to Q2 2024, the new homes comprised the same proportion of the market—nearly 20%.

The following table breaks down the activity by city:

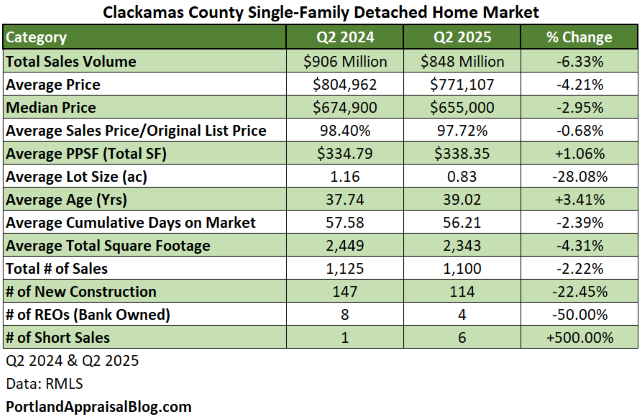

Clackamas County, while comprised of some urban cities, has many rural portions and houses on acreage lots. Commercial and hobby farming is common throughout the county. The following table summarizes important metrics for Clackamas County:

The sales volume dollar amount is down 6.3%, which is larger than the decline in the total number of sales (only 2%). Looking at the table, two stats jump out: the average lot size has declined 28% and the number of new constructions is down by over 22%. The change in the sales composition affected the aggregate stats.

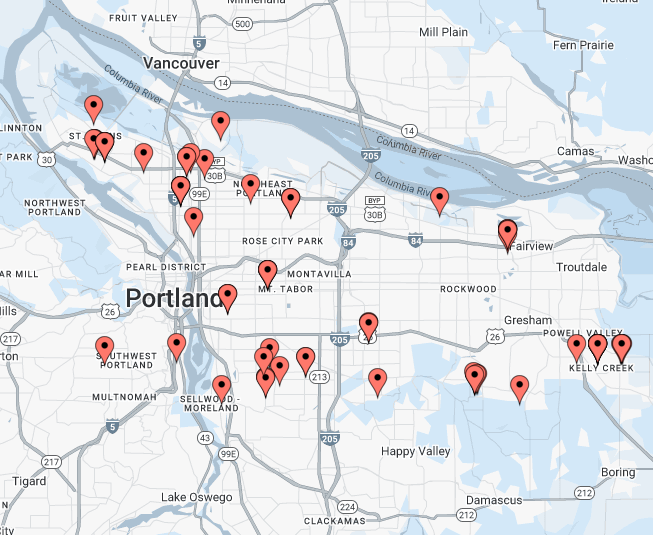

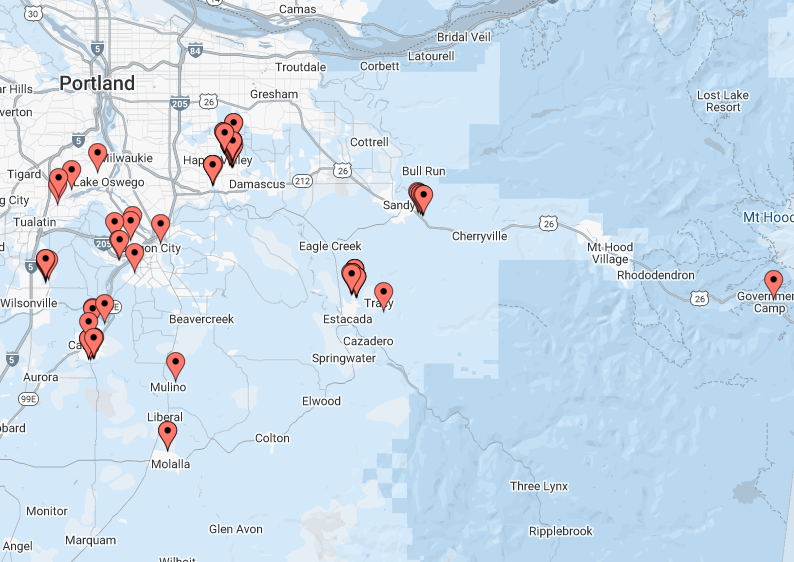

New construction activity in Clackamas County places it 2nd in the region. Most of the new sales occurred in four cities: Happy Valley, Estacada, Canby, and Sandy. The following is a map of the new construction activity in Clackamas County:

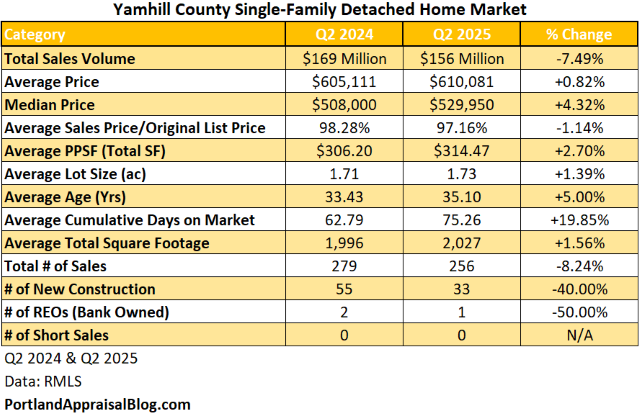

Yamhill County is known for its wineries and other agricultural products. The following table summarizes important metrics for Yamhill County:

The total sales volume dollar amount decreased by 7.5% which parallels the drop in the total number of sales (8.2%). The county experienced a sharp drop-off in new construction (40%) and homes are spending about 13 more days on market to sell. Despite the negative statistics, the average and median prices of homes have increased, indicating that individual homes are performing a bit better than the same quarter last year.

Yamhill’s new construction market is much smaller than Washington, Clackamas, or Multnomah’s in absolute size but is higher proportionally than all save Washington. New homes made up almost 13% of the market. The following is a map of the new construction activity in Yamhill County:

Most sales occurred in the city areas of Yamhill County.

While this county is 688 square miles it only has a population of approximately 54,000 people. The county is known for timber and wood products. The following table summarizes important metrics for Columbia County:

The total sales volume dollar amount was up over 13% while the total number of sales was up 5.7%. Median and average sales prices also increased, in part due to slightly larger homes on bigger lots selling in 2025 versus its counterpart quarter in 2024. Cumulative days on market climbed nearly 22%, translating to homes taking nearly 16 days longer to find a buyer. Only 2 new construction homes were sold in Q2 2025.

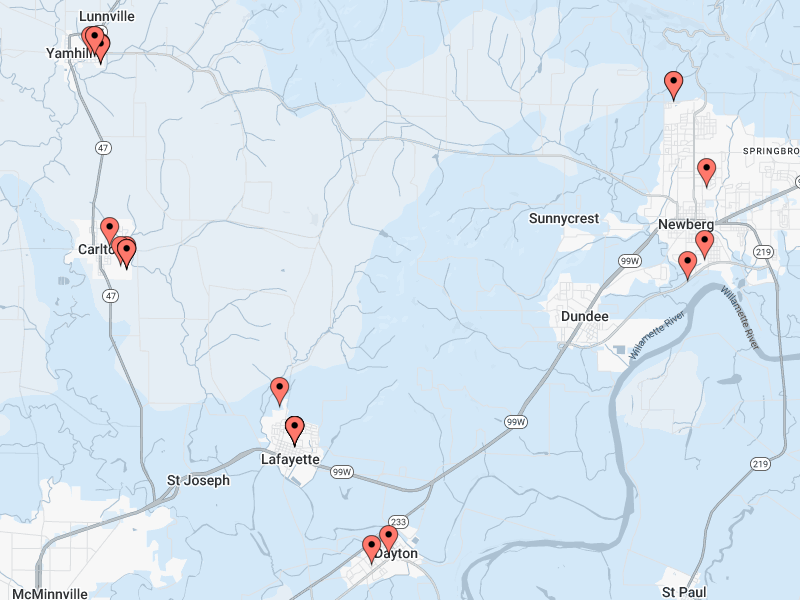

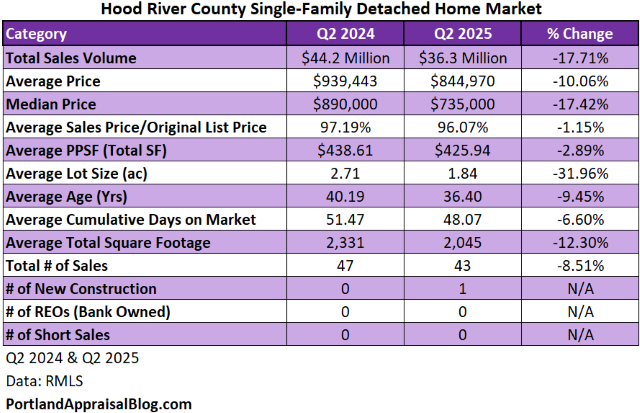

Hood River is the second smallest county in Oregon by area at 533 square miles. The population is estimated to be about 24,000 people. This county is known for its fruit products and outdoor recreational activities.

The sales volume dollar amount was down almost 18%, which is much higher than the decrease in the total number of sales (8.5%). Much of the decrease can be attributed to smaller homes on smaller lots selling in 2025 compared to Q2 2024. Due to the small market, Hood River often sees more volatility in price and property metrics quarter to quarter.

There was one new construction sale and no distressed sales.

That completes our look at the Portland Region Q2 2025 single-family market!

Thank you for reading the post! I hope you found some useful or interesting nugget of information. Please consider subscribing.

Question: Do you think Q3 2025 will be more of the same or will Q3 2025 outperform Q3 2024?

CODA

Are you an agent and wonder why appraisers always do “x”? Are you a homeowner who received a report and has one or two questions about appraisal terminology or methodology? If so, please feel free to contact me. I enjoy interacting with various market participants and am always happy to help out where I can! And if you are in need of any appraisal services, feel free to reach out to us!

The Portland Appraisal Blog now has a YouTube channel! While the YouTube channel will cover many of the same topics on the main blog, there will be unique content on the channel.

The first post is an introductory video. Check it out!

The first half of the year is already over, however, let’s have a look at how the Portland Region single-family detached home market performed in Q1 2025 versus Q1 2024.

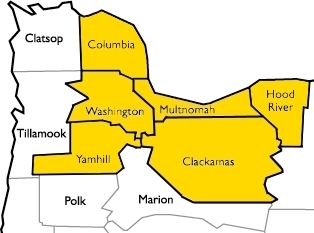

Let’s define the Portland Region as the following six counties: Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill—essentially all counties contiguous with Portland’s home county of Multnomah, plus Yamhill.

DATA HOUSEKEEPING

The information in this post will be based on properties that sold on the open market, defined as listed in RMLS, the primary multiple listing service for the Portland Region. The data was parsed with tools created by the blog author to weed out/correct, among other things, listing errors and misclassifications (e.g. land or condominium sales in the single-family category). RMLS has a listing category, SNL, Sold Not Listed, that allows agents to put properties that were sold off market into the database. Those properties have been excluded from the following analyses.

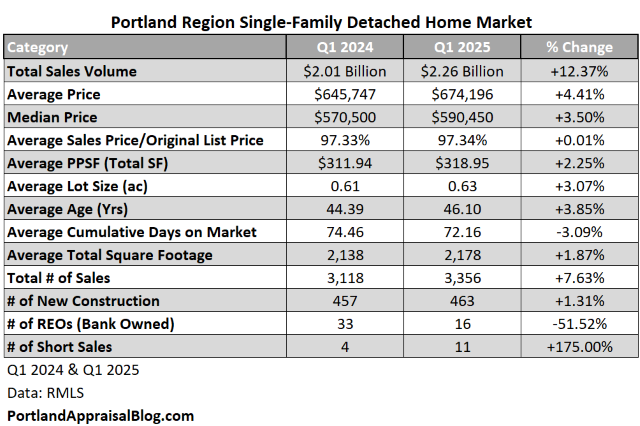

Q1 2025 beat Q1 2024 in most important metrics. The following table compares the two quarters:

The total sales volume dollar amount was about $2.26 billion in Q1 2025, representing a nearly 12.4% increase over the previous year. Much of that increase was due to the number of homes sold being up by 7.6%; however, average and median prices were up as well and the average price per square foot increased by 2.3%. The average home size and lot size were up slightly, but price per square foot generally goes down as home size goes up, so the increase in the average price per square foot in Q1 2025 indicates a stronger residential market.

Despite the increase in home prices, the typical seller had to cut their sales price by about 2.6% in order to get their home sold. This was about the same discount sellers had to give in Q1 2024.

The number of bank owned sales decreased by 51.5% and the number of short sales increased in 175% in Q1 2025. The entire distressed market only represented 0.8% of the total market—not even 1%. It should also be noted the distressed sales declined about 27% in Q1 2025 compared to Q1 2024. Despite high interest rates and persistent inflation, homeowners are meeting their mortgage obligations.

Let’s dive into the rest of the data with some visuals.

SALES VOLUME

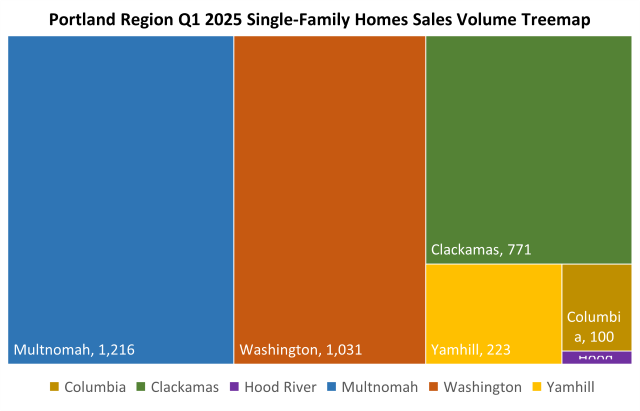

The following is a treemap of sales volume in the Portland Region for the Q1 2025:

As usual, Multnomah County had the most sales (~36% of the entire market). Clackamas, Multnomah, and Washington counties comprised 90% of the sales volume.

Sales steadily increased the first three months of the year. Each month in Q1 2025 was above its corresponding month in Q1 2024.

SALES PRICE

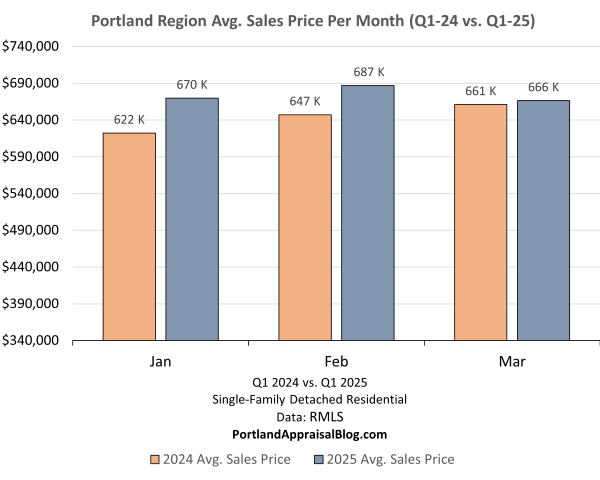

Q1 2025 was ahead of Q1 2024 every single month, although it was pretty close in March:

NEW CONSTRUCTION

New construction was about was about 13-15% of the Q1 2025 market:

Washington County had the biggest share of new homes while Clackamas County has the biggest quarter-over-quarter increase:

CUMULATIVE DAYS ON MARKET

The average cumulative days were down in Q1 2025 two months over three compared to Q1 2024. Faster marketing time indicates a stronger market:

MISC STATS

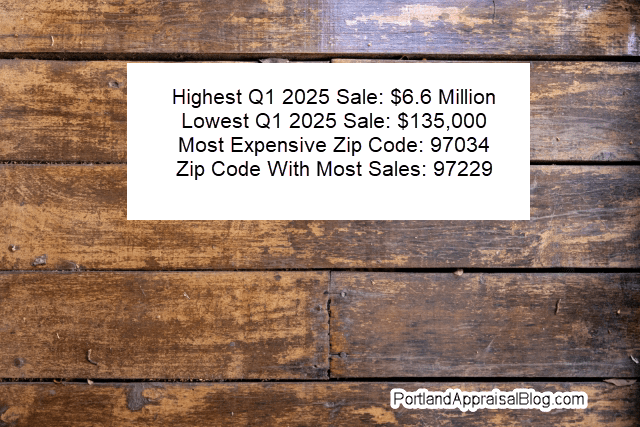

Before concluding our overview of the Portland Region as a whole, let’s look at some miscellaneous stats:

The most expensive home that sold on the open market in the Portland Region was a located in Lake Oswego. The home sold for $6,600,000, has five bedrooms, seven full bathrooms and four half bathrooms, is on 1.22 acres and is is 10,389 sq. ft. The property enjoys beautiful views of mountains and the Willamette River. A video tour of the house is currently available online and may be viewed here.

The least expensive home was a total fixer located in Sandy, Oregon. The home has commercial zoning and backs to a parking lot. It remains to be seen if the house will be torn down or rehabbed. The home is only 768 sq. ft. and sits on a small 2,275-sq. ft. lot.

The most expensive ZIP code (with more than one sale) for Q1 2025 was 97034. This area takes in most of the waterfront area of Oswego Lake:

The ZIP code with the highest volume of sales was 97229:

This ZIP code is large, covering 20.6 square miles and has parts of Multnomah and Washington counties. 150 single-family homes sold in this area in Q1 2025.

Let’s wrap up this post with a quick look at the six individual counties comprising the Portland Region. We will examine them in the order of largest number of sales to the smallest.

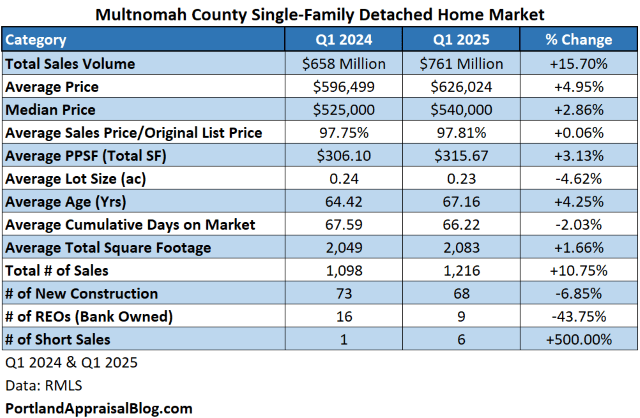

Multnomah County contains most of the City of Portland. Very tiny portions of the City of Portland are located in Clackamas and Washington counties. The following table summarizes important metrics for Multnomah County:

Multnomah County saw a robust 15.7% increase in the sales volume dollar amount. Much of that increase was due to the total number of sales increasing by 10.8%. Average price per square foot was up 3.1% and marking time was similar compared to Q1 2024. New construction comprised 5.6% of the total market and decreased 6.9% quarter over quarter. Distressed sales were 1.2% of the market and declined 11.8% compared to Q1 2024.

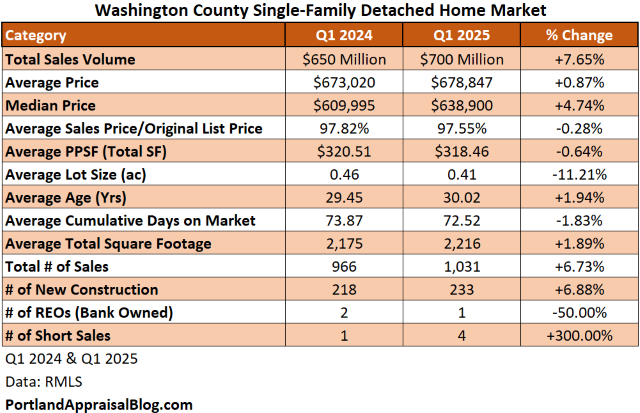

Washington County contains many properties with a Portland address that are outside official city limits and are under county control. The following table summarizes important metrics for Washington County:

The total sales volume dollar amount is up 7.7%, but nearly all of that increase can be explained by the increase in the total number of sales (6.7%). The average price per square foot was flat quarter over quarter. There was a substantial amount of new construction in Washington County—about 22.6%. Most of the new construction homes are located in Beaverton, Hillsboro, county-controlled areas of Portland, and Tigard. The following is a map showing the new construction areas:

Clackamas County, while comprised of some urban cities, has many rural portions and houses on acreage lots. Commercial and hobby farming is common throughout the county. The following table summarizes important metrics for Clackamas County:

The sales volume dollar amount is up 12.4%, but total sales volume was only up 3.4%. A large part of the increase can be explained by homes on much larger lots selling in Q1 2025 compared to Q1 2024. New construction was also up nearly 8% quarter over quarter. Market time saw a nearly 13% decrease in Q1 2025.

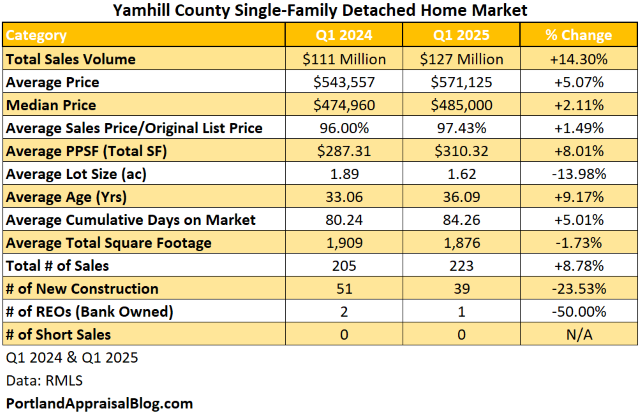

Yamhill County is known for its wineries and other agricultural products. The following table summarizes important metrics for Yamhill County:

The total sales volume dollar amount increased by 14.3% while the total number of sales were up 8.8%. The average total lot size of homes selling in Yamhill declined 14% quarter over quarter; despite the smaller lots the average sales price was up 5.1%. New construction dropped by nearly 24% and marketing time increased by 5%.

While this county is 688 square miles it only has a population of approximately 54,000 people. The county is known for timer and wood products. The following table summarizes important metrics for Columbia County:

The total sales volume dollar amount was up over 16% while the total number of sales were up 11%. Despite the increase in median and average sales prices, the cumulative days on market jumped nearly 24%. Only 1 new construction home came online in Q1 2025. Distressed sales dropped by 60%.

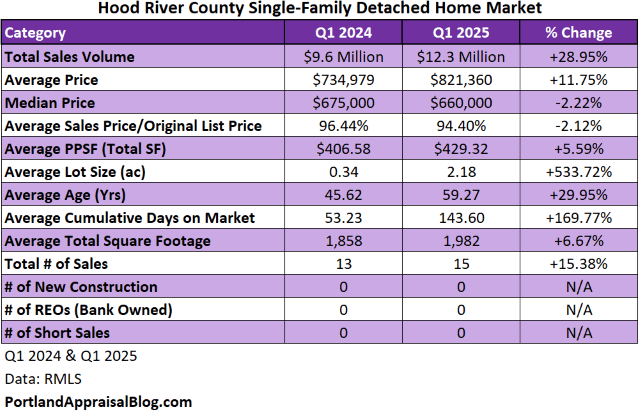

Hood River is the second smallest county in Oregon by area at 533 square miles. The population is estimated to be about 24,000 people. This county is known for its fruit products and outdoor recreational activities.

The sales volume dollar amount was up nearly 29%, which is much higher than the increase in the total number of sales (15.4%). Much of the increase can be tied to homes on much larger lots selling in Q1 2025. With so few sales, swings in average property metrics are more common. There was no new construction or distressed sale activity in this county in the first quarter of 2025.

That wraps up our look at the Portland Region Q1 2025 single-family market!

Thank you for reading the post! I hope you found some useful or interesting nugget of information. Please consider subscribing.

Question: Do you think Q2 2025 will continue the stronger performance compared to last year?

CODA

Are you an agent and wonder why appraisers always do “x”? Are you a homeowner who received a report and has one or two questions about appraisal terminology or methodology? If so, please feel free to contact me. I enjoy interacting with various market participants and am always happy to help out where I can! And if you are in need of any appraisal services, feel free to reach out to us!

Manufactured homes on owned land in the Portland Region posted modest gains in 2024 amid tight supply. This review covers sales volume, pricing adjustments, and key valuation factors unique to this segment.

We are wrapping up our annual reviews of the various housing segments in the Portland, Oregon region with a consideration of manufactured homes. We will restrict our attention to manufactured homes permanently affixed to land that is also owned by the same party. This means we are excluding classic mobile home parks where the owner of the mobile home must pay a lease/lot rental fee.

If you missed the previous annual reviews covering single-family detached homes, condominiums, and attached homes, you may click this link.

Let’s define the Portland Region as the following six counties: Columbia, Clackamas, Hood River, Multnomah, Washington, and Yamhill—essentially all counties contiguous with Portland’s home county of Multnomah, plus Yamhill.

DATA HOUSEKEEPING

The information in this post will be based on properties that sold on the open market, defined as listed in RMLS, the primary multiple listing service for the Portland Region. The data was parsed with tools created by the blog author to weed out/correct, among other things, listing errors and misclassifications (e.g. manufactured homes hiding in other categories, such as the detached category). RMLS has a listing category, SNL, Sold Not Listed, that allows agents to put properties that were sold off market into the database. Those properties have been excluded from the following analyses.

WHAT IS A MANUFACTURED HOME?

The U.S. Department of Housing and Urban Development provides the following definition and conditions for FHA mortgage insurance:

Manufactured Housing is a Structure that is transportable in one or more sections.

To be eligible for FHA mortgage insurance as a Single Family Title II Mortgage, all Manufactured Housing must:

• be designed as a one-family dwelling;

• have a floor area of not less than 400 square feet;

• have the HUD Certification Label affixed or have obtained a letter of label verification issued on behalf of HUD, evidencing the house was constructed on or after June 15, 1976, in compliance with the Federal Manufactured Home Construction and Safety Standards;

• be classified as real estate (but need not be treated as real estate for purposes of state taxation);

• be built and remain on a permanent chassis;

• be designed to be used as a dwelling with a permanent foundation built in accordance with the Permanent Foundations Guide for Manufactured Housing (PFGMH); and

• have been directly transported from the manufacturer or the dealership to the site.

The definition comes from the HUD manual (4000.1) and helps to differentiate manufactured homes from other type of prefabricated housing, such as modular homes or tiny homes. Fannie Mae essentially follows the HUD definition. Once a manufactured home is brought to the site, they state in their Selling Guide:

The towing hitch, wheels, and axles must be removed. The dwelling must assume the characteristics of site-built housing.

The manufactured home must be attached to a permanent foundation system in accordance with the manufacturer’s requirements for anchoring, support, stability, and maintenance.

The foundation system must be appropriate for the soil conditions for the site and meet local and state codes.

The manufactured home must be permanently connected to a septic tank or sewage system, and to other utilities in accordance with local and state requirements.

Manufactured homes are built in a factory and must meet the minimum guidelines established by HUD. While modular homes are also built in a factory in sections, they are not meant to movable beyond the initial transportation from the factory and have their final construction and assembly at the site and are placed on a permanent foundation. Modular homes have more stringent guidelines and building codes and are more expensive as a result.

Tiny homes, are just that, tiny. They usually don’t meet the minimum square footage requirements for manufactured homes and are often left in a transportable state; that is, they are relatively easy to move to another location. (Not a plus for collateral underwriting.) While there may be state or local ordinances, there are no federal guidelines for them and they are generally considered personal property. Getting them financed through typical mortgage channels is very difficult to nigh impossible.

So, to recap: we consider manufactured homes to be factory-built one-family dwellings that meet HUD guidelines and are permanently affixed to the land and the land must be under the same ownership. To be eligible for general financing, the manufactured home must have been built on or after June 15, 1976. The RMLS database does have a few properties in the manufactured category that were constructed before the cutoff date; those properties, while not meeting the modern requirements for manufactured housing, have been left in the dataset. Often they are not financeable, but they usually convey to the buyer the right to put a replacement manufactured dwelling or single-family home. That can be important, as there are some land parcels (mostly farmland) with zoning that does not allow residential use outright and will only permit an exception dwelling if the site has had continuous residential use (grandfathering the use in). That old manufactured home on a site could make a world of difference in the property value of an acreage lot!

Okay, so that was a lengthy preamble, let’s dive into some stats!

The following table compares 2024 with 2023:

Total dollar sales volume dropped about 9% in 2024 but this is largely a function of the total number of sales declining about 11%. Looking at the composition of sales for each year, 2024 had manufactured homes nearly the same size and age as 2023, but on lots about a half acre smaller. This points to a slightly stronger year per unit sold in 2024, which is reflected in higher average prices, median prices, and price per square foot.

New construction was only 1% of the market and bank repossessions were steady each year and represented less than 3% of the market.

Let’s dive into the rest of the data with some visuals.

SALES VOLUME

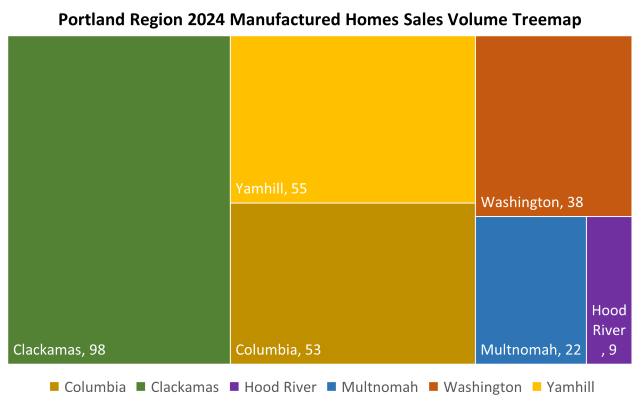

The following is a treemap of manufactured home sales volume in the Portland Region for the year 2024:

Clackamas County had almost twice as many manufactured home sales than the next largest county. This is not surprising as Clackamas County is 1,868 sq. mi. and has a lot of farming activity. The second largest county by sales volume, Yamhill, is also known for its rural areas and extensive agriculture.

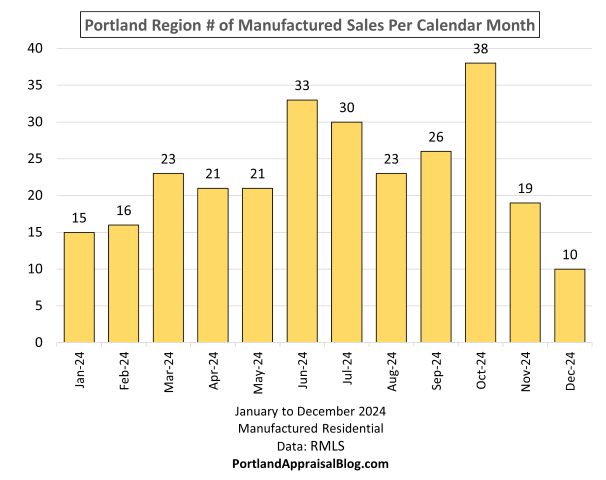

Sales followed a bell curve (with October being the exception); the market generally peaked during the summer months:

As the following graph shows, 2023 beat 2024 in sales volume eight out twelve months:

SALES PRICE

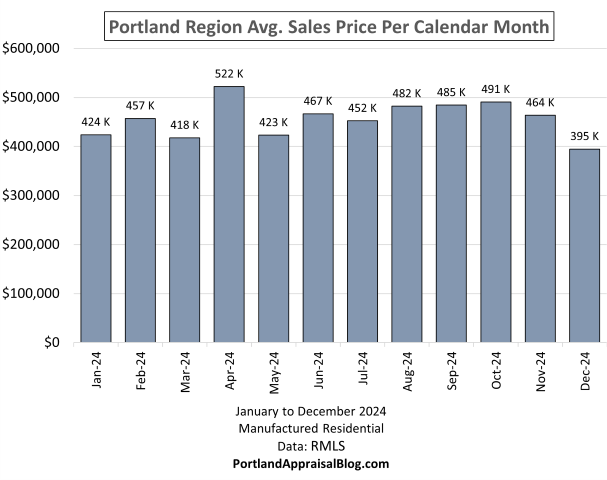

Prices were fairly level for most of the year:

2023 and 2024 were very close in average prices each month:

CUMULATIVE DAYS ON MARKET

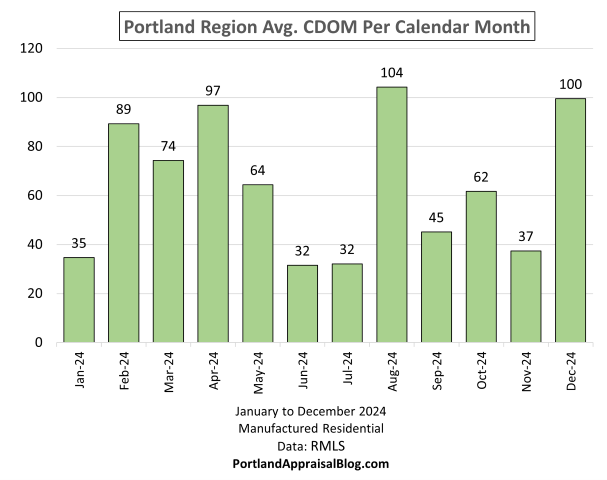

The average cumulative days on market was about two months for the entire year of 2024. Marketing time varied erratically, with no pronounced seasonality pattern:

While the average marketing time in 2024 was only up about 3 days compared to 2023, some months sharply diverged from each other. Variation like this is to be expected when the dataset is so small each year:

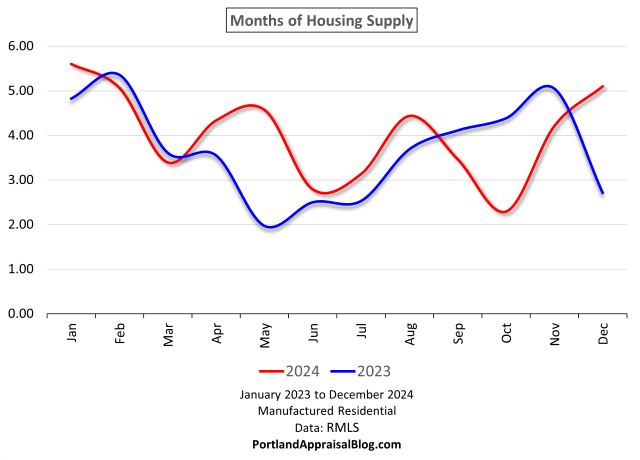

HOUSING SUPPLY

Housing supply tracks how long would it take the market to exhaust all available inventory at the current rate of absorption. For most of 2024 the months of housing supply for manufactured homes was above 4 months:

2024 was significantly above 2023 in months of housing supply during the spring and summer months, while 2023 was higher in the fall:

MISC STATS

Before concluding our overview of the Portland Region as a whole, let’s look at some miscellaneous stats:

The highest price for a manufactured home in 2024 is shared by two properties. A manufactured home in Estacada, Oregon and one in Newberg, Oregon. Both closed for $1,125,000.

The home in Estacada was built in 1998, sits on 19.8 acres, and is 1,976 sq. ft. The property has outbuildings. Photos of the home are currently available online and may be viewed here.

The home in Newberg was built in 1981, has a 9.4-acre lot, and is 1,920 sq. ft. The manufactured home was in average shape. The principal component of value for this home was the dividable lot (three parcels). After the sale the manufactured home sold again in 2025, this time for only $595,000 and the lot was only 2.5 acres. Photos of the home are currently available online and may be viewed here.

The least expensive manufactured home in 2024 was a property in Clatskanie, Oregon, which is in Columbia County. The property sold for $143,000. This was an older manufactured home that predates the HUD cutoff date and therefore could not be financed and closed as a cash sale. The home sits on a 1.58-acre lot and is only 744 sq. ft. The structure looks like it is at the end of its useful life, so this was essentially a land sale. Photos of the home are currently available online and may be viewed here.

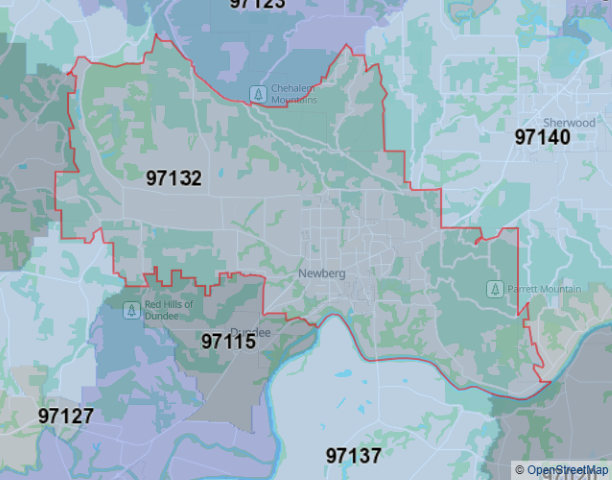

The most expensive ZIP code for manufactured homes in 2024 was 97132. This area takes in parts of Newberg. While only 4 sales occurred in 2024, the average price was about $741,000:

The ZIP code with the highest volume of sales was 97038:

This ZIP code is in Clackamas County and covers nearly 131 sq. mi. A total of 27 manufactured home sales occurred in this ZIP code in 2024.

A manufactured home in Sandy, Oregon with an 80-acre lot took the crown for the largest site in 2024. The home is a newer unit, with a manufacture date of 2021. The home is 1,836 sq. ft. and has quality interior upgrades. The site appears to be a former tree farm. While not the most expensive sale of the year, this manufactured home did rank #5 on the list! Photos of the home are currently available online and may be viewed here.

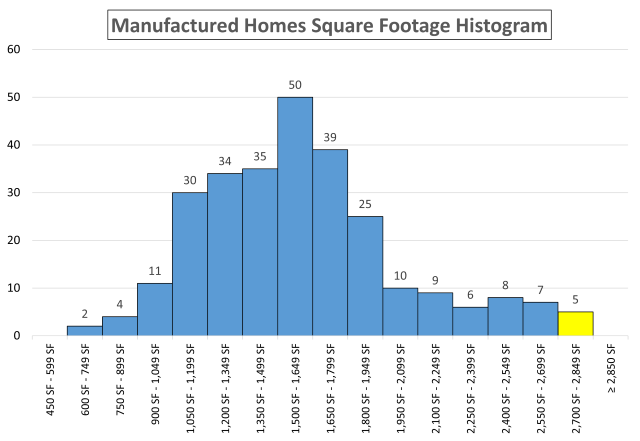

The largest manufactured home to sell in 2024 was a property in Dayton, Oregon, which is in Yamhill County. The unit was 2,813 sq. ft. and was manufactured in 2007. The home sits on a 5-acre lot. Given the average size for a manufactured home in 2024 was a little over 1,600 sq. ft., this one would be considered quite spacious. (Photos of the home are currently available online and may be viewed here.) The following histogram shows the distribution of square footage for manufactured homes in 2024:

Approximately 84% of all manufactured homes sold in 2024 are under 1,950 sq. ft.

Let’s wrap up this post with a quick look at the individual counties comprising the Portland Region.

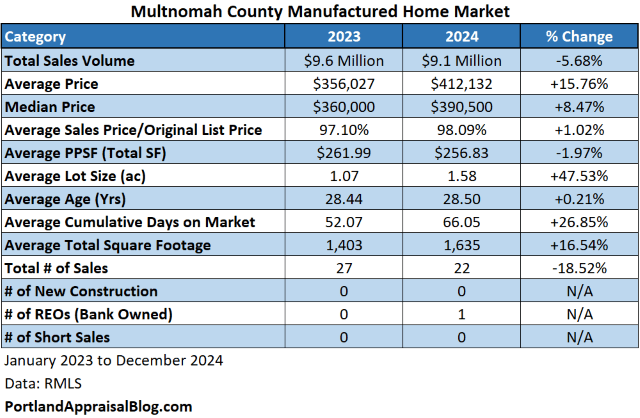

Multnomah County contains most of the City of Portland. A sliver of the City of Portland is located in Clackamas and Washington counties. The following table summarizes important metrics for Multnomah County:

Multnomah County saw a nearly 6% drop in the sales volume dollar amount. The total number of sales dropped almost 19%; the reason the sales volume dollar amount did not drop more is due to the average size of the units sold increasing as well as the lot size. Marketing time increased almost 27%. The new construction and distressed categories had almost no activity.

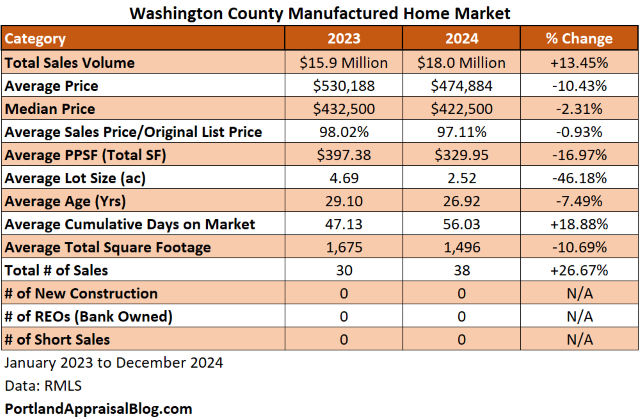

Washington County contains many properties with a Portland address that are outside official city limits and are under county control. The following table summarizes important metrics for Washington County:

The total sales volume dollar amount increased by over 13% thanks, in part, to a 27% increase in the total number of sales. The reason the sales volume dollar amount did not climb higher is due to smaller units selling on smaller lots. There were no distressed sales or new construction in 2024.

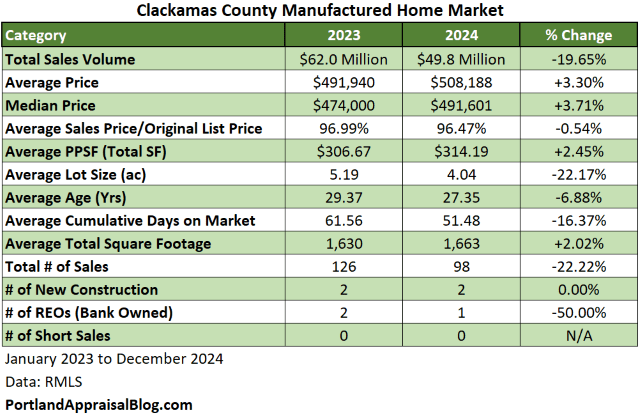

Clackamas County, due to being a large and mostly rural county, has the most activity for manufactured homes in the Portland Region. The following table summarizes important metrics for Clackamas County:

The Clackamas manufactured home sales volume dollar amount was down about 20% in 2024. This tracks the decrease in total sales (-22%). Average prices were slightly up, but so was the average total square footage of homes selling. The one-acre drop in average lot size does not appear to have had a substantial impact on average prices. There were two new construction units in 2024 and just one distressed sale.

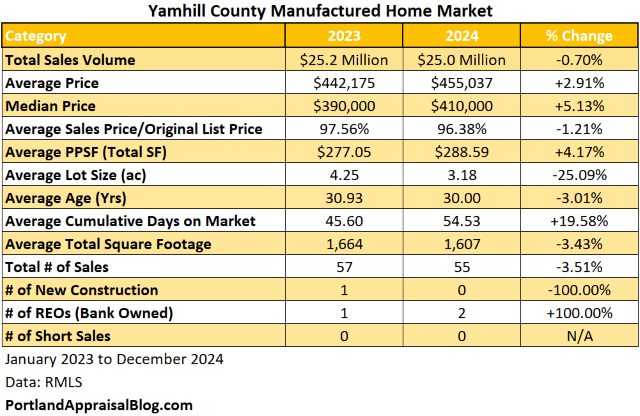

Yamhill County is known for its wineries and other agricultural products. Due to its rural areas, Yamhill had the second highest number of manufactured home sales. The following table summarizes important metrics for Yamhill County:

The total sales volume dollar amount was flat year over year. There was little change in the number of homes sold. Average prices rose nearly 3% despite smaller units on smaller lots for 2024. This indicates manufactured homes had a stronger year overall compared to 2023. There was no new construction activity and only a couple of distressed sales in 2024.

This county is 688 square miles but only has a population of approximately 54,000 people. Due to it mostly rural nature, Columbia County came in third for the total number of manufactured home sales. The following table summarizes important metrics for Columbia County:

Total sales volume dollar amount changed only 2.4% and there was almost no change in the size of the average manufactured home. Average prices rose 12% but that may be partially attributed to a nearly 61% increase in average lot size.

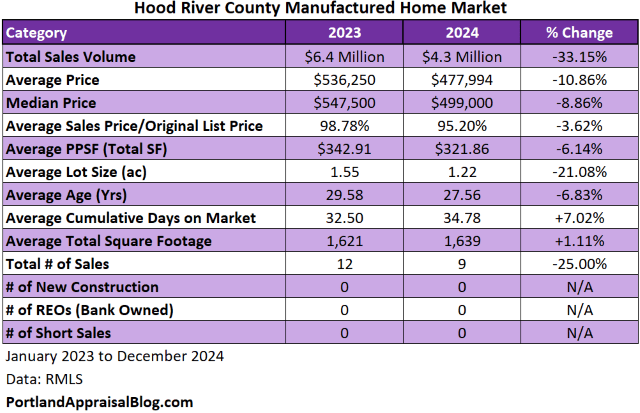

Hood River is the second smallest county in Oregon by area at 533 square miles. The population is estimated to be about 24,000 people. With such a sparse population it is no surprise this county had little activity.

There was a 33% drop in the sales volume dollar amount, but that almost mirrors the 25% decline in the total number of sales. The average size of the units did not meaningfully change, but the average lot size dropped 21%, which likely contributed to the sharper decline of the sales volume dollar amount.

That wraps up our look at the Portland Region 2024 manufactured home market!

Thank you for reading the post! I hope you found some useful or interesting nugget of information. Please consider subscribing.

Question: Do you think 2025 will see the number of manufactured home sales rebound or will high interest rates keep a clamp on the market?

CODA

Are you an agent and wonder why appraisers always do “x”? Are you a homeowner who received a report and has one or two questions about appraisal terminology or methodology? If so, please feel free to contact me. I enjoy interacting with various market participants and am always happy to help out where I can! And if you are in need of any appraisal services, feel free to reach out to us!